2025 XU3O8 Price Prediction: Uranium Market Outlook and Investment Opportunities in the Nuclear Energy Era

Introduction: Market Position and Investment Value of XU3O8

Uranium.io (XU3O8) represents the world's first tokenized uranium, with each token representing equitable ownership in physical uranium stored and verified by Cameco. As a groundbreaking asset class, XU3O8 combines deep on-chain composability with institutional-grade infrastructure through its deployment on Etherlink, the high-speed Layer 2 powered by Tezos technology. As of December 2025, XU3O8 maintains a market capitalization of approximately $8.10 million with a circulating supply of 1.6 million tokens, currently trading at around $5.06 per token. This innovative tokenized commodity is opening global, 24/7 access to uranium, a historically illiquid and restricted asset, while providing a compliant, secure, and scalable gateway for both DeFi and traditional finance participants.

This comprehensive analysis examines XU3O8's price trajectory from 2025 through 2030, incorporating historical performance patterns, market supply-demand dynamics, ecosystem development, and macroeconomic factors to deliver professional price forecasts and actionable investment strategies for market participants.

I. XU3O8 Price History Review and Current Market Status

XU3O8 Historical Price Movement Trajectory

- 2025: Project launch on July 24, 2025, with initial price of $4.47, marking the beginning of tokenized uranium trading.

- July 24, 2025: Both all-time high (ATH) of $5.678 and all-time low (ATL) of $2.46 recorded on the same date, indicating significant price volatility during the launch period.

- December 22, 2025: Current trading price at $5.061, representing a recovery of approximately 13.2% from the launch price and demonstrating sustained market interest in the tokenized uranium asset.

XU3O8 Current Market Sentiment

XU3O8 is currently trading at $5.061 as of December 22, 2025, with a 24-hour trading volume of $94,565.15. The token exhibits moderate positive momentum, gaining 0.11% over the past 24 hours. Over a longer timeframe, XU3O8 demonstrates stronger performance with a 7-day gain of 4.97% and a 30-day increase of 6.88%, reflecting growing market confidence in the tokenized uranium concept.

The total market capitalization stands at $8,097,600, with a fully diluted valuation of $8,097,600, indicating that all 1,600,000 tokens are currently in circulation. The token maintains a market dominance of 0.00024%, reflecting its early-stage status within the broader cryptocurrency market. With only 4 listed exchanges and a market rank of 1,290, XU3O8 remains a relatively nascent asset with room for expanded exchange listings and market adoption.

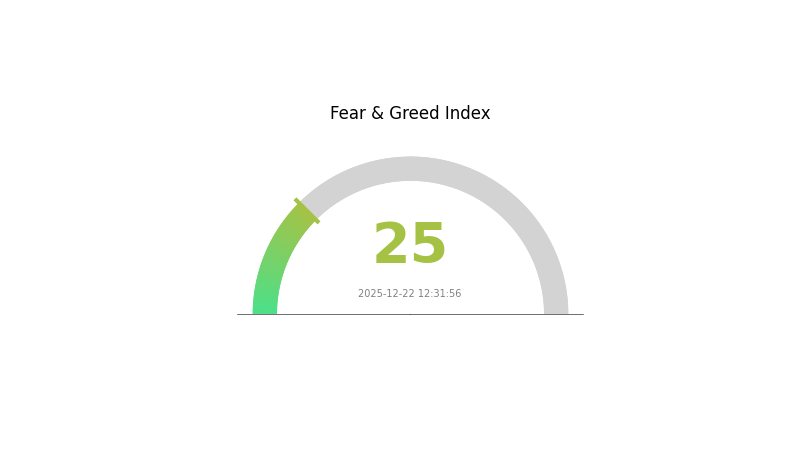

The current market sentiment is characterized by extreme fear, with a VIX reading of 25, suggesting heightened market anxiety across the broader financial environment. Despite this challenging sentiment, XU3O8 has managed to appreciate 26.83% over the past year since its launch, outperforming expectations for a new tokenized commodity asset during a period of market uncertainty.

Click to view current XU3O8 market price

XU3O8 Market Sentiment Index

2025-12-22 Fear and Greed Index: 25 (Extreme Fear)

Click to view the current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear and Greed Index dropping to 25. This indicates significant market pessimism and heightened risk aversion among investors. During such periods, markets often experience substantial volatility and potential liquidations. However, extreme fear conditions have historically presented opportunities for contrarian investors. It's crucial to conduct thorough research and implement proper risk management strategies. Monitor market developments closely and consider your investment timeline and risk tolerance before making trading decisions on Gate.com.

XU3O8 Holdings Distribution

The address holdings distribution map serves as a critical metric for assessing the concentration of token ownership across the blockchain network. This distribution reveals how XU3O8 tokens are allocated among different addresses, providing insights into the decentralization level and potential concentration risks within the ecosystem. By analyzing the top holders and their respective percentages, market participants can evaluate the vulnerability of the token to potential price manipulation and understand the structural stability of the on-chain market.

Currently, the XU3O8 holdings data presents a notably dispersed ownership structure. With no single address or group of addresses commanding an excessive concentration of total supply, the token demonstrates a relatively healthy decentralization profile. This distributed ownership pattern mitigates systemic risks associated with whale-driven market manipulation and suggests a more balanced stakeholder composition. The absence of extreme concentration indicates that the token's price discovery mechanism is less susceptible to sudden large-scale liquidations or coordinated sell-offs by dominant holders.

The current address distribution architecture reflects a market structure characterized by moderate stability and reduced concentration risk. This fragmented holdings pattern generally supports more organic price movements driven by broader market sentiment rather than individual actor decisions. Such decentralization characteristics are typically favorable for long-term market development, as they reduce the likelihood of sudden volatility spikes triggered by concentrated position adjustments and foster a more resilient on-chain ecosystem.

Click to view current XU3O8 holdings distribution

</Holdings Distribution Analysis>

| Top | Address | Holding Qty | Holding (%) |

|---|

Core Factors Influencing XU3O8's Future Price

Supply Mechanism

- Uranium Mining Output: XU3O8 supply is primarily influenced by uranium ore production scale. Changes in uranium mining capacity directly impact token availability in the market.

- Historical Patterns: Fluctuations in uranium production have historically exerted significant influence on XU3O8 price movements. Supply-side shocks in the uranium sector translate to price volatility in the token market.

- Current Impact: Ongoing developments in global uranium mining operations continue to shape near-term price dynamics for XU3O8.

Macroeconomic Environment

- Monetary Policy Impact: Changes in interest rates and monetary policy decisions by major central banks affect asset attractiveness. Shifts in global monetary conditions influence investor demand for XU3O8.

- Inflation Hedge Properties: XU3O8's positioning as "digital uranium" enhances its appeal in inflationary environments. The token's connection to physical uranium provides a potential hedge function against currency depreciation and rising price levels.

- Geopolitical Factors: International political uncertainty strengthens market demand and investment interest in XU3O8. Geopolitical tensions often drive demand for alternative assets and commodities linked to critical energy resources.

III. 2025-2030 XU3O8 Price Forecast

2025 Outlook

- Conservative Forecast: $2.93-$5.06

- Base Case Forecast: $5.06

- Optimistic Forecast: $7.39 (requiring sustained market interest and positive regulatory developments)

2026-2027 Mid-Term Outlook

- Market Stage Expectation: Recovery and consolidation phase with gradual upward momentum, driven by increasing institutional adoption and market maturation.

- Price Range Forecast:

- 2026: $4.54-$8.65

- 2027: $4.98-$8.33

- Key Catalysts: Regulatory clarity in major markets, increased institutional investment, technological upgrades, and broader cryptocurrency market expansion.

2028-2030 Long-Term Outlook

- Base Case Scenario: $5.12-$11.59 (assuming steady market growth and moderate adoption acceleration)

- Optimistic Scenario: $8.50-$11.78 (assuming accelerated institutional adoption and favorable macroeconomic conditions)

- Transformational Scenario: $9.44-$11.79 (under extreme positive conditions including breakthrough technological developments and mainstream financial integration)

- 2030-12-22: XU3O8 projected at $10.76 average (strong growth trajectory with 112% cumulative appreciation from 2025 baseline)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 7.3876 | 5.06 | 2.9348 | 0 |

| 2026 | 8.65108 | 6.2238 | 4.54337 | 22 |

| 2027 | 8.32993 | 7.43744 | 4.98309 | 46 |

| 2028 | 11.58902 | 7.88369 | 5.1244 | 55 |

| 2029 | 11.78099 | 9.73635 | 9.44426 | 92 |

| 2030 | 11.2966 | 10.75867 | 8.49935 | 112 |

Uranium.io (XU3O8) Professional Investment Strategy and Risk Management Report

IV. XU3O8 Professional Investment Strategy and Risk Management

XU3O8 Investment Methodology

(1) Long-term Holding Strategy

- Target Investors: Institutional investors, traditional finance participants seeking commodity diversification, technology-oriented investors with long-term outlook

- Operational Recommendations:

- Allocate a core position based on portfolio diversification goals, considering XU3O8's low correlation to traditional assets

- Dollar-cost averaging (DCA) approach to mitigate short-term price volatility and build positions over time

- Secure storage through institutional-grade infrastructure, utilizing on-chain verification provided by Cameco's physical uranium backing

(2) Active Trading Strategy

-

Market Analysis Considerations:

- Monitor global uranium demand trends, particularly in nuclear energy sectors experiencing renewed growth

- Track Cameco's operational updates and uranium inventory levels as key indicators of supply fundamentals

- Analyze Etherlink network activity and transaction volumes to assess ecosystem health

-

Trading Activity Points:

- Capitalize on price volatility windows while maintaining awareness of the asset's relatively small 24-hour trading volume ($94,565)

- Monitor entry/exit points around historical price ranges (ATH: $5.678, ATL: $2.46) to optimize risk-reward ratios

- Consider liquidity conditions across available trading venues before executing large positions

XU3O8 Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-3% of overall portfolio allocation

- Active Investors: 3-7% of overall portfolio allocation

- Professional/Institutional Investors: 5-15% of overall portfolio allocation, depending on commodity diversification objectives

(2) Risk Hedging Solutions

- Fundamental Asset Diversification: Maintain exposure to both Web3 and traditional finance market participants to reduce concentration risk

- Position Sizing: Implement strict position limits relative to total portfolio value, accounting for XU3O8's smaller market capitalization ($8.09M) and market dominance (0.00024%)

(3) Secure Storage Solutions

- Custodial Solutions: Utilize Gate.com's institutional custody services for secure storage of XU3O8 tokens with institutional-grade infrastructure

- Self-Custody Options: For users maintaining direct control, ensure private key management and secure backup procedures with multi-signature wallets where possible

- Security Considerations: Verify Etherlink network security protocols; maintain awareness that XU3O8 is structured as a non-security asset; ensure Cameco's physical verification processes remain intact; conduct regular security audits of storage solutions

V. XU3O8 Potential Risks and Challenges

XU3O8 Market Risks

- Limited Liquidity: With only $94,565 in 24-hour trading volume and a market cap of $8.09M, the asset faces significant liquidity constraints that could impact large position entry/exit

- Low Trading Volume Concentration: Currently available on only 4 exchanges, creating potential bottlenecks for institutional adoption and price discovery mechanisms

- Market Maturity Risk: As a pioneering tokenized commodity, XU3O8 lacks historical price data and long-term market performance benchmarks

XU3O8 Regulatory Risks

- Commodity Classification Uncertainty: While structured as non-security, regulatory frameworks governing tokenized physical assets remain evolving across jurisdictions

- Cross-Border Compliance: Global 24/7 trading access creates potential regulatory challenges in different financial jurisdictions with varying commodity trading regulations

- Physical Asset Custody Risk: Regulatory changes affecting uranium trade, storage, or export could impact the underlying asset backing

XU3O8 Technology Risks

- Etherlink Network Dependency: Asset viability depends on continued stability and adoption of the Tezos-powered L2 solution

- Smart Contract Risks: ERC-20 token implementation on Etherlink may face unforeseen vulnerabilities or protocol changes

- Verification Infrastructure: Ongoing reliance on Cameco's storage verification and custody procedures could present operational bottlenecks

VI. Conclusion and Action Recommendations

XU3O8 Investment Value Assessment

Uranium.io (XU3O8) represents a novel market infrastructure innovation that democratizes access to a historically illiquid commodity. The tokenized uranium asset demonstrates strong fundamental appeal through low correlation to traditional financial assets, structural supply imbalances in the uranium market, and growing demand driven by nuclear energy expansion. However, investors must acknowledge that as a nascent asset class with limited trading volume and market cap, XU3O8 carries execution risk, regulatory uncertainty, and technology platform dependency. The asset's non-security structure and institutional custody backing through Cameco provide legitimacy, but market maturity and liquidity remain constrained for large institutional deployments.

XU3O8 Investment Recommendations

✅ Newcomers: Begin with small exploratory positions (0.5-1% of portfolio) through Gate.com to understand market mechanics and asset behavior; prioritize educational research on uranium market fundamentals before scaling positions

✅ Experienced Investors: Develop portfolio allocation strategies (3-7%) considering XU3O8 as a commodity diversification tool; implement dollar-cost averaging to manage volatility; maintain active monitoring of uranium supply-demand dynamics and Cameco updates

✅ Institutional Investors: Evaluate XU3O8 within broader commodity diversification mandates; utilize Gate.com's institutional services for secure custody; consider strategic positions (5-15%) aligned with nuclear energy transition narratives and commodity portfolio optimization

XU3O8 Trading Participation Methods

- Spot Trading: Direct purchase and holding through Gate.com's trading platform for long-term commodity exposure

- DeFi Integration: Leverage XU3O8's on-chain composability on Etherlink for yield generation or lending strategies within DeFi protocols

- Position Scaling: Implement phased entry strategies through Gate.com with dollar-cost averaging to optimize average purchase prices and manage liquidity impact

Cryptocurrency investments carry extreme risk. This report does not constitute investment advice. Investors should make prudent decisions based on individual risk tolerance and are strongly advised to consult professional financial advisors. Never invest capital you cannot afford to lose completely.

FAQ

How much is XU3O8 token today?

The XU3O8 token is currently priced at $4.77 USD. The 24-hour trading volume is $165,771, reflecting steady market activity for this uranium-backed token.

Will uranium skyrocket?

Uranium prices are expected to surge due to growing nuclear energy demand and clean energy transition. With increased global adoption, significant price appreciation is anticipated in the coming years.

What factors influence XU3O8 price predictions?

XU3O8 price predictions are influenced by supply and demand dynamics, protocol upgrades, macroeconomic shifts, market sentiment, trading volume, and geopolitical events affecting the broader crypto market.

Is XU3O8 a good investment for 2025?

XU3O8 shows promising investment potential for 2025, with price forecasts ranging from $2.89 to $5.66. Market trends suggest moderate growth momentum, supported by increasing trading volume and positive technical indicators.

What are the risks of investing in XU3O8 tokens?

XU3O8 tokens carry smart contract risks including potential bugs or exploits. Market volatility can cause significant price fluctuations. Regulatory changes may impact token value and future viability.

What Will the EDEN Price Be in 2026? Predictions and Volatility Analysis

Crypto Crash or Just a Correction?

Why is CryptoJack so hopeful about Gate.com and GT TOKEN in this bull run?

2025 WHITEPrice Prediction: Analysis of Market Trends and Future Value Potential

OXT vs BTC: A Comparative Analysis of Orchid Protocol and Bitcoin as Digital Assets

SIX vs QNT: Analyzing Performance Metrics of Two Leading Blockchain Technology Platforms

What is a cryptocurrency airdrop?

How to Withdraw Money from a Cryptocurrency Exchange

What is HIBS: A Comprehensive Guide to Understanding Hemolytic Immune-mediated Transfusion Reactions

What is IBFK: A Comprehensive Guide to International Bank Fund Keying and Cross-Border Financial Operations

How to Withdraw Cryptocurrency to Your Bank Account