USDE vs BCH: Comparing Digital Dollar and Bitcoin Cash in the Crypto Market

Introduction: Investment Comparison of USDE vs BCH

In the cryptocurrency market, the comparison between USDE vs BCH has always been a topic that investors cannot ignore. The two not only differ significantly in market cap ranking, application scenarios, and price performance, but also represent different crypto asset positioning.

USDE (USDE): Since its launch in 2023, it has gained market recognition for its positioning as a censorship-resistant, scalable, and stable crypto-native solution for money.

BCH (BCH): Since its inception in 2017, it has been hailed as a continuation of Satoshi's vision for global adoption, and is one of the cryptocurrencies with high global trading volume and market capitalization.

This article will comprehensively analyze the investment value comparison between USDE vs BCH, focusing on historical price trends, supply mechanisms, institutional adoption, technical ecosystems, and future predictions, and attempt to answer the question investors care most about:

"Which is the better buy right now?"

I. Price History Comparison and Current Market Status

USDE and BCH Historical Price Trends

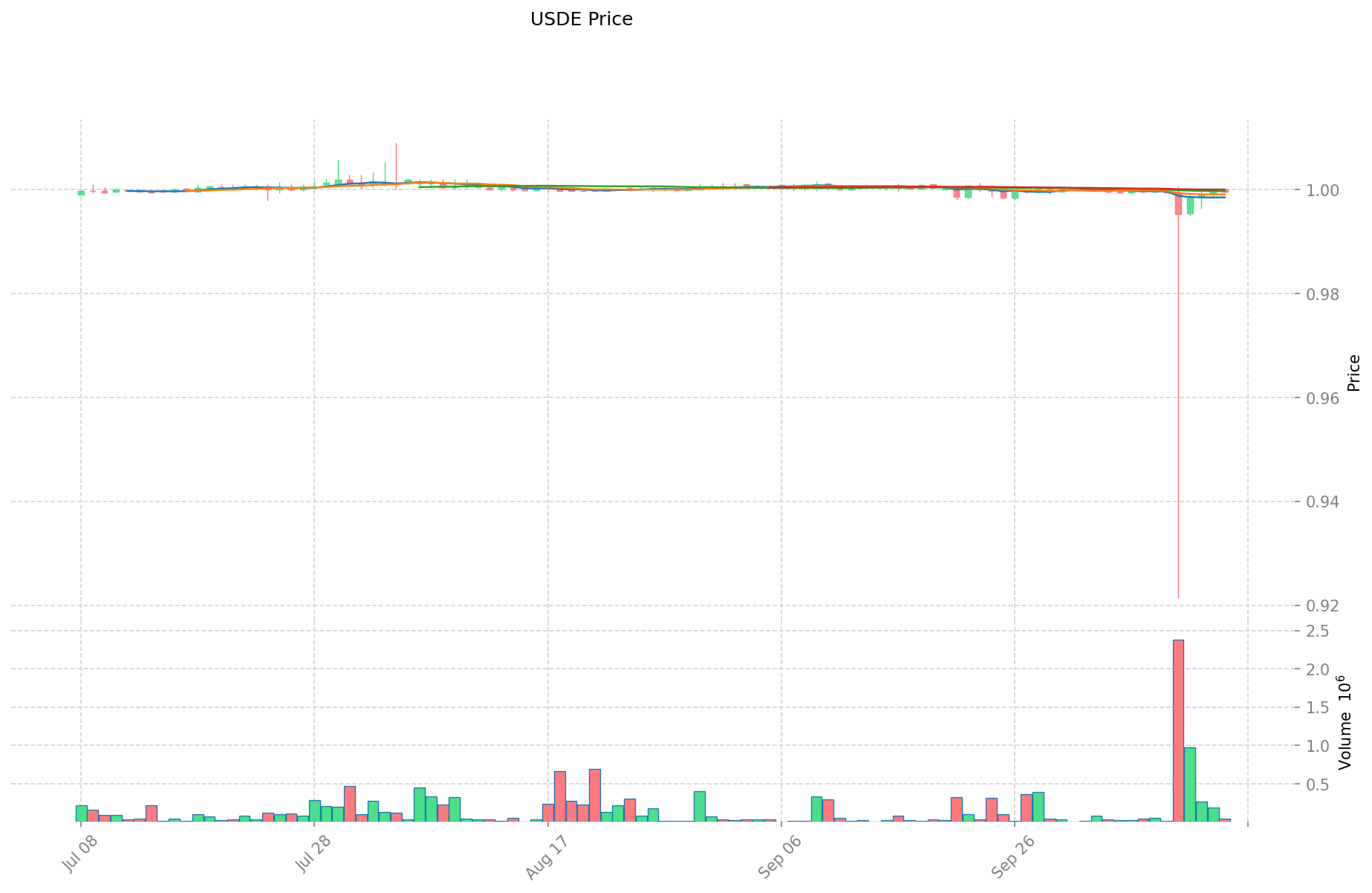

- 2024: USDE launched and maintained stability around $1 due to its stablecoin design.

- 2017: BCH forked from Bitcoin, reaching an all-time high of $3,785.82 on December 20, 2017.

- Comparative analysis: During market cycles, USDE has remained relatively stable around $1, while BCH experienced significant volatility, dropping from its all-time high to a low of $76.93 on December 16, 2018.

Current Market Situation (2025-10-15)

- USDE current price: $0.9995

- BCH current price: $535.74

- 24-hour trading volume: USDE $32,957,110 vs BCH $5,737,389

- Market Sentiment Index (Fear & Greed Index): 34 (Fear)

Click to view real-time prices:

- View USDE current price Market Price

- View BCH current price Market Price

Comparative Analysis: USDe vs BCH Investment Value Factors

I. Introduction to USDe and BCH

USDe is a next-generation decentralized stablecoin launched by Ethena Labs on the Ethereum blockchain, designed to maintain a 1:1 peg with the US dollar through a unique combination of collateralized assets and derivatives hedging. BCH (Bitcoin Cash) originated as a fork of Bitcoin in 2017, primarily focused on solving transaction efficiency through increased block sizes.

II. Core Factors Affecting USDe vs BCH Investment Value

Supply Mechanism Comparison (Tokenomics)

- USDe: Collateral-backed synthetic dollar with 1:1 peg maintained through delta-neutral hedging strategy using ETH collateral and futures positions

- BCH: Fixed supply with halving mechanism similar to Bitcoin, with a maximum cap of 21 million coins

- 📌 Historical pattern: While BCH follows Bitcoin's deflationary model potentially driving cyclical price appreciation, USDe's value stability depends on its collateral quality and hedging effectiveness.

Institutional Adoption and Market Applications

- Institutional holdings: USDe has gained traction with its higher yield offerings (averaging 18% APY in 2024), attracting institutional liquidity

- Enterprise adoption: USDe serves primarily as a trading pair and DeFi asset, while BCH focuses on payment applications and cross-border transfers

- Regulatory attitudes: Stablecoins like USDe face increasing regulatory scrutiny, with the GENIUS Act potentially reducing risk while increasing compliance requirements; BCH faces varied regulatory treatment as a payment-focused cryptocurrency

Technical Development and Ecosystem Building

- USDe technical framework: Employs a delta-neutral strategy through balanced collateral and futures positions, with staking options through sUSDe offering additional yield

- BCH technical development: Focuses on payment efficiency through larger block sizes and lower fees, maintaining Bitcoin's core functionality with improved transaction throughput

- Ecosystem comparison: USDe is deeply integrated with DeFi protocols and trading platforms (23% of USDe is staked), while BCH ecosystem emphasizes merchant adoption and payment solutions

Macroeconomic Factors and Market Cycles

- Inflation performance: USDe designed specifically for stability against inflation through its dollar peg, while BCH's fixed supply gives it potential hedge characteristics similar to Bitcoin

- Macroeconomic monetary policy: USDe directly tied to USD strength/weakness, while BCH price more influenced by risk appetite and crypto market sentiment

- Geopolitical factors: USDe serves as a compliant dollar-equivalent in cross-border transactions (71% of Latin American businesses using stablecoins over SWIFT), while BCH offers censorship-resistant payment infrastructure

III. 2025-2030 Price Prediction: USDE vs BCH

Short-term Prediction (2025)

- USDE: Conservative $0.77 - $1.00 | Optimistic $1.00 - $1.08

- BCH: Conservative $304.55 - $534.30 | Optimistic $534.30 - $609.10

Mid-term Prediction (2027)

- USDE may enter a growth phase, with estimated prices ranging from $0.96 to $1.34

- BCH may enter a bull market, with estimated prices ranging from $484.23 to $975.38

- Key drivers: Institutional capital inflow, ETF, ecosystem development

Long-term Prediction (2030)

- USDE: Base scenario $1.28 - $1.66 | Optimistic scenario $1.66 - $2.08

- BCH: Base scenario $715.43 - $1067.80 | Optimistic scenario $1067.80 - $1388.14

Disclaimer: The above predictions are based on historical data and market analysis. Cryptocurrency markets are highly volatile and subject to various unpredictable factors. These projections should not be considered as financial advice or guarantees of future performance.

USDE:

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 1.079676 | 0.9997 | 0.769769 | 0 |

| 2026 | 1.51794448 | 1.039688 | 0.95651296 | 4 |

| 2027 | 1.342757052 | 1.27881624 | 0.95911218 | 27 |

| 2028 | 1.9006406367 | 1.310786646 | 1.20592371432 | 31 |

| 2029 | 1.7181135962445 | 1.60571364135 | 0.9794853212235 | 60 |

| 2030 | 2.077392023496562 | 1.66191361879725 | 1.279673486473882 | 66 |

BCH:

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 609.102 | 534.3 | 304.551 | 0 |

| 2026 | 811.81542 | 571.701 | 445.92678 | 6 |

| 2027 | 975.3790761 | 691.75821 | 484.230747 | 29 |

| 2028 | 916.925507355 | 833.56864305 | 658.5192280095 | 55 |

| 2029 | 1260.3557882916 | 875.2470752025 | 446.376008353275 | 63 |

| 2030 | 1388.141861271165 | 1067.80143174705 | 715.4269592705235 | 99 |

IV. Investment Strategy Comparison: USDe vs BCH

Long-term vs Short-term Investment Strategies

- USDe: Suitable for investors seeking stable returns and DeFi yield opportunities

- BCH: Suitable for investors focused on payment solutions and potential for price appreciation

Risk Management and Asset Allocation

- Conservative investors: USDe: 70% vs BCH: 30%

- Aggressive investors: USDe: 40% vs BCH: 60%

- Hedging tools: Stablecoin allocation, options, cross-currency combinations

V. Potential Risk Comparison

Market Risks

- USDe: Collateral volatility, smart contract vulnerabilities

- BCH: High price volatility, market sentiment fluctuations

Technical Risks

- USDe: Scalability, network stability

- BCH: Mining centralization, security vulnerabilities

Regulatory Risks

- Global regulatory policies have different impacts on both assets

VI. Conclusion: Which Is the Better Buy?

📌 Investment Value Summary:

- USDe advantages: Stability, DeFi integration, yield potential

- BCH advantages: Payment efficiency, established ecosystem, potential for price appreciation

✅ Investment Advice:

- New investors: Consider a larger allocation to USDe for stability

- Experienced investors: Balanced portfolio with both assets based on risk tolerance

- Institutional investors: USDe for treasury management, BCH for diversification

⚠️ Risk Warning: The cryptocurrency market is highly volatile. This article does not constitute investment advice. None

VII. FAQ

Q1: What are the main differences between USDe and BCH? A: USDe is a stablecoin designed to maintain a 1:1 peg with the US dollar, while BCH is a cryptocurrency focused on payment efficiency. USDe uses a collateral-backed system with derivatives hedging, while BCH has a fixed supply with a halving mechanism similar to Bitcoin.

Q2: Which asset is more suitable for long-term investment? A: It depends on your investment goals. USDe is more suitable for investors seeking stable returns and DeFi yield opportunities, while BCH may be better for those focused on payment solutions and potential price appreciation. Long-term investors should consider their risk tolerance and portfolio diversification strategy.

Q3: How do the price predictions for USDe and BCH compare for 2030? A: By 2030, USDe is predicted to range from $1.28 to $2.08 in optimistic scenarios, while BCH is projected to range from $715.43 to $1388.14. However, these predictions are subject to market volatility and various unpredictable factors.

Q4: What are the main risks associated with investing in USDe and BCH? A: For USDe, main risks include collateral volatility, smart contract vulnerabilities, and regulatory uncertainties. BCH faces risks such as high price volatility, market sentiment fluctuations, and potential mining centralization. Both assets are subject to broader cryptocurrency market risks and regulatory changes.

Q5: How do institutional adoptions differ between USDe and BCH? A: USDe has gained traction with institutions due to its higher yield offerings, averaging 18% APY in 2024. It's primarily used as a trading pair and DeFi asset. BCH, on the other hand, focuses more on payment applications and cross-border transfers, with emphasis on merchant adoption and payment solutions.

Q6: What factors should be considered when allocating investments between USDe and BCH? A: Consider your risk tolerance, investment goals, and market outlook. Conservative investors might allocate more to USDe (e.g., 70% USDe vs 30% BCH), while aggressive investors might favor BCH (e.g., 40% USDe vs 60% BCH). Also consider factors like DeFi integration, yield potential, payment efficiency, and ecosystem development when making your decision.

Share

Content