2025 USD1 Price Prediction: Analyzing Market Trends and Economic Factors Shaping the Future Value

Introduction: USD1's Market Position and Investment Value

USD1 (USD1), as a fiat-backed digital asset designed to maintain a 1:1 equivalence with the U.S. dollar, has achieved significant milestones since its inception in 2025. As of 2025, USD1's market capitalization has reached $2,150,516,135, with a circulation of approximately 2,151,591,931 tokens, and a price hovering around $0.9995. This asset, often referred to as a "regulatory-compliant stablecoin," is playing an increasingly crucial role in streamlining digital transactions and providing seamless fungibility between fiat currency and digital assets.

This article will comprehensively analyze USD1's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price predictions and practical investment strategies.

I. USD1 Price History Review and Current Market Status

USD1 Historical Price Evolution Trajectory

- April 2025: USD1 launched by World Liberty Financial, price stabilized around $1

- June 2025: Reached all-time high of $1.971 on June 2nd, followed by all-time low of $0.9663 on June 27th

- October 2025: Price has remained relatively stable, fluctuating within a narrow range around $1

USD1 Current Market Situation

As of October 15, 2025, USD1 is trading at $0.9995, showing a 0.05% increase in the past 24 hours. The current market capitalization stands at $2,150,516,135, ranking 57th in the overall cryptocurrency market. The 24-hour trading volume is $2,573,351.74, indicating moderate market activity. USD1 maintains a close peg to the US dollar, with minimal deviation from its target value. The stability of USD1 is reflected in its narrow price range, with a 24-hour high of $1.0003 and a low of $0.9989. The total supply of USD1 is 2,151,591,931, which is fully circulating in the market.

Click to view the current USD1 market price

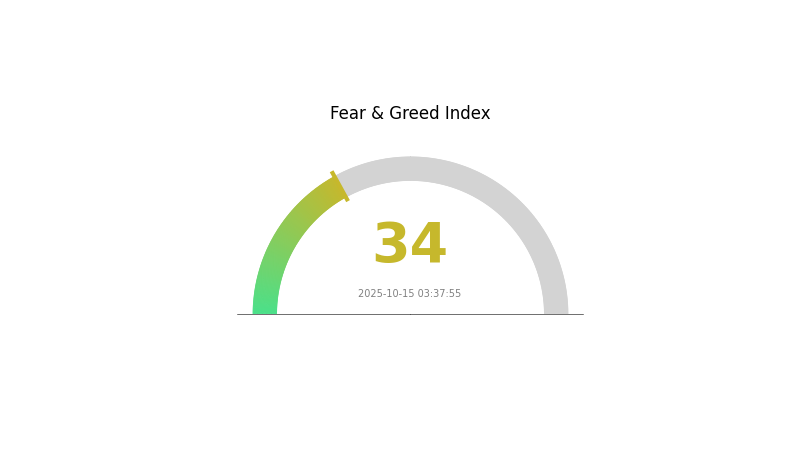

USD1 Market Sentiment Indicator

2025-10-15 Fear and Greed Index: 34 (Fear)

Click to view the current Fear & Greed Index

The crypto market continues to display signs of caution as the Fear and Greed Index stands at 34, indicating a "Fear" sentiment. This suggests investors are approaching the market with heightened skepticism and risk aversion. During such periods, some traders may view it as a potential buying opportunity, adhering to the contrarian strategy of "being greedy when others are fearful." However, it's crucial to conduct thorough research and exercise caution before making any investment decisions in this volatile market environment.

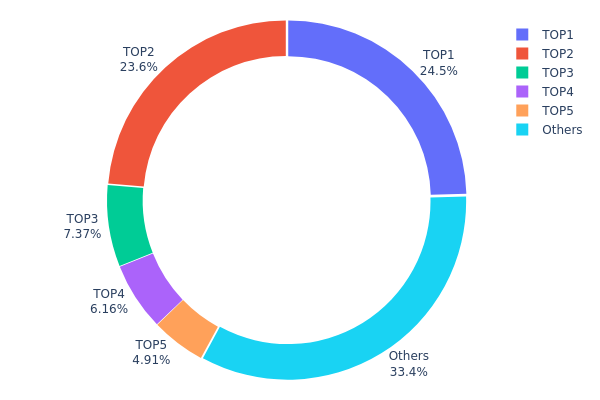

USD1 Holdings Distribution

The address holdings distribution data for USD1 reveals a highly concentrated ownership structure. The top 5 addresses collectively hold 66.61% of the total supply, with the two largest holders commanding nearly half of all tokens at 48.17%. This concentration raises concerns about potential market manipulation and volatility.

The largest address holds 24.54% of the supply, followed closely by the second-largest at 23.63%. Such significant holdings in individual addresses could impact market dynamics, as large-scale buying or selling activities from these addresses may cause substantial price fluctuations. The concentration also suggests a lower degree of decentralization, which could affect the token's overall stability and resistance to external influences.

While 33.39% of the supply is distributed among other addresses, the dominance of the top holders indicates a potential imbalance in the token's ecosystem. This structure may pose risks to market integrity and could influence governance decisions if USD1 employs a token-based voting system. Monitoring these large holders' activities will be crucial for understanding future market movements and assessing the long-term stability of USD1's on-chain structure.

Click to view the current USD1 Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x4942...0d3f8f | 99900.00K | 24.54% |

| 2 | 0x5be9...957dbb | 96194.70K | 23.63% |

| 3 | 0xf977...41acec | 30000.00K | 7.37% |

| 4 | 0x3a3c...c11dc8 | 25084.64K | 6.16% |

| 5 | 0x36a7...d9c141 | 20002.47K | 4.91% |

| - | Others | 135812.30K | 33.39% |

II. Key Factors Affecting USD1's Future Price

Supply Mechanism

- Reserve-backed system: USD1 maintains a 1:1 reserve ratio with high-liquidity assets like US dollars and US Treasury bonds.

- Historical patterns: Stable supply growth has supported USD1's price stability and market confidence.

- Current impact: The 100% reserve requirement under the GENIUS Act may enhance USD1's credibility and demand.

Institutional and Whale Movements

- Institutional holdings: Major institutions like ALT5 Sigma have invested in USD1, boosting its market presence.

- Corporate adoption: Companies like MGX have chosen USD1 for large-scale transactions, indicating growing institutional trust.

- Government policies: The GENIUS Act provides a regulatory framework for stablecoins, potentially increasing USD1's legitimacy.

Macroeconomic Environment

- Monetary policy impact: Federal Reserve policies on interest rates and inflation may affect USD1's attractiveness as a dollar-pegged asset.

- Inflation hedge properties: USD1's stability may make it appealing in high-inflation environments.

- Geopolitical factors: Global economic uncertainties could drive demand for stable digital assets like USD1.

Technical Development and Ecosystem Building

- Cross-chain interoperability: Implementation of Chainlink's CCIP technology has expanded USD1's multi-chain applications.

- RWA integration: Partnerships with platforms like Plume Network have positioned USD1 as a key player in the Real World Asset (RWA) narrative.

- Ecosystem applications: DeFi protocols like Dolomite have integrated USD1, enhancing its utility and demand within the crypto ecosystem.

III. USD1 Price Prediction for 2025-2030

2025 Outlook

- Conservative forecast: $0.53968 - $0.9994

- Neutral forecast: $0.9994 - $1.07935

- Optimistic forecast: $1.07935 - $1.35119 (requires favorable market conditions)

2027-2028 Outlook

- Market phase expectation: Potential growth phase

- Price range prediction:

- 2027: $0.77693 - $1.42239

- 2028: $0.66751 - $1.49207

- Key catalysts: Increasing adoption and market stabilization

2029-2030 Long-term Outlook

- Base scenario: $1.40045 - $1.54750 (assuming steady market growth)

- Optimistic scenario: $1.54750 - $1.88795 (assuming accelerated adoption)

- Transformative scenario: Above $1.88795 (under extremely favorable conditions)

- 2030-12-31: USD1 $1.5475 (projected average price)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 1.07935 | 0.9994 | 0.53968 | 0 |

| 2026 | 1.35119 | 1.03938 | 0.8315 | 3 |

| 2027 | 1.42239 | 1.19528 | 0.77693 | 19 |

| 2028 | 1.49207 | 1.30883 | 0.66751 | 30 |

| 2029 | 1.69455 | 1.40045 | 1.27441 | 40 |

| 2030 | 1.88795 | 1.5475 | 1.02135 | 54 |

IV. Professional Investment Strategies and Risk Management for USD1

USD1 Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Conservative investors seeking stable value preservation

- Operational suggestions:

- Allocate a portion of portfolio to USD1 as a hedge against market volatility

- Regularly rebalance portfolio to maintain desired USD1 allocation

- Store USD1 in secure, reputable digital wallets or custodial services

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Monitor short-term price deviations from the $1 peg

- Volume indicators: Track unusual trading activity that may signal market stress

- Key points for swing trading:

- Capitalize on minor price fluctuations around the $1 peg

- Set tight stop-loss orders to manage risk in case of de-pegging events

USD1 Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 5-10% of total portfolio

- Moderate investors: 10-20% of total portfolio

- Professional investors: Up to 30% of total portfolio, depending on overall strategy

(2) Risk Hedging Solutions

- Diversification: Spread holdings across multiple stablecoins to mitigate issuer risk

- Collateralization: Use USD1 as collateral in DeFi protocols to generate yield while maintaining stable value

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet for convenient trading and DeFi interactions

- Cold storage solution: Hardware wallets for long-term, high-security storage

- Security precautions: Enable two-factor authentication, use unique passwords, and regularly update software

V. Potential Risks and Challenges for USD1

USD1 Market Risks

- Liquidity risk: Potential difficulties in large-scale redemptions during market stress

- Counterparty risk: Reliance on the financial stability of World Liberty Financial and BitGo Trust Company

- Market sentiment risk: Negative publicity or loss of confidence could lead to a "bank run" scenario

USD1 Regulatory Risks

- Regulatory scrutiny: Increased oversight of stablecoins by U.S. financial regulators

- Compliance changes: Potential new requirements for reserves, audits, or operational transparency

- Cross-border restrictions: Possible limitations on USD1 use in certain jurisdictions

USD1 Technical Risks

- Smart contract vulnerabilities: Potential bugs or exploits in the underlying blockchain code

- Blockchain network congestion: Delays or increased costs for transactions during high network activity

- Interoperability issues: Challenges in seamless integration with various blockchain ecosystems

VI. Conclusion and Action Recommendations

USD1 Investment Value Assessment

USD1 offers a stable digital representation of the U.S. dollar, providing a reliable store of value and medium of exchange in the crypto ecosystem. While it presents lower volatility compared to cryptocurrencies, investors should remain vigilant of potential regulatory changes and issuer-specific risks.

USD1 Investment Recommendations

✅ Beginners: Consider USD1 as an entry point to understand stablecoins and digital assets with minimal price risk ✅ Experienced investors: Use USD1 for portfolio stabilization and as a tool for quick market entry/exit strategies ✅ Institutional investors: Incorporate USD1 into treasury management and as a base for more complex DeFi strategies

USD1 Participation Methods

- Direct purchase: Buy USD1 on Gate.com or other supported exchanges

- DeFi integration: Use USD1 in decentralized finance protocols for lending, borrowing, or yield farming

- Payment solution: Implement USD1 as a payment option for businesses seeking stable cryptocurrency transactions

Cryptocurrency investments carry extremely high risk, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

How much is USD coin worth in 2030?

USD Coin is expected to be worth $1.04 in 2030, based on technical analysis and market trends. The forecast suggests a slight increase from its current value.

How much is USD1 crypto?

USD1 crypto is priced at $1.00. It's a stablecoin pegged to the US dollar, maintaining this value as of 2025-10-15.

What is USD1 coin?

USD1 is a stablecoin pegged to the US dollar, designed for transactions and value storage in the crypto ecosystem.

What crypto has the highest price prediction?

Bitcoin (BTC) has the highest price prediction for 2025, followed by Ethereum (ETH) and Solana (SOL).

Share

Content