2025 ROOM Price Prediction: Analyzing Market Trends and Factors Influencing Future Values

Introduction: ROOM's Market Position and Investment Value

OptionRoom Token (ROOM) as a governable Oracle and prediction protocol based on Polkadot, has made significant strides since its inception in 2021. As of 2025, ROOM's market capitalization has reached $684,886, with a circulating supply of approximately 12,493,373 tokens, and a price hovering around $0.05482. This asset, known as the "prediction protocol token," is playing an increasingly crucial role in the field of decentralized finance and prediction markets.

This article will comprehensively analyze ROOM's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic environment to provide investors with professional price forecasts and practical investment strategies.

I. ROOM Price History Review and Current Market Status

ROOM Historical Price Evolution

- 2021: Project launch, price reached all-time high of $4.66 on February 5

- 2025: Significant price decline, hitting all-time low of $0.00006881 on May 1

- 2025: Market recovery, price rebounded to current level of $0.05482

ROOM Current Market Situation

ROOM is currently trading at $0.05482, with a 24-hour trading volume of $10,107.96. The token has experienced a slight decline of 0.9% in the past 24 hours. ROOM's market cap stands at $684,886.72, ranking it at 2971 in the cryptocurrency market. The circulating supply is 12,493,373.14 ROOM tokens, which represents 12.49% of the total supply of 100,000,000 ROOM. Despite the recent short-term dip, ROOM has shown significant growth over the past year, with a 90.02% increase in price. The token's performance varies across different timeframes, with a 0.4% increase over the past week and a 2.13% gain over the last 30 days.

Click to view the current ROOM market price

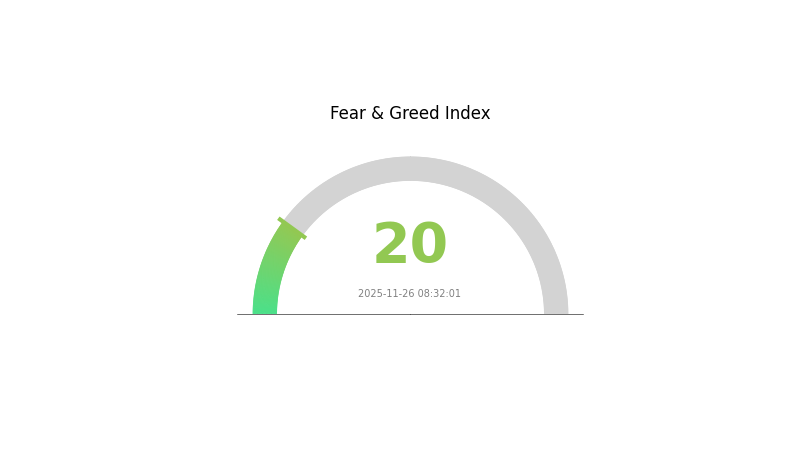

ROOM Market Sentiment Indicator

2025-11-26 Fear and Greed Index: 20 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is currently gripped by extreme fear, with the sentiment index plummeting to 20. This level of pessimism often presents unique opportunities for contrarian investors. While many are panic-selling, seasoned traders may view this as a potential buying opportunity. However, it's crucial to remember that market sentiment can shift rapidly. Always conduct thorough research and risk assessment before making any investment decisions. Stay informed and trade wisely on Gate.com.

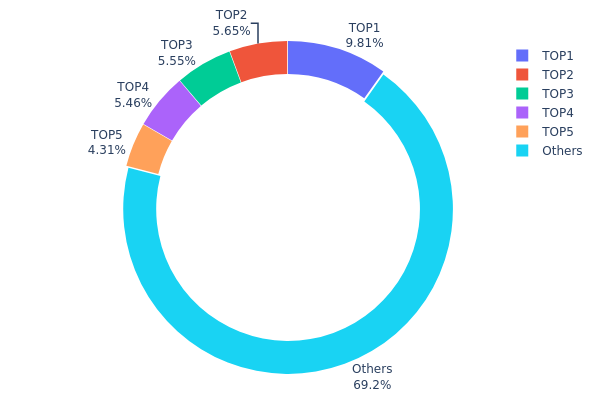

ROOM Holdings Distribution

The address holdings distribution data provides insight into the concentration of ROOM tokens among different wallet addresses. Analysis of this data reveals a moderate level of centralization in ROOM's token distribution. The top 5 addresses collectively hold 30.77% of the total supply, with the largest single address owning 9.81% of ROOM tokens.

This distribution pattern suggests a relatively balanced market structure, albeit with some concentration at the top. While the presence of large holders could potentially influence price movements, the fact that 69.23% of tokens are distributed among other addresses indicates a significant level of decentralization. This distribution may contribute to market stability, as no single entity has overwhelming control over the token supply.

The current address distribution reflects a maturing market for ROOM, with a mix of large stakeholders and a broader base of smaller holders. This structure could potentially provide a balance between institutional interest and community participation, which is often considered favorable for long-term project development and token value stability.

Click to view the current ROOM Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x84d1...a15cb3 | 9812.74K | 9.81% |

| 2 | 0x9838...d2f679 | 5652.89K | 5.65% |

| 3 | 0xda75...c2edc2 | 5552.38K | 5.55% |

| 4 | 0xca9d...4ab200 | 5456.71K | 5.45% |

| 5 | 0x0d07...b492fe | 4314.01K | 4.31% |

| - | Others | 69211.27K | 69.23% |

II. Key Factors Affecting ROOM's Future Price

Technical Development and Ecosystem Building

- Ecosystem Applications: ROOM token is primarily used within the Roomstake ecosystem, which includes various DApps and projects focused on real estate tokenization and investment.

III. ROOM Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.04454 - $0.05499

- Neutral prediction: $0.05499 - $0.06500

- Optimistic prediction: $0.06500 - $0.07534 (requires positive market sentiment and increased adoption)

2027-2028 Outlook

- Market phase expectation: Potential growth phase with increasing adoption

- Price range forecast:

- 2027: $0.07155 - $0.09937

- 2028: $0.07513 - $0.11537

- Key catalysts: Technological advancements, wider market acceptance, and potential partnerships

2029-2030 Long-term Outlook

- Base scenario: $0.10240 - $0.12493 (assuming steady market growth)

- Optimistic scenario: $0.12493 - $0.14746 (with favorable market conditions and increased utility)

- Transformative scenario: $0.14746 - $0.16000 (with breakthrough developments and mainstream adoption)

- 2030-12-31: ROOM $0.13368 (potential year-end target)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.07534 | 0.05499 | 0.04454 | 0 |

| 2026 | 0.09383 | 0.06516 | 0.04431 | 18 |

| 2027 | 0.09937 | 0.0795 | 0.07155 | 45 |

| 2028 | 0.11537 | 0.08944 | 0.07513 | 63 |

| 2029 | 0.14746 | 0.1024 | 0.08295 | 86 |

| 2030 | 0.13368 | 0.12493 | 0.07871 | 127 |

IV. ROOM Professional Investment Strategies and Risk Management

ROOM Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Risk-tolerant investors with a long-term perspective

- Operational suggestions:

- Accumulate ROOM tokens during market dips

- Set price targets and regularly review portfolio

- Store tokens in a secure Gate Web3 wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential entry/exit points

- Relative Strength Index (RSI): Monitor overbought/oversold conditions

- Key points for swing trading:

- Utilize stop-loss orders to manage downside risk

- Take profits at predetermined resistance levels

ROOM Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across different crypto assets

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 wallet

- Cold storage solution: Hardware wallet for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for ROOM

ROOM Market Risks

- High volatility: Significant price fluctuations common in small-cap tokens

- Limited liquidity: Potential difficulty in executing large trades

- Market sentiment: Susceptible to rapid changes in investor perception

ROOM Regulatory Risks

- Uncertain regulatory environment: Potential for new regulations affecting token utility

- Cross-border compliance: Varying legal status in different jurisdictions

- Operational restrictions: Possible limitations on token functionality due to regulatory actions

ROOM Technical Risks

- Smart contract vulnerabilities: Potential for exploits or bugs in the underlying code

- Scalability challenges: Possible network congestion on the Polkadot ecosystem

- Oracle reliability: Dependence on accurate and timely external data feeds

VI. Conclusion and Action Recommendations

ROOM Investment Value Assessment

ROOM presents a high-risk, high-potential investment opportunity within the oracle and prediction market niche. While its long-term value proposition is tied to the growth of decentralized prediction markets, short-term volatility and adoption challenges pose significant risks.

ROOM Investment Recommendations

✅ Beginners: Consider small, exploratory positions with strict risk management

✅ Experienced investors: Implement dollar-cost averaging strategy with set profit-taking levels

✅ Institutional investors: Conduct thorough due diligence and consider OTC trades for large positions

ROOM Trading Participation Methods

- Spot trading: Available on Gate.com for direct token purchases

- Limit orders: Set buy and sell orders at specific price points

- DCA strategy: Regular small purchases to average out entry price

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions cautiously based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is the prediction for home prices?

Home prices are expected to rise by 3-5% annually through 2025, driven by low inventory and steady demand in most major markets.

What is a price forecast?

A price forecast is a prediction of future cryptocurrency prices based on market analysis, trends, and historical data. It helps investors make informed decisions.

How much is backroom crypto?

As of November 2025, ROOM is trading at approximately $0.15 per token. The price has shown steady growth over the past year, reflecting increased adoption and market interest in the project.

Which type of machine learning algorithm is best suited for predicting house prices based on features such as size, location, and number of rooms?

Random Forest or Gradient Boosting algorithms are often best suited for predicting house prices, as they handle non-linear relationships and feature interactions well.

深入了解 Thetanuts Finance:创新期权策略平台解析

Centralized Crypto Trading Platforms: Key Challenges Revealed

Latest Analysis and Investment Outlook for Chainlink Price in June 2025

MYX Token Price and Market Analysis on Gate.com in 2025

2025 ICP Price Prediction: Analyzing Growth Factors and Market Potential in the Post-Halving Cycle

How to earn $300 in one hour

How Does MELANIA Coin Price Volatility Compare to BTC and ETH in 2025-2026?

What is Just a Chill Guy (CHILLGUY)? Complete Guide to the Viral Meme Coin

How Has GUN Crypto Price Volatility Changed in 2025: From $0.12845 Peak to Current Levels?

Dropee Question of the Day and Daily Combo Guide

What is crypto market cap ranking, trading volume, and liquidity overview for January 2026?