2025 QNT Fiyat Tahmini: Quant Network'ün Tokeni İçin Potansiyel Büyüme ve Piyasa Trendlerinin Analizi

Giriş: QNT'nin Piyasa Konumu ve Yatırım Değeri

Quant (QNT), güvenilir dijital etkileşim sağlayan bir teknoloji sağlayıcısı olarak 2018 yılında piyasaya girişinden bu yana önemli yol katetmiştir. 2025 yılı itibarıyla Quant'ın piyasa değeri 1,27 milyar dolar seviyesine ulaşmış, dolaşımdaki arzı yaklaşık 14,54 milyon tokena çıkmış ve fiyatı 87,25 dolar civarında seyretmektedir. “İnteroperabilite çözümü” olarak anılan bu varlık, blokzincir inovasyonu ve kurumsal adaptasyonun hızlanmasında giderek daha kritik bir rol üstlenmektedir.

Bu makalede, Quant'ın 2025-2030 dönemindeki fiyat eğilimleri; tarihsel veriler, piyasa arz-talep dengesi, ekosistemdeki gelişmeler ve makroekonomik etkenler ışığında kapsamlı biçimde analiz edilerek yatırımcılara profesyonel fiyat tahminleri ve uygulanabilir yatırım stratejileri sunulacaktır.

I. QNT Fiyat Geçmişi Analizi ve Güncel Piyasa Durumu

QNT Tarihsel Fiyat Seyri

- 2018: İlk piyasaya sürülüş, 23 Ağustos’ta en düşük 0,215773 dolar seviyesi

- 2021: Boğa piyasası zirvesi, 11 Eylül’de tüm zamanların en yüksek seviyesi olan 427,42 dolar

- 2022-2023: Kripto kışı, fiyatlar gerilese de dayanıklılığını korudu

QNT Güncel Piyasa Durumu

16 Ekim 2025 itibarıyla QNT'nin fiyatı 87,25 dolar seviyesinde ve piyasa değeri 1,27 milyar dolar. Son 24 saatte fiyat %2,51 düşerken, işlem hacmi 566.506 dolar olarak gerçekleşti. Son bir haftada %14,64, son 30 günde ise %12,97 oranında değer kaybı yaşansa da, bir yıl öncesine kıyasla %30,55’lik bir artış uzun vadeli büyüme potansiyelini gösteriyor.

QNT'nin dolaşımdaki arzı 14.544.176 token olup, toplam maksimum arzın %31,99’una karşılık geliyor. Bu düşük oran, ileride piyasaya daha fazla token girmesiyle büyüme potansiyelini işaret ediyor. Tam seyreltilmiş değerleme 3,97 milyar dolar ile projenin uzun vadeli hedeflerine ulaşması halinde önemli büyüme imkanı sunuyor.

Güncel QNT piyasa fiyatını görüntülemek için tıklayın

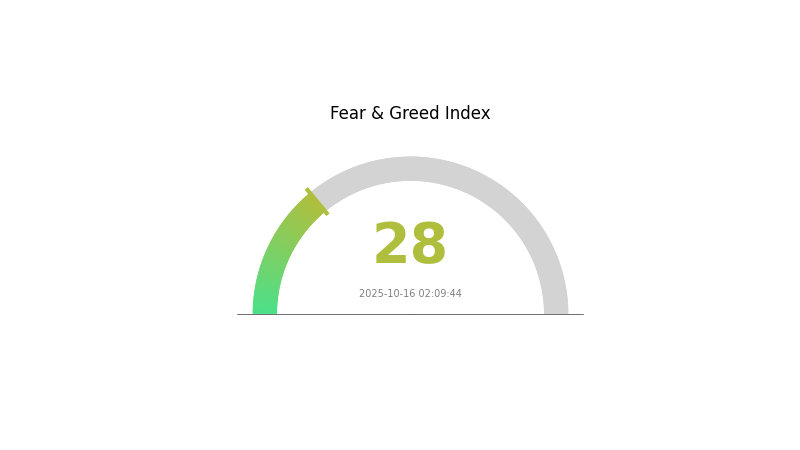

QNT Piyasa Duyarlılığı Göstergesi

2025-10-16 Korku ve Açgözlülük Endeksi: 28 (Korku)

Güncel Korku & Açgözlülük Endeksi’ni görüntülemek için tıklayın

Kripto piyasasında duyarlılık, Korku ve Açgözlülük Endeksi'nin 28 seviyesinde olması nedeniyle temkinli seyrediyor. Bu durum, yatırımcıların çekingen davrandığını ve fırsat kolladığını gösteriyor. Korku ortamında değer yatırımı fırsatları doğsa da, detaylı araştırma ve risk yönetimi şarttır. Gate.com, bu piyasa koşullarında yatırımcılara rehberlik edecek araç ve kaynaklar sunar. Duyarlılığın hızlı değişebileceğini unutmayın; stratejinizi güncel tutun.

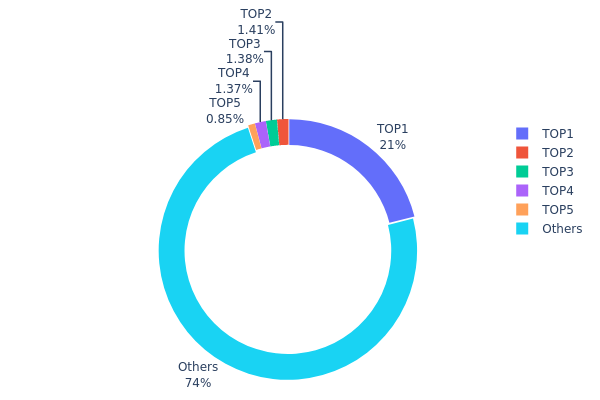

QNT Varlık Dağılımı

QNT adres bazlı varlık dağılımı, orta düzeyde yoğunlaşmış bir sahiplik yapısı sergiliyor. En büyük adres toplam arzın %21’ini, yani 9.550.600 QNT’yi elinde bulunduruyor. Bu yüksek oran dikkat çekici olsa da, kripto projeleri için olağan dışı değildir. Diğer en büyük adresler ise arzın %1,40 ile %0,85’i arasında değişen oranlarda paylara sahip.

QNT tokenlarının %74,02’si ise çok sayıda farklı adrese dağılmış durumda; bu da güçlü bir topluluk tabanını işaret ediyor. Büyük bir adresin %20’nin üzerinde paya sahip olması fiyat üzerinde etkili olabilse de, genel dağılım belirli bir merkeziyetsizlik seviyesini koruyor.

Mevcut yapı, büyük adres dışında hiçbir varlığın piyasaya mutlak hakimiyet kurmadığını gösteriyor. Ancak en büyük sahibin hareketleri fiyat oynaklığında etkili olabilir. Genel olarak QNT’nin dağılımı, büyük yatırımcılar ile çok sayıda küçük paydaşın dengede olduğu olgun bir zincir üstü ekosistemi yansıtıyor.

Güncel QNT Varlık Dağılımını görüntülemek için tıklayın

| En Büyük | Adres | Varlık Miktarı | Varlık (%) |

|---|---|---|---|

| 1 | 0x4a22...254675 | 9.550,60K | 21,00% |

| 2 | 0xf977...41acec | 640,00K | 1,40% |

| 3 | 0x48e9...04a170 | 625,78K | 1,37% |

| 4 | 0x8266...22d78b | 622,81K | 1,36% |

| 5 | 0x7e8b...8e594c | 386,67K | 0,85% |

| - | Diğerleri | 33.641,15K | 74,02% |

II. QNT'nin Gelecekteki Fiyatını Etkileyen Temel Faktörler

Kurumsal ve Whale Dinamikleri

- Whale Aktivitesi: Büyük yatırımcıların artan ilgisi, Quant fiyatında oynaklığı artırabilir. Bu yatırımcılar birikime devam ederlerse fiyat yukarıya hareket edebilir.

Makroekonomik Ortam

- Enflasyon Karşıtı Nitelikler: QNT, tıpkı diğer kripto varlıklar gibi, enflasyona karşı bir koruma olarak değerlendirilebilir.

- Jeopolitik Faktörler: Uluslararası gelişmeler ve jeopolitik olaylar, QNT dahil tüm kripto para piyasasını etkileyebilir.

Teknolojik Gelişim ve Ekosistem Oluşturma

- İnteroperabilite Çözümleri: QNT, kurumsal düzeyde blokzincirler arası birlikte çalışabilirliğe odaklanır. RWA ve zincirler arası çözümlere artan talep, QNT’nin değerini olumlu etkileyebilir.

- Ekosistem Uygulamaları: Quant teknolojisini kullanan DApp ve projelerin büyümesi, benimsenmeyi artırabilir ve QNT’nin değerini yükseltebilir.

III. 2025-2030 Dönemi için QNT Fiyat Tahminleri

2025 Görünümü

- Ihtiyatlı tahmin: 51,05 - 88,01 dolar

- Tarafsız tahmin: 88,01 - 98,57 dolar

- İyimser tahmin: 98,57 - 109,13 dolar (olumlu piyasa ortamı ve artan benimseme ile)

2027-2028 Görünümü

- Piyasanın büyüme evresine girmesi ve benimsemenin artması bekleniyor

- Fiyat aralığı tahmini:

- 2027: 72,15 - 160,87 dolar

- 2028: 83,75 - 207,97 dolar

- Temel tetikleyiciler: Teknolojik ilerlemeler, kullanım alanlarının genişlemesi ve piyasanın genel toparlanması

2029-2030 Uzun Vadeli Görünüm

- Temel senaryo: 173,77 - 192,89 dolar (istikrarlı büyüme ve benimseme varsayımıyla)

- İyimser senaryo: 212,00 - 254,61 dolar (ekosistem hızla büyür ve piyasa penetrasyonu artarsa)

- Dönüştürücü senaryo: 254,61+ dolar (büyük kurumsal benimseme ve düzenleyici netlik gibi olağanüstü olumlu koşullarda)

- 2030-12-31: QNT 254,61 dolar (iyimser projeksiyona göre zirve)

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Değişim Oranı |

|---|---|---|---|---|

| 2025 | 109,13 | 88,01 | 51,0458 | 0 |

| 2026 | 138 | 98,5712 | 92,65693 | 12 |

| 2027 | 160,87 | 118,29 | 72,15412 | 35 |

| 2028 | 207,97 | 139,58 | 83,74609 | 59 |

| 2029 | 212 | 173,77 | 121,64 | 99 |

| 2030 | 254,61 | 192,89 | 175,53 | 121 |

IV. QNT Profesyonel Yatırım Stratejileri ve Risk Yönetimi

QNT Yatırım Yöntemleri

(1) Uzun Vadeli Tutma Stratejisi

- Uygun olanlar: Uzun vadeli yatırımcılar ve blokzincirler arası birlikte çalışabilirlik çözümüne inananlar

- Öneriler:

- Piyasa düşüşlerinde QNT biriktirin

- Kısmi kar realizasyonu için fiyat hedefleri belirleyin

- QNT’yi güvenli donanım cüzdanlarında saklayın

(2) Aktif Al-Sat Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: 50 ve 200 günlük ortalamaları trend belirlemede kullanın

- RSI: Aşırı alım/aşırı satım sinyallerini takip edin

- Dalgalı al-sat için ipuçları:

- Kritik dirençlerin aşılması durumunu takip edin

- Risk yönetimi için zararı durdur emirleri kullanın

QNT Risk Yönetimi Çerçevesi

(1) Varlık Dağılımı İlkeleri

- Ihtiyatlı yatırımcılar: Kripto portföyünün %1-3’ü

- Agresif yatırımcılar: Kripto portföyünün %5-10’u

- Profesyonel yatırımcılar: Kripto portföyünün %15’ine kadar

(2) Riskten Korunma Yöntemleri

- Diversifikasyon: Yatırımı birden fazla blokzincir projesine yaymak

- Opsiyon stratejileri: Düşüş riskine karşı satım opsiyonu kullanmak

(3) Güvenli Saklama Çözümleri

- Sıcak cüzdan önerisi: Gate Web3 cüzdanı

- Soğuk depolama: Uzun vadeli tutum için donanım cüzdanları

- Güvenlik önlemleri: 2FA etkinleştirme, güçlü şifre kullanımı, düzenli güvenlik denetimleri

V. QNT için Potansiyel Riskler ve Zorluklar

QNT Piyasa Riskleri

- Volatilite: Kripto piyasasının doğasından kaynaklı fiyat dalgalanmaları

- Rekabet: Yeni ortaya çıkan birlikte çalışabilirlik çözümleri Quant’ın piyasa pozisyonunu zorlayabilir

- Benimseme: Kurumsal blokzincir adaptasyonunun yavaş ilerlemesi büyümeyi yavaşlatabilir

QNT Düzenleyici Riskleri

- Küresel düzenlemeler: Farklı ülkelerde değişen kripto para düzenlemeleri

- Menkul kıymet sınıflandırması: QNT'nin bazı ülkelerde menkul kıymet olarak değerlendirilme olasılığı

- Uyum maliyetleri: Artan regülasyonlar operasyonel maliyetleri yükseltebilir

QNT Teknik Riskleri

- Ağ güvenliği: Overledger altyapısında potansiyel güvenlik açıkları

- Ölçeklenebilirlik: Benimseme arttıkça ağ yüküyle başa çıkma zorlukları

- İnteroperabilite sorunları: Farklı blokzincir ağları arasında beklenmeyen entegrasyon problemleri

VI. Sonuç ve Eylem Önerileri

QNT Yatırım Değeri Değerlendirmesi

Quant (QNT), blokzincirler arası birlikte çalışabilirlik alanında güçlü ve uzun vadeli bir değer önerisi sunuyor. Ancak, kısa vadeli fiyat oynaklığı ve düzenleyici belirsizlikler önemli riskler taşımaktadır.

QNT Yatırım Tavsiyeleri

✅ Yeni başlayanlar: Zaman içinde pozisyon inşa etmek için küçük ve düzenli yatırımlarla başlayın ✅ Deneyimli yatırımcılar: Temel portföyünüzde QNT bulundurup piyasa döngülerine göre aktif yönetin ✅ Kurumsal yatırımcılar: QNT’yi çeşitlendirilmiş blokzincir teknoloji portföyünüzün bir parçası olarak değerlendirin

QNT Alım-Satım Yöntemleri

- Spot alım-satım: QNT tokenlarının doğrudan alınıp tutulması

- Staking: Pasif gelir için mevcut staking programlarına katılım

- DeFi entegrasyonu: QNT’yi destekleyen DeFi platformlarında ek getiri fırsatlarını değerlendirme

Kripto para yatırımları son derece yüksek risk içerir. Bu makale yatırım tavsiyesi değildir. Yatırımcılar kendi risk toleranslarına göre dikkatli karar vermeli ve profesyonel finansal danışmanlara başvurmalıdır. Asla kaybetmeyi göze alabileceğinizden fazlasını yatırmayın.

SSS

QNT 1.000 dolara ulaşabilir mi?

Evet, QNT'nin 1.000 doları görme potansiyeli mevcut. Mevcut projeksiyonlara göre 2035’e kadar 10.000 doları da aşabilir; ancak bu uzun vadeli öngörü spekülatiftir.

QNT 2030’da ne kadar olacak?

Güncel eğilimler baz alındığında QNT'nin 2030’da yaklaşık 540 dolar olması öngörülüyor. Bu tahmin, kripto piyasasında büyümenin sürmesi varsayımına dayalıdır.

QNT’nin geleceği var mı?

Evet, QNT'nin geleceği umut verici. Blokzincirden bağımsız yapısı, kıtlığı ve gelişmiş özellikleriyle, gelişen kripto ekosisteminde önemli büyüme fırsatlarına sahiptir.

Quant 2025’te ne kadar yükselebilir?

Piyasa analizlerine göre Quant (QNT), 2025’te 80,92 - 121,39 dolar aralığına ulaşabilir ve ciddi bir büyüme potansiyeli gösterebilir.

Avalanche (AVAX) üzerindeki RWA: Gerçek Dünya Varlıkları Nasıl Zincire Geçer

Ondo Finance (ONDO) iyi bir yatırım mı?: Bu yenilikçi DeFi protokolünün potansiyelini ve risklerini değerlendiriyoruz

ELYSIA (EL) İyi Bir Yatırım mı?: 2024 Yılında Bu Yükselen Kripto Paranın Potansiyeli ve Riskleri Üzerine Analiz

XDC Network (XDC) yatırım için uygun mu?: Kurumsal odaklı bu blockchain platformunun potansiyeli üzerine analiz

OCT ve AVAX: Akıllı sözleşme geliştirme alanında öne çıkan iki blockchain platformunu karşılaştırıyoruz

CAM ve DOT: Ağ trafik yönetiminde iki farklı yaklaşımın karşılaştırılması

Dropee Günlük Kombinasyonu 11 Aralık 2025

Tomarket Günlük Kombinasyonu 11 Aralık 2025

Merkeziyetsiz Finans'ta Geçici Kayıp Nedir?

Kripto Parada Çifte Harcama: Önleme Stratejileri

Kripto Ticaretinde Wyckoff Yönteminin Anlaşılması