2025 NIGHT Price Prediction: Expert Analysis and Market Forecast for the Coming Year

Introduction: NIGHT's Market Position and Investment Value

NIGHT (NIGHT), as the native token of the cutting-edge privacy-focused L1 blockchain Midnight Network, has made significant strides since its inception. As of 2025, NIGHT's market capitalization has reached $1.02 billion, with a circulating supply of approximately 16.61 billion tokens, and a price hovering around $0.06133. This asset, hailed as the "privacy pioneer" in the blockchain space, is playing an increasingly crucial role in advancing privacy-centric decentralized applications and governance.

This article will provide a comprehensive analysis of NIGHT's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. NIGHT Price History Review and Current Market Status

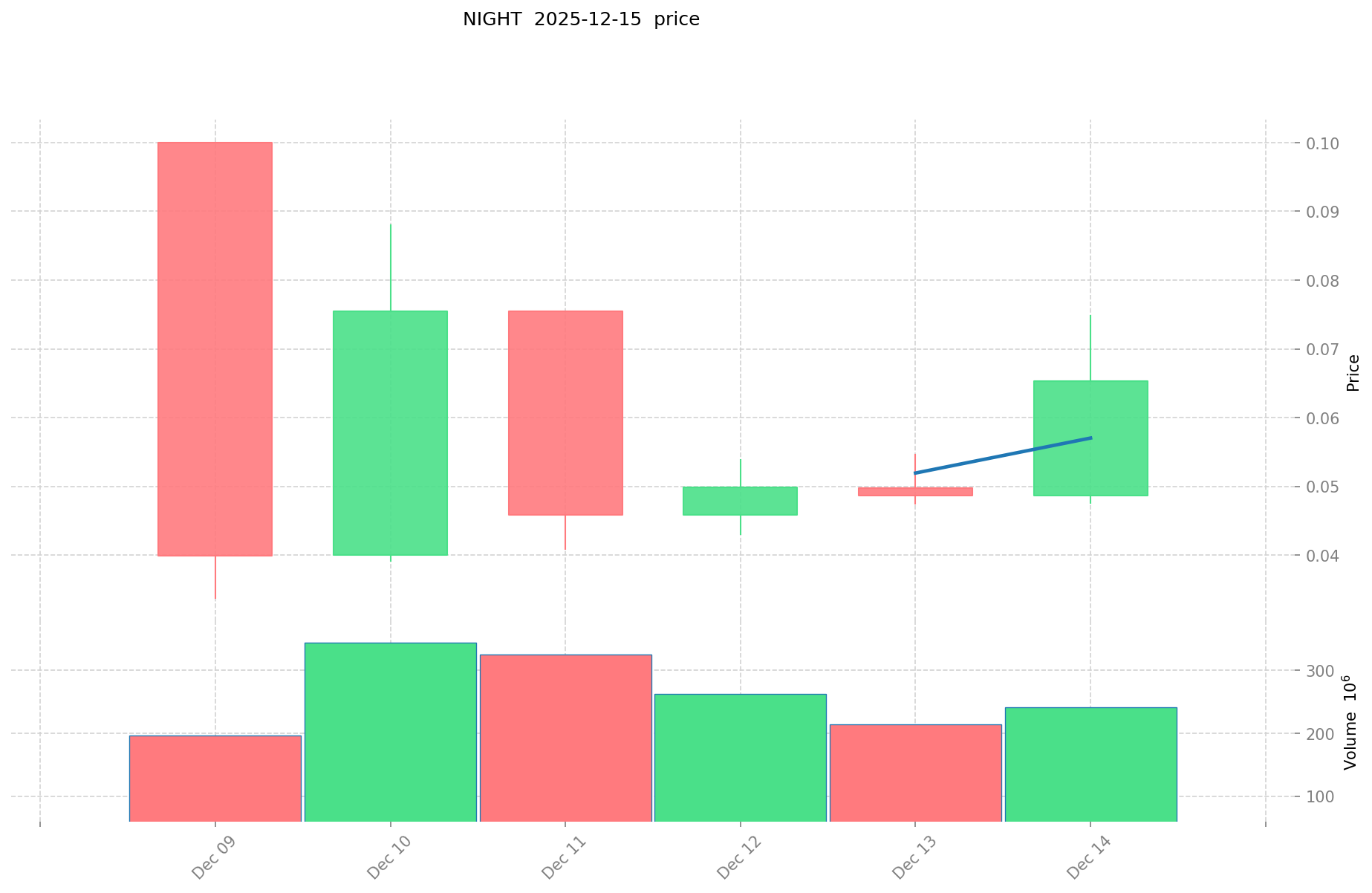

NIGHT Historical Price Evolution

- 2025: NIGHT token launched, price reached ATH of $0.1 on December 9

- 2025: Market volatility, price dropped to ATL of $0.0337 on December 9

NIGHT Current Market Situation

As of December 16, 2025, NIGHT is trading at $0.06133, with a 24-hour trading volume of $13,697,244.95. The token has experienced a 7.89% decrease in the last 24 hours, but shows a 2.15% increase in the past hour. NIGHT's market cap currently stands at $1,018,531,805.20, ranking it 81st in the cryptocurrency market. The circulating supply is 16,607,399,400 NIGHT tokens, which represents 69.2% of the total supply of 24 billion tokens. The fully diluted market cap is $1,471,920,000.

The current price of NIGHT is 38.67% below its all-time high of $0.1, indicating potential room for growth if market conditions improve. However, it's also 81.99% above its all-time low of $0.0337, suggesting some stability in the token's value since its launch.

Click to view the current NIGHT market price

NIGHT Market Sentiment Index

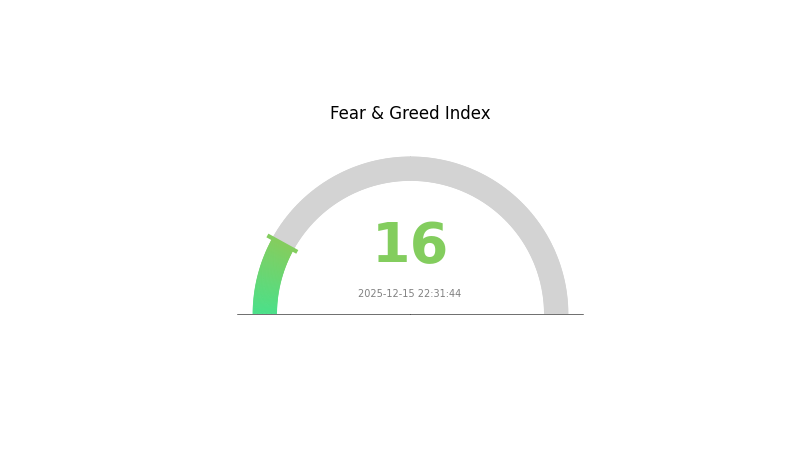

2025-12-15 Fear and Greed Index: 16 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is gripped by extreme fear, with the sentiment index plummeting to 16. This level of pessimism often precedes potential buying opportunities, as historically, extreme fear has indicated oversold conditions. However, investors should exercise caution and conduct thorough research before making any decisions. Remember, market sentiment can shift rapidly, and it's crucial to stay informed about broader economic factors and crypto-specific news that may influence future price movements.

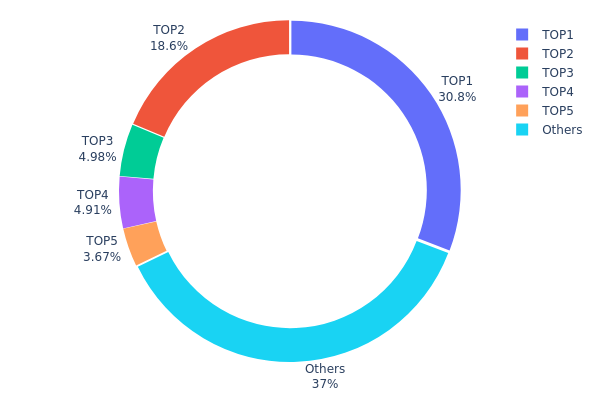

NIGHT Holdings Distribution

The address holdings distribution data for NIGHT reveals a significantly concentrated ownership structure. The top address holds 30.80% of the total supply, while the second largest holder accounts for 18.64%. Together, the top two addresses control nearly half (49.44%) of all NIGHT tokens. The top five addresses collectively hold 62.99% of the supply, leaving only 37% distributed among other addresses.

This high concentration of holdings in a few addresses raises concerns about centralization and potential market manipulation. Such a distribution pattern could lead to increased volatility and susceptibility to large price swings if major holders decide to sell or accumulate. Moreover, it may impact the overall market structure, potentially deterring smaller investors due to perceived risks of whale dominance.

The current distribution suggests a relatively low level of decentralization for NIGHT, which could affect its on-chain stability and resilience to market shocks. While this concentration might provide some price support if large holders are committed long-term investors, it also poses risks to the token's broader adoption and liquidity in the cryptocurrency ecosystem.

Click to view the current NIGHT Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | addr1w...t6a398 | 7392600.60K | 30.80% |

| 2 | addr1w...fvty7h | 4472474.48K | 18.64% |

| 3 | addr1q...25nxr2 | 1196131.07K | 4.98% |

| 4 | addr1q...w92469 | 1179365.25K | 4.91% |

| 5 | addr1q...hxuacz | 880395.38K | 3.67% |

| - | Others | 8879033.21K | 37% |

II. Key Factors Influencing NIGHT's Future Price

Supply Mechanism

- Glacier Drop: Multi-stage airdrop process across multiple ecosystems to expand distribution and increase Sybil resistance.

- Historical Pattern: Initial high unlock supply and periodic releases aimed to smooth token distribution and minimize immediate selling pressure at TGE.

- Current Impact: The percentage of tokens unlocked at TGE and the pace of Glacier Drop claims will dominate early buy and sell pressures.

Institutional and Whale Dynamics

- Enterprise Adoption: Midnight positions itself as a privacy-preserving smart contract platform, potentially attracting enterprises seeking compliant privacy solutions.

Macroeconomic Environment

- Monetary Policy Impact: Recent Fed rate cuts and potential future easing could provide support for crypto assets like NIGHT.

Technical Development and Ecosystem Building

- Privacy Layer: Implementation of zero-knowledge technology to separate data confidentiality from settlement and governance.

- Ecosystem Applications: Dual-asset model (NIGHT + DUST) combining public token economics with privacy computing.

III. NIGHT Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.04076 - $0.05000

- Neutral prediction: $0.05000 - $0.07000

- Optimistic prediction: $0.07000 - $0.08152 (requires strong market recovery and increased adoption)

2027-2028 Outlook

- Market stage expectation: Potential growth phase with increasing adoption

- Price range forecast:

- 2027: $0.04614 - $0.09634

- 2028: $0.05141 - $0.11169

- Key catalysts: Technological advancements, broader market acceptance, and possible regulatory clarity

2029-2030 Long-term Outlook

- Base scenario: $0.10017 - $0.12421 (assuming steady market growth and adoption)

- Optimistic scenario: $0.12421 - $0.14825 (assuming strong market performance and increased utility)

- Transformative scenario: $0.14825 - $0.15526 (assuming breakthrough innovations and mainstream adoption)

- 2030-12-31: NIGHT $0.15526 (potential peak price in a highly favorable market)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.08152 | 0.06176 | 0.04076 | 0 |

| 2026 | 0.09027 | 0.07164 | 0.0523 | 16 |

| 2027 | 0.09634 | 0.08096 | 0.04614 | 31 |

| 2028 | 0.11169 | 0.08865 | 0.05141 | 44 |

| 2029 | 0.14825 | 0.10017 | 0.09616 | 63 |

| 2030 | 0.15526 | 0.12421 | 0.10185 | 102 |

IV. NIGHT Professional Investment Strategies and Risk Management

NIGHT Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors with high risk tolerance

- Operation suggestions:

- Accumulate NIGHT tokens during market dips

- Hold for at least 2-3 years to ride out market volatility

- Store tokens in a secure hardware wallet

(2) Active Trading Strategy

- Technical Analysis Tools:

- Moving Averages: Use to identify trends and potential entry/exit points

- Relative Strength Index (RSI): Monitor for overbought/oversold conditions

- Key Points for Swing Trading:

- Set clear stop-loss and take-profit levels

- Monitor Cardano ecosystem developments for potential price catalysts

NIGHT Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Allocate across multiple privacy-focused cryptocurrencies

- Use of stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot Wallet Recommendation: Gate Web3 Wallet

- Cold Storage Solution: Use a hardware wallet for long-term holdings

- Security Precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for NIGHT

NIGHT Market Risks

- High volatility: Price can experience significant fluctuations

- Competition: Other privacy-focused L1 blockchains may gain market share

- Liquidity risk: Limited trading volume may affect price stability

NIGHT Regulatory Risks

- Privacy coin scrutiny: Increased regulatory focus on privacy-enhancing cryptocurrencies

- Compliance challenges: Potential difficulties in meeting evolving KYC/AML requirements

- Geographic restrictions: Some jurisdictions may limit or ban privacy coin trading

NIGHT Technical Risks

- Smart contract vulnerabilities: Potential for exploits in the underlying code

- Scalability challenges: Possible network congestion as user base grows

- Interoperability issues: Compatibility problems with other blockchain networks

VI. Conclusion and Action Recommendations

NIGHT Investment Value Assessment

NIGHT offers long-term potential as a privacy-focused L1 solution backed by a reputable figure in the crypto space. However, short-term volatility and regulatory uncertainties pose significant risks.

NIGHT Investment Recommendations

✅ Beginners: Consider small, long-term positions after thorough research ✅ Experienced Investors: Implement a dollar-cost averaging strategy with strict risk management ✅ Institutional Investors: Evaluate NIGHT as part of a diversified crypto portfolio, focusing on its privacy features and potential adoption

NIGHT Trading Participation Methods

- Spot trading: Available on Gate.com and other exchanges

- Staking: Participate in network validation for passive income

- Governance: Engage in protocol decision-making through token voting

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

How high can near go in 2025?

Based on market trends and adoption, NEAR could reach between $2.4 and $7.6 in 2025, with potential for higher peaks.

Will Ethereum reach $15,000?

Yes, Ethereum could reach $15,000 by 2025. Its growing adoption and upcoming upgrades may drive significant price appreciation.

How much is crypto worth in 2025?

Bitcoin reached $126,000 in 2025, marking a significant bull run. The crypto market saw substantial growth driven by new regulations and technological advancements.

What is the reach share price forecast for 2025?

The Reach Plc share price forecast for 2025 is expected to range between 72.00 and 75.00 GBP, based on current market trends and digital growth projections.

XZXX: A Comprehensive Guide to the BRC-20 Meme Token in 2025

Bitcoin Fear and Greed Index: Market Sentiment Analysis for 2025

5 ways to get Bitcoin for free in 2025: Newbie Guide

Top Crypto ETFs to Watch in 2025: Navigating the Digital Asset Boom

Bitcoin Market Cap in 2025: Analysis and Trends for Investors

2025 Bitcoin Price Prediction: Trump's Tariffs' Impact on BTC

How to Delete My Account

What is P2P Trading on a Leading Platform?

BTC Option Flows Explained, Why Bitcoin Above 93,000 Suggests a Bullish Start to 2026

Bitcoin Options Traders Eye USD $100,000 as Derivatives Signal Market Reset

What Is GLD ETF, Understanding Gold Price Exposure and Structure