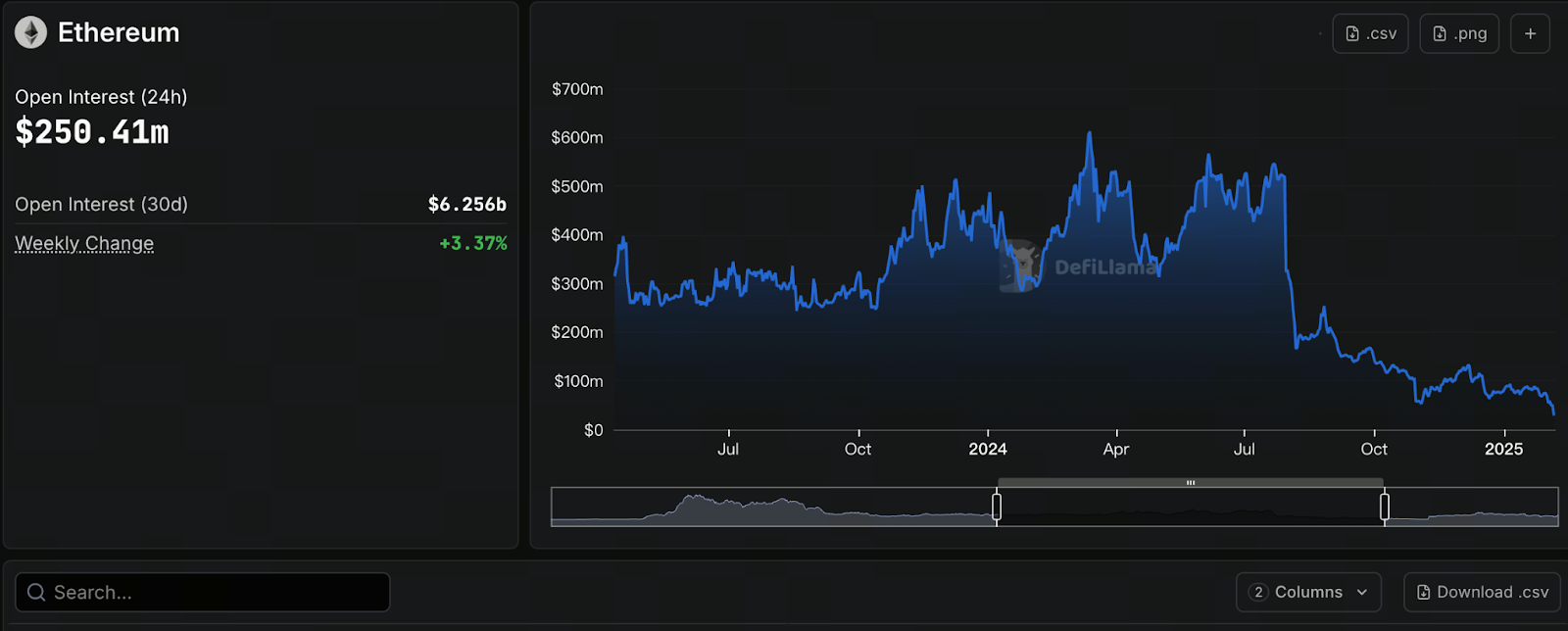

Ethereum Open Interest Drops 50% as $6.4B in Positions Vanish — Where Is ETH’s Next Major Turning Point?

Chart: https://defillama.com/open-interest/chain/ethereum

Open Interest is a core indicator for gauging the activity level and capital structure of the crypto derivatives market. It measures the total number of open long and short contracts that remain unsettled, providing insights into:

- Market speculation intensity

- Scale of leveraged positions

- Potential for price volatility

- Strength of buyer-seller dynamics

A rapid increase in Open Interest typically signals a flood of capital entering the market, rising leverage, and heightened volatility.

On the other hand, when Open Interest drops sharply in a short span—such as the recent halving—it indicates:

- Rapid unwinding of leveraged positions

- Mass withdrawal of short-term speculative capital

- Sudden decline in market activity

- Investors broadly shifting to the sidelines

Such shifts often disrupt price structures, halting or even reversing ongoing trends.

The Real Reason Behind the $6.4 Billion Contract Disappearance

The recent sharp drop in Ethereum Open Interest, based on a range of data and market behavior, can be attributed to several main factors:

Profit-Takers Exiting in Unison

Over the past few weeks, ETH has seen a pronounced rally, prompting many early long holders to lock in profits at the top, triggering a wave of long liquidations. This reflects a natural market cycle.

Market Expectations Turn Unstable

Entering a new cycle, the market has grown wary of several factors:

- Uncertainty around the Federal Reserve’s interest rate path

- Slowing pace of crypto capital inflows

- Unpredictable regulatory developments

- Lack of short-term accumulation by major institutions

These uncertainties may drive leveraged capital to adopt more conservative strategies.

High-Leverage Positions Forced Out or Voluntarily Exiting

Traders with high leverage are the most reactive—minor price swings can prompt large-scale exits. This time, capital left the derivatives market swiftly, driven by both voluntary withdrawals and forced liquidations.

Capital Rotates to More Stable Sectors

Institutional capital flows indicate:

- Rotation from ETH contracts to BTC

- Shift from derivatives to spot markets

- Movement from crypto markets to traditional financial assets

As capital moves into less volatile markets, derivatives contract volumes naturally shrink.

In summary, this is not mere “panic,” but the result of a comprehensive capital structure reshuffle.

How Does Market Sentiment Get Amplified?

Sharp fluctuations in Open Interest often serve as amplifiers of market sentiment.

Retail Investors:

When retail participants see headlines like “$6.4 billion in contracts evaporated,” panic can quickly set in, accelerating selling pressure across the market. This emotional contagion spreads far faster than in traditional markets.

Institutions:

Institutional investors focus on liquidity changes. When they observe such a steep drop in OI, they may adjust short-term strategies:

- Reducing ETH leveraged exposure

- Hedging early against potential downside

- Waiting for new entry opportunities

Market Makers:

Market makers scale back liquidity provision in thin markets, making prices more susceptible to “lightweight orders” and amplifying volatility.

This leads to a chain reaction: small volatility → liquidations → panic → larger volatility.

ETH Short-Term and Mid-Term Price Analysis

Short Term (1–2 Weeks)

After a sharp drop in OI, ETH typically exhibits:

- Tighter trading ranges

- Sideways and choppy price action

- Greater reliance on spot market inflows for price movement

Major breakouts are unlikely in the short run, as most of the leveraged capital that drives price swings has exited.

Mid Term (1–3 Months)

The key factor is whether capital returns:

- If capital flows back into derivatives and OI rebounds → ETH could resume its uptrend

- If liquidity remains tight → ETH faces continued downward pressure

Currently, ETH’s market structure suggests a “wait-and-see” phase, awaiting new macro signals or on-chain narratives.

How Should Investors Respond?

1. Long-Term Investors (HODL)

Periods of low leverage and low OI are generally healthier and less volatile environments.

If you’re a long-term holder, this period is better suited for systematic dollar-cost averaging, not chasing rallies.

2. Leverage Traders

Recommendations:

- Pause high-leverage trading

- Monitor for OI recovery signals

- Manage position sizes and avoid chasing breakouts

The current market still has the potential to retest lower levels.

3. Beginners or Observers

This is not an ideal time for aggressive entries. Instead:

- Watch for capital inflows

- Wait for OI stabilization and clear price structure

- Avoid FOMO

Patience is key—opportunities often emerge as capital returns to the market.

Related Articles

2025 BTC Price Prediction: BTC Trend Forecast Based on Technical and Macroeconomic Data

Pi Coin Transaction Guide: How to Transfer to Gate.com

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

What is N2: An AI-Driven Layer 2 Solution