2025 SUSHI Price Prediction: Expert Analysis and Market Forecast for the Upcoming Year

Introduction: Market Position and Investment Value of SUSHI

Sushiswap (SUSHI) operates as a decentralized exchange platform that enables users to mine governance tokens through staking mainstream LP tokens from Uniswap V2. Since its inception in 2020, SUSHI has established itself as a governance-driven asset within the decentralized finance ecosystem. As of December 2025, SUSHI's market capitalization has reached approximately $82.85 million, with a circulating supply of around 273 million tokens, trading at $0.288 per unit. This governance token, which grants holders the right to participate in protocol decisions and share transaction fees, continues to play an important role in the decentralized trading infrastructure.

This article will provide a comprehensive analysis of SUSHI's price trajectory through 2030, integrating historical price patterns, market supply and demand dynamics, ecosystem development, and macroeconomic factors to deliver professional price forecasts and practical investment strategies for investors seeking exposure to this digital asset on platforms such as Gate.com.

SUSHI Market Analysis Report

I. SUSHI Price History Review and Market Status

SUSHI Historical Price Evolution Trajectory

-

2021: Project launch and early momentum phase. SUSHI reached its all-time high of $23.38 on March 14, 2021, marking the peak of initial market enthusiasm for the SushiSwap protocol.

-

2021-2025: Extended bear market and consolidation period. From the peak of $23.38 to the current price of $0.288, SUSHI has experienced a sustained decline of approximately 98.77% over the four-year period, reflecting the challenging market conditions in the cryptocurrency sector and shifting investor sentiment.

-

October 2025: Recent price floor formation. SUSHI reached its all-time low of $0.254831 on October 11, 2025, indicating potential support levels in the current market cycle.

SUSHI Current Market Status

As of December 18, 2025, SUSHI is trading at $0.288 with a market capitalization of $78.63 million and a fully diluted valuation of $82.85 million. The token ranks 389th by market cap with a market dominance of 0.0026%. Over the past 24 hours, SUSHI has declined 4.38%, with the price ranging between $0.2899 (low) and $0.3096 (high). The 24-hour trading volume stands at $157,973.03.

Short-term price momentum shows weakness across multiple timeframes: the 1-hour change is -6.29%, the 7-day change is -14.26%, the 30-day change is -35.99%, and the 1-year change is -85.79%. The circulating supply of SUSHI is 273,012,266.13 tokens out of a total supply of 287,676,365.31 tokens, with unlimited maximum supply.

The token is actively traded across 48 exchanges globally, with 125,670 token holders. Market sentiment indicates extreme fear conditions, reflecting prevailing risk aversion in the broader cryptocurrency market.

Click to view current SUSHI market price

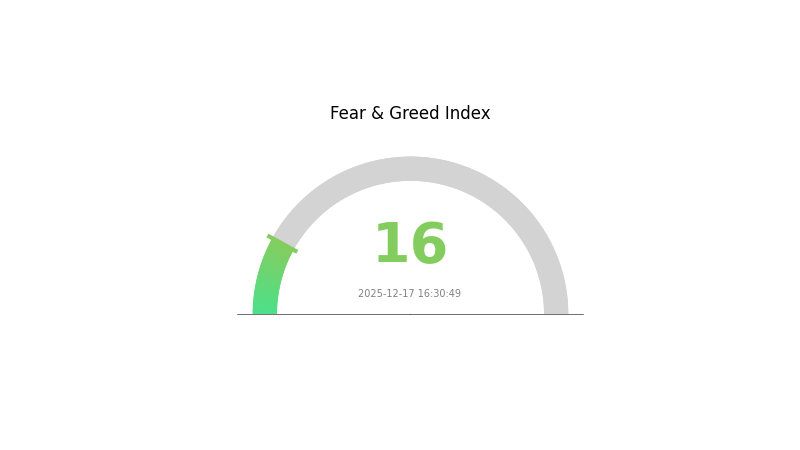

SUSHI Market Sentiment Indicator

2025-12-17 Fear and Greed Index: 16 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is experiencing extreme fear with an index reading of 16. This historically low sentiment suggests investors are highly risk-averse and pessimistic about near-term price movements. Such extreme fear often presents contrarian opportunities, as markets typically recover from these fear-driven lows. However, traders should remain cautious and conduct thorough research before making investment decisions. Monitor market conditions closely on Gate.com for real-time data and analysis.

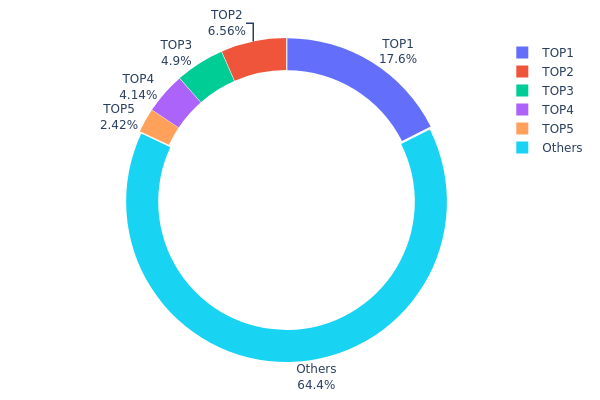

SUSHI Holdings Distribution

The address holdings distribution map illustrates the concentration of SUSHI tokens across blockchain addresses, revealing the extent to which token supply is concentrated among major holders versus distributed across the broader network. This metric serves as a critical indicator of decentralization and potential market vulnerabilities, as highly concentrated holdings can amplify price volatility and increase the risk of coordinated market movements.

Current analysis of SUSHI's holder structure reveals moderate concentration characteristics. The top five addresses collectively control approximately 35.59% of the circulating supply, with the largest holder (0xf977...41acec) commanding 17.58%. While this concentration level is notable, the distribution does not indicate extreme centralization, as the remaining 64.41% of tokens are dispersed among other addresses. This suggests a relatively balanced ecosystem where no single actor maintains overwhelming control, though the top holder's substantial position warrants ongoing monitoring for potential market impact scenarios.

The current address distribution pattern reflects a market structure typical of established DeFi protocols with institutional participation. The presence of significant holders alongside a distributed retail base creates a more stable on-chain ecosystem compared to protocols dominated by a handful of whales. However, the 17.58% concentration in the top address represents a meaningful threshold that could influence price dynamics during periods of high volatility or significant liquidation events, potentially creating asymmetric risk conditions for smaller holders.

Click to view current SUSHI Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xf977...41acec | 50595.32K | 17.58% |

| 2 | 0x8798...ff4272 | 18883.01K | 6.56% |

| 3 | 0x611f...dfb09d | 14107.51K | 4.90% |

| 4 | 0xa4b9...e1bf30 | 11905.45K | 4.13% |

| 5 | 0x5a52...70efcb | 6973.07K | 2.42% |

| - | Others | 185212.00K | 64.41% |

II. Core Factors Affecting SUSHI's Future Price

Supply Mechanism

- Inflation Rate: SUSHI's inflation rate continues to decline, which is expected to drive price appreciation over the long term.

- Historical Performance: Past supply changes have shown high correlation with price fluctuations, suggesting that deflation dynamics will likely continue to support upward price pressure.

Institutional and Whale Activity

- Whale Accumulation: Strategic accumulation by large holders may create upward price pressure due to increased demand, though long-term impacts will depend on broader market conditions and protocol performance.

Technical Development and Ecosystem Building

- Market Sentiment: Cryptocurrency prices are significantly influenced by overall market trends. Bullish sentiment typically drives SUSHI prices higher.

- Ecosystem Adoption: Price movements are influenced by trading volume, technology development, and user adoption trends within the DeFi ecosystem.

III. 2025-2030 SUSHI Price Forecast

2025 Outlook

- Conservative Forecast: $0.22-$0.28

- Neutral Forecast: $0.28-$0.32

- Optimistic Forecast: $0.32-$0.36 (requires sustained DeFi ecosystem growth)

2026-2028 Medium-term Outlook

- Market Phase Expectation: Gradual recovery and consolidation phase with moderate growth trajectory in the DeFi sector

- Price Range Forecast:

- 2026: $0.17-$0.45 (13% potential upside)

- 2027: $0.29-$0.55 (34% potential upside)

- 2028: $0.44-$0.48 (62% potential upside)

- Key Catalysts: Expansion of Sushiswap's cross-chain capabilities, increased institutional adoption of DeFi protocols, improvement in overall market sentiment toward governance tokens, and strategic partnerships within the crypto ecosystem

2029-2030 Long-term Outlook

- Base Case: $0.36-$0.62 (65% potential upside by 2029)

- Optimistic Case: $0.44-$0.75 (90% potential upside by 2030, contingent on mainstream DeFi adoption and robust regulatory framework)

- Transformational Case: $0.76+ (assumes breakthrough in protocol innovation, significant user base expansion, and positive macro market conditions)

The forecast indicates a progressive appreciation trajectory with SUSHI potentially reaching $0.76 by 2030 under favorable conditions, reflecting growing confidence in decentralized finance infrastructure and governance token valuations.

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.36462 | 0.2871 | 0.22107 | 0 |

| 2026 | 0.44643 | 0.32586 | 0.17271 | 13 |

| 2027 | 0.55218 | 0.38614 | 0.28961 | 34 |

| 2028 | 0.48324 | 0.46916 | 0.43632 | 62 |

| 2029 | 0.62382 | 0.4762 | 0.35715 | 65 |

| 2030 | 0.75902 | 0.55001 | 0.37401 | 90 |

SUSHI Investment Strategy and Risk Management Report

IV. SUSHI Professional Investment Strategy and Risk Management

SUSHI Investment Methodology

(1) Long-term Holding Strategy

- Suitable Investors: Governance participation enthusiasts, DeFi protocol believers, and long-term protocol stakeholders

- Operational Recommendations:

- Dollar-cost averaging (DCA) into SUSHI positions over extended periods to mitigate volatility impact

- Active participation in governance votes to influence protocol direction and earn governance benefits

- Reinvestment of trading fee distributions (0.05% of SushiSwap transaction fees) to compound holdings

(2) Active Trading Strategy

-

Technical Analysis Considerations:

- Price Action Analysis: Monitor support levels around $0.288 (current price) and resistance at $0.3096 (24H high)

- Volume Metrics: Daily trading volume of $157,973 suggests moderate liquidity; traders should execute positions during peak volume periods

-

Wave Trading Key Points:

- Current downtrend pattern: -4.38% (24H), -14.26% (7D), -35.99% (30D) indicates sustained selling pressure

- Entry opportunities may emerge at support levels; exit discipline critical given weak sentiment

- Monitor protocol governance announcements and trading fee accrual updates for catalyst events

SUSHI Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 0.5-2% portfolio allocation maximum

- Active Investors: 2-5% portfolio allocation range

- Professional Investors: 5-10% allocation with active governance participation

(2) Risk Hedging Solutions

- Stablecoin Pairing: Maintain SUSHI/stablecoin pairs on Gate.com for rapid exit liquidity without additional token sales

- Position Scaling: Gradually reduce SUSHI exposure during market rallies; rebuild positions during sustained downtrends

(3) Secure Storage Solutions

- Non-Custodial Approach: Store SUSHI on blockchain addresses where you control private keys; Gate.com Web3 wallet provides institutional-grade security with intuitive interfaces

- Hardware Approach: For substantial holdings, utilize air-gapped environments with offline transaction signing capabilities

- Security Considerations:

- Never share private keys or seed phrases

- Enable multi-signature verification for wallets containing significant SUSHI holdings

- Verify contract address (0x6B3595068778DD592e39A122f4f5a5cF09C90fE2 on Ethereum) before any token transactions

- Beware of phishing attempts targeting governance participants

V. SUSHI Potential Risks and Challenges

SUSHI Market Risks

- Severe Price Depreciation: SUSHI has declined 85.79% over one year and 35.99% over 30 days, indicating sustained downward pressure and potential further losses

- Low Trading Liquidity: Daily trading volume of $157,973 across 48 exchanges limits exit capacity for large positions without significant slippage

- Governance Token Dilution: Circulating supply of 273 million tokens with unlimited maximum supply poses indefinite dilution risks

SUSHI Regulatory Risks

- Governance Token Classification: Regulatory uncertainty regarding whether governance tokens constitute securities in various jurisdictions; potential future compliance requirements

- DeFi Protocol Scrutiny: Increased regulatory attention on decentralized finance protocols may impact SushiSwap operations and SUSHI token utility

- Jurisdictional Variability: Different regulatory approaches across nations create compliance complexity for global governance participation

SUSHI Technical Risks

- Protocol Vulnerability: Smart contract bugs or exploits on SushiSwap could damage ecosystem confidence and impact SUSHI token value

- Liquidity Migration Risk: Dependence on maintained liquidity within SushiSwap ecosystem; significant TVL exodus could impair fee generation

- Ethereum Network Risk: SushiSwap's primary deployment on Ethereum exposes SUSHI holders to Layer-1 network congestion and fee volatility

VI. Conclusion and Action Recommendations

SUSHI Investment Value Assessment

SUSHI represents a governance token for the SushiSwap decentralized exchange protocol, offering holders participation rights and potential fee-sharing mechanisms. However, the token demonstrates significant downward price momentum (-85.79% annually) and faces structural challenges including unlimited supply potential and competitive pressure from other DEX protocols. Current market conditions suggest heightened caution, with the token trading near historical lows established in October 2025.

SUSHI Investment Recommendations

✅ Beginners: Limit positions to 0.5-1% of portfolio; participate in governance education before significant capital deployment; use Gate.com for secure, user-friendly trading and storage

✅ Experienced Investors: Consider 2-5% allocations as tactical governance plays; actively monitor protocol developments; implement strict stop-loss orders given downtrend momentum

✅ Institutional Investors: Evaluate 5-10% allocations contingent on protocol roadmap assessment; engage directly with governance participation; utilize Gate.com institutional services for optimized execution and custody

SUSHI Participation Methods

- Gate.com Trading: Access SUSHI spot markets with competitive spreads and real-time price discovery

- Governance Participation: Stake SUSHI holdings to participate in SushiSwap protocol governance votes and earn governance rewards

- Liquidity Provision: Supply SUSHI alongside other assets in SushiSwap pools to earn trading fee distributions and farm incentives

Cryptocurrency investment carries extreme risk and volatility. This report does not constitute investment advice. Investors must conduct independent research and assess personal risk tolerance before capital deployment. Consult qualified financial advisors regarding suitability. Never invest funds you cannot afford to lose entirely.

FAQ

Does SUSHI crypto have a future?

Yes, SUSHI has promising fundamentals as a leading decentralized exchange token with strong community backing and growing ecosystem adoption. Its future depends on sustained DeFi development and market conditions.

Will SUSHI prices go up?

Yes, SUSHI prices are expected to rise. Increasing trading activity, growing ecosystem adoption, and limited token supply support upward price momentum in the coming period.

What is the all time high of SUSHI coin?

The all-time high of SUSHI coin is $23.25, reached before December 2025. This represents the peak price SUSHI has achieved since its inception.

Is SushiSwap a buy?

SushiSwap currently faces bearish signals with a projected 53.20% decline over the next 3 months. Technical indicators suggest a sell, with price forecasted between $0.0767 and $0.184. Not recommended as a buy at current levels.

XZXX: A Comprehensive Guide to the BRC-20 Meme Token in 2025

Bitcoin Fear and Greed Index: Market Sentiment Analysis for 2025

5 ways to get Bitcoin for free in 2025: Newbie Guide

Top Crypto ETFs to Watch in 2025: Navigating the Digital Asset Boom

Bitcoin Market Cap in 2025: Analysis and Trends for Investors

2025 Bitcoin Price Prediction: Trump's Tariffs' Impact on BTC

What is Mango Network? A Complete Guide to MGO Token and Multi-VM Blockchain Infrastructure

What Are Crypto Whales and How to Identify Them?

What is TON Coin? A complete guide to the Open Network’s features, tokenomics, and future prospects

Types of Cryptocurrencies: An In-Depth Overview of Key Features and Top Picks from Bitcoin to Altcoins

Stablecoins Explained: A Complete Beginner's Guide to Their Mechanisms, How to Choose the Right One, and How to Start