2025 XTER Price Prediction: Expert Analysis and Market Forecast for the Next Year

Introduction: Market Position and Investment Value of XTER

Xterio (XTER), a global cross-platform play-and-earn developer and publisher, has established itself as a significant player in the Web3 gaming ecosystem. As of December 2025, XTER maintains a market capitalization of approximately $29.39 million USD, with a circulating supply of 141.63 million tokens and a current price hovering around $0.02939. This innovative gaming token is increasingly playing a crucial role in creating deeply engaging gaming worlds enhanced by digital ownership across multiple media and platforms.

This article will provide a comprehensive analysis of XTER's price trajectory through 2030, integrating historical patterns, market dynamics, ecosystem development, and macroeconomic factors to deliver professional price forecasts and actionable investment strategies for market participants.

Xterio (XTER) Market Analysis Report

I. XTER Price History Review and Current Market Status

XTER Historical Price Evolution

- September 13, 2025: All-time high of $0.13862, marking the peak of XTER's value since launch.

- December 17, 2025: All-time low of $0.02779, representing a significant correction from historical highs.

- Current Period (December 24, 2025): Price trading at $0.02939, showing slight recovery from the recent low but still reflecting substantial year-over-year decline.

XTER Current Market Dynamics

As of December 24, 2025, XTER is trading at $0.02939 with a 24-hour trading volume of $12,383.38. The token exhibits downward pressure across multiple timeframes:

- Intraday Performance: Down 0.71% in the past hour

- Daily Performance: Down 1.1% over the last 24 hours

- Weekly Performance: Down 8.53% over the past 7 days

- Monthly Performance: Down 38.55% over the past 30 days

- Annual Performance: Down 92.58% since its launch

The current market capitalization stands at approximately $4.16 million, with a fully diluted valuation of $29.39 million. The circulating supply comprises 141.63 million tokens out of a total supply of 1 billion XTER tokens (14.16% circulating ratio).

XTER maintains listings across 15 different exchanges with 28,156 active token holders. The token operates on the BSC (Binance Smart Chain) network using the BEP-20 standard.

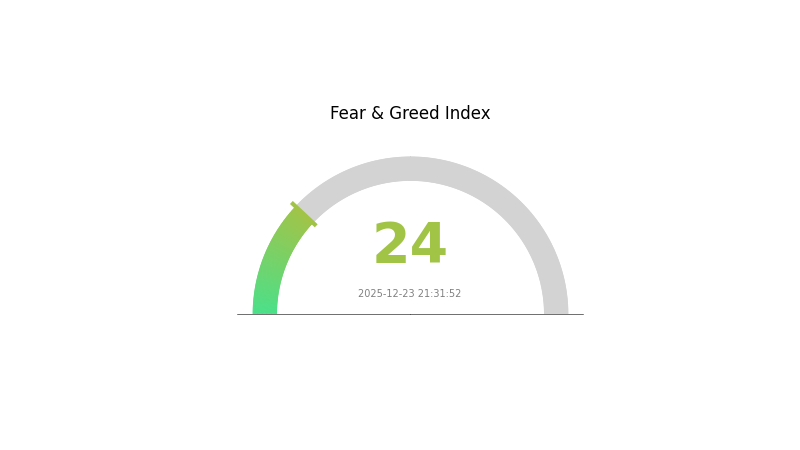

Market sentiment reflects extreme fear with a VIX reading of 24 as of December 23, 2025, indicating heightened market volatility and risk aversion across the cryptocurrency sector.

Visit Gate.com to check current XTER market price

XTER Market Sentiment Index

2025-12-23 Fear and Greed Index: 24 (Extreme Fear)

Click to view the current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear and Greed Index at 24. This indicates significant market pessimism and heightened investor anxiety. When the index reaches such extreme lows, it often signals potential buying opportunities for contrarian investors, as excessive fear can create market bottoms. However, cautious risk management remains essential. Monitor market developments closely and consider dollar-cost averaging strategies. Visit Gate.com to track real-time market sentiment and make informed trading decisions based on comprehensive market data analysis.

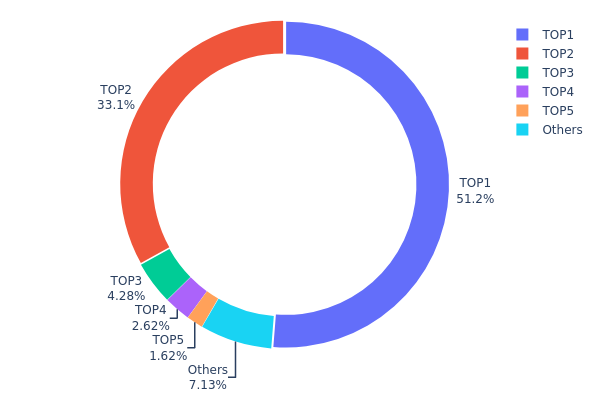

XTER Holdings Distribution

The address holdings distribution map provides a comprehensive view of how XTER tokens are allocated across the blockchain network, revealing the concentration of token ownership among key stakeholders. This metric serves as a critical indicator for assessing market structure, decentralization levels, and potential systemic risks associated with token concentration.

The current XTER holdings data demonstrates significant concentration risk, with the top two addresses collectively controlling 84.35% of the total token supply. The largest holder (0x0876...c6199f) maintains a dominant position with 51.25% of all XTER tokens, while the second-largest address (0x8dab...0d4690) commands an additional 33.10%. This extreme concentration pattern indicates a highly centralized token distribution that deviates substantially from ideal decentralization benchmarks. Beyond the top two addresses, the third-ranked holder controls 4.28%, and the remaining top five addresses account for less than 5% collectively, creating a steep concentration gradient that underscores the token's centralization characteristics.

This pronounced concentration structure presents notable implications for market dynamics and price stability. With such a significant portion of tokens concentrated in a small number of addresses, the potential for large-scale sell-offs or coordinated movements exists, which could exert substantial downward pressure on price discovery mechanisms. The remaining 7.14% distributed among other addresses further emphasizes the limited participation breadth in the token ecosystem. Such concentration patterns typically correlate with reduced market resilience and heightened vulnerability to sudden liquidity disruptions, while simultaneously limiting the degree of genuine decentralization within the XTER network architecture.

Click to view current XTER Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x0876...c6199f | 512500.00K | 51.25% |

| 2 | 0x8dab...0d4690 | 331000.00K | 33.10% |

| 3 | 0x0fb8...9e2fd8 | 42823.56K | 4.28% |

| 4 | 0x93de...85d976 | 26151.24K | 2.61% |

| 5 | 0xc851...bcbaf2 | 16226.82K | 1.62% |

| - | Others | 71298.38K | 7.14% |

II. Core Factors Influencing XTER Future Price

Institutional and Major Holder Dynamics

-

Institutional Holdings: Binance Labs invested $15 million in Xterio in July 2023 to expand its game development capabilities in the AI and Web3 sectors. XPLA served as a lead investor in Xterio's $40 million funding round and established a strategic partnership to integrate Xterio games and digital assets into the XPLA ecosystem.

-

Strategic Partnerships: Xterio has established strategic collaborations with major gaming industry players. Com2uS, a founding partner of XPLA, plans to bring its renowned games to the Xterio platform. Xterio also partners with Palio, an AI agent project developed by researchers from OpenAI, Stanford University, and Google Brain, to integrate advanced AI technology into its games.

Technology Development and Ecosystem Building

-

AI Integration: Xterio has developed an AI toolkit and integrated AI technology through its partnership with Palio. In Xterio games, Palio serves as an AI companion that interacts with players, assists in task completion, and provides game information and recommendations.

-

GameFi as a Service (GaaS) Platform: Xterio offers a comprehensive end-to-end, on-chain universal gaming solution. The platform provides Web2 and Web3 tool suites, publishing services, APIs, and ready-made smart contracts, enabling traditional game developers to easily integrate their games into blockchain technology while providing players with high-quality gaming experiences and digital asset ownership.

-

Platform Infrastructure: Xterio's platform includes game libraries, NFT markets, on-chain operation interfaces, decentralized identity systems, wallets, and community applications. The platform has completed its basic framework and functionality, with ongoing optimization and testing to ensure performance, stability, security, and user experience.

-

Game Portfolio Development: Xterio has completed core design and development for multiple games including Overworld, Age of Dino, and 3T. The flagship game Legends of Titans has been opened for internal testing, with multiple games currently in development. The development team leverages technology stacks and game engines from FunPlus, combined with proprietary AI tools, to create high-quality Web3 games across diverse genres such as MMO, sandbox, strategy, RPG, MOBA, and shooting games.

-

Soul-Bound Token (SBT) Ecosystem: Xsoul is Xterio's first soul-bound token, designed to reward and recognize important community members. As a non-transferable, non-tradable token, Xsoul provides whitelist access to future NFTs related to Xterio games.

Three、2025-2030 XTER Price Forecast

2025 Outlook

- Conservative Forecast: $0.02528 - $0.02939

- Base Case Forecast: $0.02939

- Optimistic Forecast: $0.04173 (requiring sustained market sentiment and positive fundamental developments)

2026-2027 Medium-term Outlook

- Market Stage Expectations: Gradual recovery and consolidation phase with progressive growth momentum

- Price Range Predictions:

- 2026: $0.02098 - $0.05228

- 2027: $0.03953 - $0.05973

- Key Catalysts: Ecosystem expansion, adoption growth, positive regulatory developments, and increased institutional participation through platforms like Gate.com

2028-2030 Long-term Outlook

- Base Case Scenario: $0.03213 - $0.0653 by 2028 (assuming steady market development and moderate adoption acceleration)

- Optimistic Scenario: $0.05388 - $0.08374 by 2029 (assuming significant ecosystem milestones and broader market recovery)

- Transformative Scenario: $0.05906 - $0.07969 by 2030 (assuming breakthrough technological advancement and mainstream adoption)

Note: All price forecasts represent technical analysis projections and should not be considered as investment advice. Actual market performance may vary significantly based on macroeconomic conditions, regulatory environment, and technological developments. Investors are advised to conduct thorough due diligence before making investment decisions.

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.04173 | 0.02939 | 0.02528 | 0 |

| 2026 | 0.05228 | 0.03556 | 0.02098 | 21 |

| 2027 | 0.05973 | 0.04392 | 0.03953 | 49 |

| 2028 | 0.0653 | 0.05182 | 0.03213 | 76 |

| 2029 | 0.08374 | 0.05856 | 0.05388 | 99 |

| 2030 | 0.07969 | 0.07115 | 0.05906 | 142 |

Xterio (XTER) Professional Investment Strategy and Risk Management Report

IV. XTER Professional Investment Strategy and Risk Management

XTER Investment Methodology

(1) Long-term Holding Strategy

- Suitable Investors: Web3 gaming enthusiasts, long-term believers in play-to-earn models, and investors with high risk tolerance seeking exposure to the gaming and metaverse sector.

- Operational Recommendations:

- Accumulate XTER during market downturns when prices are below historical averages, particularly given the 92.58% decline over the past year.

- Dollar-cost averaging (DCA) strategy: invest fixed amounts at regular intervals to reduce the impact of price volatility.

- Hold positions for 2+ years to capture potential recovery and ecosystem development benefits as Xterio expands its Web3 native universes across media and platforms.

(2) Active Trading Strategy

- Technical Analysis Tools:

- Support and Resistance Levels: Current price of $0.02939 is near the all-time low of $0.02779 (December 17, 2025), providing a potential support zone with resistance near the 24-hour high of $0.03018.

- Moving Averages: Use 7-day and 30-day moving averages to identify trend direction, given the -8.53% 7-day and -38.55% 30-day declines.

- Swing Trading Key Points:

- Monitor 24-hour volume trends around $12,383 to identify breakout opportunities.

- Watch for recovery patterns from historical lows as indicators of market sentiment shifts.

XTER Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% of total portfolio allocation.

- Active Investors: 2-5% of total portfolio allocation.

- Professional Investors: 5-10% of total portfolio allocation, with structured hedging strategies.

(2) Risk Hedging Solutions

- Portfolio Diversification: Balance XTER holdings with established cryptocurrencies and stablecoins to mitigate concentration risk.

- Position Sizing: Implement strict position limits based on individual risk tolerance, given XTER's high volatility and market capitalization of $4.16 million.

(3) Secure Storage Solutions

- Hot Wallet Option: Gate.com Web3 wallet for active trading and frequent transactions, offering convenient access and security features.

- Cold Storage Recommendation: Transfer long-term holdings to secure wallets offline for enhanced protection against cyber threats.

- Security Considerations: Never share private keys, enable two-factor authentication on all exchange accounts, and regularly verify contract addresses on BSCscan before transactions.

V. XTER Potential Risks and Challenges

XTER Market Risks

- Severe Price Volatility: The token has experienced a catastrophic 92.58% decline over the past year and 38.55% over the past month, indicating extreme market instability and potential for further downturns.

- Limited Market Liquidity: With only 15 exchange listings and a 24-hour volume of $12,383, XTER faces significant liquidity constraints that could result in slippage during trading.

- Low Market Capitalization: The fully diluted valuation of $29.39 million places XTER in a highly speculative segment vulnerable to sentiment shifts and exit cascades.

XTER Regulatory Risks

- Gaming and Play-to-Earn Compliance: Regulatory frameworks surrounding play-to-earn gaming and NFT-based ownership continue to evolve globally, potentially impacting Xterio's business model.

- Jurisdictional Restrictions: Different countries may impose restrictions on gaming tokens or blockchain-based gaming, affecting market access and token utility.

- Securities Classification: Regulatory authorities may classify XTER or similar gaming tokens as securities, imposing additional compliance requirements.

XTER Technical Risks

- Smart Contract Vulnerabilities: The BEP-20 token running on BSC may face smart contract audit issues or exploitation risks if security measures are insufficient.

- Blockchain Dependency: Xterio's ecosystem relies on BSC performance and security; network congestion or attacks could compromise platform operations.

- Ecosystem Adoption Risk: Success depends on widespread adoption of Xterio's games and platforms; failure to achieve user traction would diminish token utility.

VI. Conclusion and Action Recommendations

XTER Investment Value Assessment

Xterio represents a speculative investment in the emerging play-to-earn gaming sector with significant upside potential but substantial downside risks. The project's global reach across San Francisco, Los Angeles, Tokyo, and Singapore, combined with its focus on Web3 native universes, provides a compelling long-term narrative. However, the devastating 92.58% year-over-year price decline, minimal liquidity, and modest market capitalization indicate severe market skepticism. Current valuations near all-time lows present both an opportunity for contrarian investors and a warning signal of fundamental challenges. Success hinges on Xterio's ability to launch successful games, drive user adoption, and establish genuine demand for XTER tokenomics beyond speculation.

XTER Investment Recommendations

✅ Beginners: Start with minimal allocations (0.1-0.5% of portfolio) through dollar-cost averaging on Gate.com, focusing on long-term holding rather than active trading. Conduct thorough research on Xterio's gaming pipeline before committing capital.

✅ Experienced Investors: Consider tactical entries near support levels ($0.02779-$0.02939) with defined exit strategies. Implement strict stop-losses at 15-20% below entry points and monitor ecosystem developments closely.

✅ Institutional Investors: Evaluate XTER as part of a diversified gaming and metaverse exposure strategy, requiring comprehensive due diligence on game development timelines, user metrics, and token economics sustainability.

XTER Trading Participation Methods

- Spot Trading: Purchase XTER directly on Gate.com for long-term holding or active trading strategies.

- Liquidity Provision: Advanced users may participate in liquidity pools on BSC-based DEXs, though this carries additional smart contract risks.

- Game Integration: Once Xterio games are fully operational, earn XTER through gameplay as part of the play-to-earn model.

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors must make decisions based on their personal risk tolerance and should consult professional financial advisors. Never invest more capital than you can afford to lose completely.

FAQ

What is the price prediction for Xterio airdrop?

Xterio is predicted to reach $0.02083 by December 31, 2025, representing a -15.35% adjustment from current levels based on market analysis and technical forecasting.

How much is the xter coin worth today?

Xterio (XTER) is worth $0.02994 today, up 0.7% in the last hour and 0.4% since yesterday. The trading volume reflects steady market activity and investor interest in this blockchain gaming token.

What factors influence XTER token price movements?

XTER token price movements are driven by market trends, technology developments, regulatory changes, investor sentiment, and trading volume. These fundamental factors shape price dynamics.

What is the historical price performance of XTER coin?

XTER reached an all-time high of $0.5983 on January 8, 2025. Currently trading between $0.02950717 and $0.03044602, the coin has experienced significant volatility. Price movements reflect market demand and broader crypto market trends throughout 2025.

Is XTER a good investment for long-term holders?

XTER shows strong potential for long-term holders as its gaming and Web3 platform expands. Growing adoption and ecosystem development suggest promising value appreciation ahead.

2025 WIZZ Price Prediction: Will This Budget Airline Soar to New Heights?

2025 MLC Price Prediction: Expert Analysis and Market Forecast for Melania Coin in the Coming Year

Empire Token Current Market Overview and Analysis

2025 RON Price Prediction: Analyzing Growth Potential in the Play-to-Earn Gaming Ecosystem

What is SLP: Understanding the Speech-Language Pathology Profession and Its Impact on Communication Disorders

What Is Zoo (ZOO)? Telegram Play-to-Earn Game & Token Overview

Wyckoff Pattern: A Simplified Guide For Beginners

Top Bitcoin Mining Apps for Android & iOS

How to Buy BIM in Egypt

Tether TRC20 Wallet and USDT on TRON Network

What is Quant (QNT)? An Overview of the QNT Token