2025 XCNPrice Prediction: Will XCN Token Reach New Heights in the Post-Halving Bull Market?

Introduction: XCN's Market Position and Investment Value

Onyxcoin (XCN), as the backbone of web3 blockchain infrastructure, has played a significant role in the cryptocurrency market since its inception. As of 2025, Onyxcoin's market capitalization has reached $429,439,658, with a circulating supply of approximately 35,050,576,132 coins and a price hovering around $0.012252. This asset, known as the "web3 infrastructure enabler," is increasingly crucial in powering decentralized applications and blockchain networks.

This article will provide a comprehensive analysis of Onyxcoin's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. XCN Price History Review and Current Market Status

XCN Historical Price Evolution

- 2022: All-time high reached, price peaked at $0.184139 on May 27

- 2023: Significant market downturn, price hit all-time low of $0.0007055 on October 12

- 2025: Market recovery phase, price currently at $0.012252

XCN Current Market Situation

As of September 20, 2025, XCN is trading at $0.012252. The token has shown a slight increase of 0.1% in the past 24 hours, with a trading volume of $1,019,299.88. XCN's market cap stands at $429,439,658.77, ranking it 194th in the global cryptocurrency market.

The current price represents a significant recovery from its all-time low but remains far below its all-time high. XCN has demonstrated strong performance over the past year, with a remarkable 815% increase. However, short-term trends show mixed signals, with slight declines of 0.44%, 1.49%, and 1.79% over the 1-hour, 7-day, and 30-day periods respectively.

XCN's circulating supply is 35,050,576,132 tokens, which is 50.88% of its maximum supply of 68,892,071,756 tokens. The fully diluted market cap is $844,065,663.15, indicating potential for growth if the project reaches full token distribution.

Click to view the current XCN market price

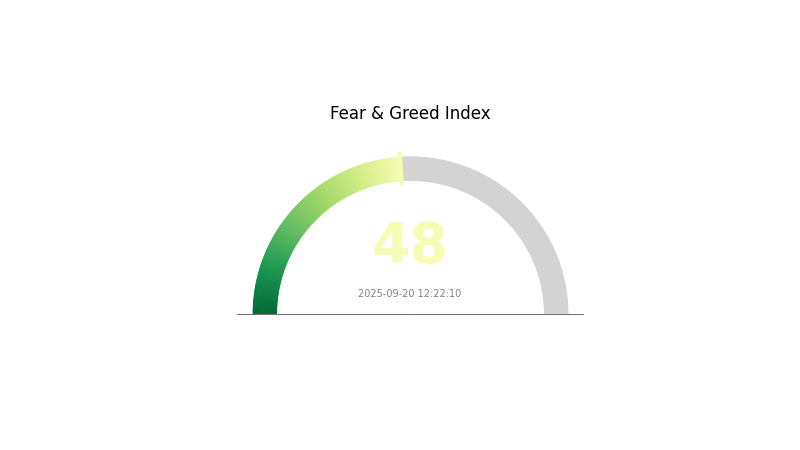

XCN Market Sentiment Index

2025-09-20 Fear and Greed Index: 48 (Neutral)

Click to view the current Fear & Greed Index

The cryptocurrency market sentiment remains neutral today, with the Fear and Greed Index standing at 48. This balanced state suggests investors are neither overly fearful nor excessively greedy. While caution persists, there's also a sense of optimism. Traders should remain vigilant, as market conditions can shift rapidly. It's advisable to conduct thorough research and consider risk management strategies before making any investment decisions. Stay informed about market trends and global events that may impact cryptocurrency valuations.

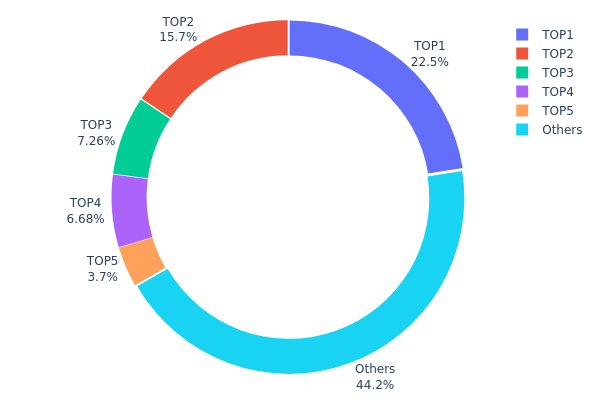

XCN Holdings Distribution

The address holdings distribution of XCN reveals a significant concentration among the top holders. The largest address, a burn address (0x0000...00dead), holds 22.48% of the total supply, indicating a substantial portion of XCN has been permanently removed from circulation. The second-largest holder possesses 15.67% of the supply, followed by three addresses holding between 3.70% and 7.25% each.

This distribution pattern suggests a moderate level of centralization, with the top 5 addresses controlling 55.78% of the total supply. Such concentration could potentially impact market dynamics, as large holders have the capacity to influence price movements through significant buy or sell actions. However, the presence of a diverse "Others" category, representing 44.22% of the supply spread across numerous addresses, indicates some degree of distribution among smaller holders.

The current holdings structure implies a balance between major stakeholders and a broader user base, which could contribute to relative stability in the XCN ecosystem. Nevertheless, market participants should remain aware of the potential for price volatility or market movements influenced by the actions of these large holders.

Click to view the current XCN Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x0000...00dead | 15489639.35K | 22.48% |

| 2 | 0x8f6f...792551 | 10800000.15K | 15.67% |

| 3 | 0x51f3...abdf6c | 5000000.00K | 7.25% |

| 4 | 0x2344...0e19a9 | 4602931.77K | 6.68% |

| 5 | 0x28ca...a5da93 | 2551938.97K | 3.70% |

| - | Others | 30447561.52K | 44.22% |

II. Key Factors Influencing XCN's Future Price

Supply Mechanism

- Token Burning: Periodic token burning events may reduce circulating supply

- Historical Pattern: Previous supply reductions have temporarily boosted price

- Current Impact: Upcoming burns could provide short-term price support

Institutional & Whale Activity

- Institutional Holdings: Major institutions have not disclosed significant XCN positions

- Corporate Adoption: No major companies have announced XCN integration yet

- Government Policies: Regulatory clarity on cryptocurrencies could impact adoption

Macroeconomic Environment

- Monetary Policy Impact: Central bank easing may increase risk appetite for crypto

- Inflation Hedging: XCN's performance as an inflation hedge remains unproven

- Geopolitical Factors: Global economic uncertainty could drive crypto demand

Technical Development & Ecosystem Growth

- Scalability Upgrades: Planned improvements to increase network throughput

- Cross-Chain Interoperability: Enhanced blockchain connectivity in development

- Ecosystem Applications: Growing number of DApps and services built on XCN

III. XCN Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.00908 - $0.01227

- Neutral prediction: $0.01227 - $0.01448

- Optimistic prediction: $0.01448 - $0.01669 (requires favorable market conditions)

2027-2028 Outlook

- Market stage expectation: Potential growth phase

- Price range forecast:

- 2027: $0.01026 - $0.01657

- 2028: $0.01343 - $0.02298

- Key catalysts: Increasing adoption and technological advancements

2029-2030 Long-term Outlook

- Base scenario: $0.01958 - $0.02418 (assuming steady market growth)

- Optimistic scenario: $0.02418 - $0.02878 (with strong positive market sentiment)

- Transformative scenario: $0.02660 - $0.02878 (under extremely favorable conditions)

- 2030-12-31: XCN $0.02418 (potential price point by end of 2030)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.01669 | 0.01227 | 0.00908 | 0 |

| 2026 | 0.01709 | 0.01448 | 0.00883 | 18 |

| 2027 | 0.01657 | 0.01579 | 0.01026 | 28 |

| 2028 | 0.02298 | 0.01618 | 0.01343 | 32 |

| 2029 | 0.02878 | 0.01958 | 0.01233 | 59 |

| 2030 | 0.0266 | 0.02418 | 0.01862 | 97 |

IV. Professional XCN Investment Strategies and Risk Management

XCN Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Risk-tolerant investors with a long-term outlook

- Operation suggestions:

- Accumulate XCN during market dips

- Set price targets for partial profit-taking

- Store XCN in a secure hardware wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversal points

- Relative Strength Index (RSI): Helps determine overbought/oversold conditions

- Key points for swing trading:

- Monitor XCN's correlation with major cryptocurrencies

- Set strict stop-loss orders to manage risk

XCN Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple crypto assets

- Options strategies: Use put options for downside protection

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Use a hardware wallet for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for XCN

XCN Market Risks

- High volatility: XCN price may experience significant fluctuations

- Liquidity risk: Limited trading volume may impact ability to exit positions

- Correlation risk: XCN may be affected by overall crypto market sentiment

XCN Regulatory Risks

- Uncertain regulatory landscape: Potential for stricter regulations on cryptocurrencies

- Cross-border restrictions: Varying legal status in different jurisdictions

- Compliance challenges: Evolving AML/KYC requirements may impact adoption

XCN Technical Risks

- Smart contract vulnerabilities: Potential for exploits in the underlying protocol

- Scalability issues: Challenges in handling increased network activity

- Technological obsolescence: Risk of being outpaced by newer blockchain technologies

VI. Conclusion and Action Recommendations

XCN Investment Value Assessment

XCN presents a high-risk, high-reward opportunity within the web3 infrastructure space. While it offers potential for significant long-term growth, investors should be prepared for substantial short-term volatility and regulatory uncertainties.

XCN Investment Recommendations

✅ Beginners: Consider small, gradual investments to gain exposure ✅ Experienced investors: Implement a dollar-cost averaging strategy with strict risk management ✅ Institutional investors: Conduct thorough due diligence and consider XCN as part of a diversified crypto portfolio

XCN Trading Participation Methods

- Spot trading: Buy and sell XCN on Gate.com's spot market

- Derivatives: Utilize futures contracts for leveraged exposure (advanced traders only)

- Staking: Participate in XCN staking programs if available on trusted platforms

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Can XCN reach $1 dollar?

Yes, XCN could potentially reach $1 by 2033, assuming continued growth in the crypto market and wider adoption of digital currencies in the global economy.

How much will XCN be worth in 5 years?

Based on current projections, XCN could be worth around $127.63 in 5 years, representing a potential increase of about 27.63% from its current value.

What is the onyxcoin future?

Onyxcoin's future looks challenging, with a projected 24.95% decrease to $0.009240 by October 2025. However, the market outlook remains neutral, suggesting potential for recovery or growth beyond this timeframe.

Why are people buying XCN?

People buy XCN due to increased listings, boosting trading volume and visibility. This often drives demand and attracts more investors to the cryptocurrency.

2025 XCNPrice Prediction: Analyzing Market Trends and Potential Growth Factors for XCN in a Changing Crypto Landscape

2025 BICO Price Prediction: Analyzing Market Trends and Expert Forecasts for the Future of Biconomy

2025 RIF Price Prediction: Analyzing Trends and Factors Shaping the Future of RIF Token

2025 XCN Price Prediction: Analyzing Market Trends and Potential Growth Factors for XCN Tokens

2025 ELF Price Prediction: Analyzing Market Trends and Potential Growth Factors for aelf Cryptocurrency

2025 ATS Price Prediction: Bullish Outlook as Adoption Soars and Market Cap Expands

2025 DVI Price Prediction: Expert Analysis and Market Forecast for Digital Video Interface Technology

2025 VOID Price Prediction: Expert Analysis and Market Forecast for the Upcoming Year

2025 MBS Price Prediction: Expert Forecast and Market Analysis for Mortgage-Backed Securities

Portal To Bitcoin (PTB): A Comprehensive Guide to Decentralized Cross-Chain Swaps and Token Economics

Systematic Cryptocurrency Investment Plan