2025 ZBCN Price Prediction: Analyzing Market Trends and Potential Growth Factors

Introduction: ZBCN's Market Position and Investment Value

Zebec Protocol (ZBCN), as a decentralized infrastructure network for seamless value transfer, has been making waves since its inception. As of 2025, ZBCN's market capitalization has reached $372,420,582, with a circulating supply of approximately 93,785,087,464 tokens, and a price hovering around $0.003971. This asset, hailed as the "real-world value mover," is playing an increasingly crucial role in providing immediate financial access and control for individuals, businesses, and investors.

This article will comprehensively analyze ZBCN's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price predictions and practical investment strategies.

I. ZBCN Price History Review and Current Market Status

ZBCN Historical Price Evolution

- 2024: Project launch, price started at $0.001

- 2024 August: Reached all-time low of $0.000686

- 2025 May: Achieved all-time high of $0.007193

ZBCN Current Market Situation

As of October 17, 2025, ZBCN is trading at $0.003971. The token has experienced a significant price decrease in the past 24 hours, dropping by 5.67%. The current price is 44.79% below its all-time high of $0.007193 reached on May 30, 2025, but still 478.86% above its all-time low of $0.000686 recorded on August 5, 2024.

ZBCN's market capitalization stands at $372,420,582, ranking it 189th among all cryptocurrencies. The token has a circulating supply of 93,785,087,464.93515 ZBCN, which represents 93.79% of its total supply of 99,997,670,124.68515 ZBCN.

The 24-hour trading volume for ZBCN is $3,352,191, indicating moderate market activity. The token is currently listed on 21 exchanges, providing liquidity and accessibility for traders and investors.

Click to view the current ZBCN market price

ZBCN Market Sentiment Indicator

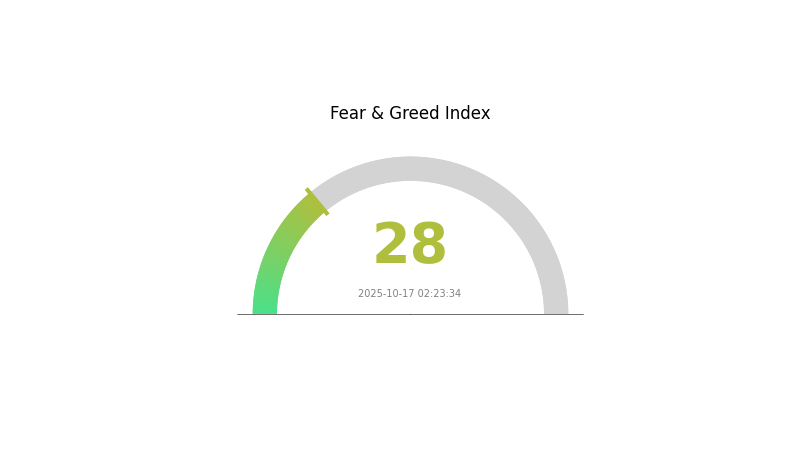

2025-10-17 Fear and Greed Index: 28 (Fear)

Click to view the current Fear & Greed Index

The crypto market is currently experiencing a period of fear, with the Fear and Greed Index standing at 28. This indicates a cautious sentiment among investors, potentially presenting buying opportunities for those willing to go against the crowd. However, it's crucial to remember that market sentiment can shift rapidly. As always, conduct thorough research and consider your risk tolerance before making any investment decisions. Stay informed and trade wisely on Gate.com.

ZBCN Holdings Distribution

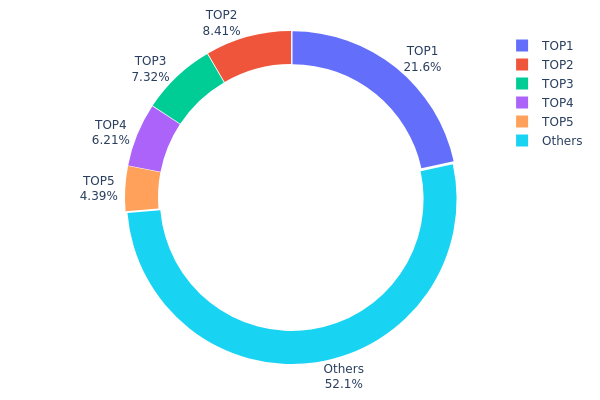

The address holdings distribution data for ZBCN reveals a moderately concentrated market structure. The top address holds 21.59% of the total supply, while the top 5 addresses collectively control 47.89% of ZBCN tokens. This concentration suggests a significant influence of major holders on the market dynamics.

However, it's noteworthy that over half (52.11%) of the tokens are distributed among other addresses, indicating a degree of decentralization. This distribution pattern may contribute to market stability by reducing the impact of individual large holders' actions. Nevertheless, the substantial holdings of the top addresses could potentially lead to increased price volatility or market manipulation if these major holders decide to make significant moves.

Overall, the current ZBCN holdings distribution reflects a balanced market structure with a mix of large stakeholders and a wider base of smaller holders. This setup suggests a moderate level of decentralization, which could contribute to the long-term stability and sustainability of the ZBCN ecosystem.

Click to view the current ZBCN Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 5rhms6...2r5rHb | 21594573.69K | 21.59% |

| 2 | 22Wnk8...h7zkBa | 8408954.73K | 8.40% |

| 3 | H8Hr96...pkDDfR | 7318217.59K | 7.31% |

| 4 | 9RE2Gc...vFsg6i | 6212582.66K | 6.21% |

| 5 | 71LxiE...pXHodV | 4388519.86K | 4.38% |

| - | Others | 52075986.30K | 52.11% |

II. Key Factors Influencing ZBCN's Future Price

Supply Mechanism

- Token Migration: ZBC completed token migration in 2024, with old ZBC tokens converted at a 1:10 ratio to ZBCN.

- Historical Pattern: The token migration event likely had a significant impact on ZBCN's price and supply dynamics.

- Current Impact: The new supply structure post-migration continues to influence ZBCN's price movements.

Institutional and Whale Dynamics

- Enterprise Adoption: Increasing adoption by DAOs and ecosystem participants on Solana is driving ZBCN's utility and value.

- Government Policies: Regulatory developments and government adoption of blockchain technologies can significantly impact ZBCN's price.

Macroeconomic Environment

- Inflation Hedging Properties: As a crypto asset, ZBCN may be viewed as a potential hedge against inflation in traditional financial markets.

- Geopolitical Factors: International events and geopolitical tensions can influence the broader crypto market, including ZBCN.

Technical Development and Ecosystem Building

- Real-time Payments: ZBCN enables real-time wage payments, subscriptions, and fund transfers on the Solana blockchain.

- Programmable Cash Flows: Zebec Network is pioneering programmable, continuous cash flows in Web3 payment infrastructure.

- Ecosystem Applications: ZBCN powers a suite of products including real-time wage applications, on-chain payment infrastructure, and networked decentralized physical infrastructure.

III. ZBCN Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.00302 - $0.00350

- Neutral prediction: $0.00351 - $0.00398

- Optimistic prediction: $0.00399 - $0.0041 (requires positive market sentiment)

2026-2027 Outlook

- Market phase expectation: Gradual growth and increased adoption

- Price range forecast:

- 2026: $0.00359 - $0.00594

- 2027: $0.00449 - $0.00718

- Key catalysts: Technological advancements and expanding use cases

2028-2030 Long-term Outlook

- Base scenario: $0.00609 - $0.00695 (assuming steady market growth)

- Optimistic scenario: $0.00705 - $0.00792 (assuming accelerated adoption)

- Transformative scenario: Above $0.00792 (under extremely favorable conditions)

- 2030-12-31: ZBCN $0.00695 (potential for 74% growth from 2025)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.0041 | 0.00398 | 0.00302 | 0 |

| 2026 | 0.00594 | 0.00404 | 0.00359 | 1 |

| 2027 | 0.00718 | 0.00499 | 0.00449 | 25 |

| 2028 | 0.00761 | 0.00609 | 0.00389 | 53 |

| 2029 | 0.00705 | 0.00685 | 0.00534 | 72 |

| 2030 | 0.00792 | 0.00695 | 0.00514 | 74 |

IV. ZBCN Professional Investment Strategies and Risk Management

ZBCN Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors and believers in decentralized infrastructure

- Operation suggestions:

- Accumulate ZBCN tokens during market dips

- Set price targets for partial profit-taking

- Store tokens in a secure wallet with regular backups

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential entry/exit points

- Relative Strength Index (RSI): Monitor overbought/oversold conditions

- Key points for swing trading:

- Monitor project developments and partnerships

- Be aware of overall market sentiment in the crypto space

ZBCN Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across different crypto assets

- Stop-loss orders: Set automatic sell orders to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallet for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for ZBCN

ZBCN Market Risks

- Volatility: Cryptocurrency markets are known for high price fluctuations

- Competition: Other decentralized infrastructure projects may gain market share

- Liquidity: Lower trading volumes may lead to increased slippage

ZBCN Regulatory Risks

- Unclear regulations: Evolving regulatory landscape may impact ZBCN's operations

- Cross-border compliance: Differing regulations across jurisdictions

- Potential restrictions: Future government actions could limit ZBCN's functionality

ZBCN Technical Risks

- Smart contract vulnerabilities: Potential bugs or exploits in the protocol

- Scalability challenges: Ability to handle increased network load

- Interoperability issues: Compatibility with other blockchain networks

VI. Conclusion and Action Recommendations

ZBCN Investment Value Assessment

ZBCN shows potential as a decentralized infrastructure solution, but faces significant competition and regulatory uncertainties. Long-term value proposition is promising, but short-term volatility and risks should be carefully considered.

ZBCN Investment Recommendations

✅ Beginners: Start with small positions and focus on education ✅ Experienced investors: Consider allocating a portion of portfolio based on risk tolerance ✅ Institutional investors: Conduct thorough due diligence and consider long-term potential

ZBCN Trading Participation Methods

- Spot trading: Buy and sell ZBCN tokens on Gate.com

- Staking: Participate in staking programs if available

- DeFi integration: Explore decentralized finance opportunities using ZBCN

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Will Zbcn reach $1 dollar?

Based on current projections, ZBCN is unlikely to reach $1 by 2025 or 2030. Forecasts suggest it may reach around $0.005 by 2025 and $0.004 by 2030.

What are the risks of investing in ZBCN?

ZBCN investment risks include high volatility, potential market manipulation, and regulatory uncertainties. The crypto market's rapid changes can lead to significant price fluctuations.

How does ZBCN compare to Bitcoin?

ZBCN is a newer cryptocurrency with lower market cap and trading volume than Bitcoin. It offers faster transactions but has less adoption and price stability compared to Bitcoin.

Which AI is best for stock price prediction?

Hybrid GARCH-AI models, especially GARCH-LSTM, are best for stock price prediction. They combine GARCH for volatility and advanced AI for accuracy.

2025 PYTH Price Prediction: Analyzing Market Trends and Growth Potential in the Oracle Protocol Ecosystem

2025 ZBCN Price Prediction: Navigating Market Trends and Future Valuation Analysis

How Can On-Chain Data Analysis Reveal Crypto Whales' Movements?

2025 SOL Price Prediction: Bullish Outlook as Solana Ecosystem Expands

2025 ZERO Price Prediction: Analyzing Market Trends and Potential Growth Factors

How Does ORE's Fundamentals Analysis Impact Its Investment Potential in 2025?

How Does EDGE Crypto Community Activity Impact Token Value and Ecosystem Growth?

Two-Factor Authentication (2FA): A Comprehensive Security Guide

# What Are On-Chain Data Analysis Metrics and How Do Whales, Active Addresses, and Transaction Volume Impact Crypto Markets?

How to Use MACD, RSI, and KDJ Technical Indicators for Crypto Trading Signals

What are the regulatory and compliance risks for crypto projects in 2026?