2025 SOL Price Prediction: Analyzing Market Trends and Potential Growth Factors for Solana

Introduction: SOL's Market Position and Investment Value

Solana (SOL), as a high-performance blockchain protocol, has achieved significant milestones since its inception in 2017. As of 2025, Solana's market capitalization has reached $111.52 billion, with a circulating supply of approximately 546.7 million coins, and a price hovering around $203.98. This asset, often hailed as the "Ethereum killer," is playing an increasingly crucial role in decentralized finance (DeFi) and blockchain scalability.

This article will provide a comprehensive analysis of Solana's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. SOL Price History Review and Current Market Status

SOL Historical Price Evolution

- 2020: SOL launched at $0.22, reaching a low of $0.500801 on May 12

- 2021: Bull market surge, SOL hit an all-time high of $293.31 on January 19, 2025

- 2025: Market correction, price fluctuating between $191.05 and $207.14 in the past 24 hours

SOL Current Market Situation

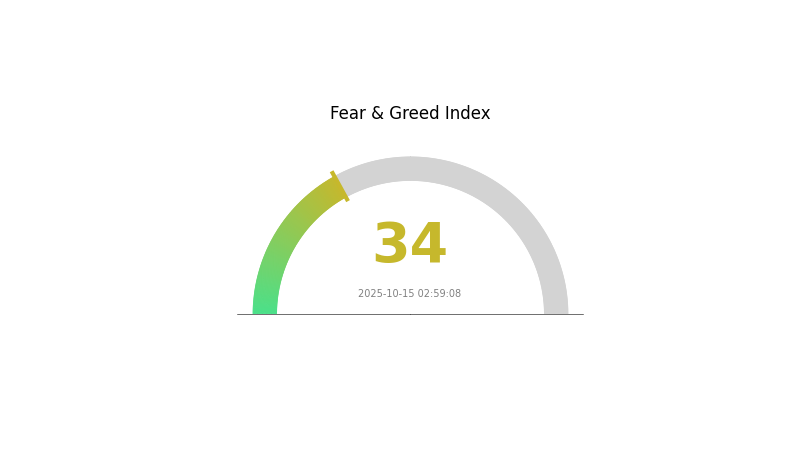

As of October 15, 2025, SOL is trading at $203.98, ranking 6th in the cryptocurrency market. The 24-hour trading volume stands at $226,218,277, with a market capitalization of $111,516,263,510. SOL has experienced a 1.42% decrease in the last 24 hours, but shows a 0.26% increase in the past hour. The 7-day and 30-day trends indicate declines of 8.11% and 15.37% respectively, while the yearly performance remains positive with a 29.36% increase. The current market sentiment for SOL is characterized as "Fear," with a VIX index of 34, suggesting a cautious investor outlook.

Click to view the current SOL market price

SOL Market Sentiment Indicator

2025-10-15 Fear and Greed Index: 34 (Fear)

Click to view the current Fear & Greed Index

The crypto market sentiment remains cautious as the Fear and Greed Index hovers in the "Fear" zone at 34. This indicates a prevailing sense of uncertainty among investors. During such periods, it's crucial to stay informed and avoid making impulsive decisions. Some traders view this as a potential buying opportunity, adhering to the adage "buy when there's blood in the streets." However, it's essential to conduct thorough research and consider your risk tolerance before making any investment choices.

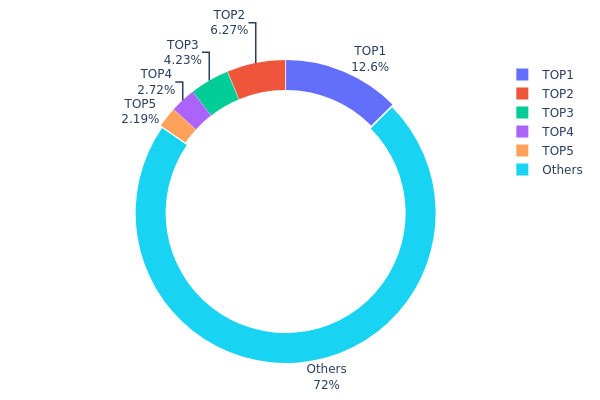

SOL Holdings Distribution

The address holdings distribution data provides insights into the concentration of SOL tokens among different wallet addresses. Based on the provided information, we can observe a moderate level of concentration in SOL holdings. The top address holds 12.55% of the total supply, while the top five addresses collectively control 27.94% of SOL tokens.

This distribution pattern suggests a relatively centralized structure, with a significant portion of tokens held by a small number of addresses. However, it's worth noting that 72.06% of SOL tokens are distributed among "Others," indicating a substantial level of dispersion among smaller holders. This balance between concentration and dispersion may contribute to market stability but could also lead to increased volatility if large holders decide to make significant moves.

The current distribution has implications for market dynamics and potential price movements. While the concentration in top addresses poses a risk of market manipulation, the substantial distribution among smaller holders provides a counterbalance, potentially mitigating extreme price swings. This structure reflects a moderate level of decentralization, which is crucial for the network's long-term stability and resistance to single-point failures or coordinated actions by large token holders.

Click to view the current SOL Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 4ZJhPQ...oekbPY | 76836.31K | 12.55% |

| 2 | 9WzDXw...YtAWWM | 38355.88K | 6.26% |

| 3 | 2RH6rU...aEFFSK | 25879.78K | 4.22% |

| 4 | 6iQKfE...e9pVSS | 16651.46K | 2.72% |

| 5 | AVzP2G...NWQK49 | 13403.93K | 2.19% |

| - | Others | 440739.82K | 72.06% |

II. Key Factors Affecting SOL's Future Price

Supply Mechanism

- Inflationary Model: SOL has an inflationary supply model with a decreasing inflation rate over time.

- Historical Pattern: Past supply increases have generally led to short-term price pressure.

- Current Impact: The gradual decrease in inflation rate is expected to support long-term price stability.

Institutional and Whale Movements

- Institutional Holdings: Major institutions have shown increasing interest in SOL, potentially driving demand.

- Corporate Adoption: Companies in DeFi, NFT, and Web3 sectors are increasingly building on Solana.

- National Policies: Regulatory clarity in key markets could significantly impact SOL's adoption and price.

Macroeconomic Environment

- Monetary Policy Impact: Central bank policies, especially those of the Federal Reserve, influence crypto market sentiment.

- Inflation Hedging Properties: SOL's performance as an inflation hedge remains to be fully established.

- Geopolitical Factors: Global economic uncertainties can drive interest in cryptocurrencies like SOL.

Technical Development and Ecosystem Growth

- Proof of History (PoH) Consensus: Solana's unique consensus mechanism enables high transaction speeds and low fees.

- Scalability Improvements: Ongoing upgrades aim to enhance network capacity and reliability.

- Ecosystem Applications: DeFi protocols, NFT platforms, and Web3 games on Solana drive demand for SOL.

III. SOL Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $120.12 - $180

- Neutral prediction: $180 - $203.59

- Optimistic prediction: $203.59 - $215.81 (requires positive market sentiment and increased adoption)

2027-2028 Outlook

- Market phase expectation: Potential growth phase with increasing adoption

- Price range forecast:

- 2027: $178.69 - $313.36

- 2028: $251.83 - $377.74

- Key catalysts: Technological advancements, ecosystem expansion, and broader market recovery

2030 Long-term Outlook

- Base scenario: $280.01 - $400.01 (assuming steady growth and adoption)

- Optimistic scenario: $400.01 - $468.01 (assuming accelerated adoption and favorable market conditions)

- Transformative scenario: $468.01+ (extreme positive developments in the Solana ecosystem and crypto market)

- 2030-12-31: SOL $400.01 (potential year-end target based on average prediction)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 215.81 | 203.59 | 120.12 | 0 |

| 2026 | 308.26 | 209.7 | 199.21 | 2 |

| 2027 | 313.36 | 258.98 | 178.69 | 26 |

| 2028 | 377.74 | 286.17 | 251.83 | 40 |

| 2029 | 468.06 | 331.96 | 262.25 | 62 |

| 2030 | 468.01 | 400.01 | 280.01 | 96 |

IV. Professional Investment Strategies and Risk Management for SOL

SOL Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Patient investors with high risk tolerance

- Operation suggestions:

- Accumulate SOL during market dips

- Set a fixed percentage of portfolio for SOL

- Store in secure non-custodial wallets

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Identify trends and potential reversal points

- RSI: Gauge overbought/oversold conditions

- Key points for swing trading:

- Monitor SOL's correlation with BTC and overall market sentiment

- Set strict stop-loss and take-profit levels

SOL Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3%

- Aggressive investors: 5-10%

- Professional investors: 10-20%

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple cryptocurrencies

- Options trading: Use put options for downside protection

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 wallet

- Cold storage solution: Hardware wallets for large holdings

- Security precautions: Enable 2FA, use unique passwords, regular security audits

V. Potential Risks and Challenges for SOL

SOL Market Risks

- Volatility: Extreme price fluctuations common in crypto markets

- Competition: Emergence of new, more efficient blockchain platforms

- Market sentiment: Vulnerability to speculative trading and market manipulation

SOL Regulatory Risks

- Regulatory uncertainty: Potential for unfavorable regulations in key markets

- Compliance challenges: Adapting to evolving global regulatory frameworks

- Legal status: Possibility of classification as a security in some jurisdictions

SOL Technical Risks

- Network congestion: Potential scalability issues during high-traffic periods

- Smart contract vulnerabilities: Risk of exploits in DApps built on Solana

- Centralization concerns: Reliance on a relatively small number of validators

VI. Conclusion and Action Recommendations

SOL Investment Value Assessment

Solana presents a compelling long-term value proposition as a high-performance blockchain, but faces short-term risks from market volatility and regulatory uncertainties.

SOL Investment Recommendations

✅ Beginners: Start with small, regular investments to understand market dynamics

✅ Experienced investors: Consider a balanced approach with both long-term holding and active trading

✅ Institutional investors: Explore strategic partnerships and ecosystem investments

SOL Trading Participation Methods

- Spot trading: Direct purchase and sale of SOL on Gate.com

- Futures trading: Leverage SOL price movements through derivatives

- Staking: Participate in network security while earning passive income

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Can Sol reach $1000 USD?

Yes, SOL could potentially reach $1000 USD if market conditions and adoption improve significantly. However, it's highly speculative and uncertain. Currently, meme coins like Dogecoin (DOGE) are showing stronger momentum in the market.

Can Solana hit $500?

Yes, Solana could hit $500 by 2025. Its low fees, high-speed network, and growing ecosystem in DeFi, dApps, and NFTs make it a strong contender for significant price growth.

Should I invest in sol for 2025?

Yes, investing in SOL for 2025 looks promising. Solana's price has surged past $200, showing strong institutional interest and technical breakout signals, suggesting potential for further growth.

What is the price of Solana in 2030?

By 2030, Solana is projected to trade between $1,004 and $1,258, with an average price of $1,042. This forecast is based on market trends and technological advancements.

How Can On-Chain Data Analysis Reveal Key Insights into Solana's Network Activity?

How Will Solana's Market Cap Evolve by 2030?

How Do Exchange Flows and Whale Holdings Impact Crypto Market Liquidity?

Discover the Powerful Solana Blockchain Explorer

Raydium's 2025 on-chain analysis: 35% active address rise and whale distribution pattern

2025 ETH Price Prediction: Analyzing Key Factors Driving Ethereum's Valuation in a Post-Merge Ecosystem

What is CANTO?

What are the major security risks and vulnerabilities threatening Bitcoin Cash (BCH) in 2026?

How Do Exchange Inflows and Outflows Affect Bitcoin Cash (BCH) Price and Holdings Concentration?

Dịch vụ Tên Solana: Hướng dẫn đầy đủ về Coin SNS

Long Short là gì?