2025 ORNG Price Prediction: Expert Analysis and Market Forecast for the Year Ahead

Introduction: ORNG's Market Position and Investment Value

Orange (ORNG) is a Layer 1 blockchain and platform dedicated to User Generated Content (UGC) tools within web3, offering AI-integrated solutions for avatar creation, voice-activated asset builders, and NFT deployment. Since its launch in June 2024, Orange has established itself as a specialized infrastructure provider for creators and developers. As of January 2026, ORNG's market capitalization has reached $17.254 million, with a circulating supply of approximately 6.25 million tokens trading at around $0.017254. This innovative blockchain solution is playing an increasingly important role in web3 gaming, metaverses, and creator economy ecosystems.

This article will comprehensively analyze ORNG's price trajectory and market dynamics, incorporating historical price patterns, market supply and demand dynamics, ecosystem development, and macroeconomic factors to provide investors with professional price forecasts and actionable investment strategies for the period ahead.

Orange (ORNG) Price Analysis Report

I. ORNG Price History Review and Market Current Status

ORNG Historical Price Evolution Trajectory

-

June 2024: Orange Network launched on Avalanche C-Chain, reaching an all-time high of $0.077 on June 28, 2024, marking the project's peak market performance during its initial phase.

-

October 2024: Market correction phase, with the token reaching an all-time low of $0.00353 on October 22, 2024, reflecting significant consolidation from the launch price of $0.12.

ORNG Current Market Situation

As of January 3, 2026, Orange (ORNG) is trading at $0.017254, representing a market capitalization of approximately $17.25 million with a fully diluted valuation (FDV) of the same amount. The token maintains a circulating supply of 6.25 million ORNG out of a total maximum supply of 1 billion tokens, indicating a circulation rate of 0.625%.

In terms of recent price performance, ORNG demonstrated the following movements:

- 1-hour change: -0.08%

- 24-hour change: +3.1%

- 7-day change: +6.61%

- 30-day change: +5.60%

- 1-year change: +178.77%

The token's 24-hour trading range spans from a low of $0.016542 to a high of $0.019011, with 24-hour trading volume at approximately $99,895.97. Currently, ORNG ranks 4,818 across all digital assets by market capitalization, holding a dominance ratio of 0.0052% in the broader crypto market.

The token is actively traded and supported by 3,209 token holders, with Gate.com being a primary exchange for ORNG trading operations.

View current ORNG market price

ORNG Market Sentiment Indicator

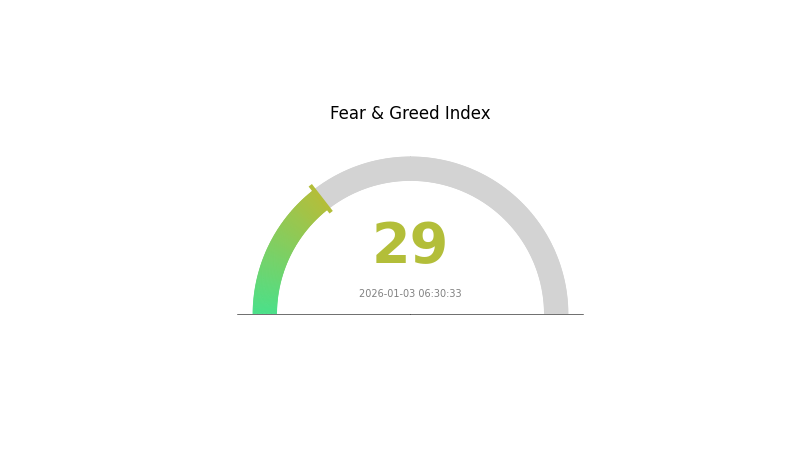

2026-01-03 Fear and Greed Index: 29 (Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing a fear sentiment with an index reading of 29. This indicates heightened anxiety among investors, suggesting potential market uncertainty and cautious trading behavior. During periods of fear, experienced traders often view this as a contrarian indicator, presenting possible accumulation opportunities for long-term investors. The current market conditions warrant careful portfolio management and risk assessment. Monitor market developments closely on Gate.com to stay informed of sentiment shifts and make informed investment decisions.

ORNG Holdings Distribution

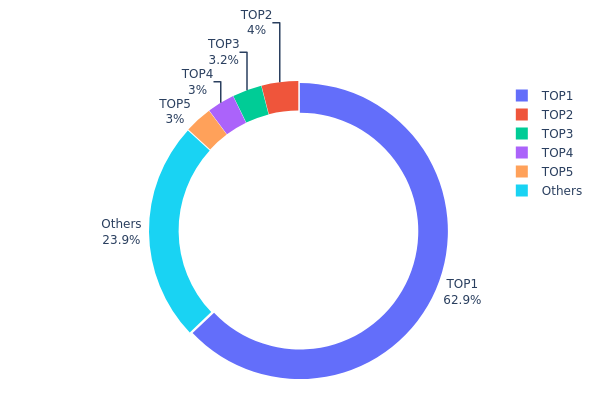

The address holdings distribution represents the concentration of token ownership across blockchain addresses, serving as a critical indicator of market structure and decentralization levels. This metric reveals how ORNG tokens are distributed among major holders and the broader user base, providing insights into potential liquidity dynamics, governance power concentration, and vulnerability to price manipulation.

ORNG currently exhibits significant concentration risk, with the top holder commanding 62.90% of total supply. This degree of centralization is notably elevated, as a single address controls nearly two-thirds of all circulating tokens. The top five addresses collectively hold 76.10% of the token supply, while the remaining 23.90% is distributed among other market participants. This distribution pattern indicates substantial concentration within a limited number of stakeholders, which raises concerns regarding true decentralization and market resilience.

The pronounced concentration observed in ORNG's holdings structure carries meaningful implications for market dynamics and stability. A single dominant holder possessing 62.90% of tokens creates asymmetric information and influence, potentially exposing the market to sudden liquidity shocks, significant price volatility, or strategic selling pressure. The remaining distribution among the top five holders—ranging from 3.00% to 4.00% each—suggests limited checks on the largest holder's market influence. Such structural characteristics may constrain price discovery mechanisms and amplify susceptibility to whale-driven market movements, while the distributed remainder (23.90%) appears insufficient to meaningfully counterbalance concentrated holdings or provide stabilizing depth.

Click to view current ORNG Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xc4be...730a76 | 629000.00K | 62.90% |

| 2 | 0xb447...f0e454 | 40000.00K | 4.00% |

| 3 | 0x766f...cb973b | 32000.00K | 3.20% |

| 4 | 0x6293...307d21 | 30000.00K | 3.00% |

| 5 | 0x50e4...177281 | 30000.00K | 3.00% |

| - | Others | 239000.00K | 23.9% |

II. Core Factors Affecting ORNG's Future Price

Supply Mechanism

- Circulating vs. Total Supply: ORNG has a circulating supply of 6,250,000 tokens, representing only 0.625% of the total supply of 1 billion tokens. This indicates significant potential supply inflation as more tokens enter circulation.

- Current Impact: The extremely low circulation rate relative to total supply suggests considerable downward pressure on price if large portions of tokens are unlocked or released into the market. The gradual release of tokens could create sustained selling pressure over time.

Institutional and Major Holder Dynamics

- Holder Concentration Risk: ORNG's token distribution is highly centralized, with the top address holding 62.90% (629 million tokens) of the supply. The top five addresses collectively control 76.10% of all ORNG tokens, while only 23.9% is distributed among other addresses.

- Market Manipulation Risk: This extreme concentration creates significant vulnerability to whale manipulation and sudden price volatility. The centralized holder structure reduces market stability and liquidity, potentially deterring institutional investment seeking transparent and decentralized ecosystems.

Macroeconomic Environment

- Current Market Sentiment: As of late November 2025, the Fear and Greed Index stood at 28 (indicating fear), reflecting investor hesitation and heightened market uncertainty. This sentiment suggests cautious trading behavior and potential resistance to risk assets.

- Crypto Market Headwinds: The broader cryptocurrency market has experienced notable volatility, with recent downturns affecting altcoins disproportionately. ORNG's price declined 35.65% over the past 30 days, reflecting both ecosystem-specific challenges and macroeconomic headwinds affecting the sector.

Technological Development and Ecosystem Building

- Web3 UGC Platform Focus: ORNG positions itself as a Layer 1 blockchain dedicated to Web3 user-generated content (UGC) tools, addressing virtual avatar creation, NFT deployment, and GameFi economic system construction. This specialized focus differentiates it within the competitive Layer 1 landscape.

- Ecosystem Applications: As a Layer 1 platform, ORNG's value proposition depends on attracting developers and users to build and deploy applications on its network. The success of UGC and GameFi applications will be critical to driving network adoption and token utility.

III. ORNG Price Forecast for 2026-2031

2026 Outlook

- Conservative Forecast: $0.01094 - $0.01761

- Base Case Forecast: $0.0171

- Bullish Forecast: $0.01761 (requires sustained market recovery and increased adoption)

2027-2029 Medium-term Outlook

- Market Stage Expectations: Consolidation and gradual accumulation phase with potential recovery momentum

- Price Range Forecasts:

- 2027: $0.01145 - $0.01892

- 2028: $0.01233 - $0.02067

- 2029: $0.013 - $0.02309

- Key Catalysts: Ecosystem expansion, institutional interest in alternative tokens, improving market liquidity, and positive regulatory developments

2030-2031 Long-term Outlook

- Base Case: $0.01084 - $0.02762 by 2030 (assumes moderate ecosystem growth and stable market conditions)

- Bullish Case: $0.0171 - $0.0259 by 2031 (assumes accelerated adoption and strengthened fundamentals)

- Transformative Case: $0.02762+ (extreme favorable conditions including widespread adoption, significant partnerships, and breakthrough use cases)

- 2031-01-03: ORNG projected at $0.02590 (41% potential upside from current levels, representing strong long-term growth trajectory)

Note: All price predictions are subject to market volatility and broader cryptocurrency market conditions. Investors are advised to conduct thorough research and risk assessment before making investment decisions on Gate.com or other platforms.

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2026 | 0.01761 | 0.0171 | 0.01094 | 0 |

| 2027 | 0.01892 | 0.01735 | 0.01145 | 0 |

| 2028 | 0.02067 | 0.01814 | 0.01233 | 5 |

| 2029 | 0.02309 | 0.0194 | 0.013 | 12 |

| 2030 | 0.02762 | 0.02125 | 0.01084 | 23 |

| 2031 | 0.0259 | 0.02444 | 0.0171 | 41 |

Orange (ORNG) Professional Investment Strategy and Risk Management Report

IV. ORNG Professional Investment Strategy and Risk Management

ORNG Investment Methodology

(1) Long-term Holding Strategy

- Target Audience: Web3 creators, developers, content creators, and long-term believers in decentralized content platforms

- Operational Recommendations:

- Accumulate ORNG tokens during price dips, particularly when prices fall below the 30-day moving average

- Hold tokens through market cycles to benefit from the platform's ecosystem growth and adoption

- Participate in staking or governance mechanisms if available to generate additional yield

(2) Active Trading Strategy

-

Technical Analysis Considerations:

- 24-hour Price Action: Monitor the current 3.1% 24-hour gain as an indicator of short-term momentum

- 7-day and 30-day Trends: Track the 6.61% 7-day increase and 5.60% 30-day performance to identify medium-term trends

-

Wave Trading Key Points:

- Identify resistance levels near the all-time high of $0.077 and support levels near recent lows of $0.01654

- Execute buy orders during pullbacks and sell positions during rallies toward resistance

- Monitor volume trends relative to the 24-hour volume of approximately $99,896 to confirm price movements

ORNG Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% of portfolio allocation

- Active Investors: 2-5% of portfolio allocation

- Professional Investors: 5-10% of portfolio allocation (with proper hedging strategies)

(2) Risk Hedging Solutions

- Portfolio Diversification: Balance ORNG holdings with established cryptocurrencies and traditional assets to reduce concentration risk

- Position Sizing: Implement strict position limits to prevent excessive exposure to a single token with a market cap of approximately $107,837

(3) Secure Storage Solutions

- Self-Custody Approach: Store ORNG tokens in a secure personal wallet by utilizing the contract address on AVAX C-Chain (0x6c14c1898C843FF66cA51e87244690bBc28DF215)

- Exchange Storage: Maintain a portion on Gate.com for active trading purposes, utilizing their security infrastructure

- Security Precautions: Never share private keys, enable two-factor authentication on all accounts, use hardware-based security measures for large holdings, and verify contract addresses before transactions

V. ORNG Potential Risks and Challenges

ORNG Market Risk

- Liquidity Risk: With a 24-hour trading volume of approximately $99,896 and only 6.25 million circulating tokens, large trades may face slippage and price impact challenges

- Volatility Risk: Historical price swings from $0.00353 to $0.077 demonstrate extreme volatility; investors must prepare for significant drawdowns

- Market Adoption Risk: As a Layer 1 platform focused on UGC tools, mainstream adoption remains uncertain, and failure to gain market traction could substantially impact token value

ORNG Regulatory Risk

- Blockchain Regulatory Uncertainty: The Web3 and NFT sector faces evolving regulatory frameworks across different jurisdictions that could impact platform operations and token utility

- Classification Risk: Regulatory agencies may classify ORNG as a security, subjecting it to additional compliance requirements and potentially limiting trading venues

- Jurisdictional Restrictions: Future regulatory changes may restrict access for certain geographic regions, limiting the token's addressable market

ORNG Technology Risk

- Layer 1 Execution Risk: As an independent blockchain, Orange must maintain network security, validator participation, and ecosystem development independently; any critical vulnerabilities could undermine trust

- Scalability Challenges: The platform must effectively handle increasing transaction volumes as it grows; failure to scale could limit adoption and reduce token utility

- Smart Contract Risk: Vulnerabilities in smart contracts supporting GameFi, CRM systems, and analytics dashboards could result in fund loss and reputational damage

VI. Conclusion and Action Recommendations

ORNG Investment Value Assessment

Orange represents a specialized Layer 1 blockchain addressing a specific niche within Web3—user-generated content tools and creator economy infrastructure. With a market cap of approximately $107,837 and a 1-year return of 178.77%, the token has demonstrated significant appreciation potential. However, this performance must be contextualized within the token's extreme volatility, limited liquidity, and dependence on successful ecosystem adoption. The platform's focus on AI-integrated tools for avatar creation, NFT deployment, and GameFi economy creation positions it within emerging Web3 trends, but execution risk remains substantial. The fully diluted valuation of approximately $17.25 million suggests modest market valuation, creating both upside opportunity and downside risk.

ORNG Investment Recommendations

✅ Beginners: Start with minimal allocations (0.5-1% of portfolio) through Gate.com, focus on long-term holding, and avoid active trading until you develop expertise in evaluating Layer 1 blockchain projects and NFT/creator economy fundamentals.

✅ Experienced Investors: Implement a structured approach combining 60% long-term holdings with 40% active trading based on technical signals; monitor ecosystem metrics, community engagement, and developer activity to assess adoption progress.

✅ Institutional Investors: Conduct thorough due diligence on Orange Network's technology infrastructure, governance mechanisms, token economics, and competitive positioning within the creator economy space before significant allocation decisions.

ORNG Trading Participation Methods

- Direct Purchase on Gate.com: Access ORNG through Gate.com's spot trading pairs; utilize limit orders to execute purchases at predetermined price levels

- Avalanche Network Direct Purchase: Acquire ORNG directly on the AVAX C-Chain using the contract address (0x6c14c1898C843FF66cA51e87244690bBc28DF215) through decentralized protocols

- Dollar-Cost Averaging: Implement systematic purchasing schedules at fixed intervals to reduce timing risk and smooth entry prices across market cycles

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors should make decisions based on their individual risk tolerance and financial circumstances. It is strongly recommended to consult with a professional financial advisor. Never invest more capital than you can afford to lose completely.

FAQ

What is the current price of ORNG token? How has its historical price trend been?

ORNG is currently trading at BTC0.061881. It reached an all-time high of BTC0.06696 in September 2025 and an all-time low of BTC0.003601 in August 2024. The token has gained 4.90% over the past 7 days, with 24-hour trading volume of $109,029.50.

What are the main factors influencing ORNG price predictions?

ORNG price predictions are primarily influenced by supply and demand dynamics, market sentiment, regulatory developments, institutional adoption rates, and macroeconomic trends. These factors collectively determine ORNG's price trajectory.

How to analyze ORNG's technical aspects for price prediction?

Analyze ORNG's technical aspects by examining historical price trends, trading volume patterns, and market sentiment indicators. Monitor holder distribution concentration, as ORNG's top 5 addresses control 76.10% of supply, amplifying volatility. Track on-chain metrics and ecosystem development to forecast future price movements.

What are the risks of investing in ORNG? Is the price volatility high?

ORNG carries higher investment risk with significant price volatility. Higher volatility typically correlates with greater potential returns, but also means more dramatic price fluctuations. Investors should be prepared for substantial price swings.

What are the advantages and disadvantages of ORNG compared to other similar tokens?

ORNG excels in decentralization and direct P2P transactions, reducing intermediary risks. However, it faces intense competition and market volatility. Success depends on adoption rates and continuous technological innovation to maintain competitive edge.

What are professional analysts' predictions for ORNG's future price?

Professional analysts predict ORNG will trade between $0.01013-$0.01633 (conservative) and $0.01633-$0.01927 (neutral) in 2026, with potential growth to $0.01238-$0.03149 by 2027 and $0.02128-$0.03565 by 2028, driven by Web3 UGC ecosystem expansion.

What is WAXP: A Comprehensive Guide to the WAX Protocol Token

What Is WEMIX and How Does Its Blockchain Technology Work?

What is PMG: Understanding the Power Management Generator in Modern Electronics

What is NAP: The Key to Productivity and Well-being in the Workplace

Treasure NFT, Let's Talk BoutIt

What is Moni

Chainlink vs XRP: How Chainlink Surpasses XRP in Institutional Blockchain Adoption

Cardano's Midnight Blockchain: Unlocking Privacy with ZK-SNARKs and NIGHT Tokens

Ethereum's $39M Revenue Drop: Network Crisis or Strategic Evolution?

Những trò lừa đảo rút tiền và đầu tư tiền mã hóa lớn mà bạn cần biết

Bitcoin Loophole