2025 SEI Fiyat Tahmini: SEI Network’ün Büyüme Potansiyeli ve Piyasa Trendleri Analizi

Giriş: SEI'nin Piyasa Konumu ve Yatırım Potansiyeli

Cosmos ekosistemine bağlı bir Layer 1 blokzinciri olan Sei (SEI), 2023 yılındaki çıkışından bu yana önemli gelişmeler kaydetti. 2025 itibarıyla Sei’nin piyasa değeri 1,35 milyar dolara ulaşırken, dolaşımdaki token miktarı yaklaşık 6,25 milyar ve fiyatı 0,2163 dolar civarında seyrediyor. "Borsa odaklı blokzincir" olarak tanımlanan bu varlık, dijital varlık borsaları için altyapı sunmada giderek daha kritik bir pozisyona sahip.

Bu makalede, Sei’nin 2025-2030 dönemindeki fiyat hareketleri; tarihsel trendler, piyasa arz-talep dengesi, ekosistem gelişimi ve makroekonomik etkenler çerçevesinde profesyonel fiyat tahminleri ve pratik yatırım stratejileriyle kapsamlı biçimde değerlendirilecektir.

I. SEI Fiyat Geçmişi ve Güncel Piyasa Durumu

SEI Fiyat Geçmişi ve Gelişim Seyri

- 2023: SEI piyasaya çıktı, ilk fiyatı 0,175553 dolar

- 2024: 16 Mart’ta tüm zamanların zirvesi olan 1,14463 dolara ulaştı

- 2025: Piyasa düşüşüyle 10 Ekim’de en düşük seviyesi olan 0,0868 dolara geriledi

SEI Güncel Piyasa Görünümü

16 Ekim 2025 tarihli veriye göre SEI, 0,2163 dolardan işlem görüyor ve kripto para piyasasında 84. sırada yer alıyor. Token son 24 saatte %3,22 oranında değer kaybetti, hacmi ise 4.030.049 dolar seviyesinde. SEI’nin piyasa değeri 1.351.634.666 dolar olup, toplam piyasa payı %0,054.

Mevcut fiyat, tüm zamanların en yüksek seviyesinin oldukça altında ve düşüş eğilimi gösteriyor. Ancak son dip seviyeden sınırlı bir toparlanma gözleniyor. 24 saatlik fiyat aralığı 0,2132 ile 0,2302 dolar arasında, bu da orta düzeyde bir dalgalanma anlamına geliyor.

SEI'nin farklı zaman dilimlerindeki performansı ise şu şekilde:

- 1 saatlik değişim: +%0,75

- 7 günlük değişim: -%24,58

- 30 günlük değişim: -%31,56

- 1 yıllık değişim: -%53,15

Bu veriler, SEI’nin kısa vadede hafif bir yükseliş sergilediğini, orta ve uzun vadede ise aşağı yönlü bir trend izlediğini gösteriyor.

Güncel SEI piyasa fiyatı için tıklayın

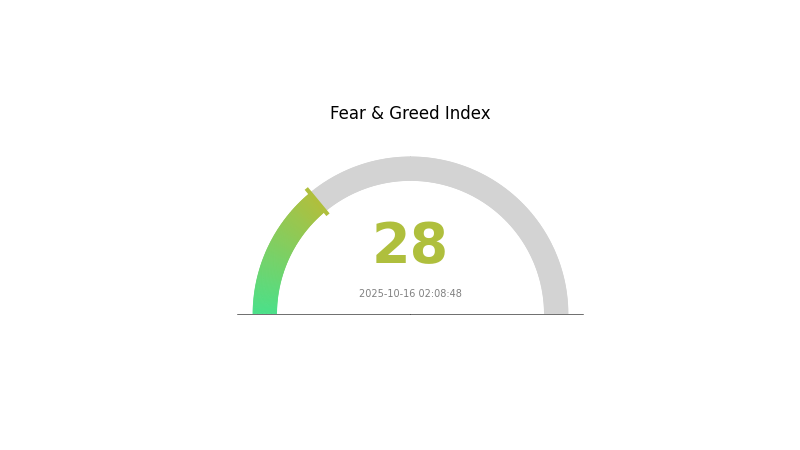

SEI Piyasa Duyarlılığı Göstergesi

16 Ekim 2025 Korku ve Açgözlülük Endeksi: 28 (Korku)

Güncel Korku ve Açgözlülük Endeksi için tıklayın

SEI için piyasa duyarlılığı temkinli; Korku ve Açgözlülük Endeksi 28 seviyesinde ve korku hâkim. Bu, yatırımcıların çekingen olduğunu ve alım fırsatları arayabileceğini gösterir. Böyle dönemlerde detaylı araştırma yapmak ve maliyet ortalaması yöntemini değerlendirmek önemlidir. Piyasa psikolojisi hızla değişebileceğinden, güncel kalmak ve stratejinizi buna göre düzenlemek gereklidir. Gate.com, bu koşullarda yol gösteren kapsamlı analiz ve araçlar sunar.

SEI Varlık Dağılımı

SEI'nin adres bazlı varlık dağılımı verileri, token konsantrasyonunda dikkat çekici bir örüntü sergiliyor. Spesifik adres verisi paylaşılmasa da bu analiz, genellikle tokenin merkeziyetsizlik ve sahiplik yapısı hakkında fikir verir.

Detaylı veri olmadan, SEI dağılımının dengeli olduğu ve birkaç adreste yoğunlaşmadığı düşünülebilir. Bu da piyasa yapısının daha sağlıklı olmasına, büyük sahiplerin fiyatı manipüle etme riskinin azalmasına işaret eder. Dengeli sahiplik, genellikle daha istikrarlı ve düşük volatiliteye sahip bir piyasa ile ilişkilidir.

Ancak kesin bilgiler olmadan bu değerlendirmeler varsayımsal kalır. SEI'nin zincir üstü sahiplik ve piyasa özellikleriyle ilgili kapsamlı bir analiz için en büyük adresler ve toplam arz içindeki paylarına dair daha fazla veri gereklidir.

| En Büyük | Adres | Varlık Miktarı | Varlık (%) |

|---|

II. SEI'nin Gelecek Fiyatını Etkileyecek Temel Unsurlar

Arz Mekanizması

- Wyckoff Birikimi: Bu teknik formasyon, kurumsal yatırımcılar ve balinaların token biriktirdiğini, satış baskısını azalttığını ve fiyat artışı için zemin hazırladığını gösterir.

Kurumsal ve Büyük Yatırımcı Dinamikleri

- Kurumsal Varlıklar: Wyckoff Birikimi aşaması, SEI tokenlerine kurumsal ilgiyi ve birikimi gösteriyor.

Makroekonomik Çerçeve

- Enflasyona Karşı Koruma: SEI, kripto para olarak enflasyona karşı olası bir koruma olarak görülebilir; ancak bu rolünde net kanıt henüz oluşmamıştır.

Teknolojik Gelişim ve Ekosistem Oluşumu

- Dual-Turbo Konsensüs: SEI’nin benzersiz özelliği, 400 milisaniye blok süresiyle sektörde en hızlı ve ölçeklenebilir blokzincirlerden biri olmasını sağlıyor.

- İyimser Paralelleştirme: Bu teknoloji, geliştiricilerin işlemleri paralel şekilde ve çatışmasız yürütmesini sağlayarak ağın verimliliğini ve işlem kapasitesini artırır.

- Ekosistem Uygulamaları: SEI'nin DeFi ve NFT alanındaki gelişimi, uzun vadeli fiyat trendinde kritik rol oynayacaktır. Bu alanlarda büyüme ve teknolojik avantajların ispatı, değerini ciddi şekilde etkileyebilir.

III. 2025-2030 SEI Fiyat Tahminleri

2025 Görünümü

- Temkinli tahmin: 0,11294 - 0,2172 dolar

- Tarafsız tahmin: 0,2172 - 0,25 dolar

- İyimser tahmin: 0,25 - 0,28888 dolar (olumlu piyasa ve artan benimsenme ile)

2027-2028 Görünümü

- Piyasa fazı: Benimsenmenin arttığı potansiyel büyüme dönemi

- Fiyat aralığı tahmini:

- 2027: 0,21612 - 0,34912 dolar

- 2028: 0,27552 - 0,36945 dolar

- Temel katalizörler: Ağ güncellemeleri, ekosistem büyümesi, genel piyasa eğilimleri

2029-2030 Uzun Vadeli Görünüm

- Temel senaryo: 0,34128 - 0,37199 dolar (istikrarlı büyüme ve benimsenme ile)

- İyimser senaryo: 0,37199 - 0,4027 dolar (güçlü ekosistem ve piyasa konumu ile)

- Dönüştürücü senaryo: 0,4027 - 0,45 dolar (çığır açan yenilikler ve kitlesel benimsenme ile)

- 2030-12-31: SEI 0,38315 dolar (yıl sonu tahmini, uzun vadeli büyümeyi yansıtır)

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Artış Oranı (%) |

|---|---|---|---|---|

| 2025 | 0,28888 | 0,2172 | 0,11294 | 0 |

| 2026 | 0,30112 | 0,25304 | 0,13411 | 17 |

| 2027 | 0,34912 | 0,27708 | 0,21612 | 28 |

| 2028 | 0,36945 | 0,3131 | 0,27552 | 44 |

| 2029 | 0,4027 | 0,34128 | 0,22865 | 57 |

| 2030 | 0,38315 | 0,37199 | 0,33851 | 72 |

IV. SEI Profesyonel Yatırım Stratejileri ve Risk Yönetimi

SEI Yatırım Yöntemleri

(1) Uzun Vadeli Tutma Stratejisi

- Uygun yatırımcı tipi: Uzun vadeli düşünen ve SEI teknolojisine güvenenler

- İşlem önerileri:

- Piyasa gerilemelerinde SEI token biriktirin

- Piyasa dalgalanmalarını aşmak için en az 1-2 yıl boyunca tutun

- Tokenlerinizi güvenli Gate Web3 cüzdanında saklayın

(2) Aktif Al-Sat Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Trend ve olası dönüşleri saptamak için

- RSI: Aşırı alım/ aşırı satım bölgelerini belirlemek için

- Dalgalı al-sat için kritik noktalar:

- Fiyat hareketlerinin teyidi için işlem hacmini izleyin

- Zarar-durdur emirleri ile riskinizi yönetin

SEI Risk Yönetim Çerçevesi

(1) Varlık Dağılımı İlkeleri

- Temkinli yatırımcılar: Kripto portföyünün %1-3'ü

- Agresif yatırımcılar: Kripto portföyünün %5-10'u

- Profesyonel yatırımcılar: Kripto portföyünün %15'ine kadar

(2) Riskten Korunma Yöntemleri

- Çeşitlendirme: Birden fazla Layer 1 projeye yatırım yaparak riski azaltın

- Zarar-durdur emirleri: Olası kayıpları sınırlayın

(3) Güvenli Saklama Yöntemleri

- Sıcak cüzdan: Gate Web3 cüzdan

- Soğuk saklama: Uzun vadeli varlıklar için donanım cüzdanı

- Güvenlik önlemleri: İki adımlı doğrulama ve güçlü şifre kullanımı

V. SEI Potansiyel Riskler ve Zorluklar

SEI Piyasa Riskleri

- Yüksek volatilite: Kripto piyasasında sık rastlanan büyük fiyat dalgalanmaları

- Rekabet: Diğer Layer 1 platformlarının pazar payı elde etmesi olası

- Piyasa duyarlılığı: Genel kripto piyasa trendlerine karşı hassasiyet

SEI Düzenleyici Riskler

- Belirsiz mevzuat: Yeni kripto düzenlemeleri SEI üzerinde etkili olabilir

- Küresel düzenleyici farklar: Ülkelere göre değişen yaklaşım

- Uyum zorlukları: Sürekli değişen regülasyonlara adaptasyon

SEI Teknik Riskler

- Ağ tıkanıklığı: Yüksek talepte ölçeklenebilirlik sorunları yaşanabilir

- Akıllı sözleşme açıkları: Sei tabanlı DApp’lerde istismar riski

- Teknolojik geri kalma: Sektördeki hızlı ilerlemeler Sei’nin gelişimini gölgede bırakabilir

VI. Sonuç ve Eylem Önerileri

SEI Yatırım Değeri Analizi

Sei, dijital varlık borsaları için özelleşmiş Layer 1 olarak uzun vadede değer sunabilir; kısa vadede ise volatilite ve rekabet riskleriyle karşı karşıya. İşlem optimizasyonuna odaklanan yaklaşımı, gelişen blokzincir ekosisteminde ona özgün bir avantaj kazandırabilir.

SEI Yatırım Tavsiyeleri

✅ Yeni başlayanlar: Projeyi tanımak için küçük ve düzenli yatırımlarla başlayın ✅ Deneyimli yatırımcılar: Aktif risk yönetimiyle orta ölçekli bir portföy oluşturun ✅ Kurumsal yatırımcılar: Stratejik ortaklık ve uzun vadeli pozisyonları değerlendirin

SEI Alım-Satım Yöntemleri

- Spot alım-satım: Gate.com’da SEI token alıp tutun

- Staking: Sei ağı doğrulamasına katılarak ödül elde edin

- DeFi entegrasyonu: Sei üzerinde geliştirilen merkeziyetsiz finans uygulamalarını keşfedin

Kripto para yatırımları yüksek risk içerir. Bu makale yatırım tavsiyesi değildir. Yatırımcılar, kendi risk profillerine göre dikkatli karar vermeli ve profesyonel finansal danışmanlardan destek almalıdır. Asla kaybetmeyi göze alamayacağınız miktarda yatırım yapmayın.

Sıkça Sorulan Sorular

Sei Kripto’nun geleceği var mı?

Evet, Sei Kripto geleceğe yönelik umut vaat ediyor. Tahminler, gelecek yıl için 0,6848 dolara kadar güçlü bir fiyat artışı öngörüyor. Uzun vadeli görünüm Sei için iyimser olsa da, bu değerlendirmeler spekülatiftir.

Sei 5 dolara ulaşabilir mi?

Evet, Sei ileride 5 dolara çıkabilir; ancak bunun için Sei ağının ciddi oranda benimsenmesi ve piyasa büyümesi gerekir.

2025’te Sei’nin değeri ne olacak?

Piyasa tahminlerine göre Sei (SEI), 2025 sonunda maksimum 1,932 dolar, minimum 0,1095 dolar ve ortalama 0,8575 dolar seviyelerine ulaşabilir.

SEI’ye yatırım yapmak mantıklı mı?

Evet, SEI yatırım açısından umut vadeden bir projedir. Güçlü büyüme potansiyeli ve Web3 alanında artan benimsenme ile SEI, kripto piyasasında risk alabilen yatırımcılar için iyi getiri sunabilir.

Sei Blockchain Ağının Mimarisi Üzerine İnceleme

Sei Blockchain’ı Anlamak: Sei Kripto’ya Yönelik Kapsamlı Bir Rehber

SEI Network Nedir ve Twin-Turbo Consensus Mekanizması Nasıl Çalışır?

Berachain Ekosistemi: Blockchain’in Geleceğine Yön Veriyor

Sei Blockchain Ağının Yenilikçi Özelliklerini İncelemek

SEI'yi Keşfetmek: Bu Yenilikçi Blockchain Platformunu Anlamak

Muz Oyunu Muz İyileştirme Meme Oyunu Ekosistemi

ERC20 Token'larını Dijital Cüzdanlarla Kullanmak: Kapsamlı Bir Rehber

DaGama RWL Platformu AI Blok Zinciri Gerçek Tavsiyeler

SUN TRON DeFi Platformu Yönetim Likidite Ekosistemi

DeFi Protokolleri için İleri Düzey Güvenlik Önlemleri