2025 MERL Fiyat Tahmini: Merlin Protocol İçin Piyasa Trendleri ve Potansiyel Büyüme Faktörlerinin Analizi

Giriş: MERL’in Piyasa Konumu ve Yatırım Değeri

Merlin Chain (MERL), yerli bir Bitcoin Katman 2 çözümü olarak, kuruluşundan bu yana önemli başarılar elde etti. 2025 yılı itibarıyla MERL’in piyasa değeri 322.860.598 $’a ulaşırken, dolaşımdaki arz yaklaşık 978.958.758 token ve fiyatı yaklaşık 0,3298 $ seviyesinde bulunuyor. “Bitcoin’in Eğlence Katmanı 2’si” olarak anılan bu varlık, Bitcoin’in yerel varlıklarını, protokollerini ve ürünlerini desteklemede giderek daha kritik bir rol üstleniyor.

Bu makalede, MERL’in 2025’ten 2030’a kadar olan fiyat trendleri; geçmiş veriler, piyasa arz-talep dengesi, ekosistem gelişimi ve makroekonomik faktörler doğrultusunda kapsamlı biçimde analiz edilerek, yatırımcılara profesyonel fiyat öngörüleri ve pratik yatırım stratejileri sunulacaktır.

I. MERL Fiyat Geçmişi ve Mevcut Piyasa Durumu

MERL Tarihsel Fiyat Gelişimi

- 2024: Ana ağ lansmanı, fiyat 19 Nisan’da tüm zamanların en yüksek seviyesi olan 1,888 $’a çıktı

- 2025: Piyasa düzeltmesi, fiyat 3 Şubat’ta tüm zamanların en düşük seviyesi olan 0,0623 $’a indi

- 2025: Toparlanma dönemi, fiyat 18 Ekim itibarıyla 0,3298 $’a yükseldi

MERL Güncel Piyasa Durumu

18 Ekim 2025 itibarıyla MERL, 0,3298 $ seviyesinden işlem görüyor ve son 24 saatte %6,55 düşüş yaşadı. Token, farklı zaman dilimlerinde karma bir performans sergiledi; son bir saatte %1,55 artarken, son bir haftada %6,74 azaldı. Özellikle son 30 günde, %78,18’lik dikkat çekici bir artış gözlendi; bu da güçlü bir orta vadeli yükseliş trendine işaret ediyor. Güncel fiyat, bir yıl öncesine göre %21,84 artış göstererek kısa vadeli oynaklığa rağmen genel olarak olumlu bir uzun vadeli performans sunuyor.

MERL’in piyasa değeri 322.860.598 $ ve kripto para piyasasında 208. sırada yer alıyor. Token’ın 24 saatlik işlem hacmi 12.274.189 $ ile orta seviyede bir piyasa hareketliliğini gösteriyor. Dolaşımdaki arz 978.958.758 MERL, toplam arz ise 2.100.000.000; mevcut dolaşım oranı yaklaşık %46,62.

Token, şu anda tüm zamanların en yüksek seviyesi olan 1,888 $’ın yaklaşık %82,52 altında işlem görüyor; ancak tüm zamanların en düşük seviyesi olan 0,0623 $’ın oldukça üzerinde. Bu durum, piyasa döngüsünde toparlanma evresine işaret ediyor. Piyasa duyarlılığı ise mevcut fiyat hareketleri ve genel kripto para koşulları göz önünde bulundurulduğunda temkinli görünüyor.

Güncel MERL piyasa fiyatını görmek için tıklayın

MERL Piyasa Duyarlılık Göstergesi

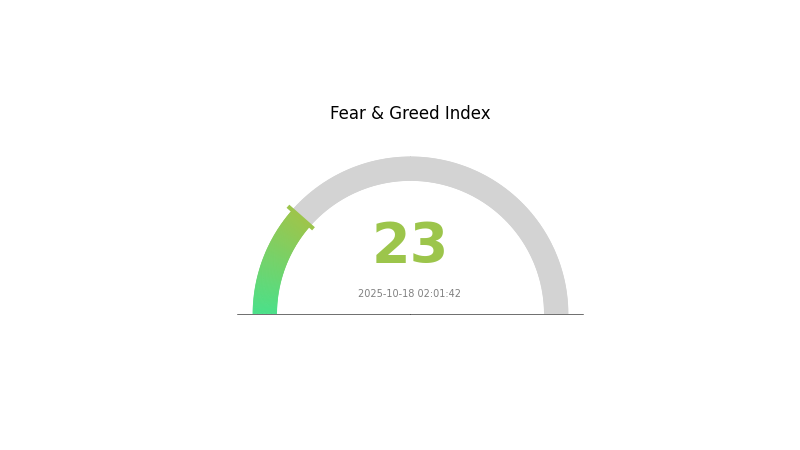

18 Ekim 2025 Korku ve Açgözlülük Endeksi: 23 (Aşırı Korku)

Güncel Korku & Açgözlülük Endeksini görmek için tıklayın

Bugün kripto piyasasında aşırı korku hakim; Korku ve Açgözlülük Endeksi 23’e geriledi. Bu düzeyde kötümserlik, genellikle karşıt yatırımcılar için potansiyel bir alım fırsatına işaret eder. Ancak, temkinli hareket etmek ve detaylı araştırma yapmak gereklidir. Unutmayın, piyasa duyarlılığı hızla değişebilir. Bilgilendirilmiş kalın, portföyünüzü çeşitlendirin ve bu dalgalı ortamda maliyet ortalaması yöntemini düşünebilirsiniz. Gate.com, zorlu piyasa koşullarında bilinçli kararlar almanız için araçlar ve kaynaklar sunar.

MERL Varlık Dağılımı

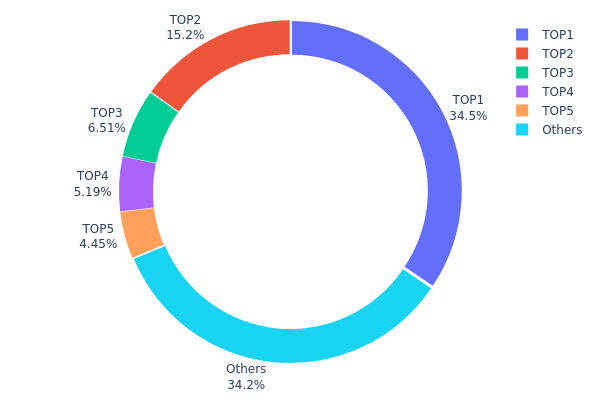

MERL için adres varlık dağılımı, tokenların büyük bölümünün birkaç üst adres arasında yoğunlaştığını gösteriyor. En büyük adres toplam arzın %34,45’ini elinde tutarken, ilk 5 adres MERL tokenlarının %65,79’unu kontrol ediyor. Bu yüksek yoğunlaşma, sahiplikte merkezileşme ve potansiyel piyasa manipülasyonu riskini artırıyor.

Böyle bir dağılım yapısı, fiyat oynaklığı ve piyasa istikrarsızlığını tetikleyebilir. Büyük yatırımcılar, yani “balinalar”, alım-satım hareketleriyle fiyat üzerinde önemli etki yaratabilir. Bu merkezileşme, MERL’in zincir üstü yönetim ve karar süreçlerinde az sayıda adresin etkili olabileceğine; projenin merkeziyetsizlik hedeflerinin ise zedelenebileceğine işaret ediyor.

Bununla birlikte, tokenların %34,21’i diğer adresler arasında dağıtılmış durumda; bu, bir miktar denge sağlıyor. Ancak genel token dağılımı hâlâ oldukça merkezileşmiş bir tablo çiziyor; piyasada istikrarı artırmak ve MERL için daha merkeziyetsiz bir ekosistem inşa edebilmek için bu konuya odaklanmak gerekebilir.

Güncel MERL Varlık Dağılımını görmek için tıklayın

| Top | Adres | Varlık Miktarı | Varlık (%) |

|---|---|---|---|

| 1 | 0xa2ff...ad8443 | 688.495,49K | 34,45% |

| 2 | 0x6353...326813 | 303.643,79K | 15,19% |

| 3 | 0x6414...f10d59 | 130.108,12K | 6,51% |

| 4 | 0xdc94...a44536 | 103.782,44K | 5,19% |

| 5 | 0xbd37...4f45ab | 88.851,83K | 4,45% |

| - | Diğerleri | 683.586,20K | 34,21% |

II. MERL’in Gelecekteki Fiyatını Etkileyecek Temel Faktörler

Arz Mekanizması

- Token Yakımı: MERL, toplam arzı zamanla azaltmak için token yakım mekanizması uygular.

- Tarihsel Model: Önceki token yakımları genellikle arz azaldığı için kısa vadede fiyatlarda yükselişe yol açmıştır.

- Güncel Etki: Yaklaşan token yakımı, talep sabit kalır veya artarsa MERL’in fiyatında yukarı yönlü baskı oluşturması bekleniyor.

Kurumsal ve Balina Dinamikleri

- Kurumsal Varlıklar: Birçok kripto yatırım fonu son dönemde MERL varlıklarını artırdı; bu, kurumsal ilginin arttığını gösteriyor.

Makroekonomik Ortam

- Enflasyona Karşı Koruma: MERL, geleneksel enflasyona karşı koruma araçlarıyla bazı korelasyonlar gösteriyor ve yüksek enflasyon dönemlerinde yatırımcı çekebilir.

Teknolojik Gelişim ve Ekosistem İnşası

- Ağ Yükseltmesi: MERL, işlem hızını artırıp ücretleri azaltacak büyük bir ağ yükseltmesi planlıyor; bu sayede daha fazla kullanıcı ve geliştirici çekebilir.

- Ekosistem Uygulamaları: MERL ağı üzerinde çeşitli DeFi protokolleri ve NFT pazar yerleri geliştiriliyor; bu da kullanım alanı ve potansiyel kullanıcı tabanını genişletiyor.

III. 2025-2030 Dönemi MERL Fiyat Tahmini

2025 Görünümü

- Temkinli tahmin: 0,28647 $ - 0,32928 $

- Tarafsız tahmin: 0,32928 $ - 0,37 $

- İyimser tahmin: 0,37 $ - 0,4116 $ (pozitif piyasa duyarlılığı ve proje gelişmeleri ile)

2027 Orta Vadeli Görünüm

- Piyasa fazı beklentisi: Artan benimsenmeyle büyüme potansiyeli

- Fiyat aralığı öngörüleri:

- 2026: 0,3371 $ - 0,40748 $

- 2027: 0,28394 $ - 0,4123 $

- Kilit katalizörler: Proje kilometre taşları, piyasa trendleri ve genel kripto benimsenmesi

2030 Uzun Vadeli Görünüm

- Temel senaryo: 0,45271 $ - 0,5093 $ (istikrarlı piyasa büyümesi varsayılırsa)

- İyimser senaryo: 0,5093 $ - 0,73849 $ (güçlü proje performansı ve piyasa koşulları ile)

- Dönüştürücü senaryo: 0,73849 $ üzeri (son derece olumlu şartlar ve yenilikler halinde)

- 31 Aralık 2030: MERL 0,73849 $ (yılın potansiyel zirve fiyatı)

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Değişim (%) |

|---|---|---|---|---|

| 2025 | 0,4116 | 0,32928 | 0,28647 | 0 |

| 2026 | 0,40748 | 0,37044 | 0,3371 | 12 |

| 2027 | 0,4123 | 0,38896 | 0,28394 | 17 |

| 2028 | 0,50479 | 0,40063 | 0,36457 | 21 |

| 2029 | 0,56589 | 0,45271 | 0,27615 | 37 |

| 2030 | 0,73849 | 0,5093 | 0,34633 | 54 |

IV. MERL Profesyonel Yatırım Stratejileri ve Risk Yönetimi

MERL Yatırım Yöntemi

(1) Uzun Vadeli Tutma Stratejisi

- Uygun yatırımcılar: Uzun vadeli düşünenler ve Bitcoin tutkunları

- İşlem önerileri:

- Piyasa geri çekilmelerinde MERL biriktirin

- Hedef portföy dağılımı belirleyip periyodik dengeleme yapın

- MERL’i güvenli donanım cüzdanında saklayın

(2) Aktif Alım-Satım Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Trendleri ve olası giriş/çıkış noktalarını belirlemede kullanılır

- Göreli Güç Endeksi (RSI): Aşırı alım ve aşırı satım seviyelerini izleyin

- Dalgalı alım-satım için önemli noktalar:

- Bitcoin fiyat hareketlerini izleyin, MERL’i etkileyebilir

- Zarar durdurma emirleriyle aşağı yönlü riski yönetin

MERL Risk Yönetimi Çerçevesi

(1) Varlık Dağılımı İlkeleri

- Temkinli yatırımcılar: Kripto portföyünün %1-3’ü

- Agresif yatırımcılar: Kripto portföyünün %5-10’u

- Profesyonel yatırımcılar: Kripto portföyünün %15’ine kadar

(2) Riskten Korunma Çözümleri

- Çeşitlendirme: Birden çok Katman 2 projeye yatırım yapın

- Zarar durdurma emirleri: Potansiyel kayıpları sınırlamak için kullanın

(3) Güvenli Saklama Alternatifleri

- Donanım cüzdanı: Gate Web3 Cüzdan önerilir

- Yazılım cüzdanı: Resmi Merlin Chain cüzdanı (varsa)

- Güvenlik önlemleri: İki faktörlü doğrulama etkinleştirin, güçlü şifre kullanın

V. MERL için Potansiyel Riskler ve Zorluklar

MERL Piyasa Riskleri

- Volatilite: Kripto piyasasında yüksek fiyat dalgalanmaları

- Rekabet: Yeni Bitcoin Katman 2 çözümleri ortaya çıkabilir

- Likidite: Piyasa stresinde likidite sorunları oluşabilir

MERL Düzenleyici Riskleri

- Düzenleyici belirsizlik: Küresel kripto regülasyonları değişken

- Uyum zorlukları: AML/KYC gereklilikleriyle ilgili potansiyel problemler

- Vergi etkisi: Bazı ülkelerde net olmayan vergi düzenlemeleri

MERL Teknik Riskleri

- Akıllı sözleşme zaafları: Açıklar veya hatalar ortaya çıkabilir

- Ölçeklenebilirlik problemleri: Yüksek talepte ağ tıkanıklığı oluşabilir

- Birlikte çalışabilirlik sorunları: Diğer blokzincirlerle uyumsuzluk yaşanabilir

VI. Sonuç ve Eylem Önerileri

MERL Yatırım Değeri Değerlendirmesi

MERL, Bitcoin Katman 2 çözümü olarak ölçeklenebilirlik ve Bitcoin ekosistemi için yeni fırsatlar sunuyor. Ancak kısa vadede güçlü rekabet ve regülasyon belirsizlikleriyle karşı karşıya.

MERL Yatırım Tavsiyeleri

✅ Yeni başlayanlar: Küçük pozisyonlarla başlayıp eğitime odaklanın

✅ Deneyimli yatırımcılar: Portföyünüzde çeşitlendirme için değerlendirin

✅ Kurumsal yatırımcılar: Uzun vadeli potansiyel için izleyin, regülasyon gelişmelerini takip edin

MERL Alım-Satım Katılım Yöntemleri

- Spot alım-satım: Gate.com’da MERL alıp tutun

- Staking: Mevcutsa MERL staking programlarına katılın

- DeFi: Merlin Chain ekosisteminde merkeziyetsiz finans seçeneklerini keşfedin

Kripto para yatırımları son derece yüksek risk içerir; bu makaledeki bilgiler yatırım tavsiyesi değildir. Yatırımcılar, kendi risk toleranslarına göre dikkatli karar vermeli ve profesyonel finansal danışmanlara başvurmalıdır. Asla kaybetmeyi göze alabileceğinizden fazla yatırım yapmayınız.

SSS

Merlin Crypto’nun geleceği nasıl?

Merlin Crypto, Web3 ekosisteminde büyüme potansiyeliyle ön plana çıkıyor. Yenilikçi teknolojisi ve artan benimsenme oranı, 2026’ya kadar kayda değer değer artışı olasılığını güçlendiriyor.

Hamster Kombat Coin 1 $’a ulaşır mı?

Hamster Kombat Coin’in yakın gelecekte 1 $’a ulaşması pek olası değil. Kripto para fiyatları son derece dalgalı ve öngörülemez olduğundan, uzun vadeli tahminler zordur.

Marlin Pond’un bir geleceği var mı?

Evet, Marlin Pond Web3 ekosisteminde büyüme potansiyeline sahip. Ağ optimizasyonu ve ölçeklenebilirlik çözümlerine odaklanması, gelecekte benimsenme ve değer artışı açısından avantaj sağlıyor.

MERL crypto nedir?

MERL, Web3 ekosisteminde merkeziyetsiz finans uygulamaları ve dijital varlık alım-satımı için tasarlanmış bir kripto para birimi tokenıdır.

Kripto 2025'te Yeniden Yükselir mi?

2025 TET Fiyat Tahmini: Piyasa Analizi ve Token Ekonomisi Trendlerine Yönelik Gelecek Projeksiyonları

2025 ZYRA Fiyat Tahmini: Kripto Paranın Piyasa Trendleri ve Potansiyel Büyüme Faktörlerinin Analizi

TAPROOT nedir: Bitcoin’in gelişmiş gizlilik ve ölçeklenebilirlik hedefiyle sunduğu en yeni güncellemeye yakından bakış

PTB nedir: Doğal Dil İşleme'de Perplexity Ölçüsünün Anlamı

Kripto Piyasa Payı Nasıl Değişiyor: 2025’te Rakiplerin Karşılaştırmalı Analizi

Xenea Günlük Quiz Yanıtı 13 Aralık 2025

Polygon Ağına Varlık Transferi Kılavuzu

Polygon Ağını Kripto Cüzdanınıza Entegre Etme Kılavuzu

BEP2 ile Dijital Varlıkların Güvenli Saklanmasına Yönelik Yeni Başlayanlar İçin Rehber

Polygon PoS Ağı’na Varlık Aktarma Kılavuzu