2025 SOON Price Prediction: Bullish Outlook as Adoption Drives Growth

Introduction: SOON's Market Position and Investment Value

SOON (SOON), as a pioneering SVM Rollup Stack bringing Solana to all ecosystems, has achieved significant milestones since its inception. As of 2025, SOON's market capitalization has reached $688,718,250, with a circulating supply of approximately 235,065,446 tokens, and a price hovering around $2.9299. This asset, dubbed the "Solana Ecosystem Expander," is playing an increasingly crucial role in cross-chain communication and copy trading.

This article will provide a comprehensive analysis of SOON's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. SOON Price History Review and Current Market Status

SOON Historical Price Evolution

- 2025 May: Initial launch, price started at $0.05

- 2025 November: Reached all-time high of $5.5368, marking a 10,973% increase from launch

SOON Current Market Situation

SOON is currently trading at $2.9299, showing strong performance with a 44.26% increase in the last 24 hours. The token has experienced significant growth over the past month, with a 261.02% price increase. SOON's market capitalization stands at $688,718,250, ranking it 113th in the cryptocurrency market. The current price represents a 47.09% retracement from its all-time high of $5.5368, reached just yesterday. With a circulating supply of 235,065,446 SOON tokens, representing 23.51% of the total supply, the project maintains a fully diluted valuation of $2,929,900,000.

Click to view the current SOON market price

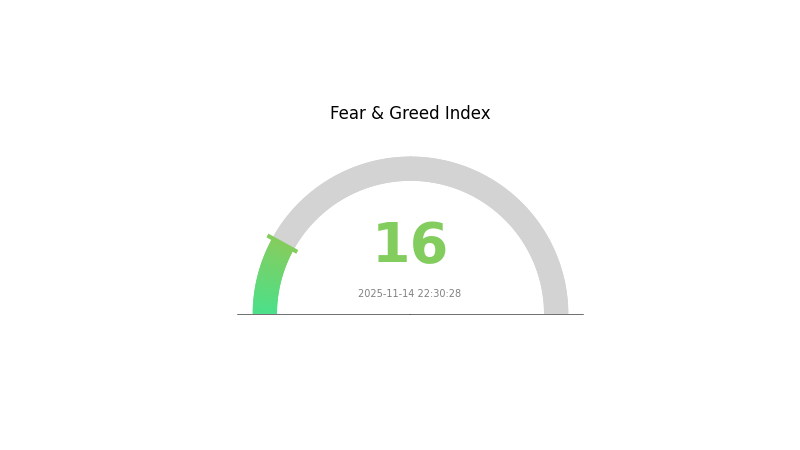

SOON Market Sentiment Indicator

2025-11-14 Fear and Greed Index: 16 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is gripped by extreme fear, with the sentiment index plummeting to 16. This level of pessimism often precedes potential buying opportunities, as it may indicate an oversold market. However, investors should exercise caution and conduct thorough research before making any decisions. Remember, market sentiment can shift rapidly, and it's crucial to maintain a balanced perspective. Consider diversifying your portfolio and staying informed about market trends to navigate these uncertain times effectively.

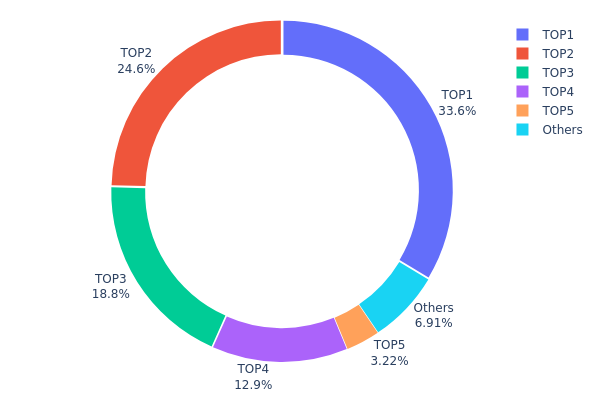

SOON Holdings Distribution

The address holdings distribution data provides crucial insights into the concentration of SOON tokens among different wallet addresses. Analysis of this data reveals a highly centralized distribution pattern, with the top 5 addresses controlling 93.07% of the total supply.

The top address holds a significant 33.61% of all SOON tokens, while the second and third largest holders possess 24.56% and 18.76% respectively. This high concentration in a few wallets raises concerns about potential market manipulation and price volatility. With such a large portion of tokens held by a small number of addresses, any significant movement or sell-off from these major holders could have a substantial impact on SOON's market dynamics.

This centralized distribution suggests a relatively low level of decentralization for SOON, which may affect its perceived stability and resistance to market manipulation. Investors and traders should be aware of this concentration risk when considering SOON in their portfolios or trading strategies.

Click to view the current SOON Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x0978...924642 | 179166.67K | 33.61% |

| 2 | 0xcc48...3fe0f7 | 130920.16K | 24.56% |

| 3 | 0xb798...55f5d4 | 100000.00K | 18.76% |

| 4 | 0xa370...9c1060 | 68888.89K | 12.92% |

| 5 | 0xffa8...44cd54 | 17182.51K | 3.22% |

| - | Others | 36853.85K | 6.93% |

II. Key Factors Affecting SOON's Future Price

Supply Mechanism

- Token Release Schedule: SOON tokens are released gradually according to a predetermined schedule, which helps maintain price stability.

- Historical Pattern: Previous token releases have shown minimal short-term price impact due to the gradual nature of the distribution.

- Current Impact: The upcoming token release is expected to have a neutral to slightly positive effect on price as the market has likely priced in the scheduled distribution.

Institutional and Whale Dynamics

- Institutional Holdings: Several prominent crypto investment firms have increased their SOON positions in recent months, signaling growing institutional interest.

Macroeconomic Environment

- Monetary Policy Impact: Major central banks are expected to maintain relatively neutral monetary policies, which could provide a stable backdrop for crypto assets like SOON.

- Inflation Hedging Properties: SOON has demonstrated moderate correlation with inflation, potentially attracting investors seeking to diversify their portfolios.

Technical Development and Ecosystem Building

- Network Upgrade: The upcoming "Horizon" upgrade aims to improve transaction speeds and reduce fees, potentially driving increased adoption.

- Ecosystem Applications: Several new DeFi protocols built on SOON's blockchain have gained traction, expanding the token's utility and demand.

III. SOON Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $2.08 - $2.50

- Neutral prediction: $2.50 - $2.89

- Optimistic prediction: $2.89 - $2.98 (requires positive market sentiment)

2027-2028 Outlook

- Market phase expectation: Potential growth and consolidation

- Price range forecast:

- 2027: $3.01 - $3.66

- 2028: $2.92 - $4.11

- Key catalysts: Market adoption, technological advancements

2029-2030 Long-term Outlook

- Base scenario: $3.85 - $4.03 (assuming steady market growth)

- Optimistic scenario: $4.20 - $5.92 (assuming strong market performance)

- Transformative scenario: $5.92+ (assuming breakthrough innovations and widespread adoption)

- 2030-12-31: SOON $4.03 (37% increase from 2025)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 2.97629 | 2.8896 | 2.08051 | -1 |

| 2026 | 4.16478 | 2.93294 | 2.63965 | 0 |

| 2027 | 3.65533 | 3.54886 | 3.01653 | 21 |

| 2028 | 4.10639 | 3.6021 | 2.9177 | 22 |

| 2029 | 4.20112 | 3.85424 | 3.39173 | 31 |

| 2030 | 5.92069 | 4.02768 | 3.18187 | 37 |

IV. SOON Professional Investment Strategy and Risk Management

SOON Investment Methodology

(1) Long-term Holding Strategy

- Target investors: Growth-oriented investors with high risk tolerance

- Operation suggestions:

- Accumulate SOON tokens during market dips

- Set long-term price targets and stick to the plan

- Store tokens in secure non-custodial wallets

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversal points

- Relative Strength Index (RSI): Monitor overbought/oversold conditions

- Key points for swing trading:

- Set clear entry and exit points based on technical indicators

- Use stop-loss orders to manage downside risk

SOON Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across different crypto assets

- Options strategies: Use put options for downside protection

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallets for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords

V. SOON Potential Risks and Challenges

SOON Market Risks

- High volatility: Significant price fluctuations common in crypto markets

- Liquidity risk: Potential difficulty in executing large trades without impacting price

- Competition: Other Layer 2 solutions may gain market share

SOON Regulatory Risks

- Uncertain regulatory landscape: Potential for new regulations affecting SOON's operations

- Cross-border compliance: Challenges in adhering to varied international regulations

- Tax implications: Evolving tax laws may impact SOON holders

SOON Technical Risks

- Smart contract vulnerabilities: Potential for exploits in the SOON protocol

- Scalability challenges: Possible network congestion during high-demand periods

- Interoperability issues: Potential difficulties in cross-chain communication

VI. Conclusion and Action Recommendations

SOON Investment Value Assessment

SOON presents a high-risk, high-potential opportunity in the Layer 2 scaling solution space. Long-term value proposition is strong, but short-term volatility and technical risks remain significant.

SOON Investment Recommendations

✅ Novice: Consider small, gradual investments to understand the market ✅ Experienced investors: Implement dollar-cost averaging strategy with set profit-taking points ✅ Institutional investors: Explore strategic partnerships and larger position sizes with hedging

SOON Trading Participation Methods

- Spot trading: Direct purchase and sale of SOON tokens on Gate.com

- Futures trading: Leverage opportunities for experienced traders on Gate.com

- Staking: Participate in SOON's ecosystem for potential passive income

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance, and it is recommended to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Is soon token a good investment?

Yes, SOON token shows promise as an investment. Its innovative features and growing adoption in the Web3 space make it an attractive option for crypto investors looking for potential high returns.

What crypto will 1000x prediction?

While it's impossible to predict with certainty, emerging projects in AI, DeFi, or metaverse sectors could potentially see massive growth. Always research thoroughly before investing.

Which crypto will reach $1 in 2025?

Based on market trends and expert predictions, SOON token is likely to reach $1 by 2025. Its innovative technology and growing adoption make it a strong contender for significant price appreciation.

Will hamster kombat reach $1?

It's unlikely for Hamster Kombat to reach $1 in the near future, given its current market performance and trends in the crypto space.

2025 ESPrice Prediction: Market Analysis and Future Trends for Enterprise Software Solutions

Is dYdX (DYDX) a good investment?: Analyzing the potential of this decentralized derivatives exchange token

TIMECHRONO vs LRC: A Comparative Analysis of Time Synchronization Technologies in Audio Production

HEI vs DYDX: Comparing Two Leading Trading Platforms in the Digital Asset Ecosystem

2025 MNT Price Prediction: Analyzing Market Trends and Expert Forecasts for Mongolian Tugrik's Future Value

CGN vs LRC: Exploring the Differences in Cognitive Processing and Learning Outcomes

What is Mango Network? A Complete Guide to MGO Token and Multi-VM Blockchain Infrastructure

What Are Crypto Whales and How to Identify Them?

Types of Cryptocurrencies: An In-Depth Overview of Key Features and Top Picks from Bitcoin to Altcoins

Stablecoins Explained: A Complete Beginner's Guide to Their Mechanisms, How to Choose the Right One, and How to Start

What is ENSO? New Infrastructure for Web3 and Smart Contract Automation