2025 NUTS Price Prediction: Expert Analysis and Market Forecast for the Next 12 Months

Introduction: Market Position and Investment Value of NUTS

Thetanuts Finance (NUTS) is a decentralized on-chain options protocol focused on altcoin options, allowing users to go long or short on digital assets. Since its inception in September 2021, the project has evolved significantly, launching Basic Vaults that generate yields for users through option premiums, and subsequently upgrading to its v3 architecture to expand new use cases in on-chain options trading. As of December 2025, NUTS has a market capitalization of approximately $3.67 million USD, with a circulating supply of around 2.75 billion tokens, currently trading at $0.001335 per token. This protocol, recognized for its innovative approach to altcoin derivatives, is playing an increasingly important role in the decentralized finance ecosystem.

This article provides a comprehensive analysis of NUTS price trends and market dynamics, combining historical performance data, market supply and demand factors, ecosystem development, and macroeconomic conditions to deliver professional price forecasts and practical investment strategies for the 2025-2030 period.

NUTS Price History Review and Market Analysis

I. NUTS Price History Review and Current Market Status

NUTS Historical Price Evolution

- May 20, 2024: NUTS reached its all-time high (ATH) of $0.0442, representing peak market valuation during the bull cycle.

- December 18, 2025: NUTS hit its all-time low (ATL) of $0.001202, marking a significant decline from historical peaks.

- Overall Performance: Since ATH, NUTS has experienced a substantial decline of approximately 74.17% on a one-year basis, reflecting significant downward pressure on token valuation.

NUTS Current Market Status

As of December 24, 2025, NUTS is trading at $0.001335, with a 24-hour trading volume of $29,554.16. The token exhibits weakness across multiple timeframes, declining 0.22% in the past hour, 0.52% over 24 hours, 7.96% over 7 days, and 9.47% over the past 30 days.

The current market capitalization stands at $3,667,554.85, with a fully diluted valuation of $13,350,000. Circulating supply reaches 2,747,232,096.51 NUTS tokens out of a total maximum supply of 10,000,000,000 tokens, representing a circulation ratio of approximately 27.47%.

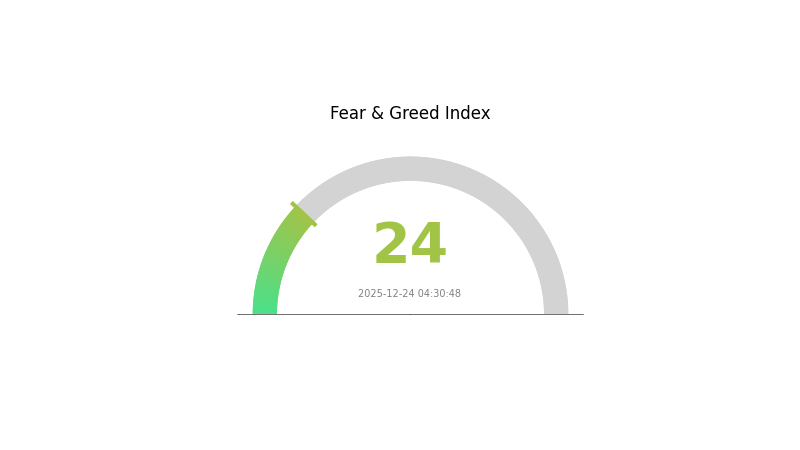

NUTS maintains a market dominance of 0.00042%, ranking 1,731st by market capitalization. The token is supported by 1,702 active holders and trades on 2 exchanges. Current market sentiment reflects extreme fear with a Crypto Fear and Greed Index reading of 24.

View current NUTS market price

NUTS Market Sentiment Indicator

2025-12-24 Fear and Greed Index: 24 (Extreme Fear)

Click to view current Fear & Greed Index

The crypto market is experiencing extreme fear with the Fear and Greed Index at 24. This indicates significant market pessimism and investor anxiety, likely driven by recent volatility and negative sentiment. During periods of extreme fear, contrarian investors often view it as a potential buying opportunity, as assets may be oversold. However, caution is advised as market conditions remain unstable. Monitor key support levels and risk management strategies carefully. On Gate.com, you can track real-time market sentiment and access comprehensive data to make informed trading decisions.

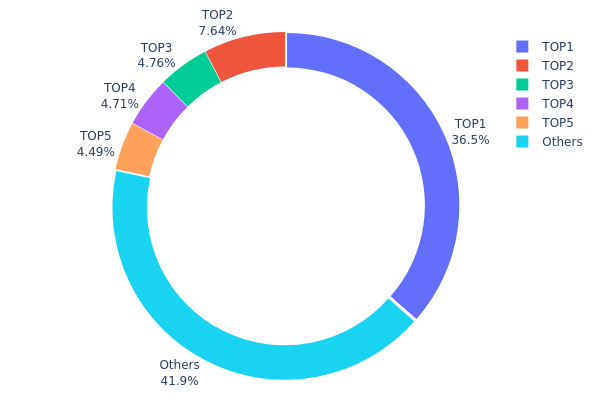

NUTS Holdings Distribution

The address holdings distribution map illustrates the concentration of token ownership across the top wallet addresses in the NUTS ecosystem. This metric is fundamental for assessing market structure, evaluating decentralization levels, and identifying potential concentration risks that could influence price dynamics and market stability.

The current holdings data reveals a moderately concentrated distribution pattern. The top address (0xf48e...3bef11) commands 36.47% of total supply, representing a substantial single-point concentration risk. When combined with the second-largest holder at 7.64%, the top two addresses collectively control 44.11% of NUTS tokens. The next three addresses hold between 4.49% and 4.76% respectively, while the remaining distributed addresses account for 41.93% of the supply. This structure indicates that while no single entity maintains overwhelming control, significant concentration exists among the top five addresses, which collectively hold 58.07% of circulating tokens.

From a market structure perspective, this concentration level presents dual implications. The substantial holdings concentrated in the top address could theoretically facilitate large-scale transactions or influence market movements through coordinated actions. However, the distribution across multiple top holders and the presence of dispersed smaller addresses holding nearly 42% of the supply suggest a partially decentralized ownership structure. This configuration represents moderate concentration rather than extreme centralization, indicating that NUTS maintains a reasonable balance between institutional or early-holder concentration and broader community distribution, though continued monitoring of whale activity remains prudent for assessing potential price volatility and market manipulation risks.

Click to view current NUTS holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xf48e...3bef11 | 552862.86K | 36.47% |

| 2 | 0x0000...e08a90 | 115827.30K | 7.64% |

| 3 | 0x0d07...b492fe | 72183.73K | 4.76% |

| 4 | 0xb15d...dc7144 | 71429.57K | 4.71% |

| 5 | 0xe2f7...edc17e | 68078.61K | 4.49% |

| - | Others | 635524.05K | 41.93% |

II. Core Factors Affecting NUTS' Future Price

Supply Mechanism

-

Market Supply and Demand: NUTS price is driven by supply and demand dynamics, exhibiting significant volatility. The cryptocurrency's price movements are directly influenced by the balance between market supply and investor demand.

-

Historical Volatility: Nut prices have historically shown considerable fluctuations, making it challenging for market participants to predict price movements with certainty.

-

Current Impact: Global supply chain challenges continue to exert downward pressure on supply stability, contributing to increased market uncertainty and price volatility in 2025.

Market Sentiment and Regulatory Environment

-

Investor Sentiment: Price fluctuations are directly influenced by investor sentiment and market psychology. Emotional swings among market participants can drive significant short-term price movements.

-

Regulatory Factors: Regulatory changes and policy frameworks across different jurisdictions impact the trading and adoption of NUTS, potentially affecting future price trajectories.

Enterprise Adoption

- Health-Related Applications: NUTS option products have gained attention for their health advantages. Increased recognition of these benefits is expected to boost demand, potentially supporting price appreciation.

III. 2025-2030 NUTS Price Forecast

2025 Outlook

- Conservative Forecast: $0.0008 - $0.00133

- Base Case Forecast: $0.00133

- Optimistic Forecast: $0.00192 (requires sustained market sentiment and increased adoption)

2026-2027 Mid-term Outlook

- Market Stage Expectation: Gradual recovery phase with incremental adoption expansion and ecosystem development maturation

- Price Range Predictions:

- 2026: $0.00102 - $0.00201 (21% upside potential)

- 2027: $0.00142 - $0.00245 (36% upside potential)

- Key Catalysts: Protocol upgrades, strategic partnerships, increased institutional participation, and ecosystem expansion initiatives

2028-2030 Long-term Outlook

- Base Scenario: $0.00205 - $0.00261 (59% appreciation by 2028), with continued utility development and market penetration

- Optimistic Scenario: $0.00261 - $0.00325 (77% appreciation by 2029), assuming accelerated adoption and positive macroeconomic conditions

- Transformational Scenario: $0.00329+ (110% cumulative growth by 2030), contingent on breakthrough technological advancements and mainstream market acceptance

- 2030-12-24: NUTS trading at $0.00281 average (mid-cycle consolidation phase)

Note: These forecasts are based on analytical projections and subject to significant market volatility. Investors are encouraged to conduct independent research and consider risk management strategies when trading on Gate.com or other platforms.

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00192 | 0.00133 | 0.0008 | 0 |

| 2026 | 0.00201 | 0.00162 | 0.00102 | 21 |

| 2027 | 0.00245 | 0.00182 | 0.00142 | 36 |

| 2028 | 0.00261 | 0.00214 | 0.00205 | 59 |

| 2029 | 0.00325 | 0.00237 | 0.0013 | 77 |

| 2030 | 0.00329 | 0.00281 | 0.00202 | 110 |

Thetanuts Finance (NUTS) Professional Investment Strategy and Risk Management Report

IV. NUTS Professional Investment Strategy and Risk Management

NUTS Investment Methodology

(1) Long-term Holdings Strategy

- Suitable Investors: DeFi protocol enthusiasts, options market participants, and long-term cryptocurrency believers with moderate to high risk tolerance

- Operational Recommendations:

- Accumulate NUTS during market downturns when the token trades below historical support levels, as the protocol continues development of its v3 infrastructure

- Dollar-cost averaging (DCA) approach over 6-12 months to reduce timing risk and average out volatility

- Participate in liquidity pools or staking opportunities offered by Thetanuts Finance to generate additional yield while holding core positions

(2) Active Trading Strategy

- Technical Analysis Tools:

- Support and Resistance Levels: The token has tested support at $0.001202 (all-time low on 2025-12-18) and previously peaked at $0.0442 (2024-05-20). Monitor these critical price zones for reversal signals

- Moving Averages: Use 20-day and 50-day moving averages to identify trend direction; trading signals emerge when shorter-term MA crosses above/below longer-term MA

- Wave Trading Key Points:

- Capitalize on the token's recent -7.96% 7-day and -9.47% 30-day declines by identifying oversold conditions

- Execute short-term trades around announcement cycles related to v3 protocol upgrades and altcoin options features

- Monitor 24-hour volume patterns ($29,554 currently) to identify liquidity windows for entry and exit

NUTS Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% of portfolio allocation maximum, as NUTS remains a highly speculative altcoin option protocol token with significant volatility

- Aggressive Investors: 3-5% of portfolio allocation, focusing on accumulation during downturns and participating in protocol governance

- Professional Investors: 5-8% of portfolio allocation with active hedging through derivatives or options positions

(2) Risk Hedging Solutions

- Protocol Risk Mitigation: Diversify across multiple DeFi option protocols rather than concentrating exclusively in Thetanuts Finance, reducing dependency on single protocol success

- Market Downturn Protection: Establish stop-loss orders at 15-20% below entry price; given the token's -74.17% 1-year performance, downside protection is critical

(3) Secure Storage Solutions

- Hardware wallet Recommendation: Use industry-standard self-custody solutions for long-term holdings of NUTS tokens

- Exchange-Based Storage: For active traders, maintain NUTS on Gate.com for immediate liquidity and reduced withdrawal friction; Gate.com provides competitive trading pairs for NUTS

- Security Considerations: Never share private keys; enable two-factor authentication on all exchange accounts; consider multi-signature wallets for institutional positions; verify contract address (0x23f3d4625aef6f0b84d50db1d53516e6015c0c9b on Ethereum) before any transactions

V. NUTS Potential Risks and Challenges

NUTS Market Risks

- Severe Price Volatility: NUTS has declined -74.17% over the past year from its peak of $0.0442, indicating extreme price instability. The current $0.001335 price represents a 96.98% loss from all-time high, suggesting significant downside risk remains

- Liquidity Constraints: 24-hour trading volume of only $29,554 indicates limited liquidity depth; large trades could face substantial slippage and price impact

- Market Adoption Uncertainty: As an altcoin options protocol, NUTS depends on sustained user adoption and trading activity; reduced market interest in options trading could significantly impact token utility and value

NUTS Regulatory Risks

- Derivatives Regulation: Options trading protocols face increasing regulatory scrutiny globally; potential regulatory crackdowns on derivatives platforms could impact Thetanuts Finance's operational ability and reduce demand for NUTS governance token

- Securities Classification Risk: Regulators may classify NUTS as a security in certain jurisdictions, triggering compliance requirements or trading restrictions

- Jurisdictional Compliance: As a decentralized protocol, Thetanuts Finance may face restrictions in major markets, limiting user base and trading volume growth

NUTS Technology Risks

- V3 Architecture Implementation Risk: The planned transition to v3 infrastructure with lending market and Uniswap v3 pool integration introduces smart contract risk; code vulnerabilities or exploits could result in fund losses and protocol failure

- Protocol Dependency Risk: Reliance on external protocols (Uniswap v3, lending markets) creates cascading failure risks if partner protocols experience security issues or shut down operations

- Liquidity Pool Impermanent Loss: Users providing liquidity to NUTS-related pools face impermanent loss risk during volatile market movements, potentially discouraging liquidity provision

VI. Conclusion and Action Recommendations

NUTS Investment Value Assessment

Thetanuts Finance presents a specialized investment opportunity focused on on-chain altcoin options trading. The project's v3 architecture upgrade demonstrates ongoing development and innovation in the options trading space. However, the token's severe year-over-year decline (-74.17%), limited trading liquidity ($29,554 daily volume), and dependence on derivatives market adoption create substantial short-term headwinds. The protocol's long-term value depends critically on successful v3 implementation, growing user adoption in altcoin options, and favorable regulatory environment. Investors should view NUTS as a high-risk, speculative holding appropriate only for risk-tolerant portfolios with dedicated research capabilities.

NUTS Investment Recommendations

✅ Beginners: Start with minimal allocation (less than 0.5% of portfolio) through Gate.com's spot market only; focus on understanding the Thetanuts Finance protocol before committing capital; avoid leverage or derivatives trading until fully understanding options mechanics

✅ Experienced Investors: Consider 2-4% portfolio allocation; participate in protocol governance; monitor v3 upgrade progress closely; implement strict stop-loss discipline at 15-20% below entry points; use dollar-cost averaging over extended accumulation periods

✅ Institutional Investors: Conduct comprehensive smart contract audits before significant allocation; negotiate liquidity agreements with market makers; establish derivatives hedges for downside protection; allocate 3-8% based on conviction in altcoin options market thesis; maintain relationships with Thetanuts Finance development team for governance participation

NUTS Trading Participation Methods

- Gate.com Spot Trading: Purchase NUTS directly on Gate.com's spot market for long-term holding or active trading; set up price alerts at key support ($0.001202) and resistance levels; use limit orders to achieve better execution than market orders given low liquidity

- Decentralized Exchange Participation: Interact directly with NUTS liquidity pools on Ethereum; provide liquidity to earn trading fees, but carefully assess impermanent loss risk given current price volatility

- Protocol-Native Engagement: Participate directly in Thetanuts Finance platform by using Basic Vaults or upcoming v3 features; earn protocol fees and rewards beyond simple token holding

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors should make careful decisions based on their individual risk tolerance and are strongly advised to consult professional financial advisors. Never invest more than you can afford to lose completely.

FAQ

What is NUTS token and what is its use case?

$NUTS is the native token of Squirrel Wallet, powering the ecosystem, rewarding users, and enabling seamless transactions across supported blockchains.

Can NUTS reach $1 in 2025?

NUTS is not expected to reach $1 in 2025. Expert analysis suggests the price will remain around $0.0021, significantly below the $1 target. Reaching such levels would require substantial market adoption and fundamental developments.

What factors will influence NUTS price prediction?

NUTS price prediction is influenced by protocol updates, market trends, hard forks, trading volume, investor sentiment, and macroeconomic conditions affecting the broader crypto market.

What is the current market cap and circulating supply of NUTS?

The current market cap of NUTS is $0.00, and its circulating supply is 0. Real-time data may vary across different sources, so please verify the latest information for accurate trading decisions.

What are the risks of investing in NUTS based on price predictions?

NUTS price predictions carry risks including market volatility, forecast inaccuracy, and potential losses from misjudged trends. Predictions may not reflect actual market conditions, and prices can fluctuate unexpectedly based on broader market movements and economic factors.

MYX Token Price and Market Analysis on Gate.com in 2025

What Is SRP Price: Analyzing Token Value and Market Trends in 2025

2025 VVSPrice Prediction: Market Analysis and Future Outlook for Crypto Investors

2025 C98 Price Prediction: Analyzing Market Trends and Growth Potential for Coin98 in the Coming Bull Cycle

2025 DBRPrice Prediction: Analyzing Market Trends and Future Value Potential for Digital Bond Reserves

2025 PNG Price Prediction: Forecasting Digital Asset Value Trends in the Evolving NFT Marketplace

Top Bitcoin Mining Apps for Android & iOS

How to Buy BIM in Egypt

Tether TRC20 Wallet and USDT on TRON Network

What is Quant (QNT)? An Overview of the QNT Token

Cryptocurrency Exchange Security Achievements: Successfully Defended Over $150 Million in Crypto Assets