Bitcoin Price Prediction Analyst Sees Potential Drop To 50000 In 2026

Analyst Predicts Bitcoin Could Decline

Crypto market analyst NoLimit has issued a bold forecast on X, warning that Bitcoin could fall below $50,000 in 2026. This projection signals a potential drop of over 42% from its current price above $86,000. According to NoLimit, such a downturn could create a historic wealth transfer opportunity for investors and mark the most significant market reset in more than a decade.

Macroeconomic Factors Fuel Market Volatility

NoLimit highlights that the imbalance between US assets and liabilities is becoming more severe. Liabilities have surged from approximately $30 trillion in 2016 to over $60 trillion by 2025, while asset growth has lagged considerably. This structural imbalance may trigger a broader market correction, further affecting the prices of Bitcoin and other financial assets.

Potential Movements in Equities and Gold

The analyst expects that in 2026, US equities could undergo a sharp correction, with the S&P 500 Index potentially dropping by 40%. Certain technology stocks might even plunge 50% to 90%, echoing the collapse seen during the 2001 dot-com bubble. In contrast, gold is projected to climb to $6,500 as Bitcoin falls, positioning it as a premier safe-haven asset.

Banking Risks and Investment Strategies

NoLimit cautions that a wave of bank failures could emerge in 2026, driven in part by excessive debt, continued reliance by governments and corporations on low-interest loans, and the upcoming maturity of $1.2 trillion in commercial real estate loans between 2025 and 2026. Investors who maintain liquidity and strategically enter the market at its lows may capitalize on this wealth transfer.

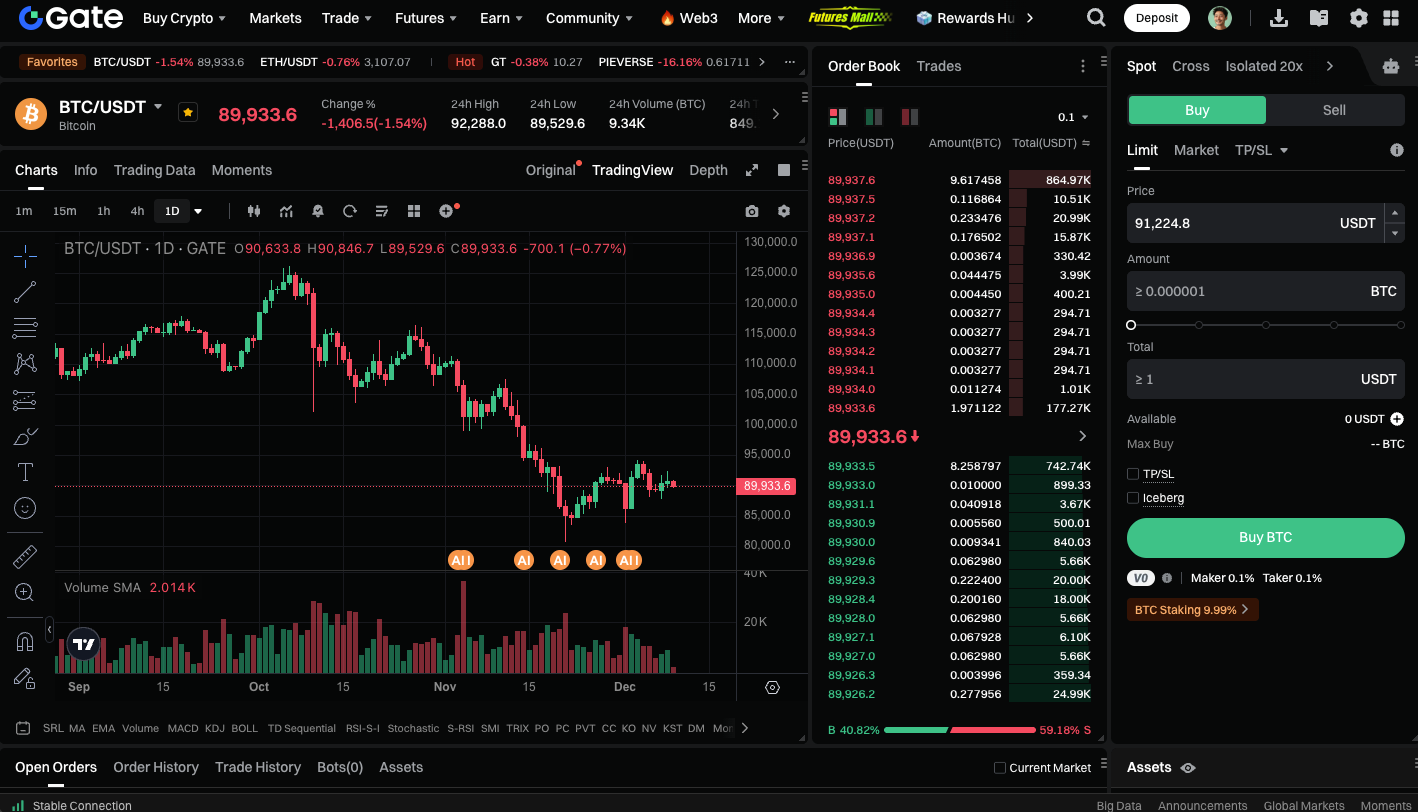

Start trading BTC spot now: https://www.gate.com/trade/BTC_USDT

Summary

While Bitcoin may face a significant short-term correction, the analyst sees this as a historic opportunity. Investors should monitor macroeconomic trends, stock market volatility, and gold’s trajectory, and prepare for the 2026 market reset by staying patient and maintaining liquidity.

Related Articles

2025 BTC Price Prediction: BTC Trend Forecast Based on Technical and Macroeconomic Data

Pi Coin Transaction Guide: How to Transfer to Gate.com

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

What is N2: An AI-Driven Layer 2 Solution