2025 SPARKLET Price Prediction: Bullish Trends and Key Factors Driving Growth in the Crypto Market

Introduction: SPARKLET's Market Position and Investment Value

SPARKLET (SPARKLET), as a native utility token of the immersive layer 1 gaming platform Upland, has been playing a significant role in the digital economy since its inception. As of 2025, SPARKLET's market capitalization has reached $5,293,485, with a circulating supply of approximately 173,500,000 tokens, and a price hovering around $0.03051. This asset, often referred to as the "metaverse gaming token," is increasingly crucial in the fields of virtual real estate and blockchain gaming.

This article will comprehensively analyze SPARKLET's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price predictions and practical investment strategies.

I. SPARKLET Price History Review and Current Market Status

SPARKLET Historical Price Evolution

- 2024: SPARKLET reached its all-time high of $0.1927 on July 24, 2024, marking a significant milestone for the token.

- 2025: The token experienced a substantial decline, hitting its all-time low of $0.01144 on April 9, 2025.

- 2025: As of October 11, 2025, SPARKLET has shown some recovery, trading at $0.03051.

SPARKLET Current Market Situation

As of October 11, 2025, SPARKLET is trading at $0.03051, with a 24-hour trading volume of $19,331.61. The token has experienced a slight increase of 0.16% in the past 24 hours. SPARKLET's market cap currently stands at $5,293,485, ranking it at 1691 in the cryptocurrency market. The circulating supply is 173,500,000 SPARKLET tokens, with a total supply of 1,000,000,000. The token's price is significantly below its all-time high, indicating potential room for growth if market conditions improve.

Click to view the current SPARKLET market price

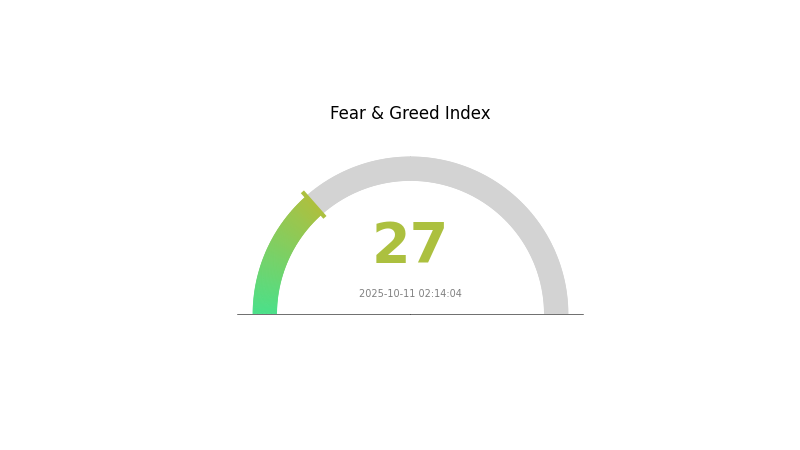

SPARKLET Market Sentiment Indicator

2025-10-11 Fear and Greed Index: 27 (Fear)

Click to view the current Fear & Greed Index

The crypto market sentiment remains in the "Fear" zone, with the Fear and Greed Index at 27. This indicates a cautious atmosphere among investors. During such periods, some view it as an opportunity to accumulate, following the contrarian investment strategy of "be fearful when others are greedy, and greedy when others are fearful." However, it's crucial to conduct thorough research and manage risks wisely before making any investment decisions in this volatile market.

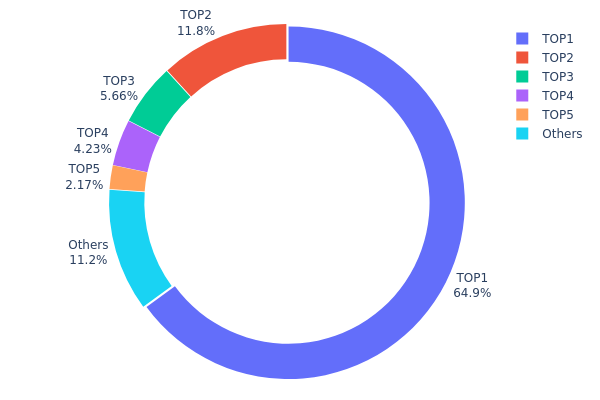

SPARKLET Holdings Distribution

The address holdings distribution data provides crucial insights into the concentration of SPARKLET tokens among different wallet addresses. Analysis of this data reveals a highly concentrated distribution pattern, with the top address holding a substantial 64.92% of the total supply. This extreme concentration is further emphasized by the fact that the top 5 addresses collectively control 88.75% of all SPARKLET tokens.

Such a high level of concentration raises concerns about market stability and potential price manipulation. With a single address controlling nearly two-thirds of the supply, there is a significant risk of market volatility should this holder decide to liquidate their position. Moreover, the top 5 addresses' dominance limits the token's decentralization, potentially impacting its governance structure and overall market dynamics.

This concentration pattern suggests that SPARKLET's on-chain structure may be less stable than desired for a decentralized asset. It indicates a need for broader distribution to enhance market resilience and reduce the risk of large-scale price movements triggered by individual holders. Investors and stakeholders should closely monitor any changes in this distribution for signs of increasing decentralization or further concentration.

Click to view the current SPARKLET Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x60fb...8e6807 | 649216.67K | 64.92% |

| 2 | 0xddab...01994b | 118000.01K | 11.80% |

| 3 | 0x9bc8...8610d2 | 56590.68K | 5.65% |

| 4 | 0x6ea5...0002fe | 42267.69K | 4.22% |

| 5 | 0xfb5b...0034a6 | 21666.67K | 2.16% |

| - | Others | 112258.29K | 11.25% |

II. Key Factors Affecting SPARKLET's Future Price

Supply Mechanism

- Market Demand: The balance between supply and demand is a fundamental driver of SPARKLET's price.

- Historical Patterns: Past supply changes have shown to influence price movements significantly.

- Current Impact: Expected supply changes may affect investor sentiment and price trajectory.

Institutional and Whale Movements

- Institutional Holdings: Major institutions' positions in SPARKLET can sway market sentiment.

- Corporate Adoption: Adoption by notable enterprises could boost SPARKLET's value proposition.

Macroeconomic Environment

- Monetary Policy Impact: Central bank policies, particularly interest rate decisions, may influence cryptocurrency markets.

- Inflation Hedging Properties: SPARKLET's performance in inflationary environments could affect its appeal as a store of value.

- Geopolitical Factors: International tensions and economic policies may impact global risk appetite for cryptocurrencies.

Technical Development and Ecosystem Growth

- Core Technology Upgrades: Improvements to SPARKLET's underlying technology could enhance its utility and value.

- Ecosystem Applications: The development of DApps and projects within the SPARKLET ecosystem may drive adoption and demand.

III. SPARKLET Price Prediction for 2025-2030

2025 Outlook

- Conservative forecast: $0.0183 - $0.0305

- Neutral forecast: $0.0305 - $0.0364

- Optimistic forecast: $0.0364 - $0.0424 (requires positive market sentiment)

2026-2027 Outlook

- Market phase expectation: Gradual growth phase

- Price range prediction:

- 2026: $0.03317 - $0.04337

- 2027: $0.03073 - $0.04989

- Key catalysts: Increasing adoption and technological improvements

2028-2030 Long-term Outlook

- Base scenario: $0.0449 - $0.0474 (assuming steady market growth)

- Optimistic scenario: $0.0474 - $0.05925 (assuming strong market performance)

- Transformative scenario: Above $0.05925 (extremely favorable market conditions)

- 2030-12-31: SPARKLET $0.0474 (potential for significant growth)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.0424 | 0.0305 | 0.0183 | 0 |

| 2026 | 0.04337 | 0.03645 | 0.03317 | 19 |

| 2027 | 0.04989 | 0.03991 | 0.03073 | 30 |

| 2028 | 0.04804 | 0.0449 | 0.03637 | 47 |

| 2029 | 0.04833 | 0.04647 | 0.02928 | 52 |

| 2030 | 0.05925 | 0.0474 | 0.02986 | 55 |

IV. SPARKLET Professional Investment Strategy and Risk Management

SPARKLET Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Risk-tolerant investors interested in metaverse and gaming projects

- Operation suggestions:

- Accumulate SPARKLET during market dips

- Monitor Upland's ecosystem growth and user adoption

- Store tokens in a secure hardware wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversal points

- RSI (Relative Strength Index): Monitor overbought and oversold conditions

- Key points for swing trading:

- Set clear entry and exit points based on technical indicators

- Keep track of Upland's development milestones and partnerships

SPARKLET Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3%

- Aggressive investors: 5-10%

- Professional investors: 10-15%

(2) Risk Hedging Solutions

- Diversification: Spread investments across different metaverse and gaming tokens

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallet for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords, and regularly update software

V. Potential Risks and Challenges for SPARKLET

SPARKLET Market Risks

- High volatility: SPARKLET price may experience significant fluctuations

- Competition: Increasing number of metaverse and gaming projects may impact market share

- Market sentiment: Overall crypto market conditions can affect SPARKLET's performance

SPARKLET Regulatory Risks

- Uncertain regulations: Evolving regulatory landscape for metaverse and gaming tokens

- Cross-border compliance: Potential challenges in adhering to various international regulations

- Tax implications: Unclear tax treatment of metaverse assets and transactions

SPARKLET Technical Risks

- Smart contract vulnerabilities: Potential security issues in the token's underlying code

- Scalability challenges: Upland's ability to handle increased user activity and transactions

- Interoperability issues: Potential difficulties in bridging SPARKLET between different blockchains

VI. Conclusion and Action Recommendations

SPARKLET Investment Value Assessment

SPARKLET presents a high-risk, high-potential opportunity in the metaverse and gaming sector. Long-term value depends on Upland's ecosystem growth and user adoption, while short-term risks include market volatility and regulatory uncertainties.

SPARKLET Investment Recommendations

✅ Beginners: Start with small, regular investments to understand the market dynamics ✅ Experienced investors: Consider a balanced approach, combining long-term holding with strategic trading ✅ Institutional investors: Conduct thorough due diligence and consider SPARKLET as part of a diversified digital asset portfolio

SPARKLET Trading Participation Methods

- Spot trading: Buy and sell SPARKLET on Gate.com's spot market

- Staking: Participate in staking programs if available to earn passive income

- DeFi integration: Explore decentralized finance opportunities within the Upland ecosystem

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

How much is Sparklet coin worth?

As of October 2025, Sparklet coin is worth approximately $0.03. The price has shown a slight upward trend recently.

Does spark crypto have a future?

Spark crypto's future looks promising. As Web3 evolves, Spark's innovative features and growing community support suggest potential for long-term growth and adoption in the decentralized finance ecosystem.

What meme coin will explode in 2025 price prediction?

Meme coins with strong exchange listings and high market caps are likely to explode in 2025. Predictions focus on coins reaching new all-time highs, with potential 8000% value increases.

Can Flare reach $10?

Flare reaching $10 is possible but challenging. It would require a market cap exceeding $1 trillion, which depends on future market conditions and adoption.

2025 ZENT Price Prediction: Analyzing Market Trends and Growth Potential in the Evolving Cryptocurrency Landscape

2025 WILDPrice Prediction: Analyzing Market Trends and Growth Potential for the WILD Token Ecosystem

ALICE vs ARB: A Comparative Analysis of Layer 1 and Layer 2 Blockchain Scaling Solutions

REZ vs SAND: A Comparative Analysis of Digital Real Estate Platforms in the Metaverse Economy

Is Ultiverse (ULTI) a good investment?: Analyzing the potential and risks of this metaverse token

ESE vs SAND: Comparing Two Novel Approaches to Efficient Data Processing in Cloud Computing

Types of Cryptocurrencies: An In-Depth Overview of Key Features and Top Picks from Bitcoin to Altcoins

Stablecoins Explained: A Complete Beginner's Guide to Their Mechanisms, How to Choose the Right One, and How to Start

What is ENSO? New Infrastructure for Web3 and Smart Contract Automation

Michael Saylor: The Path to Leadership in the Cryptocurrency Sphere

What is a Bitcoin hardware wallet