hyperfinancialisation

on the rise and ouroboric nature of gambling and financialisation

this piece was written as an accompaniment to long degeneracy

hyperfinancialisation & markets

hyperfinancialisation is an extreme stage of financialisation, which in turn is the process by which financial markets become dominant in an economy. in a hyperfinancialised economy, financial activities like speculative trading overshadow productive services which contribute more widely to society, while household wealth and inequality become increasingly tied to asset prices. to put it simply, wealth is no longer directly correlated to hard work and is disconnected from the means of production. this leads to more capital being channled into speculative activities and as keynes put it:

when the capital development of a country becomes a by-product of the activities of a casino, the job is likely to be ill-done - john maynard keynes

it is also good to understand markets. markets are important. we live in (mostly) free market economies, whereby willing buyers are matched with willing sellers, prices constantly update to reflect new information being priced in, winning traders constantly replace losing traders - in theory -and the decisions these traders make determine how scarce resources are allocated in our markets, improving the allocative efficiency of the market. in theory, markets are inherently meritocratic, which is reasonable. if traders determine where our scarce resources go, we would want those trading to be as good at capital allocation as possible.

therefore, in an idealised free market system, good traders would allocate capital to the socially desirable outcomes and be rewarded with more capital to allocate, while those worse at capital allocation would be punished with less capital to allocate. capital would naturally flow to those who allocate it best, with all of this happening concomitantly with manufacturing and services creating real output.

markets no longer fully achieve this. trading used to be an exclusive game. only those wealthy and well connected could partake in the 19th and much of the 20th century - trading on exchanges such as NYSE was restricted to licensed brokers and members, ordinary people had few opportunities to engage with markets. in addition to this, there was a high level of information asymmetry as market data wasn’t highly available.

this changed with the advent of digitalisation. with the introduction of phones and new technology, nascent apps started to democratize the process of investing, to its current evolution today, with apps like robinhood offering zero fee trading and access to options, prediction markets, and crypto. this development, while making investing more accessible and equitable, has ultimately served to increase the growing importance of markets in our day to day life.

hypergambling <> hyperfinancialisation

as a result of the rapid digitalisation of the late 20th century and early 21st century, financial speculation - hypergambling - is not only more accessible than ever, but more participated in than ever.

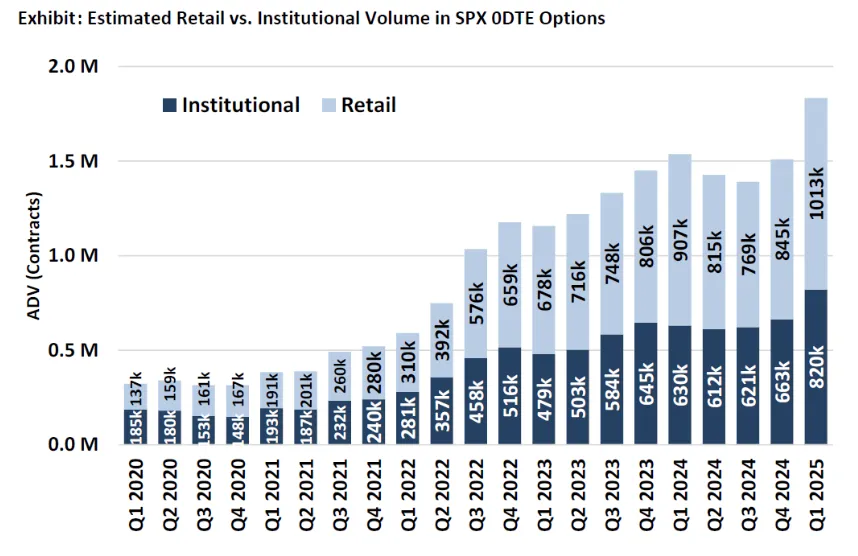

0dte options volume: can be seen as a proxy for retail gambling

one question might be whether the levels of (hyper)financialisation today is bad, to which i would say almost indubitably yes; with hyperfinancialisation, markets move away from their intended role of capital weighing machines and simply become a tool to get money. however, the question i would like to explore is more cause and effect; we live in a society where financialisation and gambling are prominent; yet it is unclear which is the cause and which is the effect. jez described hypergambling as a process whereby “real returns compress, [and] risk increases to compensate”, and i view hypergambling as one of two natural responses to hyperfinancialisation. however, unlike the other response, which is increasingly socialist attitudes in millennials, hypergambling catalyses the process of hyperfinancialisation, which in turn increases levels of hypergambling in an almost ouroboric feedback loop.

while hyperfinancialisation is a structural shift - societies coming to depend on markets more and more - hypergambling is a behavioural response to the decoupling between hard work and reward. hypergambling is not a new phenomenon per se, a 1999 study revealed that those in the US with a household income of <$10,000 spent 3% of their annual income on lottery tickets, with the motivation thought to be a desire to “correct” their low relative income status compared to their peers. however, in recent times with the increasing financialisation (and arguably digitalisation) of society, the popularity of gambling has been trending upward.

socialism as a response

we can now start to explore the first of what i described as the 2 natural responses to hyperfinancialisation;

thanks to the invention of social media and digitalisation, financialisation has penetrated large aspects of our livelihoods. our lives increasingly revolve around markets, which are now responsible for capital allocation more than ever. as a result, it is now nearly impossible to break onto the homeowner ladder from a young age, the median age of a homeowner is now a record 56, while the median age of first time homeowners is at 39, another record high. asset prices are decoupling from real wages, in part due to inflation, making it near impossible for younger people to accumulate capital. peter thiel discussed this as a growing reason for socialism:

“when one has too much student debt or if housing is too unaffordable, then one will have negative capital for a long time and/or find it very hard to start accumulating capital in the form of real estate; and if one has no stake in the capitalist system, then one may well turn against it.”

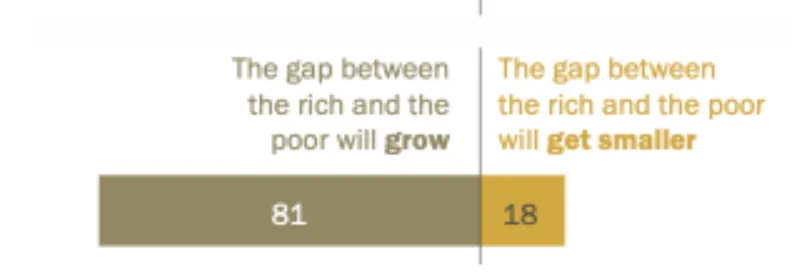

asset inflation and high housing prices (i would also argue mimetic desire and survivorship bias via social media have compounded this, but that’s a topic for another day) have reduced perceived social mobility, the idea of this broken social contract can be seen through the a recent poll by the wsj, in which only 31% of respondents stated that they believed the american dream - that if they work hard they will get ahead - still held true. additionally, most americans see this trend of financialisation continuing looking through to 2050, with most believing the gap between the rich and poor will only grow.

this pessimism only serves to reinforce the idea that rising asset prices will leave those without capital behind, and hard work cannot change that. when people no longer believe their lives can improve by working hard, they have no incentive to work hard in what they believe to be a “rigged” system favouring the already capital owning bourgeoisie. this has cumulated in the rise of socialism today, a structural response¹ to the growing financialisation of today’s world, in the hope that a more equitable distribution of assets can rekindle the link between hard work and rewards.

socialism is the ideological response hoping to bridge the gap between the bourgeoisie and the proletariat. however, with public trust in the government at just 22% as of May 2024, another natural response has occurred. instead of trusting in socialism to close the gap, an increasing number of people are simply hoping to (hyper)gamble their way into the upper class.

the ouroborus

as i mentioned earlier, people dreaming of gambling their way into the upper class is nothing new.

however, the mechanics of gambling have fundamentally changed with the advances of the internet. today, almost anyone at any age can gamble. once something that was frowned upon, it has embedded itself into society, thanks to its’ glorification on social media and increased accessibility.

the rise of gambling, as mentioned earlier, is a downstream of the rise of the internet. today, one doesn’t need to go to a physical casino to gamble, gambling is everywhere. anyone can spinup a robinhood account and start trading 0dte, crypto is equally as accessible, and online casino revenues are at all time highs.

as the nyt put it, is that

“today’s gamblers aren’t just retirees at poker tables. They’re young men on smartphones. And thanks to a series of quasi-legal innovations by the online wagering industry, Americans can now bet on virtually anything from their investment accounts.”

recently, google and polymarket announced a collaboration to display betting odds in search results. “Betting on football and elections is becoming as much a part of our lives as watching football and voting,” wrote the wall street journal. while much of this is social, i would argue the large majority is thanks to hyperfinancialisation, and even social gambling is a result of markets becoming more ingrained in our lives.

as household wealth becomes increasingly tied to asset prices with wage growth lagging behind, and perceived social mobility in relation to working hard decreases, it begets the question; why work hard if i cannot improve my standard of living? a recent study found that as households perceived odds of reaching homeownership declines, they consume more relative to their wealth, reduce work effort, and take on riskier investments. the same was found true for renters with low wealth, and these responses compound over lifecycles, further increasing wealth dispersion between those who own assets and those who don’t.

and now survivorship bias works its magic. success stories on social media of people becoming rich overnight gambling, conspicuous consumption and social signalling on instagram or day traders promising people they can quit their jobs create a wider degenerate mindsets. south korea is a perfect example of this; low perceived social mobility, rising income inequality, high property prices and gambling tendencies in normal south koreans. according to the ft, “speculative retail [is] a major force — accounting for more than half of daily turnover in the $2tn [korean stock] market.” they refer to themselves as the “sampo” generation - those who have given up on 3 things, dating, marriage and having children, due to a multitude of reasons: high youth unemployment and job insecurity, stagnant wages compared to living costs heavy household debt burdens and intense competition in education and the job market amongst others.

this phenomenon is not reserved to korea, japan’s satori generation and china’s tangping generation emulate this

and across the world in america, half of males 18-49 have a sports betting account, while 42% of Americans and 46% of Gen Z respondents agreed with the statement, “No matter how hard I work, I will never be able to afford a home I really love.” why slave away at a job you hate for minimum wage when you could make a week, a month or even a years salary in minutes in a single bet. as thiccy so eloquently put it: “Technology makes speculating effortless, while social media spreads the story of each new overnight millionaire, luring the broader population into one giant losing bet like moths to a light.”

the dopamine effects of this cannot be understated. in the long run these gamblers will lose money, but how will they ever be able to go back to work knowing how easily they once made money? surely it’s worth it to keep trying, they just need to get lucky one more time, one last big win, and then they’ll stop and quit their job.

“all you need is a dollar and a dream” - an old catchphrase for the new york state lottery

and now the ouroborus starts. hyperfinancialisation causes nihilism with the system, leading to the uptick in gambling, which in turn only compounds hyperfinancialisation. more survivorship bias stories propagate the media, more people start gambling and losing money, resources are misdirected away from productive behaviours. the market stops allocating to socially beneficial companies and instead to companies accelerating gambling. it is a telling fact that $hood is up 184% ytd when the median individual investor spends approximately six minutes on research per trade on traded tickers, mostly just before the trade.

i do not believe this can be called market failure, however. markets are just an extension of human nature, and human nature is very much flawed and selfish, hence the market allocating to not the most socially optimum outcome but the most profitable, even if that is net negative for humanity in the long run cannot be considered pure market failure. markets aren’t moral arbiters. despite this, i find it almost sad how an entire industry exists built to con people out of their money. however, as milei stated: “The reality is if you go to the casino and lose money, I mean, what is the claim if you knew that it had those characteristics?”, or more eloquently, there’s no crying in the casino. i do believe that hyperfinancialisation distorts markets though. whilst markets will never be perfect, hyperfinancialisation causes them to resemble a casino more than anything else, and when net negative outcomes are profitable, there is clearly a bigger problem than the market itself.

regardless of whether moral or not, it accelerates hyperfinancialism. stock prices go up more. unemployment rises. escapism starts, tiktok, instagram reels, the metaverse. and the problem with this is gambling is a zero sum game. technically it is a negative sum game thanks to fees, but even taking the simplistic zero sum game viewpoint, no new wealth is created. no benefits to society are created. the same money is just redistributed to different people. less and less capital is being allocated to innovation, development and positive sum outcomes. “[civilisation] is about making far more than one consumes” according to elon musk, yet this cannot ring true in a hyperfinancialised society, thanks to the other downstreams of hyperfinancialism we must contend with; the escapism.

the gap between the middle class and the upper class in terms of leisure activities has never been smaller as humanity spends an increasingly large amount of its time online. this, along with reduced social mobility massively reduces incentives for not just people to work hard, but for people to create good new things.

after reading choose good quests, i would argue that there are a lack of good quests being chosen today. back to my earlier $hood example, robinhood went from being a good quest of zero fee trading to a bad quest of extracting as much money from retail as possible. meanwhile, comparing yc’s request for startups page in 2014 vs 2025 tells a similar story of the increasing lack of good quests being chosen (or funded. i digress, but if interested, here is a good article on that).

but my point is, in a hyperfinancialised society, we have less good quests, and without good quests being chosen, one cannot make far more than one consumes, and society fails to be positive sum.

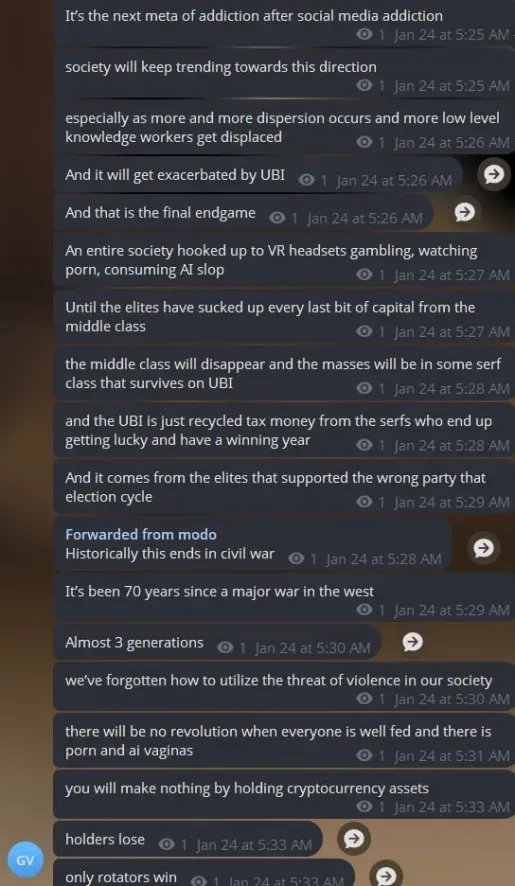

i end with this description of a technocapitalist hyperfinancialised society:

footnotes:

¹ i would note here that we could say that populism is the wider collective response, of which socialism is a key part of, but right wing populism in europe with anti immigration sentiment for example is another response to a similar problem. however, in this article we focus on socialism for ease (as i would argue it is the most economically focused populist response), perhaps the wider populism response is a topic for another day.

Disclaimer:

- This article is reprinted from [polarthedegen]. All copyrights belong to the original author [polarthedegen]. If there are objections to this reprint, please contact the Gate Learn team, and they will handle it promptly.

- Liability Disclaimer: The views and opinions expressed in this article are solely those of the author and do not constitute any investment advice.

- Translations of the article into other languages are done by the Gate Learn team. Unless mentioned, copying, distributing, or plagiarizing the translated articles is prohibited.

Related Articles

The Future of Cross-Chain Bridges: Full-Chain Interoperability Becomes Inevitable, Liquidity Bridges Will Decline

Solana Need L2s And Appchains?

Sui: How are users leveraging its speed, security, & scalability?

Navigating the Zero Knowledge Landscape

What is Tronscan and How Can You Use it in 2025?