2025 RENDER Fiyat Tahmini: Piyasa Trendleri ve Olası Büyüme Faktörlerinin Analizi

Giriş: RENDER'ın Piyasa Konumu ve Yatırım Potansiyeli

Render Network (RENDER), kuruluşundan bu yana merkeziyetsiz GPU render çözümü olarak sektörde önemli bir konum elde etmiştir. 2025 yılı itibarıyla RENDER'ın piyasa değeri 1.413.661.663 $ düzeyine ulaşırken, dolaşımdaki token miktarı yaklaşık 518.584.616 ve fiyatı 2,726 $ civarındadır. "GPU render devrimi" olarak nitelenen bu varlık, 3D render ve yeni GPU odaklı uygulamalarda giderek daha kritik bir rol üstleniyor.

Bu makalede, RENDER'ın 2025-2030 fiyat eğilimleri; geçmiş fiyat hareketleri, piyasa arz-talep dengesi, ekosistem gelişimi ve makroekonomik etkenler temelinde detaylı şekilde analiz edilerek, yatırımcılara profesyonel fiyat öngörüleri ve pratik yatırım stratejileri sunulacaktır.

I. RENDER Fiyat Geçmişi ve Güncel Piyasa Durumu

RENDER Tarihsel Fiyat Seyri

- 2020: İlk çıkış, fiyat 0,036763626053 $ (ATL) seviyesinden başladı

- 2024: 18 Mart'ta tüm zamanların zirvesi olan 13,596115966188627 $'a ulaştı

- 2025: Piyasa düzeltmesiyle fiyat 2,726 $'a geriledi

RENDER Güncel Piyasa Durumu

16 Ekim 2025 itibarıyla RENDER 2,726 $ seviyesinden işlem görüyor, piyasa değeri 1.413.661.663 $'dır. Token, son 24 saatte %3,87 ve son bir haftada %18,06 değer kaybetmiştir. Mevcut fiyat, Mart 2024'teki zirvesinden %79,95 aşağıdadır. Dolaşımdaki 518.584.616 RENDER token ile projenin piyasa değeri/tam seyreltilmiş değer oranı %97,44 ve bu yüksek dolaşım oranına işaret ediyor. 24 saatlik işlem hacmi 1.263.570 $ ile orta düzeyde piyasa aktivitesi göstermektedir. RENDER, genel kripto para piyasasında 81'inci sıradadır ve piyasa hakimiyeti %0,036'dır.

Güncel RENDER piyasa fiyatını görmek için tıklayın

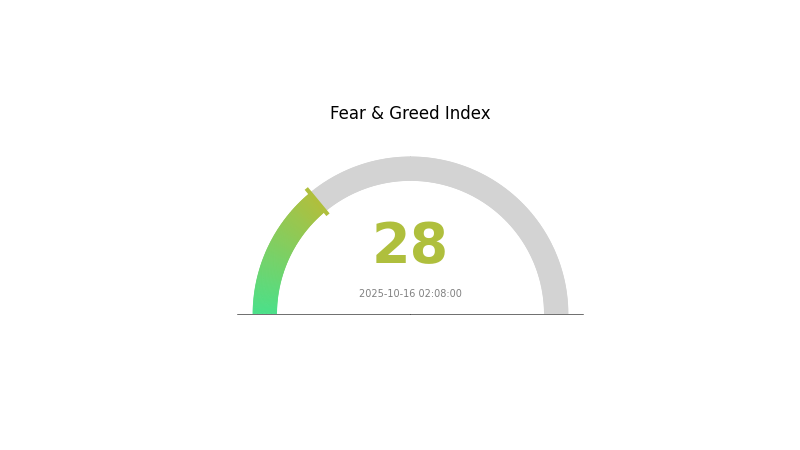

RENDER Piyasa Duyarlılık Göstergesi

16 Ekim 2025 Korku ve İştah Endeksi: 28 (Korku)

Güncel Korku & İştah Endeksi için tıklayın

Kripto piyasasında korku hakim; Korku ve İştah Endeksi'nin 28 olması yatırımcıların temkinli davrandığını gösteriyor. Bu durum, zıt bakış açısına sahip yatırımcılar için alım fırsatı sunabilir. Ancak piyasa duyarlılığının hızla değişebileceğini unutmamak gerekir. Yatırımcılar dikkatli olmalı, kapsamlı araştırma yapmalı ve Gate.com gibi platformlarda sunulan risk yönetim araçlarını kullanarak bu belirsiz ortamda pozisyon almalıdır.

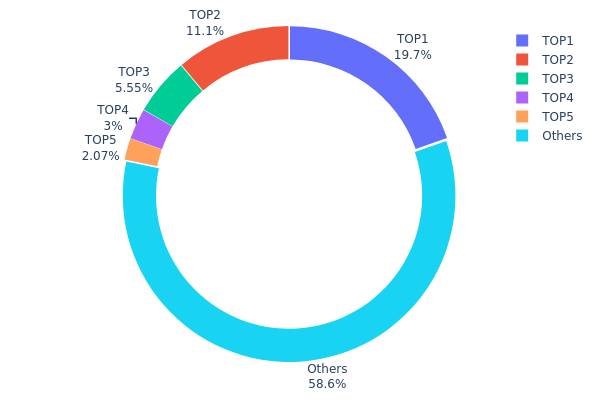

RENDER Varlık Dağılımı

RENDER'ın adres dağılım verileri, orta düzeyde yoğunlaşmış bir sahiplik yapısı göstermektedir. En büyük adres toplam arzın %19,67'sini, ikinci en büyük adres %11,09'unu elinde tutuyor. İlk beş adres, RENDER tokenlarının %41,36'sına sahipken kalan %58,64 diğer adreslerde bulunuyor.

Bu yoğunlaşma seviyesi, görece merkezi bir dağılımı ifade eder ve piyasa dinamiklerini etkileyebilir. Büyük adreslerin varlıkları, fiyat hareketleri ve likidite üzerinde ciddi etki yaratabilir. Bununla birlikte, arzın yarısından fazlası farklı adreslere dağılmıştır ve bu RENDER'ın merkeziyetsiz yapısını koruduğunu gösterir.

Mevcut dağılım, büyük paydaşlar ile geniş topluluk arasında bir denge oluşturuyor. Bu yapı, göreli istikrar sağlarken büyük sahiplerin ani hareketleri halinde fiyat oynaklığı riski taşır. Yatırımcılar, önemli adreslerdeki varlık değişimlerini takip etmeli; bu değişimler piyasa yönünü veya proje içi eğilimleri gösterebilir.

Güncel RENDER varlık dağılımını görüntülemek için tıklayın

| En Büyük | Adres | Varlık Miktarı | Varlık (%) |

|---|---|---|---|

| 1 | AZB72t...m2qAdC | 88.576,39K | 19,67% |

| 2 | 9WzDXw...YtAWWM | 49.937,83K | 11,09% |

| 3 | CPj5Jg...SXKrvv | 25.000,04K | 5,55% |

| 4 | 3gd3dq...hCkW2u | 13.487,43K | 2,99% |

| 5 | 51PZFs...tBqZk1 | 9.311,86K | 2,06% |

| - | Diğerleri | 263.863,23K | 58,64% |

II. RENDER'ın Gelecek Fiyatını Etkileyen Temel Unsurlar

Arz Mekanizması

- Token Geçişi: RNDR tokenları, 2 Kasım 2023 tarihinden itibaren yeni RENDER Solana tokenlarına dönüştürülebiliyor.

- Güncel Etki: Solana'ya geçiş, token arzı ve dağılımı üzerinde etkili olabilir.

Kurumsal ve Balina Dinamikleri

- Kurumsal Benimseme: Merkeziyetsiz render hizmetlerinin şirketlerce daha fazla benimsenmesi, RENDER fiyatını artırabilir.

Makroekonomik Ortam

- Enflasyona Karşı Koruma: Kripto varlık olarak RENDER, olası bir enflasyona karşı koruma aracı olarak görülebilir.

Teknolojik Gelişim ve Ekosistem İnşası

- Solana Geçişi: Render Network'ün Solana ekosistemine geçişi, ölçeklenebilirlik ve verimlilikte iyileşme sağlayabilir.

- Ekosistem Uygulamaları: Ağ, özellikle yapay zeka ve render alanında GPU yoğunluklu görevleri destekleyerek RENDER token talebini artırabilir.

III. 2025-2030 Dönemi RENDER Fiyat Tahmini

2025 Beklentisi

- Temkinli tahmin: 1,79 $ - 2,72 $

- Tarafsız tahmin: 2,72 $ - 3,00 $

- İyimser tahmin: 3,00 $ - 3,24 $ (güçlü piyasa ivmesiyle)

2027-2028 Beklentisi

- Piyasa fazı: Potansiyel büyüme dönemi

- Fiyat aralığı:

- 2027: 3,05 $ - 4,27 $

- 2028: 3,13 $ - 5,18 $

- Temel katalizörler: Render ve yapay zeka uygulamalarında artan kullanım

2030 Uzun Vadeli Beklenti

- Temel senaryo: 3,31 $ - 5,25 $ (istikrarlı piyasa büyümesiyle)

- İyimser senaryo: 5,25 $ - 6,46 $ (yaygın benimsemeyle)

- Dönüştürücü senaryo: 6,46 $+ (yapay zeka ve blokzincir entegrasyonunda olağanüstü olumlu koşullar)

- 31 Aralık 2030: RENDER 5,25 $ (2025'e göre %92 artış)

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Değişim Oranı |

|---|---|---|---|---|

| 2025 | 3,23918 | 2,722 | 1,79652 | 0 |

| 2026 | 3,96418 | 2,98059 | 2,11622 | 9 |

| 2027 | 4,27104 | 3,47239 | 3,0557 | 27 |

| 2028 | 5,18809 | 3,87171 | 3,13609 | 42 |

| 2029 | 5,97947 | 4,5299 | 4,12221 | 66 |

| 2030 | 6,46327 | 5,25469 | 3,31045 | 92 |

IV. RENDER Profesyonel Yatırım Stratejileri ve Risk Yönetimi

RENDER Yatırım Metodu

(1) Uzun Vadeli Tutma Stratejisi

- Uygun yatırımcı: Yüksek risk toleranslı ve uzun vadeli bakış açısına sahip yatırımcılar

- İşlem önerileri:

- Piyasa düşüşlerinde RENDER token biriktirin

- En az 3-5 yıl tutarak dalgalanmalara karşı korunun

- Tokenları güvenli donanım cüzdanında saklayın

(2) Aktif Alım-Satım Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Trend yönü ve dönüş noktalarını saptamak için

- RSI (Göreli Güç Endeksi): Aşırı alım/satım durumunu izlemek için

- Salınım işlemlerinde ana noktalar:

- Teknik göstergelerle net giriş-çıkış seviyeleri belirleyin

- Zarar-durdur emirleriyle risk yönetin

RENDER Risk Yönetimi Çerçevesi

(1) Varlık Dağıtım İlkeleri

- Temkinli yatırımcılar: Kripto portföyünün %1-3'ü

- Agresif yatırımcılar: %5-10 arası

- Profesyonel yatırımcılar: En fazla %15'i

(2) Riskten Korunma Yöntemleri

- Çeşitlendirme: Farklı kripto varlıklara yatırım yapın

- Opsiyon sözleşmeleri: Satım opsiyonlarıyla aşağı yönlü riski sınırlayın

(3) Güvenli Saklama

- Sıcak cüzdan: Gate Web3 cüzdan

- Soğuk saklama: Donanım cüzdanı ile uzun vadeli güvenli saklama

- Güvenlik önlemleri: İki aşamalı doğrulama, güçlü şifre ve düzenli güncellemeler

V. RENDER Potansiyel Riskler ve Zorluklar

RENDER Piyasa Riskleri

- Yüksek oynaklık: Fiyat dalgalanmaları ciddi olabilir

- Rekabet: Yeni blokzincir tabanlı render projeleri çıkabilir

- Piyasa duyarlılığı: Genel kripto trendleri RENDER performansını etkiler

RENDER Düzenleyici Riskler

- Belirsiz regülasyon: Kripto varlıklara yönelik yeni düzenlemeler gelebilir

- Uyum zorlukları: Regülasyonlardaki değişiklikler operasyonu etkileyebilir

- Sınır ötesi kısıtlamalar: Farklı ülke regülasyonları benimsemeyi sınırlayabilir

RENDER Teknik Riskler

- Ağ güvenliği: Solana blokzincirinde açıklar oluşabilir

- Ölçeklenebilirlik: Artan ağ talebine yanıt verme zorlukları

- Akıllı kontrat riskleri: Hatalar veya açıklar kayıplara sebep olabilir

VI. Sonuç ve Eylem Önerileri

RENDER Yatırım Değeri Değerlendirmesi

RENDER, merkeziyetsiz GPU render pazarında uzun vadeli potansiyele sahip olsa da kısa vadede volatilite ve rekabet baskısı altındadır. Projenin başarısı, benimsenme oranı ve teknolojik gelişimine bağlıdır.

RENDER Yatırım Önerileri

✅ Yeni başlayanlar: Küçük miktarlarla yatırım yapın ve teknolojiye odaklanın ✅ Deneyimli yatırımcılar: Uzun vadeli tutum ile aktif alım-satımı dengeleyin ✅ Kurumsal yatırımcılar: Detaylı inceleme yaparak RENDER'ı çeşitlendirilmiş portföyde değerlendirin

RENDER Alım-Satım Yöntemleri

- Spot alım-satım: Gate.com üzerinden RENDER token alıp satın

- Staking: RENDER stake programları ile pasif gelir elde edin

- DeFi entegrasyonu: RENDER destekli merkeziyetsiz finans protokollerini keşfedin

Kripto para yatırımları son derece yüksek risk içerir; bu makale yatırım tavsiyesi değildir. Yatırımcılar, risk toleranslarını göz önünde bulundurmalı ve profesyonel finans danışmanlarından destek almalıdır. Asla kaybetmeyi göze alabileceğinizden fazla yatırım yapmayın.

Sıkça Sorulan Sorular

RENDER 100 $'a ulaşır mı?

Render'ın yakın vadede 100 $ seviyesine ulaşması beklenmiyor. Mevcut piyasa trendleri ve veriler bu hedefin oldukça uzağında olduğunu gösteriyor. Tahminler şimdilik temkinli kalmaktadır.

Render kripto para biriminin geleceği var mı?

Evet, Render kripto para biriminin geleceği parlak görünüyor. Merkeziyetsiz render teknolojisi, çeşitli sektörlerde büyüme ve benimsenme potansiyeline sahip olup token için olumlu bir görünüm sunuyor.

2030'da Render'ın değeri ne olacak?

Render Token'ın 2030 yılında güncel piyasa trendleri ve analizlere göre maksimum 56,74 $ üzeri bir değere ulaşması bekleniyor.

Render ne kadar yükselebilir?

Render, mevcut piyasa trendleri ve projeksiyonlara göre 2025'te 12,205 $'a ve 2030'da 85,11 $ seviyesine kadar yükselebilir.

AICell'i Keşfetmek: White Paper Mantığı ve Devrimci Kullanım Senaryoları

COAI Kripto: Nedir ve Nasıl Çalışır

2025 AIOZ Fiyat Tahmini: Piyasa Trendleri, Teknolojik Gelişmeler ve Yatırım Potansiyeli Analizi

SAROS nedir: Güneş Tutulması Döngüsünü ve Bunun Astronomik Önemini Anlamak

AITECH nedir: Yapay Zeka Teknolojisinin Geleceği Üzerine Bir İnceleme

BLESS nedir: Dijital işlemler için blokzincir tabanlı güvenlik sistemini anlamak

BEP-20 Token Standardı: Temel Özellikleri ve Avantajları

Tap Crypto’yu Anlamak: Dijital Takas Üzerine Kapsamlı Bir Rehber

ENS Alan Adları: Web3’te Kimlik Yönetimini Kolaylaştırıyor

Kripto para birimlerinde çift harcama sorununun anlaşılması

Kripto paralarda Mnemonic ifadelerin kavranması