Stop packaging high-risk investments as stablecoins.

The stablecoin market is never short on drama—but what’s truly lacking is a healthy respect for risk. November brought another crisis to the stablecoin arena.

xUSD, a so-called “stablecoin,” suffered a flash crash on November 4, plunging from $1 to $0.26. As of now, it continues its decline, trading at $0.12—a staggering 88% loss in market value.

Source: Coingecko

The project at the center of this is Stream Finance, a high-profile platform managing $500 million in assets.

Stream Finance promoted its high-risk investment strategy as a dividend-paying stablecoin, xUSD, boasting a “dollar peg and auto-yield”—but in reality, it packaged investment returns into the stablecoin. Since the product relied on investment strategies, guaranteed profits were impossible. On October 11, when the crypto market crashed, their off-chain strategy failed, resulting in a $93 million loss (about RMB 660 million). That’s enough to purchase over forty 1,000-square-foot apartments within Beijing’s Second Ring Road.

A month later, Stream Finance suspended all deposits and withdrawals, and xUSD lost its peg.

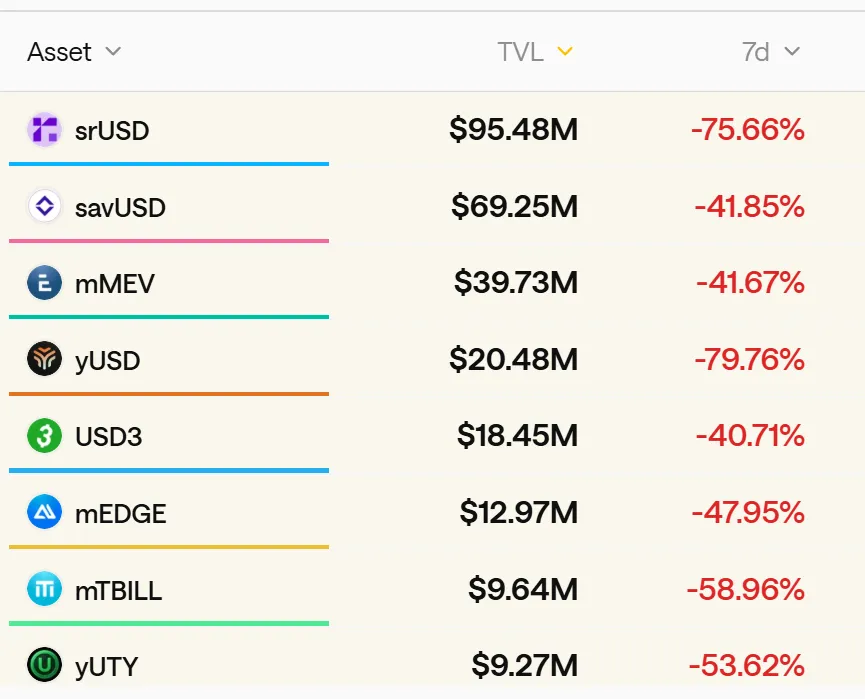

Panic spread rapidly. According to research firm stablewatch, more than $1 billion exited various “dividend stablecoin” products in the following week. That’s comparable to a mid-sized city’s entire commercial bank deposit base being emptied in just seven days.

Alarm bells sounded across the DeFi investment sector. In certain protocols, borrowing rates reached a staggering -752%, making collateral worthless—no one would repay or redeem it, and the market descended into chaos.

All of this was triggered by one seemingly perfect promise: stability with high yields.

When the illusion of “stability” was shattered overnight, it forced a re-examination: Which stablecoins are truly stable? Which are just risky investments disguised as stablecoins? And how did high-risk investment products come to call themselves “stablecoins” with impunity?

The Emperor’s New Clothes

In finance, the most attractive masks often conceal the sharpest fangs. Stream Finance and its stablecoin xUSD are textbook examples.

Stream Finance claimed xUSD used a “delta-neutral strategy,” a technical term from professional trading meant to hedge market volatility through complex financial instruments. It sounded secure and sophisticated. The narrative: no matter the market direction, users would see steady returns.

Within a matter of months, the project drew in $500 million in capital. But once the mask slipped, blockchain data analysts revealed glaring flaws in xUSD’s real operating model.

First, the lack of transparency was extreme. Of the claimed $500 million in assets, less than 30% was verifiable on-chain. The remaining “Schrödinger’s $350 million” operated in the shadows—no one knew what was happening until disaster struck.

Second, the leverage was breathtaking. With just $170 million in actual assets, Stream Finance repeatedly collateralized and borrowed through other DeFi protocols, amassing $530 million in loans—a real leverage ratio over 4x.

What does that mean? Investors thought they were buying a safely pegged “digital dollar” expecting double-digit annual yields. In reality, they held LP shares in a 4x leveraged hedge fund, with 70% of the fund’s positions completely opaque.

Behind the façade of “stability,” users’ money was engaged in high-frequency trading at the world’s largest digital casino.

This is the danger of these “stablecoins.” The “stable” label hides the reality: they’re hedge funds in disguise, promising retail investors the safety of bank deposits but running high-risk strategies only expert traders can manage.

Deddy Lavid, CEO of blockchain security firm Cyvers, commented, “Even if the protocol is secure, external fund managers, off-chain custody, and human oversight remain critical weaknesses. This collapse wasn’t about code—it was about people.”

That’s the heart of the matter. Stream Finance’s core problem was that its team carefully repackaged an extremely complex, high-risk, and unregulated financial scheme as a “stable investment product” for mass participation.

Domino Effect

If Stream Finance built the bomb, then Curator, a DeFi lending product, became its courier—setting off a chain reaction.

In newer lending protocols like Morpho and Euler, Curators act as “fund managers.” They’re typically professional investment teams, packaging complex DeFi strategies into “strategy vaults” so ordinary users can deposit with a click and earn. Their primary income is performance fees—taken as a cut of user returns.

Theoretically, they’re supposed to be risk gatekeepers, helping users choose quality assets. But the performance fee model incentivizes chasing high-risk assets: in the hyper-competitive DeFi world, higher yields attract more users and capital, and thus more fees.

When Stream Finance’s “stable, high-yield” asset appeared, it became irresistible to many Curators.

The Stream Finance event showcased the worst-case scenario. Blockchain data revealed that several prominent Curators—including MEV Capital, Re7 Labs, and TelosC—allocated significant portions of their vaults to risky xUSD assets in Euler and Morpho. TelosC’s exposure alone reached $123 million.

Critically, these allocations were no accident. Days before the incident, industry KOLs and analysts publicly warned on social media about xUSD’s opacity and leverage risks. Yet, these Curators—holding large funds and responsible for risk—chose to ignore the warnings.

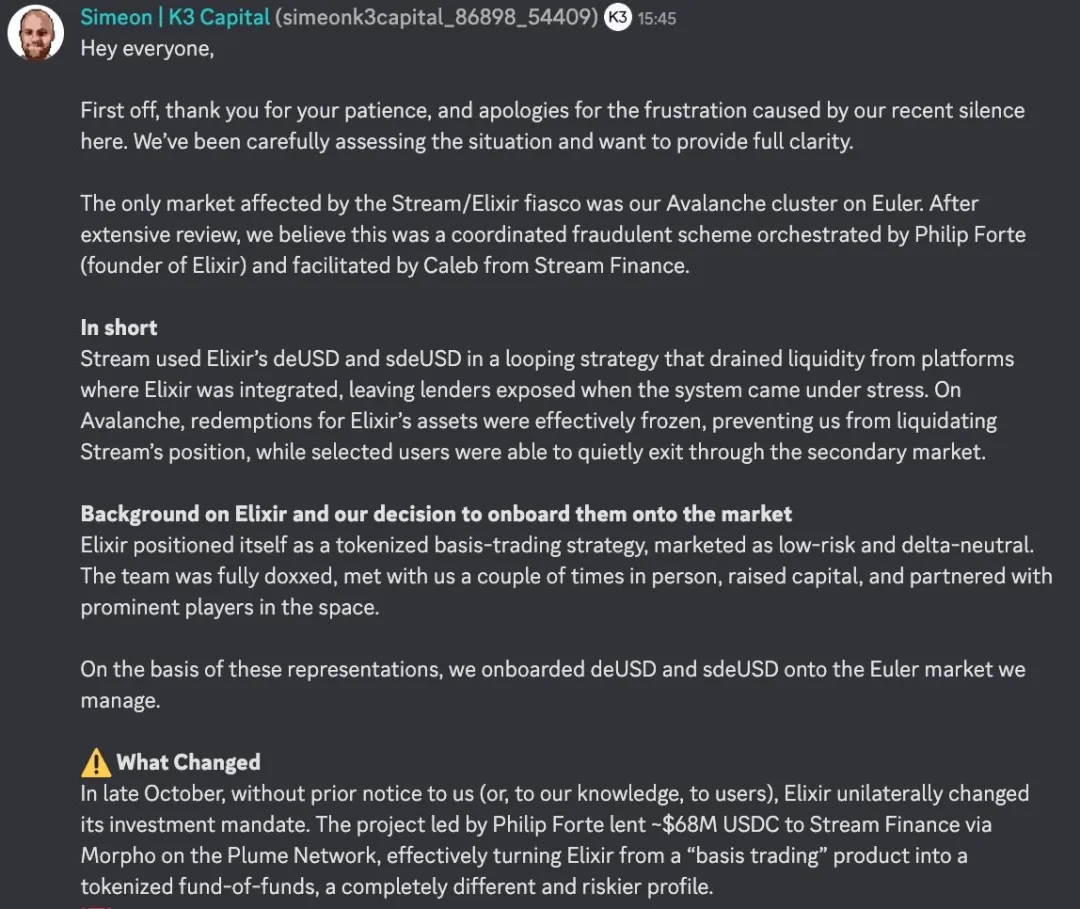

Some Curators were victims themselves. Case in point: K3 Capital, which managed millions on Euler and lost $2 million in the fallout.

On November 7, K3’s founder spoke out in Euler’s Discord channel, describing how they were deceived.

Source: Discord

The story began with another “stablecoin” project: Elixir, issuer of the dividend stablecoin deUSD, claimed to use a “basis trading strategy.” K3 allocated deUSD based on this promise.

But in late October, without Curator consent, Elixir unilaterally changed its strategy—lending around $68 million USDC to Stream Finance via Morpho, shifting from basis trading to a “fund-of-funds” approach.

These are fundamentally different products. Basis trading targets specific strategies with manageable risk. Fund-of-funds means lending to another investment product, stacking additional risk on top of the original.

When Stream Finance’s bad debt became public on November 3, K3 immediately contacted Elixir’s founder, Philip Forte, seeking a 1:1 deUSD redemption. Philip was silent and did not respond. Forced into action, K3 liquidated its position on November 4, holding $2 million in deUSD. On November 6, Elixir declared insolvency. Their solution: retail users and liquidity pools could redeem deUSD 1:1 for USDC, but Curator vaults would not—requiring collective negotiation.

K3 has now retained top U.S. attorneys, preparing to sue Elixir and Philip Forte for unilateral contract changes and false advertising, seeking compensation for reputational harm and forced deUSD redemption to USDC.

When the gatekeepers themselves sell risk, the collapse of the fortress is only a matter of time. And when the gatekeepers are fooled, who’s left to protect users?

Old Wine, New Bottles

This “packaging-spread-collapse” pattern is a recurring theme in financial history.

Consider LUNA’s 2022 meltdown—$40 billion gone in 72 hours, fueled by “algorithmic stability and 20% annual returns.” Or further back, in 2008, when Wall Street packaged risky subprime loans into complex AAA “premium bonds (CDOs),” ultimately igniting a global financial crisis. The underlying logic remains: complex packaging turns high-risk assets into seemingly low-risk products, sold to investors unable to fully grasp the risks.

From Wall Street to DeFi, from CDOs to “dividend stablecoins,” technology and product names change, but human greed persists.

Industry data shows that more than 50 similar dividend stablecoin projects are active in DeFi today, with total value locked exceeding $8 billion. Most use intricate financial engineering to package high-leverage, high-risk strategies as “stable” high-yield products.

Source: stablewatch

The root problem: we’ve given these products the wrong name. “Stablecoin” creates a false sense of security, dulling risk awareness. When people hear “stablecoin,” they think of dollar-backed assets like USDC or USDT—not high-leverage hedge funds.

A lawsuit can’t save a market, but it can be a wake-up call. When the tide recedes, it’s not just the naked swimmers who are revealed—it’s those who never intended to wear trunks in the first place.

$8 billion, 50 projects—the next Stream Finance could emerge at any time. Until then, remember this simple rule: if a product needs ultra-high annual yields to attract you, it’s anything but stable.

Statement:

- This article is republished from [动察Beating], copyright remains with the original author [Sleepy.txt]. For republication objections, please contact the Gate Learn team; they will respond promptly per relevant procedures.

- Disclaimer: The views and opinions expressed are solely those of the author and do not constitute investment advice.

- Other language versions are translated by Gate Learn and may not be copied, distributed, or plagiarized unless Gate is credited.

Related Articles

The Future of Cross-Chain Bridges: Full-Chain Interoperability Becomes Inevitable, Liquidity Bridges Will Decline

Solana Need L2s And Appchains?

Sui: How are users leveraging its speed, security, & scalability?

Navigating the Zero Knowledge Landscape

What is Tronscan and How Can You Use it in 2025?