2025 PUNDIX Price Prediction: Will This Crypto Asset Reach New Heights in the DeFi Era?

Introduction: PUNDIX's Market Position and Investment Value

PundiX (PUNDIX), as a decentralized offline cryptocurrency network, has been making cryptocurrency usage more accessible since its inception. As of 2025, PUNDIX's market capitalization has reached $87,127,941, with a circulating supply of approximately 258,386,541 tokens, and a price hovering around $0.3372. This asset, known as the "everyday crypto payment solution," is playing an increasingly crucial role in facilitating daily cryptocurrency transactions.

This article will comprehensively analyze PUNDIX's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price predictions and practical investment strategies.

I. PUNDIX Price History Review and Current Market Status

PUNDIX Historical Price Evolution

- 2021: PUNDIX launched, reaching an all-time high of $10.07 on March 31

- 2022: Market downturn, price declined significantly

- 2025: Price hit an all-time low of $0.212924 on October 11

PUNDIX Current Market Situation

As of October 21, 2025, PUNDIX is trading at $0.3372, with a market cap of $87,127,941.66. The token has experienced a 24-hour price decrease of 2.51% and a 7-day decline of 2.63%. However, it shows a 30-day gain of 7.29%, indicating some recent positive momentum. The current price is significantly below its all-time high, suggesting potential for recovery but also reflecting the challenges faced by the project in the current market conditions.

Click to view the current PUNDIX market price

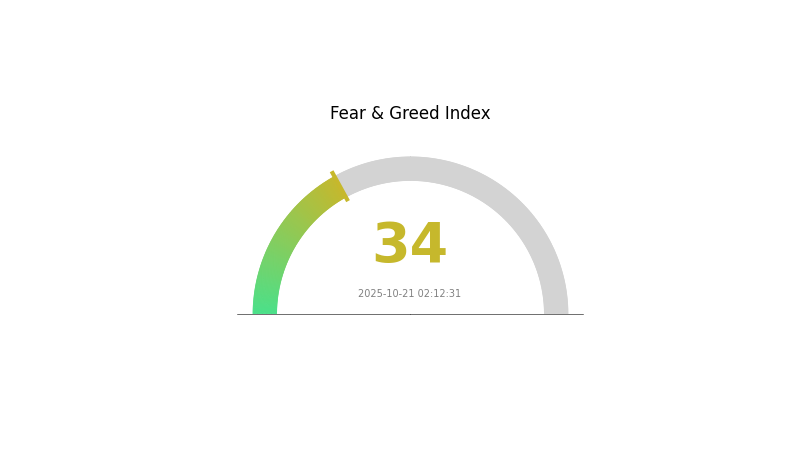

PUNDIX Market Sentiment Indicator

2025-10-21 Fear and Greed Index: 34 (Fear)

Click to view the current Fear & Greed Index

The crypto market is currently gripped by fear, with the Fear and Greed Index registering at 34. This cautious sentiment suggests investors are wary of potential risks in the PUNDIX ecosystem. However, for contrarian traders, periods of fear often present opportunities to accumulate assets at discounted prices. As always, it's crucial to conduct thorough research and manage risk carefully before making any investment decisions in the volatile crypto market.

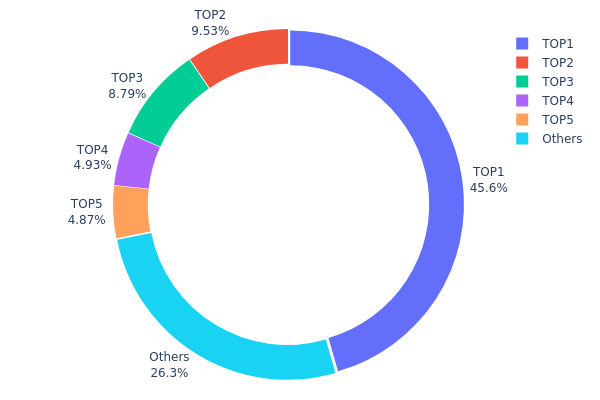

PUNDIX Holdings Distribution

The address holdings distribution data for PUNDIX reveals a highly concentrated ownership structure. The top address holds a substantial 45.56% of the total supply, while the top 5 addresses collectively control 73.64% of PUNDIX tokens. This level of concentration raises concerns about the token's decentralization and market stability.

Such a concentrated distribution can significantly impact market dynamics. The dominance of a few large holders may lead to increased price volatility and potential market manipulation risks. Any substantial movement from these top addresses could trigger significant price swings, potentially destabilizing the market.

This concentration also suggests a relatively low level of token dispersion among smaller holders, which may indicate limited adoption or circulation within the broader market. While this structure might provide some stability in terms of large holders potentially having long-term interests, it also presents challenges for achieving a more decentralized and resilient ecosystem for PUNDIX.

Click to view the current PUNDIX Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x2bc8...2a2960 | 117727.79K | 45.56% |

| 2 | 0xf977...41acec | 24616.11K | 9.52% |

| 3 | 0x6f1d...d80a27 | 22708.81K | 8.78% |

| 4 | 0x5a52...70efcb | 12733.82K | 4.92% |

| 5 | 0x28c6...f21d60 | 12570.96K | 4.86% |

| - | Others | 68029.06K | 26.36% |

II. Key Factors Affecting PUNDIX's Future Price

Institutional and Whale Dynamics

- Institutional Holdings: Grayscale Fund's increase or decrease in PUNDIX holdings may significantly impact the price.

Macroeconomic Environment

- Monetary Policy Impact: Changes in central bank policies and macroeconomic trends could influence PUNDIX's price.

- Geopolitical Factors: International political situations and regulatory changes, such as SEC's classification of certain cryptocurrencies as securities, may affect PUNDIX's market performance.

Technological Development and Ecosystem Building

- Technical Upgrades: Advancements in blockchain technology, such as Ethereum's merge leading to reduced gas fees, could impact PUNDIX's price.

- Ecosystem Applications: The growth of global crypto payment trends, including the adoption of crypto payment cards by major financial institutions, may boost PUNDIX's utility and value.

III. PUNDIX Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.1829 - $0.3387

- Neutral prediction: $0.3387 - $0.37934

- Optimistic prediction: $0.37934 - $0.40 (requires significant market recovery and project developments)

2027-2028 Outlook

- Market stage expectation: Potential growth phase with increasing adoption

- Price range forecast:

- 2027: $0.33551 - $0.46745

- 2028: $0.31244 - $0.54043

- Key catalysts: Technological advancements, expanding use cases, and broader crypto market trends

2029-2030 Long-term Outlook

- Base scenario: $0.48132 - $0.50539 (assuming steady market growth and project development)

- Optimistic scenario: $0.52945 - $0.73786 (assuming strong market conditions and widespread adoption)

- Transformative scenario: $0.75 - $1.00 (extreme favorable conditions such as major partnerships or technological breakthroughs)

- 2030-12-31: PUNDIX $0.73786 (potential peak based on optimistic projections)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.37934 | 0.3387 | 0.1829 | 0 |

| 2026 | 0.39492 | 0.35902 | 0.33748 | 6 |

| 2027 | 0.46745 | 0.37697 | 0.33551 | 11 |

| 2028 | 0.54043 | 0.42221 | 0.31244 | 25 |

| 2029 | 0.52945 | 0.48132 | 0.40431 | 42 |

| 2030 | 0.73786 | 0.50539 | 0.27796 | 49 |

IV. Professional Investment Strategies and Risk Management for PUNDIX

PUNDIX Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors with high risk tolerance

- Operation suggestions:

- Accumulate PUNDIX during market dips

- Set a long-term price target and stick to the plan

- Store PUNDIX in a secure hardware wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversal points

- RSI (Relative Strength Index): Monitor overbought/oversold conditions

- Key points for swing trading:

- Set clear entry and exit points based on technical indicators

- Use stop-loss orders to manage risk

PUNDIX Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple cryptocurrencies

- Stop-loss orders: Set automatic sell orders to limit potential losses

(3) Secure Storage Solutions

- Hardware wallet recommendation: Gate Web3 Wallet

- Software wallet option: Official PUNDIX wallet

- Security precautions: Use two-factor authentication, backup private keys securely

V. Potential Risks and Challenges for PUNDIX

PUNDIX Market Risks

- Volatility: Cryptocurrency markets are highly volatile

- Competition: Increasing competition in the crypto payment sector

- Adoption: Slow mainstream adoption of crypto payment solutions

PUNDIX Regulatory Risks

- Global regulations: Changing cryptocurrency regulations in different countries

- Compliance: Potential challenges in meeting evolving regulatory requirements

- Legal status: Uncertainty regarding the legal status of cryptocurrencies in some jurisdictions

PUNDIX Technical Risks

- Smart contract vulnerabilities: Potential bugs or exploits in the token contract

- Blockchain scalability: Challenges in handling increased transaction volumes

- Technological obsolescence: Risk of being outpaced by newer technologies

VI. Conclusion and Action Recommendations

PUNDIX Investment Value Assessment

PUNDIX shows potential in the crypto payment sector but faces significant competition and regulatory challenges. Long-term value proposition exists if adoption increases, but short-term volatility and risks remain high.

PUNDIX Investment Recommendations

✅ Beginners: Consider small, long-term positions after thorough research

✅ Experienced investors: Implement a balanced approach with active risk management

✅ Institutional investors: Conduct in-depth due diligence and consider as part of a diversified crypto portfolio

PUNDIX Trading Participation Methods

- Spot trading: Buy and hold PUNDIX on Gate.com

- Staking: Participate in PUNDIX staking programs if available

- DeFi: Explore decentralized finance opportunities involving PUNDIX

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Will pi coin reach $100?

It's unlikely Pi coin will reach $100 soon. While possible long-term, current market trends and expert opinions suggest a more modest valuation for Pi in the near future.

What is Pundi X's main goal?

Pundi X aims to enable mainstream use of cryptocurrencies through retail POS solutions and blockchain devices, facilitating crypto-based payments in real-life scenarios.

How much will 1 pi coin be worth in 2025?

Based on market analysis, 1 Pi coin is predicted to be worth around $10 in 2025. However, cryptocurrency prices are highly volatile and subject to change.

What is the price prediction for ripple in 2030?

Analysts predict XRP could range between $4.67 and $26.97 in 2030, depending on adoption and regulations. This range hinges on institutional use and regulatory clarity.

Is Amp (AMP) a good investment?: Analyzing the potential and risks of this cryptocurrency token

2025 ACH Price Prediction: Expert Analysis and Market Outlook for Alchemy Pay Token

ALKIMI vs XLM: A Comprehensive Comparison of Two Blockchain Tokens and Their Market Position

Is Wirex (WXT) a good investment?: A Comprehensive Analysis of Token Utility, Market Potential, and Risk Factors for 2024

2025 XFI Price Prediction: Expert Analysis and Market Outlook for the Coming Year

2025 BCCOIN Price Prediction: Expert Analysis and Market Forecast for the Coming Year

Popular English-Language Telegram Groups and Channels for Finance and Cryptocurrency

What Is the Long/Short Ratio? How to View Long/Short Ratio Data in Futures Trading?

TradFi Opens the Door to Cryptocurrencies: What It Means for Markets in 2026

TradFi Embraces Digital Assets as Japan Signals a New Era of Financial Integration

Is cryptocurrency mining legal in Germany?