2025 PSTAKE Price Prediction: Analyzing Market Trends and Potential Growth Factors

Introduction: PSTAKE's Market Position and Investment Value

PSTAKE (PSTAKE), as a liquid staking protocol for proof-of-stake (PoS) assets, has been unlocking the true potential of staked PoS assets since its inception. As of 2025, PSTAKE's market capitalization has reached $5,054,000, with a circulating supply of approximately 500,000,000 tokens, and a price hovering around $0.010108. This asset, known as a "liquidity enhancer for PoS tokens," is playing an increasingly crucial role in the Cosmos and Ethereum ecosystems.

This article will comprehensively analyze PSTAKE's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price predictions and practical investment strategies.

I. PSTAKE Price History Review and Current Market Status

PSTAKE Historical Price Evolution

- 2022: All-time high of $1.21 reached on March 7, marking a significant milestone for the project

- 2023-2024: Gradual decline in price as the broader crypto market experienced a downturn

- 2025: Price hit an all-time low of $0.00867604 on April 7, representing a substantial drop from its peak

PSTAKE Current Market Situation

As of November 22, 2025, PSTAKE is trading at $0.010108, showing a slight decline of 1.11% in the past 24 hours. The token has experienced significant depreciation over the past year, with a 79.88% decrease in value. The current price is 99.16% below its all-time high and 16.50% above its all-time low. With a market capitalization of $5,054,000, PSTAKE ranks 1553rd in the cryptocurrency market. The token's trading volume in the last 24 hours stands at $10,964.18, indicating moderate market activity. The circulating supply matches the total and maximum supply at 500,000,000 PSTAKE tokens, suggesting no further token issuance is planned.

Click to view the current PSTAKE market price

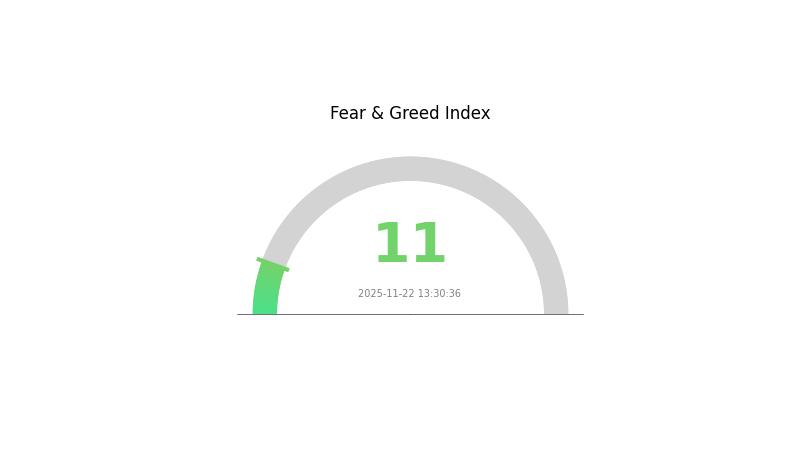

PSTAKE Market Sentiment Indicator

2025-11-22 Fear and Greed Index: 11 (Extreme Fear)

Click to view the current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the sentiment index plummeting to 11. This indicates a highly pessimistic outlook among investors, potentially creating oversold conditions. Historically, such extreme fear has often preceded market bottoms, presenting potential buying opportunities for contrarian investors. However, caution is advised as the underlying reasons for this fear should be thoroughly analyzed before making any investment decisions. As always, diversification and risk management remain crucial in navigating these volatile market conditions.

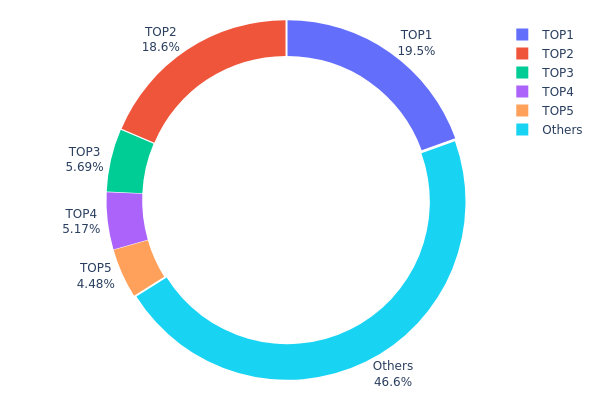

PSTAKE Holdings Distribution

The address holdings distribution data provides insights into the concentration of PSTAKE tokens across different wallets. According to the provided data, the top two addresses hold a significant portion of the total supply, with 19.49% and 18.59% respectively, accounting for nearly 38% of all tokens. The next three largest holders possess between 4.48% and 5.69% each, while the remaining 46.58% is distributed among other addresses.

This distribution pattern indicates a relatively high concentration of PSTAKE tokens among a few key holders. The top five addresses control approximately 53.42% of the total supply, which could potentially impact market dynamics. Such concentration may lead to increased volatility if large holders decide to trade significant portions of their holdings. Additionally, it raises concerns about the potential for market manipulation or coordinated actions by major token holders.

From a market structure perspective, this level of concentration suggests that PSTAKE's ecosystem may be less decentralized than ideal. However, the fact that nearly half of the tokens are distributed among smaller holders provides some balance and could contribute to long-term stability if this portion of the supply remains widely dispersed.

Click to view the current PSTAKE Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xc942...157496 | 97487.75K | 19.49% |

| 2 | 0x91d4...c8debe | 92963.75K | 18.59% |

| 3 | 0x8a65...35318f | 28470.00K | 5.69% |

| 4 | 0xf89d...5eaa40 | 25861.53K | 5.17% |

| 5 | 0xad94...3da067 | 22402.04K | 4.48% |

| - | Others | 232814.93K | 46.58% |

II. Key Factors Affecting PSTAKE's Future Price

Technical Development and Ecosystem Building

- Staking Infrastructure: PSTAKE is developing a robust staking infrastructure to support various Proof-of-Stake blockchains.

- Cross-Chain Integration: The project is working on expanding its cross-chain capabilities to enhance interoperability.

- Ecosystem Applications: PSTAKE is focusing on building DApps and tools to facilitate liquid staking across multiple networks.

III. PSTAKE Price Prediction 2025-2030

2025 Outlook

- Conservative forecast: $0.00547 - $0.00800

- Neutral forecast: $0.00800 - $0.01013

- Optimistic forecast: $0.01013 - $0.01185 (requires favorable market conditions)

2026-2027 Outlook

- Market phase expectation: Gradual growth and consolidation

- Price range forecast:

- 2026: $0.00572 - $0.01154

- 2027: $0.01003 - $0.01499

- Key catalysts: Increased adoption and network upgrades

2028-2030 Long-term Outlook

- Base scenario: $0.01313 - $0.01648 (assuming steady market growth)

- Optimistic scenario: $0.01648 - $0.01951 (assuming strong market performance)

- Transformative scenario: $0.01951+ (assuming breakthrough developments and mass adoption)

- 2030-12-31: PSTAKE $0.01945 (potential peak)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.01185 | 0.01013 | 0.00547 | 0 |

| 2026 | 0.01154 | 0.01099 | 0.00572 | 8 |

| 2027 | 0.01499 | 0.01127 | 0.01003 | 11 |

| 2028 | 0.01378 | 0.01313 | 0.00774 | 29 |

| 2029 | 0.01951 | 0.01345 | 0.01278 | 33 |

| 2030 | 0.01945 | 0.01648 | 0.0145 | 63 |

IV. PSTAKE Professional Investment Strategies and Risk Management

PSTAKE Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term believers in PoS assets and liquid staking protocols

- Operation suggestions:

- Accumulate PSTAKE tokens during market dips

- Stake PSTAKE tokens to earn additional rewards

- Store tokens in a secure non-custodial wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Monitor short-term and long-term trends

- RSI (Relative Strength Index): Identify overbought and oversold conditions

- Key points for swing trading:

- Set clear entry and exit points based on technical indicators

- Monitor news and developments in the liquid staking sector

PSTAKE Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: 10-15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple PoS assets and protocols

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallet for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords, and keep private keys offline

V. Potential Risks and Challenges for PSTAKE

PSTAKE Market Risks

- High volatility: PSTAKE price may experience significant fluctuations

- Competition: Increasing number of liquid staking protocols may impact market share

- Market sentiment: Overall crypto market conditions can affect PSTAKE's performance

PSTAKE Regulatory Risks

- Uncertain regulatory environment: Potential for increased scrutiny of liquid staking protocols

- Compliance challenges: Evolving regulations may require protocol adjustments

- Cross-border restrictions: Varying regulations across jurisdictions may limit adoption

PSTAKE Technical Risks

- Smart contract vulnerabilities: Potential for exploits or bugs in the protocol

- Scalability issues: Challenges in handling increased user demand

- Interoperability concerns: Compatibility issues with different blockchain networks

VI. Conclusion and Action Recommendations

PSTAKE Investment Value Assessment

PSTAKE offers potential long-term value in the growing liquid staking sector but faces short-term risks due to market volatility and regulatory uncertainties.

PSTAKE Investment Recommendations

✅ Beginners: Start with small positions and focus on learning about liquid staking ✅ Experienced investors: Consider allocating a portion of PoS assets to PSTAKE for diversification ✅ Institutional investors: Conduct thorough due diligence and consider PSTAKE as part of a broader liquid staking strategy

PSTAKE Participation Methods

- Direct token purchase: Buy PSTAKE tokens on Gate.com

- Staking: Participate in PSTAKE's staking program for additional rewards

- Liquid staking: Use PSTAKE protocol to stake PoS assets and receive liquid tokens

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Is pSTAKE a good buy?

Yes, pSTAKE looks like a good buy in 2025. Its innovative staking solutions and growing adoption in the DeFi space make it a promising investment with potential for significant returns.

Which crypto will reach $1000 in 2030?

Bitcoin is the most likely cryptocurrency to reach $1000 by 2030, with Ethereum also having a strong chance. Other potential candidates include Cardano and Solana, depending on their technological advancements and adoption rates.

What is pSTAKE crypto?

pSTAKE is a liquid staking protocol that allows users to stake their PoS assets and receive liquid staking tokens in return, enabling them to participate in DeFi while earning staking rewards.

What crypto has the highest price prediction?

Bitcoin (BTC) is often predicted to have the highest future price among cryptocurrencies, with some analysts forecasting it could reach $500,000 or more by 2030.

How Does On-Chain Data Analysis Impact DOT Price in 2025?

What is FIS: A Comprehensive Guide to Financial Information Systems

What is PSTAKE: Exploring the Innovative Staking Protocol for Decentralized Finance

What is VNO: A Comprehensive Guide to Virtual Network Operators and Their Role in Modern Telecommunications

What is MILK: A Comprehensive Guide to Its Nutritional Benefits, Types, and Uses in Daily Life

What is MILK: A Comprehensive Guide to Understanding Dairy's Most Essential Beverage

BTC Option Flows Explained, Why Bitcoin Above 93,000 Suggests a Bullish Start to 2026

Bitcoin Options Traders Eye USD $100,000 as Derivatives Signal Market Reset

What Is GLD ETF, Understanding Gold Price Exposure and Structure

SMH ETF Explained, How Semiconductor Sector Investing Works

Samsung Q4 Profit Jumps 160 Percent, How the AI Chip Boom Is Reshaping Markets