QTUM vs DOT: Comparing Two Innovative Blockchain Platforms for Smart Contract Development

Introduction: QTUM vs DOT Investment Comparison

In the cryptocurrency market, the comparison between QTUM vs DOT has been an unavoidable topic for investors. The two not only show significant differences in market cap ranking, application scenarios, and price performance, but also represent different positioning in the crypto asset space.

Qtum (QTUM): Since its launch in 2017, it has gained market recognition for its unique approach of combining Bitcoin's UTXO model with Ethereum's smart contract functionality.

Polkadot (DOT): Introduced in 2020, it has been hailed as the "Internet of Blockchains," aiming to facilitate interoperability between different blockchain networks.

This article will comprehensively analyze the investment value comparison between QTUM and DOT, focusing on historical price trends, supply mechanisms, institutional adoption, technological ecosystems, and future predictions, attempting to answer the question investors are most concerned about:

"Which is the better buy right now?"

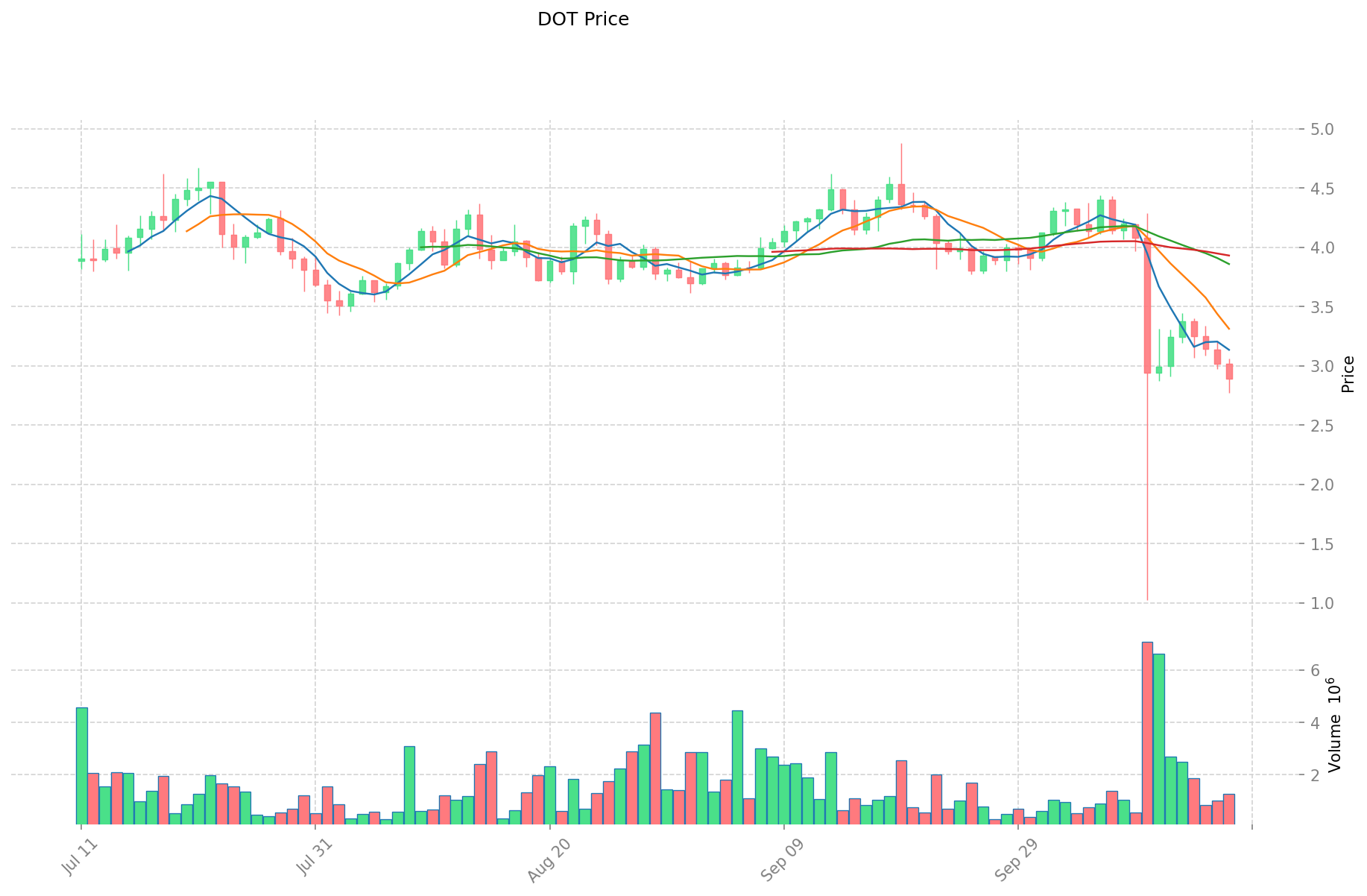

I. Price History Comparison and Current Market Status

QTUM and DOT Historical Price Trends

- 2018: QTUM reached its all-time high of $100.22 on January 6, 2018.

- 2021: DOT reached its all-time high of $54.98 on November 4, 2021.

- Comparative analysis: QTUM has fallen from its all-time high of $100.22 to a current price of $1.903, while DOT has dropped from its peak of $54.98 to $2.908.

Current Market Situation (2025-10-18)

- QTUM current price: $1.903

- DOT current price: $2.908

- 24-hour trading volume: QTUM $143,992.95 vs DOT $3,625,124.41

- Market Sentiment Index (Fear & Greed Index): 23 (Extreme Fear)

Click to view real-time prices:

- Check QTUM current price Market Price

- Check DOT current price Market Price

II. Core Factors Affecting the Investment Value of QTUM vs DOT

Supply Mechanism Comparison (Tokenomics)

- QTUM: Fixed maximum supply of 107,822,406 QTUM tokens

- DOT: Inflationary model with approximately 10% annual inflation rate

- 📌 Historical Pattern: QTUM's fixed supply creates potential scarcity value, while DOT's inflation model rewards participation in network security but may create selling pressure.

Institutional Adoption and Market Applications

- Institutional Holdings: DOT has greater institutional interest, being listed on more major exchanges and included in more institutional products

- Enterprise Adoption: DOT has stronger enterprise adoption through Substrate framework enabling custom blockchain development, while QTUM's enterprise solutions are more limited in scope

- Regulatory Attitudes: Both projects maintain compliance focus, though DOT's higher market visibility has attracted more regulatory attention

Technical Development and Ecosystem Building

- QTUM Technical Upgrades: Implementation of the Bitcoin UTXO model combined with Ethereum Virtual Machine for smart contracts; DGP (Decentralized Governance Protocol) for network parameter updates

- DOT Technical Development: Substrate framework for custom blockchain creation, cross-chain interoperability through parachains, and shared security model

- Ecosystem Comparison: DOT has a significantly larger ecosystem with numerous parachains, DeFi protocols, and NFT projects; QTUM's ecosystem is smaller but focuses on enterprise applications and DeFi

Macroeconomic and Market Cycles

- Inflation Environment Performance: Neither has proven strong inflation-hedging capabilities compared to BTC or ETH

- Macroeconomic Monetary Policy: Both are highly correlated with overall crypto market conditions and affected by Federal Reserve decisions

- Geopolitical Factors: DOT's focus on interoperability potentially positions it better for cross-border applications in fragmented regulatory environments

III. 2025-2030 Price Prediction: QTUM vs DOT

Short-term Prediction (2025)

- QTUM: Conservative $1.18-$1.91 | Optimistic $1.91-$2.06

- DOT: Conservative $1.83-$2.91 | Optimistic $2.91-$4.07

Mid-term Prediction (2027)

- QTUM may enter a growth phase, with prices expected in the range of $2.08-$3.06

- DOT may enter a consolidation phase, with prices expected in the range of $2.28-$4.59

- Key drivers: Institutional fund inflows, ETF, ecosystem development

Long-term Prediction (2030)

- QTUM: Base scenario $3.91-$4.97 | Optimistic scenario $4.97-$5.96

- DOT: Base scenario $5.82-$7.28 | Optimistic scenario $7.28-$8.73

Disclaimer

QTUM:

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 2.05956 | 1.907 | 1.18234 | 0 |

| 2026 | 2.3601032 | 1.98328 | 1.8246176 | 4 |

| 2027 | 3.062085156 | 2.1716916 | 2.084823936 | 14 |

| 2028 | 3.89916368322 | 2.616888378 | 1.51779525924 | 37 |

| 2029 | 4.561236442854 | 3.25802603061 | 2.3131984817331 | 71 |

| 2030 | 4.96523167064964 | 3.909631236732 | 2.3457787420392 | 105 |

DOT:

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 4.0726 | 2.909 | 1.83267 | 0 |

| 2026 | 4.782396 | 3.4908 | 2.96718 | 20 |

| 2027 | 4.59162378 | 4.136598 | 2.2751289 | 42 |

| 2028 | 5.7606263748 | 4.36411089 | 2.9239542963 | 50 |

| 2029 | 6.58107922212 | 5.0623686324 | 3.239915924736 | 74 |

| 2030 | 7.277154909075 | 5.82172392726 | 3.493034356356 | 100 |

IV. Investment Strategy Comparison: QTUM vs DOT

Long-term vs Short-term Investment Strategies

- QTUM: Suitable for investors focused on enterprise blockchain solutions and UTXO-based smart contracts

- DOT: Suitable for investors interested in interoperability and scalable blockchain ecosystems

Risk Management and Asset Allocation

- Conservative investors: QTUM: 30% vs DOT: 70%

- Aggressive investors: QTUM: 40% vs DOT: 60%

- Hedging tools: Stablecoin allocation, options, cross-currency portfolios

V. Potential Risk Comparison

Market Risks

- QTUM: Lower liquidity and trading volume compared to DOT

- DOT: Higher correlation with overall crypto market trends

Technical Risks

- QTUM: Scalability, network stability

- DOT: Parachain auction dynamics, cross-chain security

Regulatory Risks

- Global regulatory policies may have different impacts on both, with DOT potentially facing more scrutiny due to its higher market visibility

VI. Conclusion: Which Is the Better Buy?

📌 Investment Value Summary:

- QTUM advantages: Fixed supply, UTXO model with smart contracts, focus on enterprise solutions

- DOT advantages: Larger ecosystem, interoperability features, institutional interest

✅ Investment Advice:

- Novice investors: Consider a higher allocation to DOT due to its larger ecosystem and market presence

- Experienced investors: Balanced approach, potentially higher QTUM allocation for diversification

- Institutional investors: Focus on DOT for its interoperability features and broader market adoption

⚠️ Risk Warning: The cryptocurrency market is highly volatile. This article does not constitute investment advice. None

VII. FAQ

Q1: What are the main differences between QTUM and DOT? A: QTUM combines Bitcoin's UTXO model with Ethereum's smart contract functionality, while DOT focuses on interoperability between different blockchain networks. QTUM has a fixed maximum supply, whereas DOT has an inflationary model. DOT has a larger ecosystem and more institutional interest, while QTUM focuses more on enterprise blockchain solutions.

Q2: Which cryptocurrency has performed better historically, QTUM or DOT? A: Historically, QTUM reached its all-time high of $100.22 in January 2018, while DOT reached its all-time high of $54.98 in November 2021. However, both have since fallen significantly from their peaks. As of 2025-10-18, DOT is trading at a higher price ($2.908) compared to QTUM ($1.903).

Q3: How do the supply mechanisms of QTUM and DOT differ? A: QTUM has a fixed maximum supply of 107,822,406 tokens, which creates potential scarcity value. DOT, on the other hand, has an inflationary model with approximately 10% annual inflation rate, which rewards participation in network security but may create selling pressure.

Q4: Which cryptocurrency has better institutional adoption? A: DOT has greater institutional interest, being listed on more major exchanges and included in more institutional products. It also has stronger enterprise adoption through its Substrate framework, which enables custom blockchain development.

Q5: What are the long-term price predictions for QTUM and DOT? A: By 2030, the base scenario predicts QTUM to be in the range of $3.91-$4.97, with an optimistic scenario of $4.97-$5.96. For DOT, the base scenario predicts a range of $5.82-$7.28, with an optimistic scenario of $7.28-$8.73.

Q6: How should investors allocate their portfolios between QTUM and DOT? A: For conservative investors, a suggested allocation is 30% QTUM and 70% DOT. For aggressive investors, the suggested allocation is 40% QTUM and 60% DOT. However, these are general guidelines and individual investment decisions should be based on personal risk tolerance and investment goals.

Q7: What are the main risks associated with investing in QTUM and DOT? A: For QTUM, the main risks include lower liquidity and trading volume compared to DOT, as well as potential scalability and network stability issues. For DOT, risks include higher correlation with overall crypto market trends, parachain auction dynamics, and cross-chain security concerns. Both face regulatory risks, with DOT potentially facing more scrutiny due to its higher market visibility.

Share

Content