2025 TOWN Price Prediction: Analyzing Market Trends and Growth Potential for the Digital Real Estate Token

Introduction: TOWN's Market Position and Investment Value

Alt.town (TOWN), as a next-generation Web3 platform for virtual celebrity value growth, has been empowering creators, fans, and brands since its inception. As of 2025, TOWN's market cap has reached $448,402.5, with a circulating supply of approximately 455,000,000 tokens, and a price hovering around $0.0009855. This asset, known as the "Web3 entertainment ecosystem enabler," is playing an increasingly crucial role in digital ownership and data-driven fan engagement.

This article will comprehensively analyze TOWN's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price forecasts and practical investment strategies.

I. TOWN Price History Review and Current Market Status

TOWN Historical Price Evolution

- 2025 August: TOWN reached its all-time high of $0.0233, marking a significant milestone for the project

- 2025 October: The market experienced a downturn, with TOWN price dropping to its all-time low of $0.0007133

- 2025 October 31: TOWN shows signs of recovery, with price rebounding to $0.0009855

TOWN Current Market Situation

As of October 31, 2025, TOWN is trading at $0.0009855, representing a 24-hour increase of 8.11%. The token has shown strong momentum in the past week, with a 31.080% gain over the last 7 days. However, looking at the broader timeframe, TOWN has experienced significant losses, with a 56.32% decrease in the past 30 days and a staggering 96.0090% drop over the last year.

The current market capitalization of TOWN stands at $448,402.5, ranking it at 3541 in the global cryptocurrency market. With a circulating supply of 455,000,000 TOWN tokens, representing 22.75% of the total supply, the project has a fully diluted valuation of $1,971,000.

Trading volume in the last 24 hours has reached $20,238.0965657, indicating moderate market activity. The current price is significantly below the all-time high of $0.0233, suggesting potential room for growth if market conditions improve and the project gains traction.

Click to view the current TOWN market price

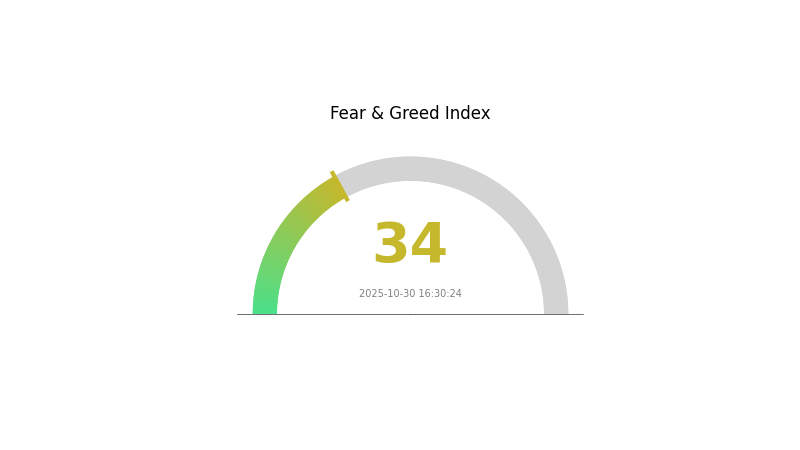

TOWN Market Sentiment Indicator

2025-10-30 Fear and Greed Index: 34 (Fear)

Click to view the current Fear & Greed Index

The cryptocurrency market is currently experiencing a period of fear, with the Fear and Greed Index standing at 34. This suggests that investors are cautious and uncertain about the market's direction. During such times, it's crucial to remain vigilant and avoid making impulsive decisions. Some traders view fear as a potential buying opportunity, adhering to the contrarian approach of "be fearful when others are greedy, and greedy when others are fearful." However, always conduct thorough research and consider your risk tolerance before making any investment decisions.

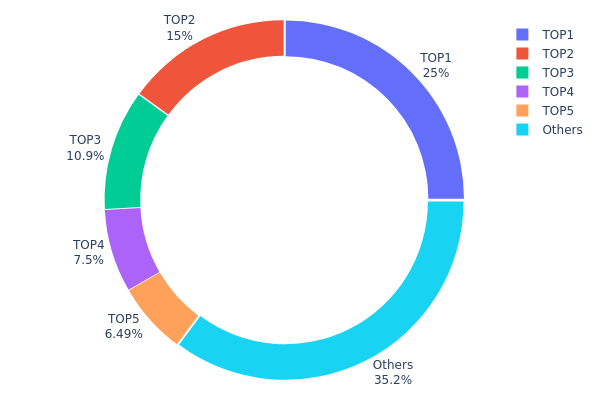

TOWN Holdings Distribution

The address holdings distribution data reveals a significant concentration of TOWN tokens among a few top addresses. The top holder possesses 25% of the total supply, while the top five addresses collectively control 64.83% of all TOWN tokens. This high level of concentration suggests a relatively centralized ownership structure, which could have implications for market dynamics and token governance.

Such a concentrated distribution may lead to increased volatility in TOWN's market price. Large holders, often referred to as "whales," have the potential to significantly impact the market through substantial buy or sell orders. Moreover, this concentration of tokens in a few hands could raise concerns about the decentralization ethos that many cryptocurrency projects aspire to achieve.

From a market structure perspective, the current distribution indicates a potential risk of price manipulation. However, it's worth noting that 35.17% of tokens are distributed among other addresses, which provides some level of diversification. This distribution pattern underscores the importance of monitoring large holder activities and emphasizes the need for broader token distribution to enhance market stability and reduce manipulation risks.

Click to view the current TOWN Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x6829...f9c418 | 500000.00K | 25.00% |

| 2 | 0xca1b...bc034d | 300000.00K | 15.00% |

| 3 | 0xa903...ca888b | 217000.00K | 10.85% |

| 4 | 0xc59b...ebb24a | 150000.00K | 7.50% |

| 5 | 0x1ab4...8f8f23 | 129769.68K | 6.48% |

| - | Others | 703230.31K | 35.17% |

II. Key Factors Influencing TOWN's Future Price

Supply Mechanism

- Supply and Demand Dynamics: The balance between supply and demand plays a crucial role in determining TOWN's price movements.

- Historical Pattern: Past supply changes have significantly impacted price fluctuations.

- Current Impact: Expected supply changes are likely to influence price trends in the near future.

Macroeconomic Environment

- Monetary Policy Impact: Central bank policies are expected to have a substantial effect on TOWN's valuation.

- Inflation Hedge Properties: TOWN's performance in inflationary environments may affect its price.

- Geopolitical Factors: International political situations could influence TOWN's market value.

Technical Development and Ecosystem Building

- Market Trends: Overall or local market trends in the real estate sector will impact TOWN's price.

- Ecosystem Applications: The development of major DApps or ecosystem projects related to TOWN could affect its value.

III. TOWN Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.00083 - $0.00090

- Neutral prediction: $0.00090 - $0.00105

- Optimistic prediction: $0.00105 - $0.00116 (requires favorable market conditions)

2027-2028 Outlook

- Market phase expectation: Potential growth phase

- Price range forecast:

- 2027: $0.00124 - $0.00158

- 2028: $0.00090 - $0.00156

- Key catalysts: Increased adoption, technological advancements, market sentiment

2029-2030 Long-term Outlook

- Base scenario: $0.00149 - $0.00153 (assuming steady market growth)

- Optimistic scenario: $0.00157 - $0.00167 (assuming strong bullish trends)

- Transformative scenario: $0.00170+ (assuming major breakthroughs and widespread adoption)

- 2030-12-31: TOWN $0.00167 (potential peak price)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00116 | 0.00099 | 0.00083 | 0 |

| 2026 | 0.00149 | 0.00107 | 0.00095 | 8 |

| 2027 | 0.00158 | 0.00128 | 0.00124 | 30 |

| 2028 | 0.00156 | 0.00143 | 0.0009 | 45 |

| 2029 | 0.00157 | 0.00149 | 0.00102 | 51 |

| 2030 | 0.00167 | 0.00153 | 0.00113 | 55 |

IV. TOWN Professional Investment Strategies and Risk Management

TOWN Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Investors with a high-risk tolerance and belief in the virtual celebrity ecosystem

- Operation suggestions:

- Accumulate TOWN tokens during market dips

- Monitor Alt.town platform development and adoption rates

- Store tokens securely in a non-custodial wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trend directions and potential reversals

- Relative Strength Index (RSI): Monitor overbought and oversold conditions

- Key points for swing trading:

- Set clear entry and exit points based on technical indicators

- Stay informed about Alt.town project updates and partnerships

TOWN Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple Web3 entertainment projects

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallet for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords, and regularly update software

V. Potential Risks and Challenges for TOWN

TOWN Market Risks

- High volatility: TOWN's price may experience significant fluctuations

- Competition: Other Web3 entertainment platforms may emerge and capture market share

- Adoption risk: Slow user adoption could impact token value

TOWN Regulatory Risks

- Uncertain regulations: Changes in cryptocurrency regulations may affect TOWN's operations

- Cross-border compliance: Navigating different regulatory environments in various countries

- KYC/AML requirements: Potential impact on platform accessibility and token liquidity

TOWN Technical Risks

- Smart contract vulnerabilities: Potential for exploits or bugs in the underlying code

- Scalability challenges: Ability to handle increased user activity and transactions

- Interoperability issues: Integration difficulties with other blockchain networks or Web3 applications

VI. Conclusion and Action Recommendations

TOWN Investment Value Assessment

TOWN presents a unique opportunity in the Web3 entertainment sector, with potential for long-term growth. However, investors should be aware of the high volatility and nascent nature of the virtual celebrity ecosystem.

TOWN Investment Recommendations

✅ Beginners: Consider small, experimental investments to understand the platform ✅ Experienced investors: Implement a dollar-cost averaging strategy with strict risk management ✅ Institutional investors: Conduct thorough due diligence and consider strategic partnerships with Alt.town

TOWN Participation Methods

- Gate.com: Purchase TOWN tokens directly on the exchange

- Alt.town platform: Engage with the ecosystem to earn or utilize TOWN tokens

- Staking: Participate in any available staking programs to earn additional rewards

Cryptocurrency investments carry extremely high risk. This article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Can Coti reach $10?

Yes, COTI has potential to reach $10. Its advancements in privacy, Ethereum Layer 2 integration, and scalability features could drive significant demand and price growth in the current bullish market conditions.

What is the price prediction for the towns token?

The TOWNS token is predicted to reach $0.014935 in the next 5 years, based on consensus ratings from Binance users.

Will Coti recover?

Coti's recovery prospects remain uncertain. While they've addressed the Nomad Bridge exploit, specific recovery plans are not clear as of 2025.

Will TON reach $10?

Based on current predictions, TON is expected to reach $10 by April 2025. However, as of October 2025, it has not yet hit this milestone.

2025 RLC Price Prediction: Will RLC Reach $10 in the Next Bull Run?

2025 STOS Price Prediction: Analyzing Market Trends and Potential Growth Factors for the Digital Asset

2025 PPrice Prediction: Analyzing Market Trends and Future Valuation Prospects for Investors

2025 SQR Price Prediction: Analyzing Market Trends and Potential Growth Factors

2025 LIY Price Prediction: Navigating Market Trends and Potential Growth Factors

2025 CHAPZ Price Prediction: Analyzing Market Trends and Potential Growth Factors

What are on-chain data analysis metrics for Monad (MON): active addresses, whale movements, and transaction trends in 2026?

What is a token economics model: allocation mechanisms, inflation design, and governance utility explained

# How Do Exchange Net Inflows and DOT Holdings Impact Polkadot's Liquidity and Fund Flows in 2025?

What Is a Bitcoin ETF? Comprehensive 2026 Guide

What is HBAR coin holdings and fund flows: ETF inflows hit $68 million with institutional interest surging