2025 UDSPrice Prediction: Analyzing Market Trends and Key Factors Influencing Future Valuations

Introduction: UDS Market Position and Investment Value

Undeads Games (UDS), as a prominent player in the GameFi sector, has made significant strides since its inception in 2022. By 2025, UDS has achieved a market capitalization of $169,732,299, with a circulating supply of approximately 102,143,768 tokens, and a price hovering around $1.6617. This asset, often referred to as a "zombie-themed GameFi innovator," is playing an increasingly crucial role in the intersection of blockchain gaming and cryptocurrency earnings.

This article will provide a comprehensive analysis of UDS's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

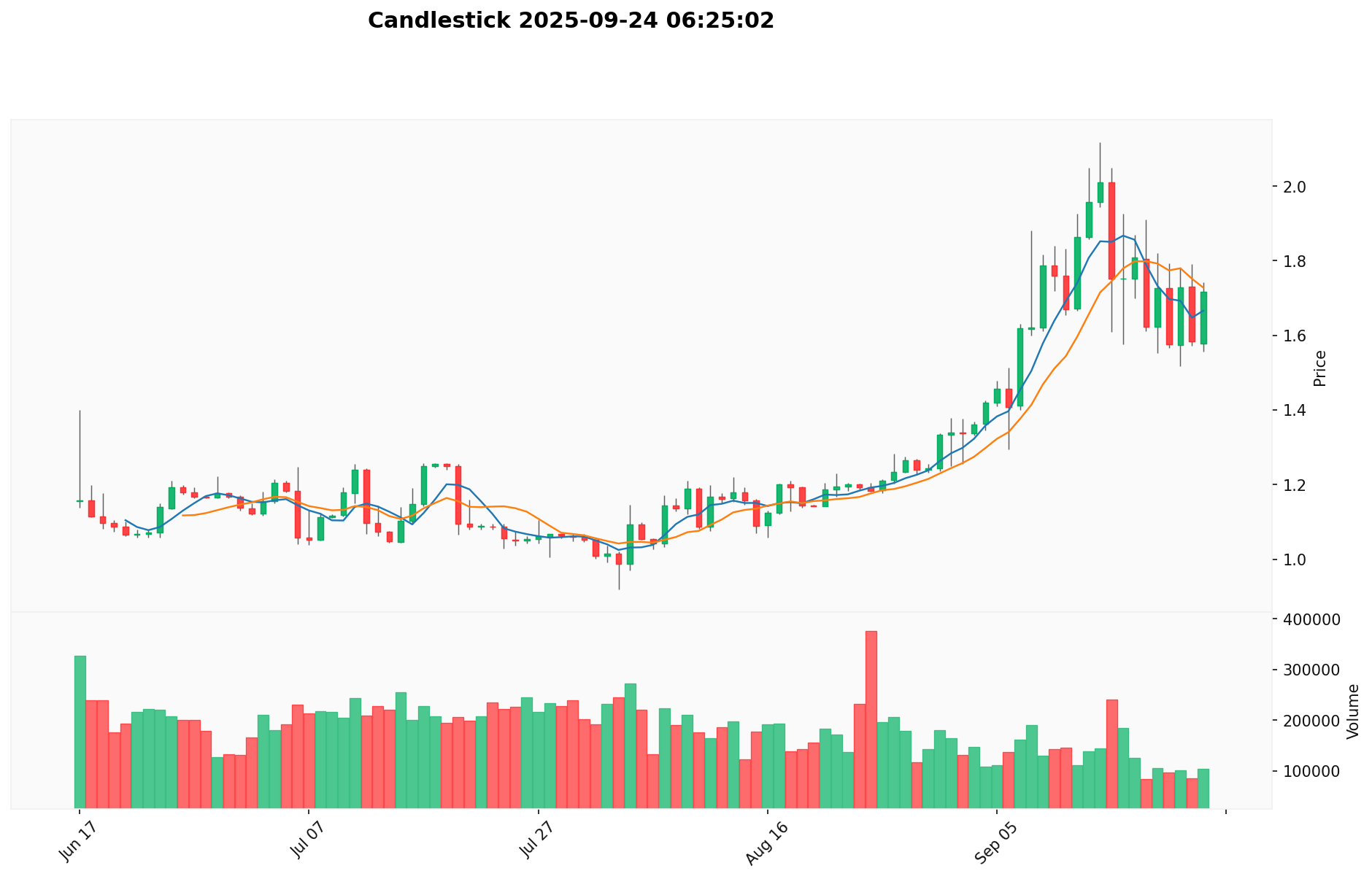

I. UDS Price History Review and Current Market Status

UDS Historical Price Evolution

- 2024: Initial launch, price reached all-time high of $3.00 on August 9

- 2024: Market correction, price dropped to all-time low of $0.0409 on October 29

- 2025: Recovery phase, price rebounded to current level of $1.6617

UDS Current Market Situation

UDS is currently trading at $1.6617, with a 24-hour trading volume of $142,670.23. The token has seen a 5.88% increase in the last 24 hours, indicating positive short-term momentum. However, it's down 7.51% over the past week, suggesting some recent volatility. The 30-day performance shows a significant 38.99% gain, pointing to a strong medium-term uptrend. UDS has a market cap of $169,732,299, ranking it 328th in the cryptocurrency market. With a circulating supply of 102,143,768.25 UDS out of a total supply of 250,000,000, the token has a circulation ratio of 40.86%. The current price is 44.61% below its all-time high and 3,963.82% above its all-time low, indicating potential for both growth and volatility.

Click to view the current UDS market price

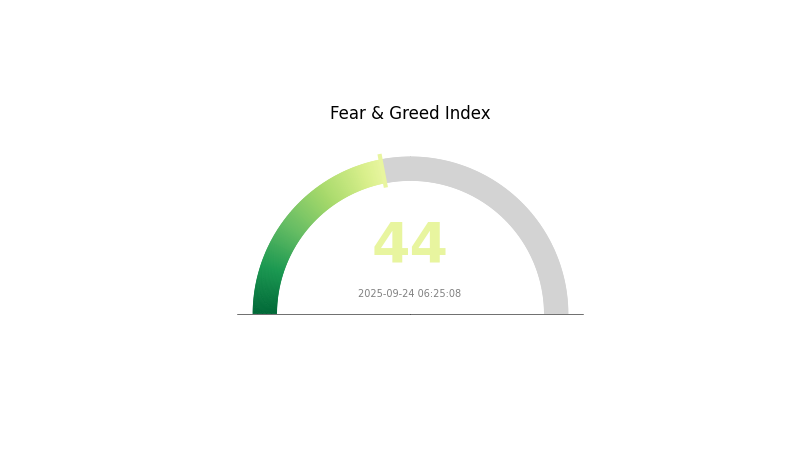

UDS Market Sentiment Indicator

2025-09-24 Fear and Greed Index: 44 (Fear)

Click to view the current Fear & Greed Index

The crypto market sentiment remains cautious, with the Fear and Greed Index at 44, indicating a state of fear. This suggests investors are still hesitant, potentially creating buying opportunities for those willing to take risks. However, it's crucial to remember that market sentiment can shift rapidly. Always conduct thorough research and consider your risk tolerance before making investment decisions. Gate.com offers various tools to help you navigate these market conditions effectively.

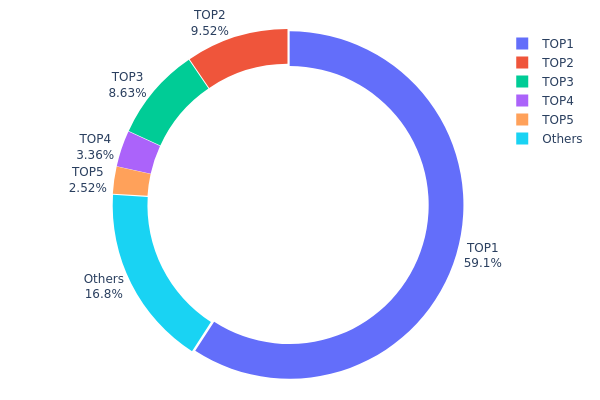

UDS Holdings Distribution

The address holdings distribution data for UDS reveals a highly concentrated ownership structure. The top address holds an overwhelming 59.14% of the total supply, amounting to 147,856.23K UDS tokens. This level of concentration is significant and could potentially impact market dynamics. The second and third largest holders possess 9.52% and 8.63% respectively, further consolidating the token distribution among a few major players.

Such a concentrated distribution raises concerns about market manipulation and price volatility. With nearly 80% of tokens held by just five addresses, the UDS market is susceptible to large price swings should any of these major holders decide to sell or accumulate more tokens. This centralization also challenges the notion of decentralization often associated with cryptocurrency projects, as a small number of entities hold significant influence over the token's ecosystem.

The current distribution suggests a relatively immature market structure for UDS, with limited circulation among a broader base of holders. This concentration may impact liquidity and could potentially deter new investors concerned about the outsized influence of major token holders. As the project evolves, monitoring changes in this distribution will be crucial for assessing the token's long-term stability and adoption.

Click to view the current UDS Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xd321...e493a2 | 147856.23K | 59.14% |

| 2 | 0xb705...12964e | 23800.00K | 9.52% |

| 3 | 0x6f2a...125b6d | 21580.08K | 8.63% |

| 4 | 0x0642...ccbf51 | 8409.47K | 3.36% |

| 5 | 0x65a6...8181a1 | 6302.70K | 2.52% |

| - | Others | 42051.51K | 16.83% |

II. Key Factors Influencing Future UDS Prices

Macroeconomic Environment

-

Impact of Monetary Policy: The Federal Reserve's interest rate decisions are a major driver of UDS prices. If the Fed slows down rate cuts or shifts towards a tightening policy, it could further support the UDS exchange rate.

-

Inflation Hedging Properties: Rising inflation or negative real interest rates strengthen the attractiveness of UDS as a hedge against inflation.

-

Geopolitical Factors: The U.S. presidential election, U.S.-China trade relations, and global conflicts may affect market confidence and UDS prices.

III. UDS Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $1.56 - $1.65

- Neutral prediction: $1.65 - $1.90

- Optimistic prediction: $1.90 - $2.20 (requires positive market sentiment)

2027-2028 Outlook

- Market phase expectation: Potential growth phase

- Price range forecast:

- 2027: $1.20 - $2.72

- 2028: $2.40 - $3.12

- Key catalysts: Increased adoption, technological improvements

2029-2030 Long-term Outlook

- Base scenario: $2.80 - $3.25 (assuming steady market growth)

- Optimistic scenario: $3.25 - $3.65 (assuming strong market performance)

- Transformative scenario: $3.65 - $4.11 (assuming breakthrough innovations)

- 2030-12-31: UDS $3.24 (potential 94% growth from 2025)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 2.19636 | 1.6514 | 1.56883 | 0 |

| 2026 | 2.77039 | 1.92388 | 1.42367 | 15 |

| 2027 | 2.72268 | 2.34713 | 1.19704 | 41 |

| 2028 | 3.11793 | 2.53491 | 2.40816 | 52 |

| 2029 | 3.64608 | 2.82642 | 1.97849 | 70 |

| 2030 | 4.11004 | 3.23625 | 3.1068 | 94 |

IV. UDS Professional Investment Strategies and Risk Management

UDS Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors and GameFi enthusiasts

- Operation suggestions:

- Accumulate UDS during market dips

- Stay informed about Undeads Games' development progress

- Store UDS in secure wallets with private key control

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversal points

- Relative Strength Index (RSI): Monitor overbought/oversold conditions

- Key points for swing trading:

- Monitor game-related announcements and updates

- Track overall GameFi sector sentiment

UDS Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3%

- Aggressive investors: 5-10%

- Professional investors: 10-15%

(2) Risk Hedging Solutions

- Portfolio diversification: Allocate across different GameFi projects

- Stop-loss orders: Set appropriate levels to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallets for large holdings

- Security precautions: Enable two-factor authentication, use unique passwords

V. UDS Potential Risks and Challenges

UDS Market Risks

- High volatility: GameFi tokens can experience significant price swings

- Competition: Increasing number of blockchain gaming projects

- Market sentiment: Susceptible to overall crypto market trends

UDS Regulatory Risks

- Uncertain regulations: Potential changes in crypto and gaming regulations

- Cross-border compliance: Varying legal frameworks in different jurisdictions

- Token classification: Possible security token designation by regulators

UDS Technical Risks

- Smart contract vulnerabilities: Potential for exploits or bugs

- Scalability challenges: Game performance issues during high user load

- Blockchain interoperability: Limitations in cross-chain functionality

VI. Conclusion and Action Recommendations

UDS Investment Value Assessment

UDS presents a high-risk, high-reward opportunity in the growing GameFi sector. Long-term potential is tied to Undeads Games' success, while short-term volatility remains a significant risk.

UDS Investment Recommendations

✅ Beginners: Start with small positions, focus on learning the GameFi ecosystem ✅ Experienced investors: Consider allocating as part of a diversified crypto portfolio ✅ Institutional investors: Conduct thorough due diligence on Undeads Games' team and technology

UDS Trading Participation Methods

- Spot trading: Buy and sell UDS on Gate.com

- Staking: Participate in UDS staking programs if available

- In-game purchases: Use UDS within the Undeads Games ecosystem

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

2025 OSHI Price Prediction: Analyzing Market Trends and Potential Growth Factors

2025 METAN Price Prediction: Analyzing Market Trends and Potential Growth Factors

2025 IXORA Price Prediction: Analyzing Market Trends and Potential Growth Factors for the Emerging Cryptocurrency

2025 BSU Price Prediction: Analyzing Market Trends and Potential Growth Factors for Boise State University Tokens

2025 MONI Price Prediction: Analyzing Market Trends and Potential Growth Factors for the Digital Asset

2025 LUNC Price Prediction: Analyzing Terra Luna Classic's Potential Recovery and Market Outlook in the Post-Crash Era

What is driving BONK's +12.84% price surge and where are the key support and resistance levels?

How do on-chain data metrics like active addresses, whale holdings, and daily transaction volume reveal on-chain data analysis trends in 2025?

What Are Bitcoin Runes?

How to Read Technical Indicators for PAXG Trading: MACD, RSI, and Moving Average Analysis

Will Pi Network Be Listed on Mainstream Exchanges?