GUSD vs ETH: The Battle for Stablecoin Supremacy in the Ethereum Ecosystem

Introduction: GUSD vs ETH Investment Comparison

In the cryptocurrency market, GUSD vs ETH comparison has always been an unavoidable topic for investors. The two not only have significant differences in market cap ranking, application scenarios, and price performance, but also represent different crypto asset positioning.

GUSD (GUSD): Since its launch, it has gained market recognition for its positioning as a flexible, principal-protected investment product with daily rewards.

Ethereum (ETH): Since 2015, it has been hailed as the foundation for decentralized applications and smart contracts, and is one of the cryptocurrencies with the highest global trading volume and market capitalization.

This article will comprehensively analyze the investment value comparison between GUSD and ETH, focusing on historical price trends, supply mechanisms, institutional adoption, technological ecosystems, and future predictions, attempting to answer the question investors care about most:

"Which is the better buy right now?"

I. Price History Comparison and Current Market Status

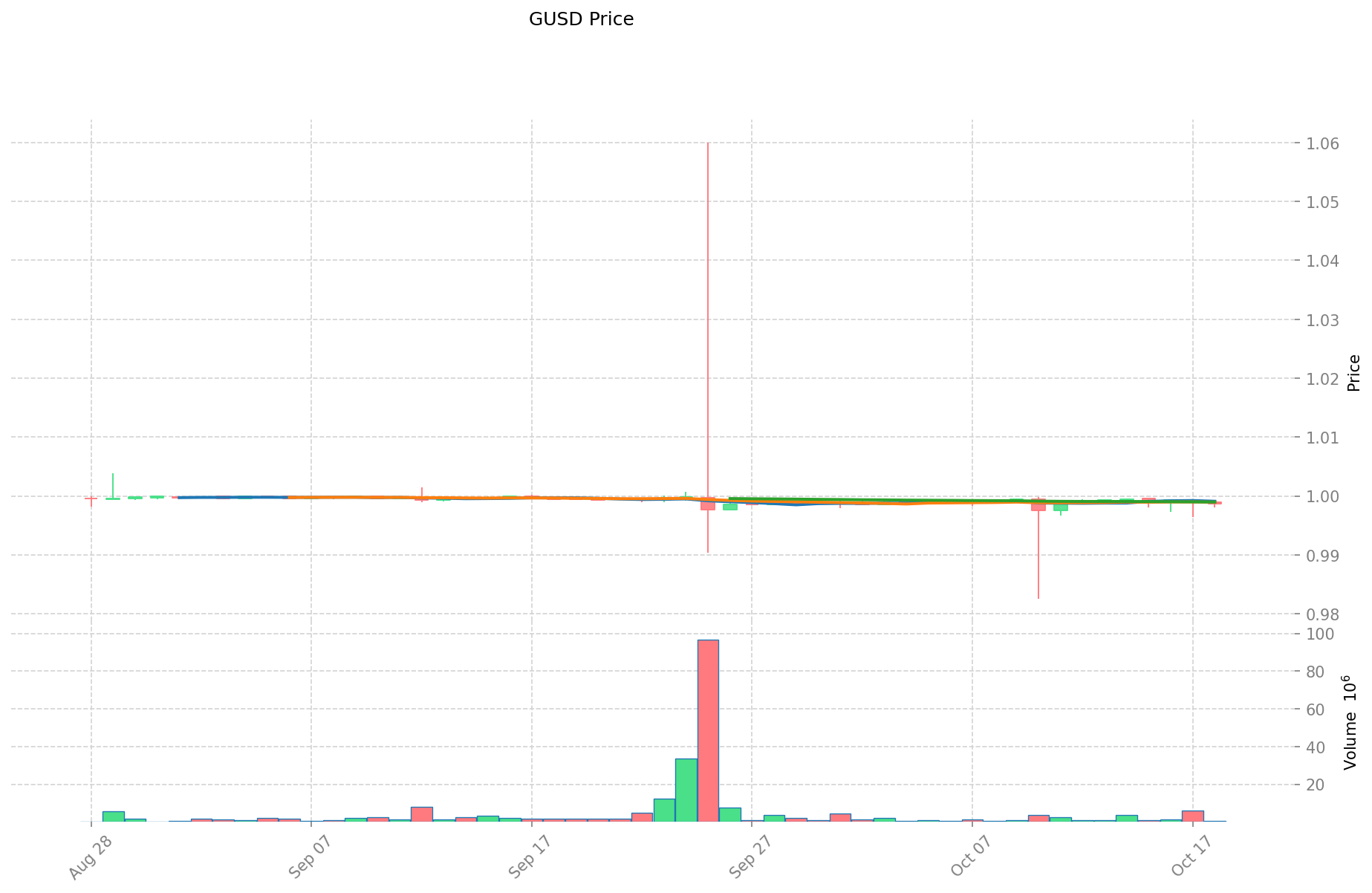

GUSD and ETH Historical Price Trends

- 2025: GUSD maintained relative stability as a stablecoin, with minor fluctuations around its $1 peg.

- 2025: ETH reached a new all-time high of $4,946.05 on August 25, 2025, driven by increased adoption and network upgrades.

- Comparative analysis: While GUSD aims to maintain a stable value, ETH has shown significant volatility, ranging from a low of $0.432979 to its recent high of $4,946.05.

Current Market Situation (2025-10-19)

- GUSD current price: $0.9992

- ETH current price: $3,884.17

- 24-hour trading volume: GUSD $425,018.41 vs ETH $419,385,905.84

- Market Sentiment Index (Fear & Greed Index): 29 (Fear)

Click to view real-time prices:

- Check GUSD current price Market Price

- Check ETH current price Market Price

II. Project Overview and Ecosystem Comparison

GUSD (Gemini Dollar)

- GUSD is a flexible, principal-protected investment product that distributes rewards daily.

- Returns are sourced from the Gate ecosystem's revenue, tokenized treasuries or other RWA, and stablecoin-backed yield assets.

- Designed to provide relatively stable yields in both bullish and bearish market conditions.

- Fully tradable and can be used as collateral.

ETH (Ethereum)

- Ethereum is a decentralized, open-source blockchain platform supporting smart contracts and decentralized applications (DApps).

- Operates using Ether (ETH) as its native cryptocurrency.

- Facilitates the functioning of various cryptocurrencies and enables the execution of decentralized smart contracts.

Key Differences

- Purpose: GUSD aims for stable value and yield, while ETH serves as a platform for decentralized applications.

- Price stability: GUSD is designed to maintain a stable value, ETH is subject to market volatility.

- Yield generation: GUSD offers daily rewards, ETH does not inherently provide yields.

- Use cases: GUSD focuses on investment and stable value transfer, ETH is used for transaction fees, smart contract execution, and as a store of value.

III. Technical Analysis and Market Indicators

GUSD Technical Indicators

- Price: $0.9992

- 24h High/Low: $0.9993 / $0.9980

- 7-day price change: +0.02%

- 30-day price change: -0.06%

ETH Technical Indicators

- Price: $3,884.17

- 24h High/Low: $3,927.58 / $3,824.84

- 7-day price change: +3.64%

- 30-day price change: -15.35%

Market Capitalization and Supply

- GUSD Market Cap: $148,101,274

- ETH Market Cap: $468,813,433,280

- GUSD Circulating Supply: 148,219,849.96

- ETH Circulating Supply: 120,698,484.69

Volume and Liquidity

- GUSD 24h Volume: $425,018.41

- ETH 24h Volume: $419,385,905.84

- GUSD is primarily traded on Gate.io

- ETH is widely traded across 79 exchanges

IV. Risk Assessment

GUSD Risk Factors

- Counterparty risk associated with the issuer (Gate.io)

- Regulatory risks surrounding stablecoins

- Potential fluctuations in yield rates

- Limited adoption compared to major stablecoins

ETH Risk Factors

- High market volatility

- Scalability challenges

- Competition from other smart contract platforms

- Regulatory uncertainties in various jurisdictions

Comparative Risk Analysis

- GUSD presents lower price volatility but higher counterparty risk

- ETH offers greater potential for price appreciation but with higher market risk

- Both face regulatory risks, though of different natures

V. Future Outlook and Potential Developments

GUSD Prospects

- Potential for increased adoption as a yield-bearing stablecoin

- Possible expansion of use cases within the Gate ecosystem

- Ongoing efforts to maintain competitive yield rates

ETH Prospects

- Continued development of Ethereum 2.0 and scalability solutions

- Growing DeFi and NFT ecosystems built on Ethereum

- Potential for increased institutional adoption

Industry Trends Affecting Both Assets

- Evolving regulatory landscape for cryptocurrencies and stablecoins

- Increasing interest in yield-generating crypto assets

- Growing importance of interoperability between blockchain networks

VI. Conclusion

GUSD and ETH serve different purposes in the cryptocurrency ecosystem. GUSD offers stability and yield for conservative investors, while ETH provides exposure to the growth and innovation in the blockchain space. Investors should consider their risk tolerance and investment goals when choosing between these assets. The current market sentiment indicates caution, with the Fear & Greed Index at 29 (Fear), suggesting potential opportunities for long-term investors in both assets.

II. Core Factors Influencing GUSD vs ETH Investment Value

Supply Mechanism Comparison (Tokenomics)

- GUSD: Fully collateralized stablecoin with a 1:1 USD backing mechanism; supply expands and contracts based on market demand and redemptions

- ETH: Deflationary model since the EIP-1559 implementation; controlled issuance with burning mechanism through transaction fees

- 📌 Historical pattern: While ETH's reducing supply creates upward price pressure during demand increases, GUSD maintains stable value regardless of market conditions due to its dollar peg.

Institutional Adoption and Market Applications

- Institutional holdings: ETH has gained significant institutional interest through ETFs and treasury holdings, while GUSD serves primarily as a USD-pegged trading and settlement instrument

- Enterprise adoption: GUSD functions primarily in trading pairs and settlement systems, while ETH powers the entire Ethereum ecosystem including smart contracts and decentralized applications

- Regulatory attitudes: Stablecoins like GUSD face increasing regulatory scrutiny regarding reserve backing and financial stability, while ETH has generally received more regulatory clarity as a non-security digital asset in most jurisdictions

Technical Development and Ecosystem Building

- ETH technical upgrades: The Ethereum network has undergone major improvements including the transition to Proof of Stake, with scalability solutions like sharding and Layer 2 networks enhancing transaction throughput and efficiency

- Ecosystem comparison: ETH dominates in DeFi applications, NFT markets, and smart contract functionality, while GUSD serves primarily as a stablecoin within trading and payment systems

Macroeconomic Factors and Market Cycles

- Performance during inflation: ETH has shown some properties as an inflation hedge during certain market cycles, while GUSD maintains stable value but suffers from the same inflation erosion as the US dollar

- Macroeconomic monetary policy: Interest rate changes directly impact GUSD's competitiveness versus other yield-bearing instruments, while ETH price action is more correlated with risk asset sentiment and technology adoption cycles

- Geopolitical factors: Cross-border transaction demand benefits both assets, with GUSD offering dollar stability and ETH providing censorship-resistant value transfer

III. 2025-2030 Price Prediction: GUSD vs ETH

Short-term Prediction (2025)

- GUSD: Conservative $1 | Optimistic $1

- ETH: Conservative $2796.92 - $3884.61 | Optimistic $3884.61 - $4156.53

Mid-term Prediction (2027)

- ETH may enter a growth phase, with an estimated price range of $2779.02 - $5558.04

- Key drivers: Institutional capital inflow, ETF, ecosystem development

Long-term Prediction (2030)

- GUSD: Base scenario $1 | Optimistic scenario $1

- ETH: Base scenario $3662.40 - $6658.91 | Optimistic scenario $6658.91 - $8257.05

Disclaimer

GUSD:

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 1 | 1 | 1 | 0 |

| 2026 | 1 | 1 | 1 | 0 |

| 2027 | 1 | 1 | 1 | 0 |

| 2028 | 1 | 1 | 1 | 0 |

| 2029 | 1 | 1 | 1 | 0 |

| 2030 | 1 | 1 | 1 | 0 |

ETH:

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 4156.5327 | 3884.61 | 2796.9192 | 0 |

| 2026 | 4663.862766 | 4020.57135 | 2532.9599505 | 3 |

| 2027 | 5558.03783424 | 4342.217058 | 2779.01891712 | 11 |

| 2028 | 6336.1631310336 | 4950.12744612 | 3613.5930356676 | 27 |

| 2029 | 7674.677592464448 | 5643.1452885768 | 4627.379136632976 | 45 |

| 2030 | 8257.05018624557376 | 6658.911440520624 | 3662.4012922863432 | 71 |

IV. Investment Strategy Comparison: GUSD vs ETH

Long-term vs Short-term Investment Strategies

- GUSD: Suitable for investors seeking stable value and consistent yield

- ETH: Suitable for investors focused on long-term growth potential and ecosystem development

Risk Management and Asset Allocation

- Conservative investors: GUSD: 70% vs ETH: 30%

- Aggressive investors: GUSD: 30% vs ETH: 70%

- Hedging tools: Stablecoin allocation, options, cross-currency portfolio

V. Potential Risk Comparison

Market Risk

- GUSD: Limited price volatility but susceptible to stablecoin market sentiment

- ETH: High volatility and susceptibility to overall crypto market trends

Technical Risk

- GUSD: Centralization risks, smart contract vulnerabilities

- ETH: Scalability challenges, network congestion during high demand

Regulatory Risk

- Global regulatory policies have different impacts on stablecoins and smart contract platforms

VI. Conclusion: Which Is the Better Buy?

📌 Investment Value Summary:

- GUSD advantages: Stable value, daily rewards, low volatility

- ETH advantages: Growth potential, ecosystem dominance, institutional adoption

✅ Investment Advice:

- Novice investors: Consider a higher allocation to GUSD for stability

- Experienced investors: Balance between GUSD for stability and ETH for growth

- Institutional investors: Evaluate ETH for long-term blockchain exposure and GUSD for treasury management

⚠️ Risk Warning: The cryptocurrency market is highly volatile. This article does not constitute investment advice. None

VII. FAQ

Q1: What are the main differences between GUSD and ETH? A: GUSD is a stablecoin pegged to the US dollar, offering stability and daily rewards. ETH is the native cryptocurrency of the Ethereum blockchain, known for its smart contract functionality and potential for price appreciation.

Q2: Which asset is more suitable for risk-averse investors? A: GUSD is generally more suitable for risk-averse investors due to its stable value and lower volatility compared to ETH.

Q3: What factors could drive ETH's price growth in the future? A: Factors that could drive ETH's price growth include increased adoption of Ethereum-based applications, successful implementation of Ethereum 2.0 upgrades, growing institutional interest, and expansion of the DeFi and NFT ecosystems.

Q4: How do regulatory risks compare between GUSD and ETH? A: GUSD faces regulatory risks related to stablecoin oversight and reserve requirements, while ETH faces broader cryptocurrency regulations and potential scrutiny of its status as a non-security asset.

Q5: Can GUSD be used in decentralized finance (DeFi) applications like ETH? A: While GUSD can be used in some DeFi applications, ETH has much wider support and integration across the DeFi ecosystem due to its role as the native currency of the Ethereum network.

Q6: How do the long-term price predictions for GUSD and ETH differ? A: GUSD is expected to maintain its $1 value long-term due to its stablecoin nature. ETH has more variable predictions, with optimistic scenarios suggesting potential growth to $6,658.91 - $8,257.05 by 2030.

Q7: What are the key factors to consider when choosing between GUSD and ETH for investment? A: Key factors include risk tolerance, investment goals, market outlook, regulatory environment, technological developments, and overall portfolio strategy. GUSD offers stability and yield, while ETH provides exposure to the growth of the Ethereum ecosystem.

Share

Content