2025 PUMPBTC Price Prediction: Expert Analysis and Market Forecast for the Upcoming Year

Introduction: Market Position and Investment Value of PUMPBTC

PumpBTC (PUMPBTC) is an AI-driven staking and liquidity operating system designed for modular chains, enabling Bitcoin holders to maximize returns through seamless DeFi ecosystem integration. As of December 23, 2025, PumpBTC has achieved a market capitalization of $26.06 million with a circulating supply of 285 million tokens, currently trading at $0.02606. This innovative asset is playing an increasingly critical role in enabling Bitcoin holders to participate in decentralized finance while maintaining control over their assets.

This article will conduct a comprehensive analysis of PumpBTC's price trajectory from 2025 through 2030, combining historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic factors to provide investors with professional price forecasts and practical investment strategies.

I. PUMPBTC Price History Review and Current Market Status

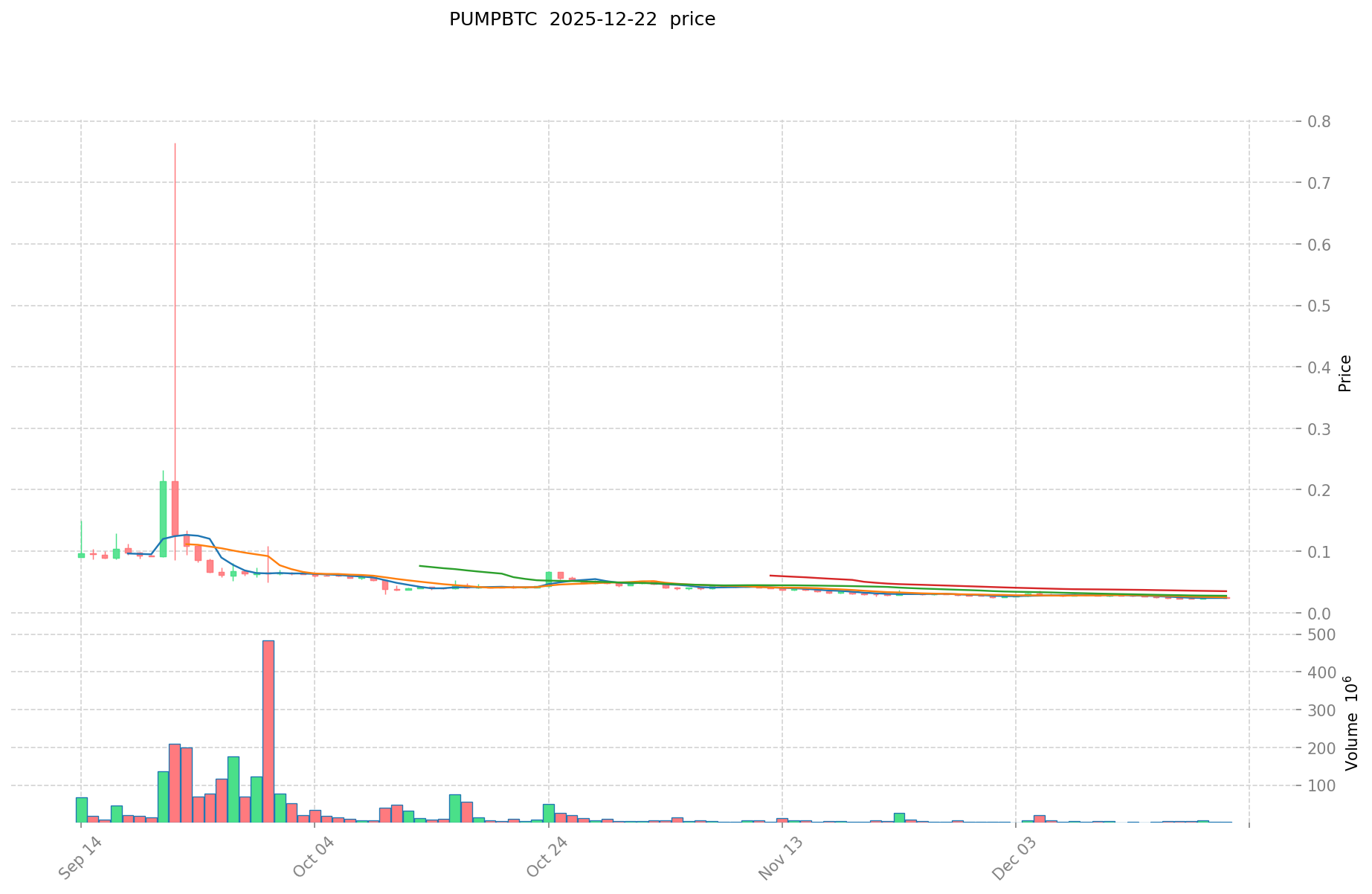

PUMPBTC Historical Price Evolution

- September 22, 2025: Project milestone achieved, price reached all-time high of $0.76464

- December 18, 2025: Market correction phase, price declined to all-time low of $0.02217

- December 23, 2025: Recent recovery period, price rebounded to $0.02606

PUMPBTC Current Market Conditions

As of December 23, 2025, PUMPBTC is trading at $0.02606, reflecting a 24-hour price increase of 7.33%. The token demonstrates short-term bullish momentum with a 1-hour gain of 1.6%, though longer-term performance shows significant headwinds with a 30-day decline of 8.79% and a year-to-date loss of 61.45%.

The token's market capitalization stands at approximately $7.43 million with a fully diluted valuation of $26.06 million, representing a circulation ratio of 21.28%. Current trading volume for the past 24 hours reached $37,371.69, indicating moderate liquidity levels. The 24-hour price range fluctuated between $0.02405 and $0.02685.

PumpBTC maintains a market ranking of 1331 with a market dominance of 0.00080%. The token currently has 129 token holders and operates on both BEP-20 and ERC-20 blockchain standards, with primary deployment on the Ethereum network.

View current PUMPBTC market price

PUMPBTC Market Sentiment Index

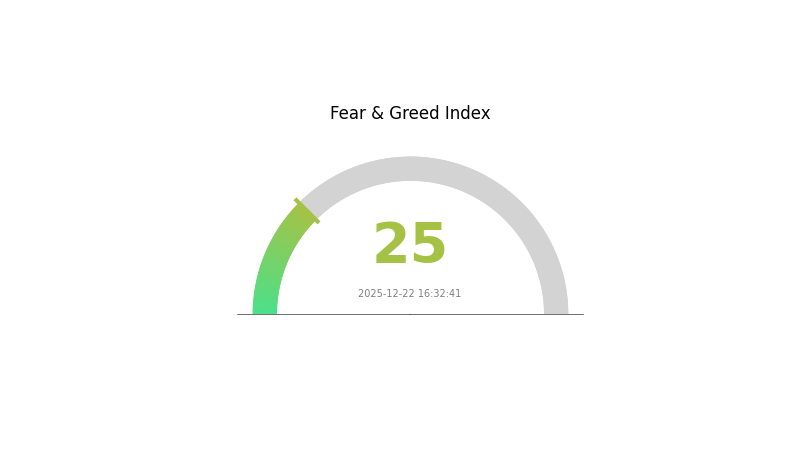

2025-12-22 Fear and Greed Index: 25 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is experiencing extreme fear, with the Fear and Greed Index dropping to 25. This indicates significant market pessimism and heightened risk aversion among investors. During such periods, market volatility tends to increase, and selling pressure dominates. Experienced traders often view extreme fear as a potential contrarian signal, as markets may be oversold. However, caution is advised, as further downside movements could occur. Monitor key support levels closely and consider your risk tolerance before making investment decisions on Gate.com.

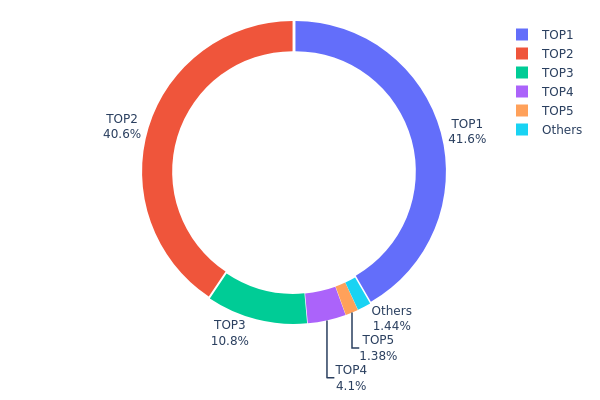

PUMPBTC Holdings Distribution

Address holdings distribution represents the allocation of token ownership across different blockchain addresses, serving as a critical indicator of tokenomics health and market structure. This metric reveals concentration patterns, potential whale activity, and the overall decentralization level of the asset. By analyzing top holder positions, researchers can assess liquidity dynamics, price vulnerability, and governance implications within the ecosystem.

PUMPBTC currently exhibits significant concentration risk in its holder base. The top two addresses collectively control 82.24% of the total token supply, with the leading address alone holding 41.64% and the second-largest holder maintaining 40.60%. This extreme concentration indicates a highly centralized ownership structure where decision-making power and price influence are concentrated among a minimal number of entities. The third-largest holder represents only 10.82% of the supply, creating a stark disparity that underscores the dominance of the top two positions. The remaining addresses, including the fourth and fifth-largest holders at 4.10% and 1.38% respectively, hold marginal positions compared to the top tier.

This distribution pattern presents considerable implications for market stability and potential manipulation risks. With over four-fifths of the token supply held by just two addresses, PUMPBTC faces substantial volatility concerns should these major holders execute significant transactions. The inability of smaller holders to counterbalance such concentrated positions creates asymmetric information dynamics and heightened liquidation risks. The minimal participation of dispersed holders at 1.46% further accentuates the lack of organic, distributed ownership, suggesting limited grassroots adoption and community engagement. Such extreme centralization raises questions about long-term sustainability and price discovery efficiency in secondary markets.

For current PUMPBTC holdings distribution data, visit Gate.com.

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xa5a7...10e6ce | 200000.00K | 41.64% |

| 2 | 0x12e0...bdbcde | 195000.00K | 40.60% |

| 3 | 0x1091...e3e2e9 | 52000.45K | 10.82% |

| 4 | 0xf42a...36f173 | 19697.72K | 4.10% |

| 5 | 0x0d07...b492fe | 6638.43K | 1.38% |

| - | Others | 6936.49K | 1.46% |

Core Factors Affecting PUMPBTC's Future Price

Supply Mechanism

-

1:1 Peg Mechanism: PUMPBTC maintains a 1:1 peg with Bitcoin, meaning Bitcoin price fluctuations directly impact PUMPBTC's value. The protocol's ability to maintain this peg is crucial for price stability.

-

Current Impact: With PUMPBTC's total locked value (TVL) exceeding $200 million, the supply dynamics are influenced by the broader Bitcoin restaking ecosystem. The field currently faces over-construction on the supply side, while demand-side market scale remains uncertain. This suggests potential price pressure from increased competition in the wrapped Bitcoin space.

Macro-Economic Environment

-

Monetary Policy Impact: Federal Reserve rate cuts have driven positive market sentiment, with the sentiment index recovering to 87% from 65.5%. This supportive monetary environment benefits risk assets like PUMPBTC, though short-term Bitcoin volatility remains possible.

-

Stock Market Correlation: In 2024 Q4, cryptocurrency total market cap showed strong positive correlation (0.84) with the S&P 500, with crypto assets delivering 45.7% returns compared to the S&P 500's 3.0%. This indicates PUMPBTC's price performance is increasingly tied to broader financial market trends.

-

Market Sentiment Dynamics: Overall market sentiment continues to support crypto assets, with the 2024 annual report showing strong institutional and retail interest in the cryptocurrency space.

Competitive Landscape

-

Protocol Competition: PUMPBTC faces intensifying competition in the Bitcoin restaking sector. Leading protocols like Solv hold over 24,000 BTC in reserves ($1.6 billion in liquidity), while Lombard has accumulated nearly 10,000 BTC deposits. This competitive pressure from well-capitalized competitors could impact PUMPBTC's market share.

-

Regulatory Environment: The uncertain regulatory landscape for cross-chain assets may affect operational flexibility and market adoption, creating additional price volatility factors.

Three、2025-2030 PUMPBTC Price Forecast

2025 Outlook

- Conservative Forecast: $0.02397

- Neutral Forecast: $0.02605

- Optimistic Forecast: $0.02787

2026-2028 Mid-term Outlook

- Market Stage Expectation: Gradual accumulation phase with moderate growth trajectory as market sentiment stabilizes and adoption expands.

- Price Range Forecast:

- 2026: $0.02427 - $0.03181

- 2027: $0.02351 - $0.03497

- 2028: $0.0177 - $0.03443

- Key Catalysts: Increased institutional interest, improved liquidity on platforms like Gate.com, growing ecosystem development, and positive regulatory environment.

2029-2030 Long-term Outlook

- Base Case: $0.03503 - $0.04896 (Assuming steady ecosystem maturation and sustained market growth)

- Optimistic Case: $0.04630 - $0.04896 (Assuming accelerated adoption and stronger market fundamentals)

- Transformative Case: Above $0.04896 (Contingent on breakthrough partnerships, mainstream adoption acceleration, and favorable macroeconomic conditions)

- 2030-12-31: PUMPBTC targeting $0.04896 (52% projected growth from baseline, representing long-term value appreciation)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.02787 | 0.02605 | 0.02397 | 0 |

| 2026 | 0.03181 | 0.02696 | 0.02427 | 3 |

| 2027 | 0.03497 | 0.02939 | 0.02351 | 12 |

| 2028 | 0.03443 | 0.03218 | 0.0177 | 23 |

| 2029 | 0.0463 | 0.03331 | 0.02365 | 27 |

| 2030 | 0.04896 | 0.0398 | 0.03503 | 52 |

PumpBTC Professional Investment Strategy and Risk Management Report

IV. PumpBTC Professional Investment Strategy and Risk Management

PumpBTC Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Bitcoin holders seeking yield optimization through DeFi participation, risk-averse investors with strong conviction in modular chain ecosystems

- Operational Recommendations:

- Allocate a core position in PumpBTC tokens and hold through market cycles to benefit from the platform's staking and liquidity mechanisms

- Enable staking rewards on the PumpBTC platform to generate passive income while maintaining asset control

- Regularly monitor the platform's AI-driven optimization updates and reinvest yields for compounding effects

(2) Active Trading Strategy

- Technical Analysis Tools:

- Support and Resistance Levels: Identify key price points at $0.02405 (24H low) and $0.02685 (24H high) to determine entry and exit positions

- Moving Averages: Apply short-term (7-day) and medium-term (30-day) moving averages to confirm trend direction and momentum strength

- Wave Trading Key Points:

- Monitor the 24-hour price volatility of 7.33% as an indicator of trading opportunity windows

- Assess the 30-day decline of -8.79% for potential reversal signals and accumulation opportunities

PumpBTC Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 2-3% of cryptocurrency portfolio allocation

- Active Investors: 5-8% of cryptocurrency portfolio allocation

- Professional Investors: 10-15% of cryptocurrency portfolio allocation with hedging strategies

(2) Risk Hedging Solutions

- Diversification Strategy: Combine PumpBTC holdings with established Bitcoin and Ethereum positions to reduce concentration risk

- Position Sizing: Implement strict position limits based on individual risk tolerance and overall portfolio construction to avoid overexposure

(3) Secure Storage Solutions

- Hot Wallet Solution: Gate Web3 wallet for active trading and staking participation on the PumpBTC platform

- Cold Storage Approach: Transfer non-trading portions to secure offline storage for long-term holdings

- Security Precautions: Enable two-factor authentication, maintain private key backups in secure locations, and never share seed phrases with any third parties

V. PumpBTC Potential Risks and Challenges

PumpBTC Market Risk

- Extreme Volatility: The token has experienced a decline of -61.45% over the past year, indicating significant price fluctuations that may result in substantial losses for investors

- Low Trading Volume: With a 24-hour volume of $37,371.69 and limited exchange availability (1 exchange), liquidity constraints may prevent efficient entry and exit at favorable prices

- Market Capitalization Concentration: The token maintains a market cap of $7,427,100 with only 129 holders, suggesting potential exposure to whale manipulation and sudden price movements

PumpBTC Regulatory Risk

- Evolving Regulatory Framework: The classification of AI-driven staking platforms and DeFi protocols remains uncertain across different jurisdictions, creating potential compliance challenges

- Bitcoin-Backed Asset Regulatory Status: Regulatory authorities may impose new restrictions on Bitcoin derivative products and yield-generating mechanisms

- Cross-Chain Regulatory Gaps: Operating across multiple blockchain networks (BEP-20, ERC-20) may expose the project to differing regulatory interpretations in various regions

PumpBTC Technology Risk

- Smart Contract Vulnerabilities: AI-driven systems managing staking and liquidity operations require continuous security audits to prevent potential exploits

- Modular Chain Integration Risk: Dependency on modular chain infrastructure adoption and performance; failure or delays in ecosystem development could impact platform functionality

- Protocol Scalability Concerns: Increased network activity during market rallies could expose limitations in the platform's ability to handle transaction volumes while maintaining security

VI. Conclusion and Action Recommendations

PumpBTC Investment Value Assessment

PumpBTC presents an innovative approach to Bitcoin yield generation through AI-driven staking mechanisms designed for modular chain ecosystems. However, the platform faces significant challenges including extreme price volatility, limited liquidity, concentrated holder distribution, and uncertain regulatory status. The project's value proposition depends heavily on successful adoption of modular chain infrastructure and sustained demand for Bitcoin-backed DeFi solutions. While the technology addresses genuine pain points in Bitcoin utilization, the current market performance and structural limitations suggest treating this as a speculative, high-risk investment rather than a core portfolio holding.

PumpBTC Investment Recommendations

✅ Beginners: Start with a minimal test allocation (0.5-1% of crypto portfolio) on Gate.com to understand platform mechanics before scaling exposure; focus exclusively on long-term holding strategy without active trading.

✅ Experienced Investors: Establish a 3-5% position for yield farming through the platform's staking mechanisms; employ active trading strategies during high-volatility periods identified through technical analysis; implement strict stop-loss orders at -15% to -20% levels.

✅ Institutional Investors: Conduct comprehensive due diligence on smart contract security and regulatory compliance before any allocation; consider position sizing at 5-10% maximum; establish hedging strategies through inverse positions on correlated assets; negotiate direct partnerships with the development team to access proprietary market data.

PumpBTC Trading Participation Methods

- Direct Trading on Gate.com: Access PumpBTC token trading through Gate.com's spot trading market with competitive fees and professional trading tools

- Staking Through PumpBTC Platform: Deposit tokens directly into the PumpBTC platform to participate in AI-driven yield optimization and liquidity programs

- DeFi Protocol Integration: Provide liquidity to modular chain-based pools and participate in governance mechanisms while earning protocol fees

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors must carefully evaluate their risk tolerance and personal financial situation before making any decisions. Consultation with professional financial advisors is strongly recommended. Never invest more than you can afford to lose.

FAQ

Can pump coin reach $1?

Yes, Pump Coin could potentially reach $1 if market conditions improve and adoption increases significantly. However, this would require substantial growth in trading volume and community engagement over the coming years.

What crypto will 1000x prediction?

PUMPBTC has strong potential for significant gains. With growing adoption, innovative tokenomics, and increasing market attention, it's positioned as a strong candidate for substantial returns in the upcoming bull market cycle.

Does pump crypto have a future?

Yes. Pump crypto has a future backed by its unique utility and profitable platform. The project allocates over 98% of platform revenue to token buybacks, directly supporting price action. Its innovative no-code model and strong market performance demonstrate solid fundamentals beyond typical memecoin characteristics.

What is the price of PumpBTC?

The price of PumpBTC is $0.02477 as of December 22, 2025, with a 24-hour trading volume of $9,930,214.

# How Much SOL Are Institutions Currently Holding: 2025 Holdings & Fund Flow Analysis

What is PUMPBTC: A Comprehensive Guide to the Bitcoin Pump Token and Its Market Impact

Is Bedrock (BR) a good investment? An In-Depth Analysis of Market Potential, Risk Factors, and Expert Predictions for 2024

2025 BANK Price Prediction: Expert Analysis and Market Forecast for the Banking Sector

2025 BB Price Prediction: Expert Analysis and Market Forecast for the Coming Year

2025 SOLV Price Prediction: Expert Analysis and Market Forecast for the Coming Year

Sàn DEX là gì?

Main Differences Between TradFi and DeFi: A Complete Guide in 2026

How to Buy Bitcoin ETF? A Complete Guide in 2026

What are on-chain data analysis metrics for Monad (MON): active addresses, whale movements, and transaction trends in 2026?

What is a token economics model: allocation mechanisms, inflation design, and governance utility explained