2025 TRUMP Price Prediction: Expert Analysis and Market Forecast for the Upcoming Year

Introduction: TRUMP's Market Position and Investment Value

OFFICIAL TRUMP (TRUMP), as a meme coin related to US President Donald Trump, has gained significant community attention since its inception. As of 2025, TRUMP's market capitalization has reached $1,057,399,857, with a circulating supply of approximately 199,999,973 tokens, and a price hovering around $5.287. This asset, often referred to as a "politically-themed meme coin," is playing an increasingly significant role in the cryptocurrency market and social media discourse.

This article will comprehensively analyze TRUMP's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price predictions and practical investment strategies.

I. TRUMP Price History Review and Current Market Status

TRUMP Historical Price Evolution

- 2025: Launch and rapid growth, price surged from $1.318 to $78.104

- 2025: Market correction, price dropped to current level of $5.287

TRUMP Current Market Situation

TRUMP is currently trading at $5.287, with a 24-hour trading volume of $1,365,580.75. The token has experienced a 2.01% decrease in the last 24 hours. Its market cap stands at $1,057,399,857.71, ranking 79th in the overall cryptocurrency market. The circulating supply is 199,999,973.09 TRUMP tokens, with a total supply of 1,000,000,000 TRUMP. The token has shown significant volatility, with a 7-day decrease of 7.61% and a 30-day decline of 26.25%. However, TRUMP has demonstrated strong long-term performance, with a 337.57% increase over the past year.

Click to view the current TRUMP market price

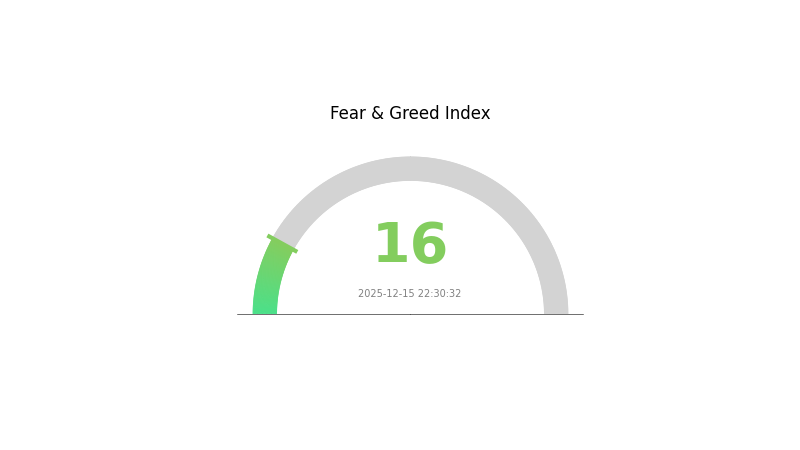

TRUMP Market Sentiment Index

2025-12-15 Fear and Greed Index: 16 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is gripped by extreme fear, with the sentiment index plummeting to 16. This heightened anxiety suggests a potential buying opportunity for contrarian investors. However, caution is advised as market volatility may persist. Traders should consider diversifying their portfolios and implementing risk management strategies. Keep a close eye on market trends and fundamental analysis before making investment decisions. Remember, market sentiment can shift rapidly, and it's crucial to stay informed and adaptable in these uncertain times.

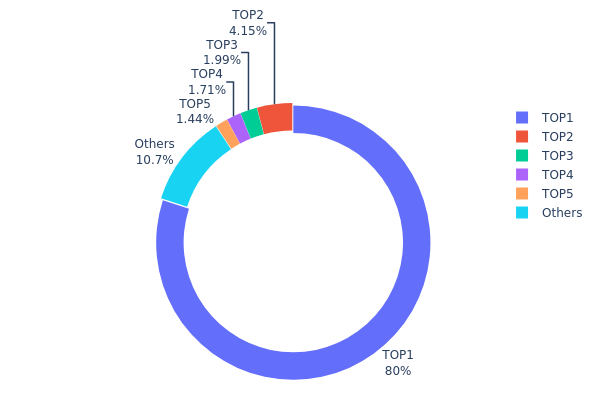

TRUMP Holdings Distribution

The address holdings distribution data for TRUMP reveals a highly concentrated ownership structure. The top address holds an overwhelming 80% of the total supply, indicating significant centralization. This concentration is further emphasized by the fact that the top 5 addresses collectively control 89.27% of all TRUMP tokens.

Such extreme concentration poses potential risks to market stability and liquidity. The dominant address has the power to significantly influence price movements, potentially leading to high volatility or market manipulation. Moreover, this centralized distribution contradicts the principles of decentralization often associated with cryptocurrencies.

The current distribution pattern suggests a nascent or tightly controlled market structure for TRUMP. It may indicate an early stage of token distribution or a deliberate strategy by project leaders. This concentration could impact the token's ability to achieve widespread adoption and could be a concern for potential investors considering the asset's long-term viability and fair market dynamics.

Click to view the current TRUMP Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 2RH6rU...aEFFSK | 800000.03K | 80.00% |

| 2 | 9WzDXw...YtAWWM | 41544.48K | 4.15% |

| 3 | 9d9mb8...9ixyy2 | 19875.93K | 1.98% |

| 4 | 8Tp9fF...DdeBzG | 17075.69K | 1.70% |

| 5 | 8N2ssX...DxwNnS | 14430.43K | 1.44% |

| - | Others | 107072.68K | 10.73% |

II. Key Factors Influencing TRUMP's Future Price

Supply Mechanism

- Fixed Supply: TRUMP has a total fixed supply, which could significantly influence price trends due to scarcity.

- Historical Pattern: Assets with limited supply tend to drive up demand and price.

- Current Impact: Recently, 90 million TRUMP tokens (nearly half of the current circulating supply) were unlocked and released to the market. This was the first major "cliff" unlock since the token's launch in early 2025, potentially expanding the circulating supply and significantly impacting the price.

Institutional and Whale Dynamics

- Corporate Adoption: TRUMP is the first official cryptocurrency directly associated with a sitting U.S. president, giving it historical significance.

Macroeconomic Environment

- Geopolitical Factors: Political events and international situations can have a substantial impact on TRUMP's price.

Technical Development and Ecosystem Building

- Ecosystem Applications: TRUMP is built on the Solana blockchain, known for its fast transaction speeds and low fees, making it an ideal platform for community-driven projects. Solana's decentralized architecture ensures transparency, scalability, and efficiency for TRUMP transactions.

III. TRUMP Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $4.82 - $5.30

- Neutral prediction: $5.30 - $5.46

- Optimistic prediction: $5.46 - $5.70 (requires positive market sentiment)

2027 Mid-term Outlook

- Market phase expectation: Potential growth phase with increased volatility

- Price range forecast:

- 2026: $4.89 - $7.69

- 2027: $3.79 - $7.97

- Key catalysts: Increased adoption and potential regulatory developments

2030 Long-term Outlook

- Base scenario: $9.98 - $12.00 (assuming steady market growth)

- Optimistic scenario: $12.00 - $14.57 (assuming strong bullish trends)

- Transformative scenario: $14.57 - $16.00 (assuming widespread adoption and favorable regulations)

- 2030-12-31: TRUMP $14.57 (potential peak value)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 5.45591 | 5.297 | 4.82027 | 0 |

| 2026 | 7.68833 | 5.37646 | 4.89257 | 1 |

| 2027 | 7.96952 | 6.53239 | 3.78879 | 23 |

| 2028 | 10.73141 | 7.25096 | 3.98803 | 37 |

| 2029 | 10.96925 | 8.99119 | 8.00216 | 70 |

| 2030 | 14.57112 | 9.98022 | 7.68477 | 88 |

IV. TRUMP Professional Investment Strategies and Risk Management

TRUMP Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Risk-tolerant investors with a high-risk appetite

- Operational suggestions:

- Dollar-cost averaging to mitigate short-term volatility

- Set price targets and rebalance portfolio periodically

- Store tokens in a secure non-custodial wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Relative Strength Index (RSI): Use for overbought/oversold conditions

- Moving Averages: Identify trends and potential reversal points

- Key points for swing trading:

- Monitor social media sentiment and news related to Trump

- Set strict stop-loss and take-profit levels

TRUMP Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-2% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across various crypto assets

- Use of options or futures: Consider hedging positions during high volatility periods

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallet for long-term holdings

- Security precautions: Enable two-factor authentication, use unique passwords

V. Potential Risks and Challenges for TRUMP

TRUMP Market Risks

- High volatility: Price can fluctuate dramatically based on Trump-related news

- Liquidity risk: Potential difficulties in large-scale buying or selling

- Market manipulation: Susceptibility to pump-and-dump schemes

TRUMP Regulatory Risks

- Political uncertainty: Changes in administration could affect token sentiment

- SEC scrutiny: Potential classification as a security token

- International regulations: Varying legal status across different jurisdictions

TRUMP Technical Risks

- Smart contract vulnerabilities: Potential for exploits or bugs

- Blockchain congestion: Transaction delays during high network activity

- Wallet security: Risk of hacks or user errors in token storage

VI. Conclusion and Action Recommendations

TRUMP Investment Value Assessment

TRUMP presents a high-risk, high-reward opportunity tied closely to political sentiment and meme culture. Long-term value is speculative, while short-term volatility remains a significant risk.

TRUMP Investment Recommendations

✅ Newcomers: Limit exposure, focus on education and small test transactions ✅ Experienced investors: Consider as part of a diversified crypto portfolio, actively manage positions ✅ Institutional investors: Approach with caution, thorough due diligence required

TRUMP Trading Participation Methods

- Spot trading: Direct purchase and sale of TRUMP tokens on Gate.com

- Futures trading: Leverage opportunities for experienced traders on Gate.com

- Staking: Participate in yield-generating programs if available

Cryptocurrency investments carry extremely high risk. This article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is the price prediction for TRUMP in 2030?

Based on current market trends, the price of TRUMP is predicted to reach $8.402399 by 2030.

How high will Trumpcoin go?

Trumpcoin could reach $7.00-$9.00 by late 2025, assuming favorable market conditions and gradual recovery.

What is the price of the TRUMP token?

As of December 15, 2025, the price of the TRUMP token is $5.66. This price is available for direct purchase in MetaMask using various payment methods.

What is TRUMP's crypto plan?

TRUMP's crypto plan involves creating a 'Crypto Strategic Reserve' for the U.S. to buy and sell cryptocurrency, aiming to establish the country as a leader in the crypto market.

XZXX: A Comprehensive Guide to the BRC-20 Meme Token in 2025

Bitcoin Fear and Greed Index: Market Sentiment Analysis for 2025

5 ways to get Bitcoin for free in 2025: Newbie Guide

Top Crypto ETFs to Watch in 2025: Navigating the Digital Asset Boom

Bitcoin Market Cap in 2025: Analysis and Trends for Investors

2025 Bitcoin Price Prediction: Trump's Tariffs' Impact on BTC

Sàn DEX là gì?

Main Differences Between TradFi and DeFi: A Complete Guide in 2026

How to Buy Bitcoin ETF? A Complete Guide in 2026

What are on-chain data analysis metrics for Monad (MON): active addresses, whale movements, and transaction trends in 2026?

What is a token economics model: allocation mechanisms, inflation design, and governance utility explained