2025 NS Price Prediction: Analyzing Market Trends and Factors Driving Nintendo's Console Value

Introduction: NS's Market Position and Investment Value

SuiNS (NS), as a leading digital identity solution in the blockchain space, has made significant strides since its inception. As of 2025, SuiNS has achieved a market capitalization of $6,095,606, with a circulating supply of approximately 155,302,085 tokens and a price hovering around $0.03925. This asset, often referred to as the "digital identity guardian," is playing an increasingly crucial role in simplifying blockchain interactions and ensuring user privacy.

This article will provide a comprehensive analysis of SuiNS's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. NS Price History Review and Current Market Status

NS Historical Price Evolution Trajectory

- 2024: Initial launch, price reached an all-time high of $1.1936 on November 14

- 2025: Market correction, price declined significantly throughout the year

NS Current Market Situation

As of November 22, 2025, NS is trading at $0.03925, representing a substantial decline from its all-time high. The token has experienced significant downward pressure across various timeframes:

- 1 hour: -1.13%

- 24 hours: -7.84%

- 7 days: -27.38%

- 30 days: -52.28%

- 1 year: -88.85%

The current price is close to its all-time low of $0.03732, recorded just a day earlier on November 21, 2025. With a market capitalization of $6,095,606.84, NS ranks 1458th in the cryptocurrency market. The 24-hour trading volume stands at $246,002.13, indicating moderate market activity.

The circulating supply of NS tokens is 155,302,085.08, which represents 31.06% of the total supply of 500,000,000 tokens. This suggests a relatively low circulation rate compared to the maximum supply.

Click to view the current NS market price

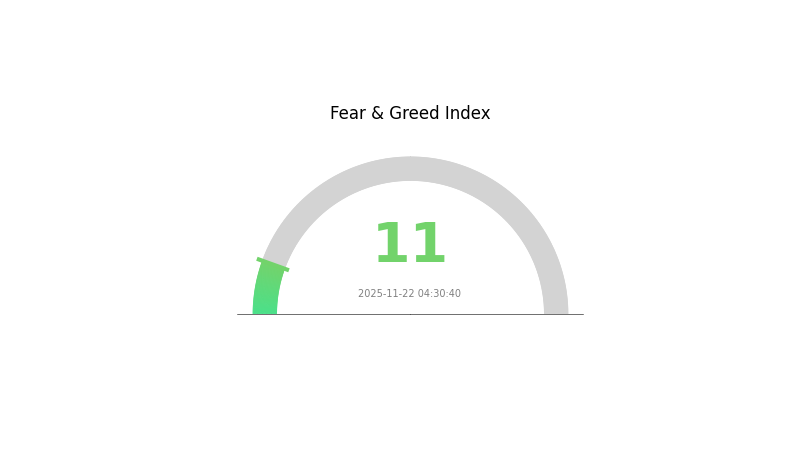

NS Market Sentiment Indicator

2025-11-22 Fear and Greed Index: 11 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is gripped by extreme fear, with the sentiment index plummeting to 11. This level of pessimism often precedes potential buying opportunities, as historically, extreme fear has marked market bottoms. However, investors should exercise caution and conduct thorough research before making any decisions. Gate.com offers a range of tools and resources to help navigate these turbulent market conditions. Remember, market sentiment can shift rapidly, and diversification remains key in managing risk.

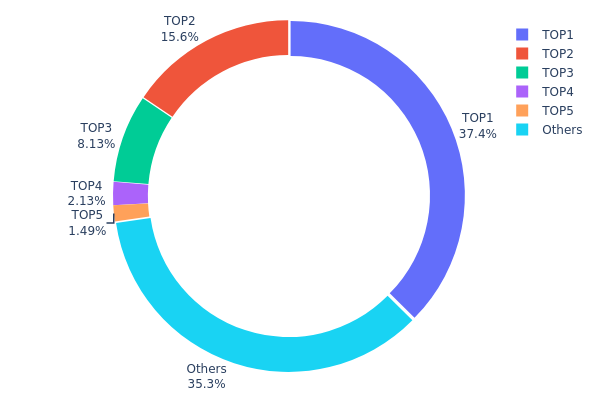

NS Holdings Distribution

The address holdings distribution chart provides crucial insights into the concentration of NS tokens across different wallet addresses. Analysis of the current data reveals a highly concentrated distribution pattern. The top address holds a significant 37.41% of all NS tokens, while the top five addresses collectively control 64.71% of the total supply.

This concentration level raises concerns about potential market manipulation and price volatility. With such a large portion of tokens held by a few addresses, there's an increased risk of sudden large-scale selling or buying activities that could dramatically impact NS's market price. Moreover, this concentration may undermine the project's claims of decentralization, as a small number of entities have substantial influence over the token's circulation and governance.

The current distribution structure suggests a relatively low level of on-chain stability and a higher risk profile for NS. While the presence of a 35.29% distribution among "Others" indicates some level of wider adoption, the overall picture points to a market that could be susceptible to significant shifts based on the actions of a few major holders. This concentration may deter potential investors concerned about fair market practices and long-term stability.

Click to view the current NS Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x2ba3...7206fe | 187053.25K | 37.41% |

| 2 | 0x2893...2c6d07 | 77897.74K | 15.57% |

| 3 | 0xe0d5...0a4d28 | 40626.54K | 8.12% |

| 4 | 0x60dd...b0984d | 10671.46K | 2.13% |

| 5 | 0x45dc...ced046 | 7432.68K | 1.48% |

| - | Others | 176318.34K | 35.29% |

II. Key Factors Influencing the Future Price of NS

Macroeconomic Environment

- Inflation Hedging Properties: As a cryptocurrency, NS may potentially serve as a hedge against inflation in certain economic conditions. However, its effectiveness as an inflation hedge would depend on various factors and market dynamics.

Technology Development and Ecosystem Building

- Ecosystem Applications: The NS ecosystem likely includes various decentralized applications (DApps) and projects built on its blockchain. These applications could contribute to the network's utility and overall value proposition.

III. NS Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.03774 - $0.03931

- Neutral prediction: $0.03931 - $0.04383

- Optimistic prediction: $0.04383 - $0.04835 (requires favorable market conditions)

2026-2027 Outlook

- Market phase expectation: Potential growth phase

- Price range forecast:

- 2026: $0.04032 - $0.06399

- 2027: $0.04259 - $0.07602

- Key catalysts: Increasing adoption and market expansion

2028-2030 Long-term Outlook

- Base scenario: $0.06496 - $0.0883 (assuming steady market growth)

- Optimistic scenario: $0.0883 - $0.12979 (assuming strong market performance)

- Transformative scenario: Above $0.12979 (extremely favorable market conditions)

- 2030-12-31: NS $0.12979 (potential peak price)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.04835 | 0.03931 | 0.03774 | 0 |

| 2026 | 0.06399 | 0.04383 | 0.04032 | 11 |

| 2027 | 0.07602 | 0.05391 | 0.04259 | 37 |

| 2028 | 0.09485 | 0.06496 | 0.03573 | 65 |

| 2029 | 0.09669 | 0.07991 | 0.06392 | 103 |

| 2030 | 0.12979 | 0.0883 | 0.0468 | 124 |

IV. NS Professional Investment Strategies and Risk Management

NS Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Patient investors with a high-risk tolerance

- Operation suggestions:

- Accumulate NS tokens during market dips

- Set price alerts for significant market movements

- Store tokens in a secure wallet with regular backups

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trend directions and potential reversals

- Relative Strength Index (RSI): Helps in identifying overbought or oversold conditions

- Key points for swing trading:

- Monitor trading volume for confirmation of price movements

- Set stop-loss orders to limit potential losses

NS Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3%

- Aggressive investors: 5-10%

- Professional investors: 10-15%

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple cryptocurrencies and traditional assets

- Stop-loss orders: Implement to limit potential losses on trades

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallet for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords, and be cautious of phishing attempts

V. Potential Risks and Challenges for NS

NS Market Risks

- High volatility: NS price can fluctuate dramatically in short periods

- Limited liquidity: May face challenges in executing large trades without significant price impact

- Market sentiment: Susceptible to rapid changes based on news or social media influence

NS Regulatory Risks

- Uncertain regulatory landscape: Potential for new regulations affecting NS or the Sui ecosystem

- Cross-border restrictions: Possible limitations on NS trading or usage in certain jurisdictions

- Taxation complexities: Evolving tax laws may impact NS holders and traders

NS Technical Risks

- Smart contract vulnerabilities: Potential for exploits in the NS token contract

- Network congestion: Sui blockchain performance issues could affect NS transactions

- Integration challenges: Possible difficulties in integrating NS with other blockchain systems or applications

VI. Conclusion and Action Recommendations

NS Investment Value Assessment

NS offers potential long-term value as a digital identity solution within the Sui ecosystem, but faces short-term risks due to market volatility and regulatory uncertainties.

NS Investment Recommendations

✅ Beginners: Start with small, regular purchases to understand the market dynamics ✅ Experienced investors: Consider a balanced approach with both long-term holding and active trading ✅ Institutional investors: Conduct thorough due diligence and consider NS as part of a diversified crypto portfolio

NS Trading Participation Methods

- Spot trading: Purchase NS tokens directly on Gate.com

- Staking: Participate in staking programs if available to earn additional rewards

- DeFi integration: Utilize NS in decentralized finance applications within the Sui ecosystem

Cryptocurrency investment carries extremely high risk, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What crypto will 1000x prediction?

While it's impossible to predict with certainty, emerging projects in AI, DeFi, and Web3 infrastructure have the potential for massive growth. Always research thoroughly before investing.

Will hamster kombat reach $1?

It's unlikely for Hamster Kombat to reach $1 in the near future, given its current market performance and trends in the crypto space.

What is the price prediction for BNS 2025?

Based on market trends and expert analysis, BNS price is predicted to reach $0.15 to $0.20 by 2025, showing potential for significant growth in the coming years.

Will dent reach $1?

It's unlikely for DENT to reach $1 in the near future, given its current market cap and supply. However, with increased adoption and market growth, it could potentially approach this target in the long term.

2025 PI Price Prediction: Assessing the Future Value of Pi Network's Digital Currency

2025 SKM Price Prediction: Analyzing Market Trends and Potential Growth Factors

Gate Launchpad Welcomes Ika (IKA): The Future of Privacy Computing on Sui

2025 LUNC Price Prediction: Analyzing Terra Luna Classic's Potential Recovery and Market Outlook in the Post-Crash Era

2025 HTX Price Prediction: Analyzing Market Trends and Growth Potential for the Digital Asset Exchange Token

2025 HBAR Price Prediction: Will Hedera Hashgraph Reach New Heights in the Crypto Market?

How to Use MACD, RSI, and KDJ Indicators for Crypto Trading in 2025

How does LAB token price volatility compare to Bitcoin and Ethereum in 2026?

What Is FTN Price Volatility: Why Did FTN Drop From $4.4 to $1.95 in 2025?

Goerli Testnet

The Rise of AI Linked Debt: What Investors Should Know in 2026