2025 VSN Fiyat Tahmini: Dalgalı Kripto Piyasasında Dijital Varlıkların Geleceğinde Yol Haritası

Giriş: VSN’nin Piyasa Konumu ve Yatırım Değeri

Vision (VSN), bir Web3 ekosistem token’ı olarak kuruluşundan bu yana hem bireysel hem kurumsal kullanıcılara hizmet sunuyor. 2025 yılı itibarıyla Vision’ın piyasa değeri 295.003.800 $’a ulaşırken, dolaşımdaki arz yaklaşık 2.730.000.000 adet ve fiyatı 0,10806 $ civarında seyrediyor. “Web3 fayda token’ı” olarak bilinen bu varlık; cüzdan ödülleri, işlem ücreti indirimleri, zincirler arası işlevler ve MiCAR uyumlu menkul kıymet token çözümlerinde giderek daha belirleyici bir rol üstleniyor.

Bu makalede, Vision’ın 2025-2030 yılları arasındaki fiyat trendleri; tarihsel desenler, piyasa arz ve talep dengesi, ekosistem gelişimi ve makroekonomik çevreyle birlikte kapsamlı şekilde analiz edilerek, yatırımcılara profesyonel fiyat tahminleri ve uygulanabilir yatırım stratejileri sunulacak.

I. VSN Fiyat Geçmişi ve Mevcut Piyasa Durumu

VSN Tarihsel Fiyat Seyri

- 2025 Ağustos: VSN, 0,23 $ ile tarihinin en yüksek seviyesine ulaşarak önemli bir dönüm noktası yaşadı.

- 2025 Ekim: 10 Ekim’de 0,09523 $ ile tüm zamanların en düşük seviyesini gördü.

- 2025 3. Çeyrek-4. Çeyrek: VSN, tarihi zirve ve dip arasında fiyatın dalgalandığı volatil bir piyasa döngüsüne girdi.

VSN Güncel Piyasa Görünümü

18 Ekim 2025 itibarıyla VSN, 0,10806 $ seviyesinde işlem görerek son dönemdeki dip seviyesinden hafif bir toparlanma sergiliyor. Token, farklı zaman dilimlerinde karma performans gösteriyor:

- Son 1 saatte VSN %0,67 yükseldi.

- Son 24 saatte %0,22 değer kazandı.

- Ancak 7 günlük trend %4,8 düşüş gösteriyor.

- 30 günlük performans %34,19’luk sert bir geri çekilmeye işaret ediyor.

- Yıl başından bu yana VSN %13,80 geride.

Piyasa değeri şu anda 295.003.800 $ olup, dolaşımdaki arz 2.730.000.000 VSN token. Tam seyreltilmiş piyasa değeri 453.852.000 $. Son 24 saatteki işlem hacmi ise 509.726,12782 $ ile orta düzeyde piyasa faaliyeti olduğuna işaret ediyor.

Güncel VSN piyasa fiyatını görüntülemek için tıklayın

VSN Piyasa Duyarlılık Göstergesi

2025-10-18 Korku ve Açgözlülük Endeksi: 23 (Aşırı Korku)

Güncel Korku & Açgözlülük Endeksini görüntülemek için tıklayın

Kripto piyasasında şu anda aşırı korku hakim; Korku ve Açgözlülük Endeksi’nin 23 gibi düşük bir değerde olması, yatırımcıların ciddi endişe ve kötümserlik yaşadığını gösteriyor. Bu dönemlerde piyasa katılımcıları genellikle riskten kaçınır, bu da satış baskısına ve işlem hacimlerinde azalmaya yol açabilir. Öte yandan, zıt görüşlü yatırımcılar için aşırı korku, bazen piyasa diplerinin habercisi olarak fırsat yaratabilir. Her durumda, dalgalı piyasa ortamında yatırım kararı alırken kapsamlı araştırma yapmak ve risk yönetimini ön planda tutmak esastır.

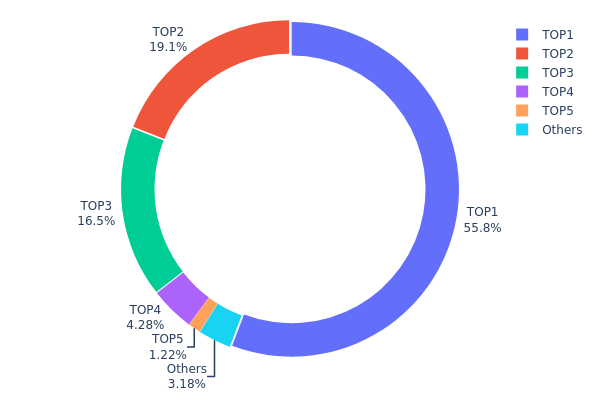

VSN Varlık Dağılımı

VSN adres varlık dağılım verileri, son derece yoğunlaşmış bir sahiplik yapısına işaret ediyor. En büyük adres, toplam arzın %55,78’ini elinde bulundururken; ilk beş adres, tüm VSN token’larının %96,79’unu kontrol ediyor. Bu yüksek yoğunlaşma, token’ın merkeziyetsizliği ve piyasa istikrarı açısından önemli soru işaretleri doğuruyor.

Böylesine yoğunlaşmış bir varlık dağılımı, piyasa dinamiklerini ciddi biçimde etkileyebilir. Tek bir adresin arzın yarısından fazlasını kontrol etmesi, fiyat manipülasyonu ve volatilite riskini artırır. Büyük sahipler, yüklü alım-satım işlemleriyle token fiyatında belirleyici etki yaratabilir. Ayrıca bu yapı, likidite ve adil piyasa uygulamaları konusunda yeni yatırımcıları caydırabilir.

Blokzincir perspektifinden bakıldığında, bu dağılım VSN için düşük bir merkeziyetsizlik seviyesine işaret ediyor. Az sayıda adreste yoğunlaşan varlıklar, ağda karar alma gücünü merkezileştirir ve genel ağ güvenliğini olumsuz etkileyebilir. Yatırımcılar ve paydaşlar, dağılım desenindeki değişiklikleri yakından izlemeli; çünkü bu, token’ın piyasa davranışını ve uzun vadeli sürdürülebilirliğini doğrudan etkiler.

Güncel VSN Varlık Dağılımını görüntülemek için tıklayın

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xcc24...cee376 | 2.346.381,46K | 55,78% |

| 2 | 0xf197...f16bc9 | 802.069,84K | 19,07% |

| 3 | 0xb090...e3789d | 692.588,48K | 16,46% |

| 4 | 0x0ec3...74148a | 180.005,64K | 4,27% |

| 5 | 0x0529...c553b7 | 51.206,59K | 1,21% |

| - | Others | 133.667,54K | 3,21% |

II. VSN’nin Gelecekteki Fiyatını Etkileyen Temel Unsurlar

Makroekonomik Çevre

- Enflasyona Karşı Koruma Özelliği: VSN, bir kripto para olarak bazı ekonomik ortamlarda enflasyona karşı koruma sağlayabilir. Ancak bu etkinlik; piyasa benimsenmesi ve genel kripto piyasası eğilimleri gibi çeşitli faktörlere bağlıdır.

Teknik Gelişim ve Ekosistem Kurulumu

- Ekosistem Uygulamaları: VSN’nin gelecekteki fiyatı, ekosisteminde geliştirilen merkeziyetsiz uygulamalar (DApp’ler) ve projelerin başarısı ile şekillenebilir. Bu uygulamaların büyümesi, VSN token’a olan talebi artırabilir.

III. VSN Fiyat Tahmini 2025-2030

2025 Perspektifi

- Temkinli tahmin: 0,08322 $ - 0,10000 $

- Tarafsız tahmin: 0,10000 $ - 0,12000 $

- İyimser tahmin: 0,12000 $ - 0,15239 $ (olumlu piyasa duyarlılığı ve proje gelişimi şartıyla)

2027-2028 Görünümü

- Piyasa aşaması beklentisi: Konsolidasyon ve büyüme dönemi olasılığı

- Fiyat aralığı öngörüsü:

- 2027: 0,12344 $ - 0,15673 $

- 2028: 0,13590 $ - 0,18465 $

- Kilit katalizörler: Proje ekosisteminin genişlemesi ve artan benimseme

2029-2030 Uzun Vadeli Görünüm

- Temel senaryo: 0,16618 $ - 0,18114 $ (istikrarlı piyasa büyümesiyle)

- İyimser senaryo: 0,19609 $ - 0,23186 $ (güçlü proje başarısı ve olumlu piyasa koşullarıyla)

- Dönüştürücü senaryo: 0,25000 $ - 0,30000 $ (çığır açıcı gelişmeler ve kitlesel benimseme halinde)

- 2030-12-31: VSN 0,23186 $ (yılın potansiyel zirvesi)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0,15239 | 0,10808 | 0,08322 | 0 |

| 2026 | 0,14717 | 0,13024 | 0,11591 | 20 |

| 2027 | 0,15673 | 0,1387 | 0,12344 | 28 |

| 2028 | 0,18465 | 0,14772 | 0,1359 | 36 |

| 2029 | 0,19609 | 0,16618 | 0,11799 | 53 |

| 2030 | 0,23186 | 0,18114 | 0,16665 | 67 |

IV. VSN Profesyonel Yatırım Stratejisi ve Risk Yönetimi

VSN Yatırım Metodolojisi

(1) Uzun Vadeli Tutma Stratejisi

- Uygun profiller: Uzun vadeli bakış açısına sahip, risk toleransı yüksek yatırımcılar

- Uygulama önerileri:

- Piyasa düşüşlerinde VSN toplayın

- Kısmi kar realizasyonu için fiyat hedefleri belirleyin

- Token’ları güvenli donanım cüzdanlarında saklayın

(2) Aktif Alım-Satım Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Trend yönü ve olası dönüş noktalarını belirlemek için kullanılır

- RSI (Göreceli Güç Endeksi): Aşırı alım ya da satım koşullarını saptamaya yardımcı olur

- Dalgalı işlemde kritik noktalar:

- VSN’nin başlıca kripto varlıklarla korelasyonunu takip edin

- Web3 ekosistemi gelişmelerini yakından izleyin

VSN Risk Yönetim Çerçevesi

(1) Varlık Dağılımı İlkeleri

- Temkinli yatırımcılar: Kripto portföyünün %1-3’ü

- Agresif yatırımcılar: Kripto portföyünün %5-10’u

- Profesyonel yatırımcılar: Kripto portföyünün %15’ine kadar

(2) Riskten Koruma Yöntemleri

- Çeşitlendirme: Birden fazla Web3 token’ına yatırım yapın

- Zarar durdur emirleri: Potansiyel kayıpları sınırlamak için kullanın

(3) Güvenli Saklama Çözümleri

- Sıcak cüzdan önerisi: Gate Web3 cüzdanı

- Soğuk depolama: Uzun vadeli saklama için donanım cüzdanı kullanın

- Güvenlik tedbirleri: İki aşamalı doğrulama aktif edin, güçlü şifreler oluşturun

V. VSN Olası Riskler ve Zorluklar

VSN Piyasa Riskleri

- Yüksek volatilite: VSN fiyatı sert dalgalanmalara açık

- Likidite riski: Düşük işlem hacmi, alım-satım pozisyonlarını zorlaştırabilir

- Rekabet: Diğer Web3 ekosistem token’ları VSN’nin pazar payını etkileyebilir

VSN Regülasyon Riskleri

- Mevzuat belirsizliği: Değişen kripto regülasyonları VSN’nin kullanım alanını etkileyebilir

- MiCAR uyumluluğu: AB düzenlemelerindeki değişiklikler, VSN’nin menkul kıymet token çözümleri üzerinde etkili olabilir

- Sınır ötesi kısıtlamalar: Uluslararası düzenleyici farklılıklar, VSN’nin küresel benimsenmesini sınırlayabilir

VSN Teknik Riskleri

- Akıllı sözleşme açıkları: Token kodundaki potansiyel güvenlik zafiyetleri

- Ölçeklenebilirlik sorunları: Yüksek talepte VSN ağı tıkanıklık yaşayabilir

- İşlevler arası uyumluluk: Zincirler arası işlevsellikte uygulama zorlukları

VI. Sonuç ve Eylem Önerileri

VSN Yatırım Değeri Değerlendirmesi

VSN, hem bireysel hem de kurumsal kullanıcılar için özgün özellikler sunan bir Web3 ekosistem token’ı olarak uzun vadede potansiyel taşıyor. Ancak kısa vadeli volatilite ve mevzuat belirsizlikleri önemli riskler oluşturuyor.

VSN Yatırım Önerileri

✅ Yeni başlayanlar: Küçük pozisyonlarla başlayın, Web3 teknolojileri hakkında bilgi edinin ✅ Deneyimli yatırımcılar: VSN’yi çeşitlendirilmiş kripto portföyünüzde değerlendirin, piyasa trendlerini yakından takip edin ✅ Kurumsal yatırımcılar: VSN’nin MiCAR uyumlu menkul kıymet token çözümlerini inceleyin, detaylı durum tespiti yapın

VSN İşlem Katılım Yöntemleri

- Spot alım-satım: Gate.com spot piyasasında VSN alım-satımı yapın

- Staking: Uygun programlar varsa VSN staking’e katılın

- DeFi entegrasyonu: VSN token’larını içeren merkeziyetsiz finans fırsatlarını değerlendirin

Kripto para yatırımları son derece yüksek risk içerir, bu makale yatırım tavsiyesi değildir. Yatırımcılar, kendi risk toleranslarını gözeterek dikkatli karar vermeli ve profesyonel finansal danışmanlardan destek almalıdır. Asla kaybetmeyi göze alabileceğinizden fazla yatırım yapmayın.

Sıkça Sorulan Sorular

VeChain 1 $’a ulaşabilir mi?

Evet, VeChain gelecekte 1 $’a ulaşabilir. Güçlü iş ortaklıkları ve tedarik zinciri yönetiminde artan benimsemesiyle VeChain, 2025’e kadar önemli fiyat artışı potansiyeline sahip.

VeChain 10 dolara çıkabilir mi?

Uzun vadede iddialı olsa da, VeChain’in 10 dolara ulaşması mümkündür. Güçlü iş ortaklıkları ve gerçek dünya uygulamaları sayesinde, 2025’e kadar ciddi büyüme sağlayıp bu hedefe yaklaşabilir.

VeChain 50 cent’e ulaşabilir mi?

Evet, VeChain 2025’e kadar 50 cent seviyesine ulaşabilir. Güçlü ortaklıklar ve tedarik zinciri yönetiminde artan kullanım, önümüzdeki yıllarda değerinde önemli artış sağlayabilir.

VET 2025’te ne kadar olacak?

Piyasa eğilimleri ve uzman tahminlerine göre, VET 2025’te 0,15 $ ile 0,20 $ aralığına ulaşabilir ve mevcut fiyatına kıyasla kayda değer bir büyüme gösterebilir.

2025 REDO Fiyat Tahmini: Piyasa Trendleri ve Olası Büyüme Faktörlerinin Analizi

2025 AKI Fiyat Tahmini: Kripto para piyasasında trendler ve potansiyel büyüme faktörlerinin analizi

2025 LF Fiyat Öngörüsü: Piyasa Eğilimlerinin ve Olası Büyüme Etkenlerinin Analizi

2025 ATEM Fiyat Tahmini: Kripto Para Piyasası Trendleri ve Gelecek Beklentilerinin Analizi

2025 IDOL Fiyat Tahmini: Piyasa Trendleri ve Potansiyel Büyüme Faktörlerinin Analizi

2025 NUMI Fiyat Tahmini: Bu Kripto Varlık, Önümüzdeki Yıllarda Yükselişe mi Geçecek Yoksa Durağan mı Kalacak?

SNS ID'nin İncelenmesi: Blockchain Ad Hizmetlerine Yönelik Analizler

BFC ve SNX: İki Önde Gelen Blockchain Finans Protokolünün Detaylı Karşılaştırması