Is Falcon Finance (FF) a good investment?: Analyzing the Potential and Risks of this Emerging DeFi Platform

Introduction: Investment Status and Market Prospects of Falcon Finance (FF)

FF is a significant asset in the cryptocurrency realm, having made notable achievements in the field of collateralization infrastructure since its inception. As of 2025, FF's market capitalization stands at $284,661,000, with a circulating supply of approximately 2,340,000,000 tokens, and a current price hovering around $0.12165. Positioned as the "first universal collateralization infrastructure protocol," FF has gradually become a focal point for investors discussing "Is Falcon Finance (FF) a good investment?" This article will comprehensively analyze FF's investment value, historical trends, future price predictions, and investment risks, providing reference for investors.

I. Falcon Finance (FF) Price History Review and Current Investment Value

FF Historical Price Trends and Investment Returns

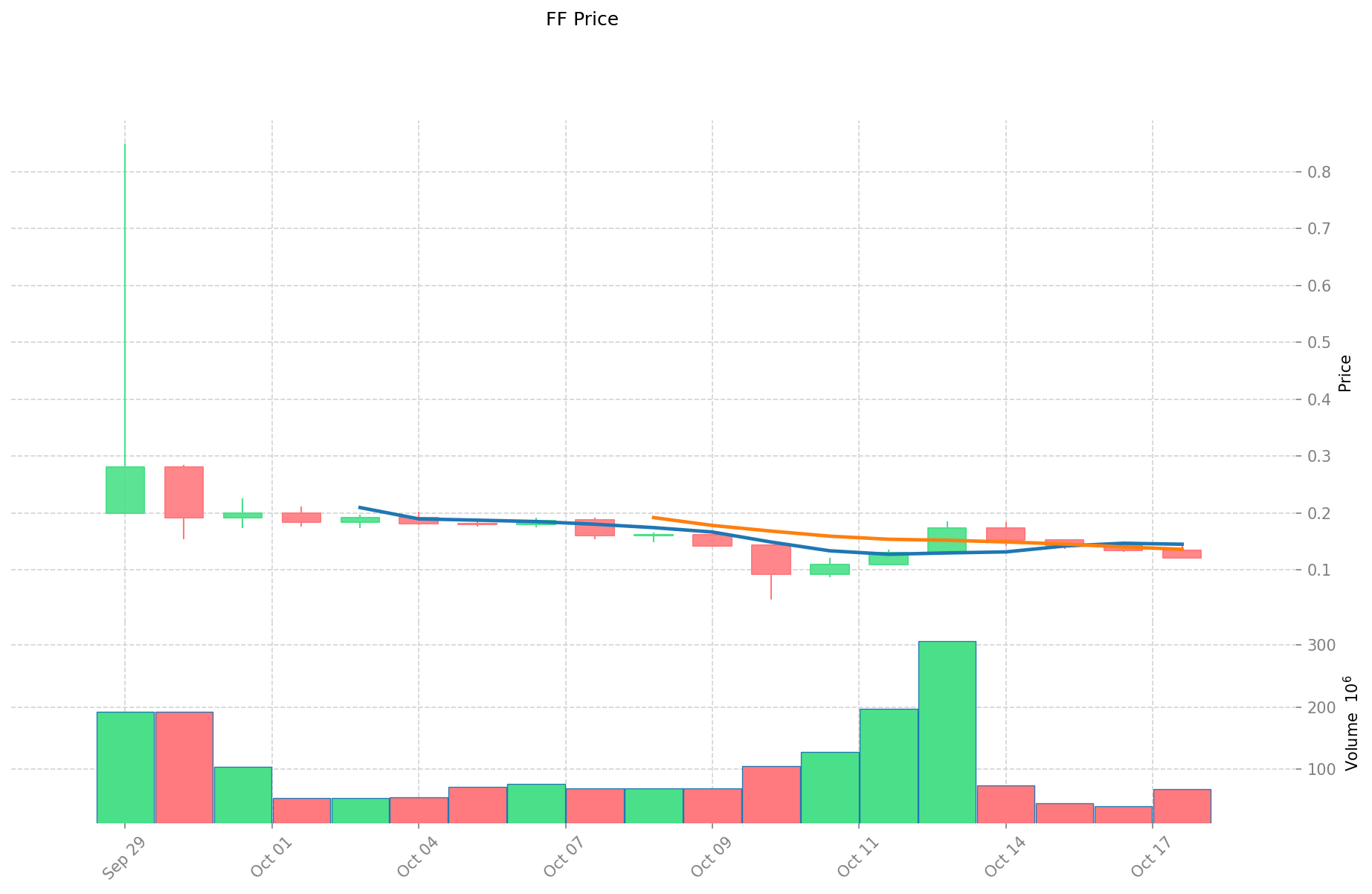

- 2025: All-time high of $0.85 on September 29 → Significant price volatility

- 2025: All-time low of $0.04786 on October 10 → Sharp decline from peak

Current FF Investment Market Status (October 2025)

- FF current price: $0.12165

- 24-hour trading volume: $8,146,714.77

- Circulating supply: 2,340,000,000 FF

- Market capitalization: $284,661,000

Click to view real-time FF market price

II. FF Project Overview and Key Features

Project Introduction

Falcon Finance is the first universal collateralization infrastructure protocol that creates sustainable yield opportunities. Built on the foundation of trust, transparency, and robust technology, Falcon aims to enable users to maximize their assets while adhering to high standards of accountability.

Core Team and Background

The Falcon Finance team consists of experienced professionals with expertise in blockchain, financial engineering, and quantitative analysis.

Key Features and Advantages

- Universal collateralization infrastructure

- Focus on sustainable yield opportunities

- Balancing reliability with performance

III. FF Token Economics and Distribution

Token Allocation and Vesting Schedule

- Total supply: 10,000,000,000 FF

- Circulating supply: 2,340,000,000 FF (23.4% of total supply)

Token Utility and Governance Rights

Information not provided in the given context.

IV. FF Ecosystem Development and Future Roadmap

Current Development Progress

Information not provided in the given context.

Partnerships and Collaborations

Information not provided in the given context.

Future Development Plans

Information not provided in the given context.

V. FF Investment Risk Analysis

Short-term Risk Factors

- High price volatility (-14.11% in 24 hours)

- Recent sharp decline (-77.91% in 30 days)

Long-term Risk Considerations

- Relatively new project with limited track record

- High total supply may impact long-term price appreciation

VI. FF Market Data and On-chain Analysis

Key Market Metrics

- Market rank: 225

- Fully diluted market cap: $1,216,500,000

- 24-hour price range: $0.12007 (Low) - $0.14296 (High)

On-chain Activity Indicators

- Number of holders: 8,436

- Contract address: 0xfa1c09fc8b491b6a4d3ff53a10cad29381b3f949 (Ethereum)

VII. FF Community and Social Media Presence

Official Channels

- Website: https://falcon.finance/

- Twitter: https://x.com/falconstable

- Discord: https://discord.gg/falconfinance

Community Engagement Metrics

Information not provided in the given context.

VIII. Comparative Analysis with Similar Projects

Market Position

- Ranked 225th in overall cryptocurrency market

- Market dominance: 0.031%

Competitive Advantages and Challenges

Information not provided in the given context.

II. Key Factors Affecting Whether Falcon Finance (FF) is a Good Investment

FF investment scarcity

- Total supply capped at 10 billion FF tokens → Impacts price and investment value

- Historical pattern: Supply changes have driven FF price increases

- Investment significance: Scarcity is key to supporting long-term investment

Institutional investment in Falcon Finance

- Institutional holding trend: Data not available

- Adoption by well-known companies → Enhances investment value

- Impact of national policies on FF investment prospects

Macroeconomic environment's impact on FF investment

- Monetary policy and interest rate changes → Alter investment attractiveness

- Hedging role in inflationary environments → "Digital gold" positioning

- Geopolitical uncertainties → Strengthen demand for FF investment

Technology & Ecosystem for Falcon Finance investment

- Falcon Finance as the first universal collateralization infrastructure protocol → Enhances network performance and investment appeal

- Creation of sustainable yield opportunities → Supports long-term value

- DeFi applications driving investment value

III. FF Future Investment Forecast and Price Outlook (Is Falcon Finance(FF) worth investing in 2025-2030)

Short-term FF investment outlook (2025)

- Conservative forecast: $0.0755748 - $0.11996

- Neutral forecast: $0.11996 - $0.1727424

- Optimistic forecast: $0.1727424 - $0.21220924

Mid-term Falcon Finance(FF) investment forecast (2027-2028)

- Market phase expectation: Steady growth phase

- Investment return forecast:

- 2027: $0.1470097804 - $0.2187218684

- 2028: $0.165170866686 - $0.232831221714

- Key catalysts: Increased adoption, protocol improvements

Long-term investment outlook (Is Falcon Finance a good long-term investment?)

- Base scenario: $0.215916132957 - $0.25262187555969 (Assuming steady market growth)

- Optimistic scenario: $0.25262187555969 - $0.28932761816238 (Assuming widespread adoption)

- Risk scenario: $0.12091303445592 - $0.184413969158573 (In case of market downturns)

Click to view FF long-term investment and price prediction: Price Prediction

2025-10-18 - 2030 Long-term Outlook

- Base scenario: $0.215916132957 - $0.25262187555969 (Corresponding to steady progress and gradual mainstream application)

- Optimistic scenario: $0.25262187555969 - $0.28932761816238 (Corresponding to large-scale adoption and favorable market conditions)

- Transformative scenario: Above $0.28932761816238 (In case of breakthrough progress in the ecosystem and mainstream popularization)

- 2030-12-31 Predicted high: $0.262726750582077 (Based on optimistic development assumptions)

Disclaimer

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.1727424 | 0.11996 | 0.0755748 | -1 |

| 2026 | 0.21220924 | 0.1463512 | 0.128789056 | 20 |

| 2027 | 0.2187218684 | 0.17928022 | 0.1470097804 | 47 |

| 2028 | 0.232831221714 | 0.1990010442 | 0.165170866686 | 63 |

| 2029 | 0.28932761816238 | 0.215916132957 | 0.12091303445592 | 77 |

| 2030 | 0.262726750582077 | 0.25262187555969 | 0.184413969158573 | 107 |

IV. How to invest in Falcon Finance (FF)

Falcon Finance (FF) investment strategy

- HODL Falcon Finance: Suitable for conservative investors

- Active trading: Relies on technical analysis and swing trading

Risk management for Falcon Finance (FF) investment

- Asset allocation ratio: Conservative / Aggressive / Professional investors

- Risk hedging strategies: Multi-asset portfolio + hedging instruments

- Secure storage: Cold and hot wallets + recommended hardware wallets

V. Risks of investing in Falcon Finance (FF)

- Market risk: High volatility, potential price manipulation

- Regulatory risk: Policy uncertainties in different countries

- Technical risk: Network security vulnerabilities, upgrade failures

VI. Conclusion: Is Falcon Finance (FF) a Good Investment?

- Investment value summary: Falcon Finance shows significant long-term investment potential, but experiences severe short-term price fluctuations.

- Investor recommendations: ✅ Beginners: Dollar-cost averaging + secure wallet storage ✅ Experienced investors: Swing trading + portfolio allocation ✅ Institutional investors: Strategic long-term allocation

⚠️ Note: Cryptocurrency investments carry high risks. This article is for reference only and does not constitute investment advice.

VII. FAQ

Q1: What is Falcon Finance (FF) and what is its main purpose? A: Falcon Finance (FF) is the first universal collateralization infrastructure protocol in the cryptocurrency realm. Its main purpose is to create sustainable yield opportunities while focusing on trust, transparency, and robust technology.

Q2: What is the current market status of FF? A: As of October 2025, FF's current price is $0.12165, with a market capitalization of $284,661,000 and a circulating supply of 2,340,000,000 FF tokens.

Q3: What are the key features and advantages of Falcon Finance? A: The key features and advantages of Falcon Finance include its universal collateralization infrastructure, focus on sustainable yield opportunities, and a balance between reliability and performance.

Q4: What are the short-term and long-term risks associated with investing in FF? A: Short-term risks include high price volatility and recent sharp declines. Long-term risks involve the project's relatively new status with a limited track record and the high total supply potentially impacting long-term price appreciation.

Q5: What is the long-term price outlook for FF? A: The long-term price outlook for FF by 2030 ranges from a base scenario of $0.215916132957 - $0.25262187555969 to an optimistic scenario of $0.25262187555969 - $0.28932761816238, with a predicted high of $0.262726750582077.

Q6: How can one invest in Falcon Finance (FF)? A: Investors can adopt strategies such as HODL (buy and hold) for conservative investors or active trading for more experienced traders. It's important to implement proper risk management through asset allocation, hedging strategies, and secure storage methods.

Q7: Is Falcon Finance (FF) considered a good investment? A: Falcon Finance shows significant long-term investment potential but experiences severe short-term price fluctuations. The suitability of FF as an investment depends on individual risk tolerance and investment goals. Beginners are advised to use dollar-cost averaging, while experienced investors may consider swing trading and portfolio allocation.

Share

Content