2025 SUPER Fiyat Tahmini: Piyasa Trendleri ve Olası Büyüme Faktörlerinin Analizi

Giriş: SUPER’ın Pazar Konumu ve Yatırım Potansiyeli

SuperFarm (SUPER), NFT farming yoluyla herhangi bir tokene işlev kazandırmak amacıyla tasarlanmış zincirler arası bir DeFi protokolüdür ve 2021’de faaliyete geçmesinden bu yana önemli ilerlemeler kaydetmiştir. 2025 yılı itibarıyla SUPER’ın piyasa değeri 246.149.224 dolar olup, yaklaşık 628.412.622 adet dolaşımdaki token mevcuttur; fiyatı ise 0,3917 dolar civarında seyretmektedir. “NFT Utility Innovator” (NFT Kullanım Alanı Yenilikçisi) olarak anılan SUPER, DeFi ve NFT altyapısı alanlarında giderek daha etkili bir rol üstlenmektedir.

Bu makale, SUPER’ın 2025-2030 arasındaki fiyat eğilimlerini kapsamlı biçimde analiz edecek; geçmiş fiyat hareketleri, piyasa arz-talep dengesi, ekosistem gelişimi ve makroekonomik faktörleri birleştirerek yatırımcılar için profesyonel fiyat tahminleri ve pratik yatırım stratejileri sunacaktır.

I. SUPER Fiyat Geçmişinin İncelenmesi ve Güncel Piyasa Durumu

SUPER’ın Tarihsel Fiyat Seyri

- 2021: SUPER, 31 Mart’ta 4,72995838 dolar ile tüm zamanların en yüksek seviyesine ulaşarak proje için kritik bir kilometre taşı kaydetti.

- 2023: Piyasa düşüş yaşadı ve SUPER, 19 Ekim’de 0,07043172184672868 dolar ile en düşük seviyesini gördü.

- 2025: SUPER bir miktar toparlandı ancak hâlâ tarihi zirvesinin oldukça gerisinde seyrediyor.

SUPER’ın Güncel Piyasa Durumu

18 Ekim 2025 tarihi itibarıyla SUPER, 0,3917 dolardan işlem görmektedir. Token, son 24 saatte %3,16 oranında değer kaybederken işlem hacmi 227.395.169,884 dolara ulaşmıştır. SUPER’ın piyasa değeri 246.149.224,2007065 dolar olup, genel kripto para sıralamasında 245. sıradadır. Dolaşımdaki miktar 628.412.622,4169173 token olup, bu toplam arzın (999.998.077,417 token) %62,84’üne denk gelmektedir. Son 24 saatlik düşüşe rağmen SUPER, son 1 saatte %2,42’lik pozitif bir ivme göstermiştir. Ancak uzun vadede ciddi kayıplar yaşamış; son 30 günde %34,62, son bir yılda ise %69,67 oranında düşüş kaydetmiştir.

Güncel SUPER piyasa fiyatını görmek için tıklayın

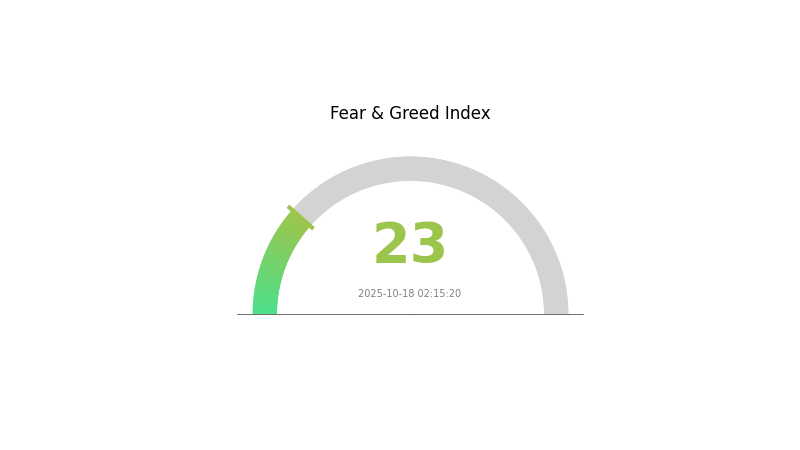

SUPER Piyasa Duyarlılığı Göstergesi

18 Ekim 2025 Korku ve Açgözlülük Endeksi: 23 (Aşırı Korku)

Güncel Korku & Açgözlülük Endeksini görmek için tıklayın

Kripto piyasası şu anda aşırı korku seviyesinde; Korku ve Açgözlülük Endeksi 23’e gerilemiş durumda. Bu sert düşüş, yatırımcılar arasında yaygın kötümserliğe işaret ederek, ters pozisyon alanlar için alım fırsatı yaratabilir. Ancak, piyasa duyarlılığı hızla değişebilir; bu nedenle yatırımcıların portföylerini çeşitlendirmesi ve risk yönetimi stratejilerini uygulaması tavsiye edilir. Güncel gelişmeleri takip ederek ve kapsamlı analizler sonrasında yatırım kararı almak bu zorlu ortamda kritik önem taşır.

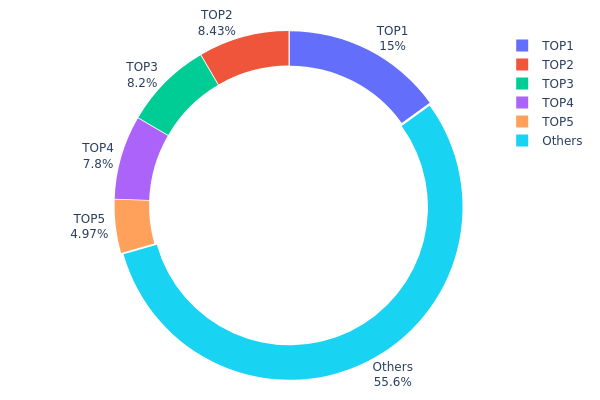

SUPER Token Dağılımı

Süper Token adres dağılımı, varlıkların büyük sahipler arasında yüksek oranda yoğunlaştığını gösteriyor. En büyük adres toplam arzın %15,02’sini elinde tutarken, ilk beş adres SUPER’ın %44,41’ini kontrol ediyor. Bu seviyedeki yoğunlaşma, görece merkezi bir dağılım yapısına işaret ediyor.

Böyle bir yoğun sahiplik yapısı, piyasada oynaklık riski yaratabilir; büyük adreslerden yapılacak satışlar SUPER fiyatı üzerinde baskı oluşturabilir. Öte yandan, arzın büyük kısmının projeye bağlı çıkarı olan adreslerde toplanması, belirli bir istikrar sağlayabilir.

İlk beş adres toplam arzın önemli kısmını elinde bulundururken, tokenların %55,59’u diğer adreslere dağıtılmıştır. Bu daha geniş dağılım, merkeziyetçilik endişelerini bir ölçüde azaltır ve zincir üstü yapının çeşitliliğine katkı sağlasa da, merkeziyetsizlik açısından geliştirme alanı mevcuttur.

Güncel SUPER Token Dağılımını görmek için tıklayın

| En Yüksek | Adres | Token Miktarı | Oran (%) |

|---|---|---|---|

| 1 | 0x7226...250cb1 | 150.257,48K | 15,02% |

| 2 | 0x8c96...d0b887 | 84.294,94K | 8,42% |

| 3 | 0xbda1...3a4700 | 82.000,00K | 8,20% |

| 4 | 0xf6e4...2e14ca | 78.020,00K | 7,80% |

| 5 | 0x7080...ac3f2c | 49.720,80K | 4,97% |

| - | Diğerleri | 555.704,86K | 55,59% |

II. SUPER’ın Gelecek Fiyatını Etkileyen Temel Unsurlar

Makroekonomik Koşullar

- Enflasyona karşı koruma: Bir kripto varlık olarak SUPER, ekonomik belirsizlik dönemlerinde enflasyona karşı koruma sağlayabilir. Ancak bu rol, piyasa benimsenmesi ve genel kripto piyasası koşulları gibi birçok faktöre bağlıdır.

Teknik Gelişim ve Ekosistem Büyümesi

- Ekosistem uygulamaları: SUPER, NFT ve blockchain oyunları odaklı SuperFarm ekosistemi içinde kullanılmaktadır. Ekosistemdeki projelerin büyümesi ve gelişimi, SUPER’ın değerini ve kullanım alanını doğrudan etkileyebilir.

III. 2025-2030 SUPER Fiyat Tahminleri

2025 Görünümü

- Temkinli tahmin: 0,25766 - 0,3904 dolar

- Tarafsız tahmin: 0,3904 - 0,45677 dolar

- İyimser tahmin: 0,45677 - 0,48289 dolar (güçlü piyasa ivmesi ve artan benimseme gerektirir)

2027-2028 Görünümü

- Piyasa evresi: Volatilite potansiyeliyle istikrarlı büyüme dönemi

- Fiyat aralığı tahmini:

- 2027: 0,34899 - 0,47136 dolar

- 2028: 0,44381 - 0,62873 dolar

- Başlıca katalizörler: Teknolojik gelişmeler, yeni iş ortaklıkları ve genel piyasa trendleri

2029-2030 Uzun Vadeli Görünüm

- Temel senaryo: 0,54551 - 0,67916 dolar (sürekli büyüme ve benimsenme varsayımıyla)

- İyimser senaryo: 0,67916 - 0,82858 dolar (hızlı benimsenme ve olumlu piyasa koşulları varsayımıyla)

- Dönüştürücü senaryo: 0,82858 - 1,00 dolar (aşırı olumlu piyasa koşulları ve çığır açan kullanım durumları ile)

- 2030-12-31: SUPER 0,82858 dolar (mevcut projeksiyonlara göre potansiyel zirve fiyat)

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Değişim (%) |

|---|---|---|---|---|

| 2025 | 0,45677 | 0,3904 | 0,25766 | 0 |

| 2026 | 0,48289 | 0,42358 | 0,25415 | 8 |

| 2027 | 0,47136 | 0,45323 | 0,34899 | 15 |

| 2028 | 0,62873 | 0,4623 | 0,44381 | 18 |

| 2029 | 0,81282 | 0,54551 | 0,27821 | 39 |

| 2030 | 0,82858 | 0,67916 | 0,54333 | 73 |

IV. SUPER İçin Profesyonel Yatırım Stratejileri ve Risk Yönetimi

SUPER Yatırım Metodolojisi

(1) Uzun Vadeli Tutma Stratejisi

- Uygun kitle: Uzun vadeli değer yatırımcıları

- İşlem önerileri:

- Piyasa düşüşlerinde SUPER biriktirin

- Piyasa dalgalanmalarını absorbe etmek için en az 1-2 yıl elde tutun

- Token’ları güvenli donanım cüzdanında muhafaza edin

(2) Aktif Alım-Satım Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: 50 ve 200 günlük MA ile trendleri tespit edin

- RSI: Aşırı alım/aşırı satım durumlarını izleyin

- Dalgalı işlemde kritik noktalar:

- Destek/direnç seviyelerine göre net giriş/çıkış noktaları belirleyin

- Risk kontrolü için zarar durdur emirleri kullanın

SUPER Risk Yönetimi Çerçevesi

(1) Varlık Dağılımı İlkeleri

- Temkinli yatırımcılar: Kripto portföyünün %1-3’ü

- Agresif yatırımcılar: Kripto portföyünün %5-10’u

- Profesyonel yatırımcılar: Kripto portföyünün %15’ine kadar

(2) Riskten Korunma Çözümleri

- Çeşitlendirme: Yatırımları farklı kripto varlıkları arasında dağıtın

- Opsiyon işlemleri: Aşağı yönlü riskten korunmak için satım opsiyonu kullanın

(3) Güvenli Saklama Yöntemleri

- Donanım cüzdanı tavsiyesi: Gate web3 cüzdanı

- Soğuk saklama: Uzun vadeli tutmak için kağıt cüzdan

- Güvenlik önlemleri: 2FA etkinleştirin, güçlü şifreler oluşturun, düzenli yedek alın

V. SUPER İçin Potansiyel Riskler ve Zorluklar

SUPER Piyasa Riskleri

- Yüksek volatilite: Kripto piyasalarında sık görülen sert fiyat dalgalanmaları

- Rekabet: NFT ve DeFi projelerinin sayısında artış

- Likidite riski: Büyük miktarların hızlıca satılmasında zorluk yaşanabilir

SUPER Düzenleyici Riskleri

- Belirsiz düzenlemeler: Küresel kripto düzenlemelerinin değişmesi SUPER’ı etkileyebilir

- Vergi sonuçları: Kripto varlıklar için değişen vergi yasaları

- Sınır ötesi kısıtlamalar: Uluslararası işlemlerde olası sınırlamalar

SUPER Teknik Riskler

- Akıllı kontrat açıkları: Protokol kodunda hata olasılığı

- Ölçeklenebilirlik sorunları: Artan ağ trafiğini yönetmede güçlük

- Birlikte çalışabilirlik problemleri: Zincirler arası fonksiyonlarda yaşanabilecek zorluklar

VI. Sonuç ve Eylem Önerileri

SUPER Yatırım Potansiyeli Değerlendirmesi

SUPER, NFT ve DeFi alanlarında uzun vadeli potansiyel sunar; ancak kısa vadede volatilite ve rekabet baskısı altındadır. Projenin başarısı, ekosistemin gelişimi ve geniş çaplı benimsenmeye bağlıdır.

SUPER Yatırım Tavsiyeleri

✅ Yeni başlayanlar: Zaman içinde pozisyon oluşturmak için küçük ve düzenli yatırımlar tercih edin ✅ Deneyimli yatırımcılar: Hem uzun vadeli tutma hem de aktif alım-satım içeren dengeli bir yaklaşım benimseyin ✅ Kurumsal yatırımcılar: Kapsamlı inceleme yaparak SUPER’ı çeşitlendirilmiş bir kripto portföyüne dahil etmeyi değerlendirin

SUPER Alım-Satım Katılım Yöntemleri

- Spot alım-satım: Gate.com üzerinden SUPER alıp tutun

- Staking: Pasif gelir için SUPER staking programlarına katılın

- NFT farming: SuperFarm ekosisteminde NFT odaklı etkinliklere katılın

Kripto para yatırımları çok yüksek risk içerir; bu makale yatırım tavsiyesi niteliğinde değildir. Yatırımcılar, kendi risk toleranslarına göre temkinli karar vermeli ve profesyonel finans danışmanlarına başvurmalıdır. Asla kaybetmeyi göze alabileceğinizden fazlasını yatırmayın.

Sıkça Sorulan Sorular

2025’te hangi coin 1 dolara ulaşacak?

SUPER, oyun ve NFT sektörlerindeki güçlü büyüme potansiyeli ve artan benimsenme sayesinde 2025’te 1 dolara ulaşabilir.

SuperRare coinleri yükselecek mi?

Evet, SuperRare coinlerinin yükselmesi muhtemel. NFT pazarının büyümesi ve SuperRare’ın dijital sanat alanındaki benzersiz konumu, önümüzdeki yıllarda talebi ve değerini artırabilir.

Super Micro’nun 2025 fiyat tahmini nedir?

Piyasa trendleri ve uzman analizlerine göre, Super Micro’nun fiyatı 2025 sonuna kadar 500-550 dolar aralığına ulaşabilir; bu rakam teknoloji sektöründeki güçlü büyümeyi yansıtmaktadır.

Hamster Kombat Coin 1 dolara ulaşacak mı?

Mevcut piyasa değeri ve arzı göz önünde bulundurulduğunda, Hamster Kombat Coin’in yakın zamanda 1 dolara ulaşması pek olası değildir. Ancak artan benimseme ve geliştirme ile zaman içinde daha yüksek fiyat seviyelerine ulaşabilir.

2025 BLUR Fiyat Tahmini: NFT Pazar Yeri Tokeni İçin Piyasa Trendleri ve Gelecek Potansiyelinin Analizi

2025 MAGIC Fiyat Tahmini: Kripto Ekosisteminde MAGIC Token'ın Piyasa Trendleri ve Gelecekteki Büyüme Potansiyelinin Analizi

2025 DEGO Fiyat Tahmini: Uzun Vadeli Büyüme Potansiyeli Açısından Temel Faktörler ve Piyasa Trendlerinin Analizi

SUPER vs UNI: Akıllı Telefon İşletim Sistemleri Mücadelesi

2025 AURA Fiyat Tahmini: Bu DeFi Token Boğa Piyasasında Yeni Zirvelere Çıkabilir mi?

UDS ve KAVA: İki Önde Gelen Merkeziyetsiz Finans Platformunun Karşılaştırılması

Kripto Terminolojisini Anlama: Yeni Başlayanlar İçin Rehber

NFT’lerde Yeni Bir Dönem: Soulbound Token’ların Temelini Kavramak

Blockchain Teknolojisinde Tendermint’in Konsensüs Mekanizmasını Anlamak

Ethereum Name Service Alan Adlarını Satın Alma ve Yönetme Yöntemleri

Yakında hayata geçirilecek benzersiz NFT projesinin öne çıkan temel özellikleri