2025 PSG Price Prediction: Expert Analysis and Market Forecast for the Upcoming Year

Introduction: PSG's Market Position and Investment Value

Paris Saint-Germain (PSG) is a functional token designed to provide fans of Paris Saint-Germain Football Club with tokenized shares to participate in club governance decisions through the Socios platform. Since its launch in December 2020, PSG has established itself as a pioneering fan engagement token built on the Chiliz Chain. As of December 2025, PSG maintains a market capitalization of approximately $16.12 million with a circulating supply of 13,364,771 tokens, trading at around $0.8105 per token. This innovative "fan participation token" is playing an increasingly important role in the sports and entertainment ecosystem, enabling token holders to vote on binding club decisions, participate in rewarding activities, and stake tokens for NFT rewards.

This article provides a comprehensive analysis of PSG's price trajectory through 2030, integrating historical performance patterns, market supply-demand dynamics, ecosystem development, and macroeconomic factors to deliver professional price forecasts and practical investment strategies for investors seeking exposure to sports-backed digital assets.

Paris Saint-Germain Fan Token (PSG) Market Analysis Report

I. PSG Price History Review and Current Market Status

PSG Historical Price Evolution

-

August 2021: PSG reached its all-time high of $61.23, marking the peak of early market enthusiasm for sports fan tokens following the token's launch in December 2020 at $12.88.

-

2021-2024: The token experienced a prolonged bear market, with significant depreciation as the broader cryptocurrency market contracted and fan token adoption faced challenges.

-

October 2025: PSG touched its all-time low of $0.537, reflecting sustained downward pressure over the multi-year period.

PSG Current Market Status

As of December 22, 2025, PSG is trading at $0.8105, with a 24-hour price movement of +1.54%. The token has recovered slightly from its recent lows but remains significantly below historical highs.

Key Market Metrics:

| Metric | Value |

|---|---|

| Current Price | $0.8105 |

| 24H Change | +1.54% |

| 1H Change | -1.58% |

| 7D Change | -6.61% |

| 30D Change | -6.46% |

| 1Y Change | -74.81% |

| Market Cap | $10,832,146.90 |

| Fully Diluted Valuation | $16,120,845.00 |

| 24H Trading Volume | $17,557.52 |

| Circulating Supply | 13,364,771 PSG |

| Total Supply | 19,890,000 PSG |

| Market Cap Rank | #1,131 |

The token continues to demonstrate weakness in shorter timeframes, declining 6.61% over the past week and 6.46% over the past month. The one-year performance shows a substantial loss of 74.81%, illustrating the prolonged bearish trend affecting the asset. Currently, 66.82% of the maximum supply is in circulation, indicating moderate release of tokens into the market.

With approximately 4,487 token holders and availability on 19 exchanges, including Gate.com, PSG maintains a modest but established presence in the cryptocurrency market. The token's market dominance stands at 0.00050%.

View current PSG market price

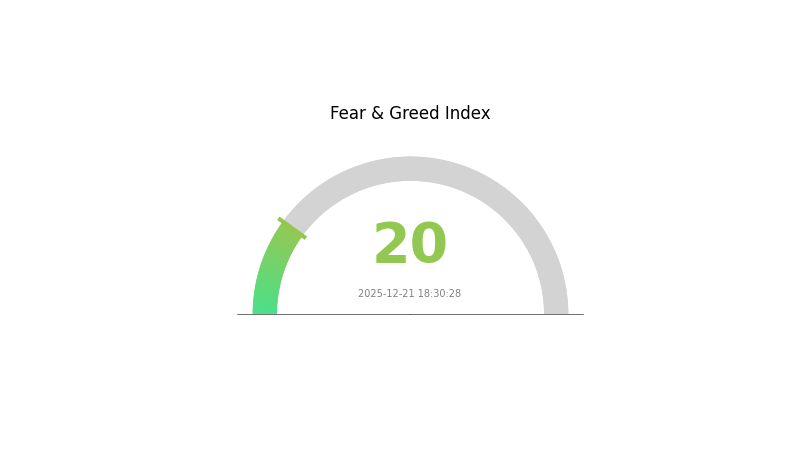

PSG Market Sentiment Index

2025-12-21 Fear and Greed Index: 20 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is experiencing extreme fear, with the Fear and Greed Index dropping to 20. This indicates heightened market anxiety and pessimistic sentiment among investors. During such periods, market volatility typically increases, and prices may face downward pressure. However, extreme fear often presents contrarian opportunities for long-term investors to accumulate assets at lower valuations. It's crucial to maintain a rational investment strategy, conduct thorough research, and avoid making impulsive decisions driven by market emotions. Risk management remains paramount in navigating such challenging market conditions.

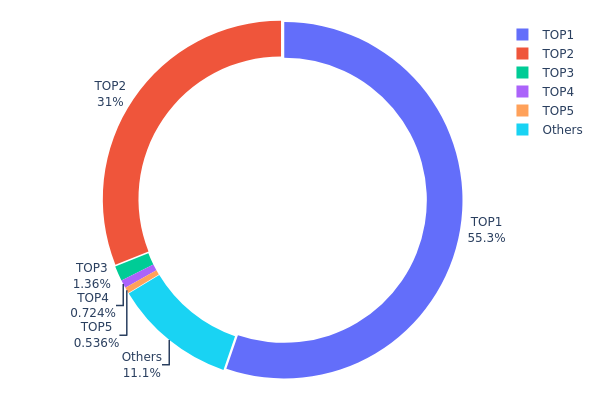

PSG Holdings Distribution

The address holdings distribution map provides a comprehensive snapshot of token concentration across the PSG ecosystem by tracking the allocation percentages held by the largest addresses. This metric serves as a critical indicator of decentralization levels, market structure vulnerability, and potential price manipulation risks within the token's on-chain infrastructure.

The current holdings distribution reveals a highly concentrated token structure dominated by the top two addresses, which collectively control 86.27% of all PSG tokens in circulation. The leading address (0x9bf4...632d59) alone maintains 55.26% of total holdings, while the second-largest address (0x8894...e2d4e3) holds an additional 31.01%. This substantial concentration in just two entities represents a significant structural concern for market decentralization. The remaining top five addresses hold progressively smaller positions ranging from 1.36% down to 0.53%, while the broader holder base accounts for only 11.12% of total supply. Such a distribution pattern indicates that PSG operates with limited decentralization, as decision-making power and price influence remain concentrated within a small number of wallets.

This level of concentration presents meaningful risks to market stability and governance integrity. The top two addresses collectively possess sufficient holdings to execute substantial sell orders that could trigger significant downward price pressure, or coordinate market movements with relative ease. The thin liquidity beyond these major holders suggests limited circuit-breaking mechanisms if large-scale liquidations occur. Additionally, the decentralized nature of blockchain networks requires broader token distribution to establish genuine community consensus and resilience. Current on-chain metrics indicate that PSG's holder structure remains dependent on the actions and intentions of a small cohort of entities, which fundamentally undermines the token's decentralization objectives and increases systemic risk exposure.

To explore current PSG holdings distribution data

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x9bf4...632d59 | 155.30K | 55.26% |

| 2 | 0x8894...e2d4e3 | 87.14K | 31.01% |

| 3 | 0x6f45...41a33d | 3.83K | 1.36% |

| 4 | 0xd2a3...6a2785 | 2.03K | 0.72% |

| 5 | 0xdafe...a00656 | 1.50K | 0.53% |

| - | Others | 31.18K | 11.12% |

II. Core Factors Influencing PSG's Future Price

Macroeconomic Environment

- Anti-inflation Attributes: As a digital asset, PSG has the potential to serve as an inflation hedge tool in certain economic environments.

Three、2025-2030 PSG Price Forecast

2025 Outlook

- Conservative Forecast: $0.76-$0.81

- Neutral Forecast: $0.81-$1.06

- Optimistic Forecast: $1.06 (requiring sustained market momentum and positive ecosystem developments)

2026-2028 Medium-term Outlook

- Market Phase Expectation: Consolidation with gradual recovery and growth acceleration phase, characterized by volatility and foundation building for medium-term expansion

- Price Range Forecast:

- 2026: $0.51-$1.12 (15% upside potential)

- 2027: $0.74-$1.45 (26% upside potential)

- 2028: $0.74-$1.30 (52% upside potential)

- Key Catalysts: Ecosystem expansion, increased institutional adoption, technology upgrades, market sentiment recovery, and growing utility of the PSG token across platforms

2029-2030 Long-term Outlook

- Base Case: $1.10-$1.93 (moderate growth trajectory with sustained ecosystem development and market recovery)

- Optimistic Scenario: $1.80-$1.93 (strong institutional adoption, significant ecosystem expansion, and broad market recovery)

- Transformational Scenario: $1.93+ (extreme positive conditions including major partnerships, mainstream adoption acceleration, and favorable macroeconomic environment)

- 2030-12-31: PSG reaching $1.93 average price level (89% cumulative upside from current baseline, representing sustained growth and market maturation)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 1.05586 | 0.8122 | 0.76347 | 0 |

| 2026 | 1.12084 | 0.93403 | 0.51372 | 15 |

| 2027 | 1.44868 | 1.02743 | 0.73975 | 26 |

| 2028 | 1.29996 | 1.23806 | 0.74283 | 52 |

| 2029 | 1.80199 | 1.26901 | 1.12942 | 56 |

| 2030 | 1.93473 | 1.5355 | 1.10556 | 89 |

PSG Token Investment Strategy and Risk Management Report

IV. PSG Professional Investment Strategy and Risk Management

PSG Investment Methodology

(1) Long-term Holding Strategy

- Target Investors: Sports fans and blockchain enthusiasts who believe in the long-term value of fan engagement platforms

- Operational Recommendations:

- Accumulate PSG tokens during market downturns to average down entry costs

- Participate actively in Socios governance votes to maximize token utility and community engagement

- Reinvest rewards earned from Socios activities back into PSG holdings

(2) Active Trading Strategy

- Technical Analysis Tools:

- Support and Resistance Levels: Monitor key price levels at $0.84 (24H high) and $0.79 (24H low) for entry and exit signals

- Moving Averages: Track 7-day and 30-day price trends to identify momentum shifts

- Wave Trading Key Points:

- Enter positions during negative sentiment phases when prices approach the all-time low of $0.5371

- Exit during positive momentum when prices approach resistance levels

PSG Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 2-3% of portfolio allocation

- Active Investors: 5-8% of portfolio allocation

- Professional Investors: 10-15% of portfolio allocation

(2) Risk Hedging Solutions

- Diversification Strategy: Balance PSG holdings with other blockchain assets and traditional investments to reduce concentration risk

- Position Sizing: Implement strict position limits based on portfolio size and risk tolerance to prevent catastrophic losses

(3) Secure Storage Solutions

- Hot Wallet Recommendation: Gate Web3 wallet for active trading and frequent Socios platform interactions

- Cold Storage Option: Hardware-secured storage for long-term holdings exceeding 6 months

- Security Considerations: Enable multi-signature authentication, use strong passwords, store recovery phrases in secure offline locations, and verify contract addresses before transactions

V. PSG Potential Risks and Challenges

PSG Market Risks

- Extreme Volatility: PSG has experienced a -74.81% decline over one year, demonstrating severe price instability that can result in substantial losses

- Limited Liquidity: With only 19 trading venues and a 24-hour trading volume of $17,557.52, the relatively low liquidity can cause slippage during large transactions

- Market Sentiment Dependency: Fan token valuations are highly susceptible to sports performance, fan sentiment, and social media trends

PSG Regulatory Risks

- Fan Token Classification Uncertainty: Regulatory bodies globally continue debating whether fan tokens constitute securities, creating potential compliance challenges

- Sports Industry Regulations: Changes in sports league policies regarding blockchain partnerships and token programs could impact PSG utility and adoption

- Jurisdiction-Specific Restrictions: Different countries may implement restrictions on fan token trading, particularly in highly regulated financial markets

PSG Technical Risks

- Chiliz Chain Dependency: PSG relies on the Chiliz Chain infrastructure, making it vulnerable to any technical failures, consensus issues, or security breaches on the underlying blockchain

- Smart Contract Vulnerabilities: Governance and reward mechanisms depend on smart contracts that could contain undiscovered exploits or vulnerabilities

- Bridge Security Risks: Cross-chain functionality between BSC and CHZ2 networks introduces potential security vectors and asset bridging risks

VI. Conclusions and Action Recommendations

PSG Investment Value Assessment

PSG represents a unique intersection of sports fandom and blockchain technology, offering governance participation and reward mechanisms for Paris Saint-Germain fans. However, the token faces significant headwinds, including an 85% decline from its all-time high of $61.23, limited liquidity, and regulatory uncertainty surrounding the fan token classification. The project's long-term viability depends on sustained fan engagement, continued Socios platform adoption, and favorable regulatory developments. Current market conditions suggest PSG is more suitable for risk-tolerant investors with genuine interest in fan engagement ecosystems rather than profit-focused traders.

PSG Investment Recommendations

✅ Beginners: Start with minimal positions (0.5-1% of portfolio) on Gate.com while learning about Socios governance mechanisms and fan token utility ✅ Experienced Investors: Consider tactical positions during significant price corrections, participate actively in governance votes to justify holding, and maintain strict stop-loss orders ✅ Institutional Investors: Conduct thorough due diligence on Socios platform adoption metrics, monitor regulatory developments in key jurisdictions, and evaluate correlation with broader sports entertainment tokenization trends

PSG Trading Participation Methods

- Direct Trading: Trade PSG tokens on Gate.com with fiat onramps for direct purchasing and selling

- Socios Platform Integration: Acquire PSG through the Socios app to directly participate in fan voting and access exclusive rewards

- Liquidity Pools: Provide liquidity on supported blockchain networks through Chiliz Chain and BSC to generate yield while enabling platform functionality

Cryptocurrency investment carries extreme risk and is highly speculative. This report does not constitute investment advice. Investors must conduct their own due diligence and consult professional financial advisors before making investment decisions. Never invest more than you can afford to lose completely. PSG token holders should actively monitor regulatory announcements and project developments.

FAQ

How much is a PSG token worth?

As of December 2025, a PSG token is worth approximately $0.80 USD. The price fluctuates based on market conditions and trading activity. For 1 USD, you can acquire approximately 1.26 PSG tokens.

How much is PSG worth now?

As of December 21, 2025, PSG (Paris Saint-Germain Fan Token) is trading at approximately $0.82 USD. The token has experienced a minor 0.3% decline in the past hour and a 2.1% decline over the last 24 hours.

How much is 1000 PSG?

1000 PSG is equivalent to approximately USD 883.32 based on current market rates. The exact value fluctuates with real-time market conditions.

What is the price of PSG?

The current price of PSG is $0.927 (USD). The token has experienced a significant decline of 87.92% from its all-time high of $7.68. PSG maintains steady market presence with consistent trading volume in the crypto market.

What is the PSG token price prediction for the future?

PSG token is predicted to reach a maximum price of $66.82 and a minimum of $45.72 by the end of 2025, based on current market trends and technical analysis.

What factors influence PSG token price?

PSG token price is influenced by market demand, investor sentiment, trading volume, overall crypto market conditions, and project developments. Supply dynamics and news sentiment also significantly impact its value movements.

Is PSG a good investment based on price trends?

PSG shows strong potential driven by fan engagement and market momentum. Recent price trends indicate positive growth trajectory. Monitor trading volume and technical indicators for optimal entry points and investment decisions.

What Does 'Stonks' Mean ?

Aergo Price Analysis: 112% Surge in 90 Days - What's Next for 2025?

Sahara AI (SAHARA) Price Analysis: Recent Volatility Trends and Market Correlations

why is crypto crashing and will it recover ?

How to convert SOL to USD: Real-time Solana price calculator

Crypto Crash or Just a Correction?

How to Conduct Cryptocurrency Project Fundamental Analysis: Whitepaper, Use Cases, Technology, and Roadmap

What is the current crypto market cap ranking and trading volume overview for 2026?

Hamster Kombat Daily Combo & Cipher Answer 4 january 2026

Dropee Daily Combo for 4 january 2026

# What Drives TTD Price Volatility? 52-Week Range Analysis and Trading Patterns