The debate between tokenized deposits and stablecoins: The future of finance is not replacement, but integration.

Banks generate money, while stablecoins fuel liquidity. Both are essential.

Supporters of tokenized deposits claim, Stablecoins are unregulated shadow banks. Once banks tokenize deposits, everyone will choose banks.

Many banks and central banks welcome this argument.

Stablecoin advocates counter, Banks are dinosaurs. We don’t need them on-chain. Stablecoins are the future of money.

This narrative especially resonates with crypto natives.

But both sides are missing the real issue.

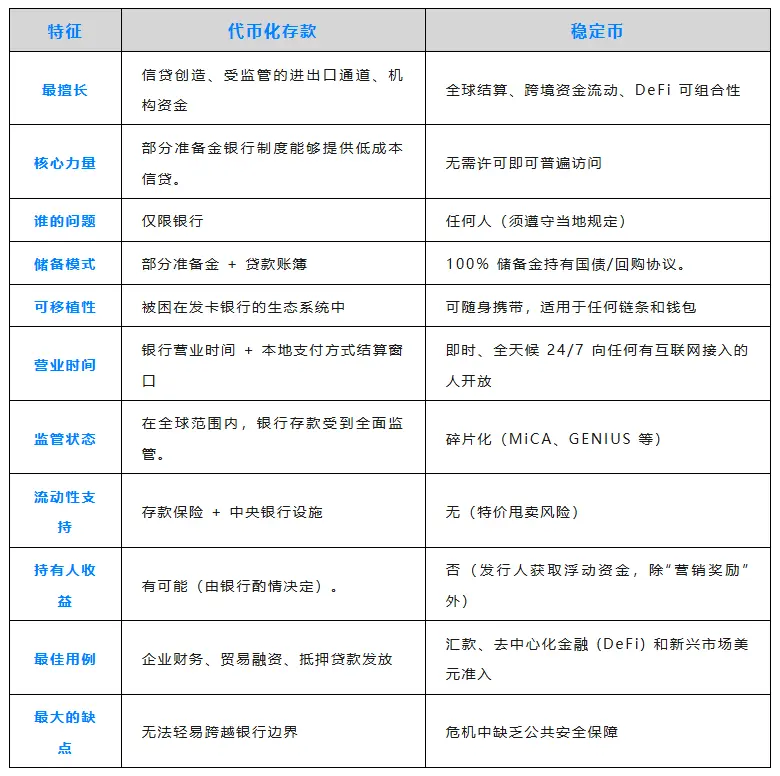

Banks Provide Cheaper Credit to Their Largest Clients

Deposit $100, and it becomes $90 in loans—or even more. That’s fractional reserve banking in action, a system that has fueled economic growth for centuries.

- Fortune 500 firms deposit $500 million at JPMorgan Chase.

- In return, they receive enormous credit lines at rates below market averages.

- Deposits are the core of the banking business model, and large corporations know this well.

Tokenized deposits bring this dynamic on-chain, but only for the bank’s own clients. You remain under bank oversight, bound by their hours, processes, and compliance requirements.

For businesses seeking low-cost credit, tokenized deposits are a compelling option.

Stablecoins Operate Like Cash

Circle and Tether maintain full reserves, holding $200 billion in securities. They earn 4–5% yields but pass on none of that to you.

In return, your funds are outside the reach of banking regulations. By 2025, stablecoins are projected to handle $9 trillion in cross-border transfers. With an internet connection, you can access your money anytime, anywhere—permissionless and always on.

No need for a correspondent bank, no waiting on SWIFT, and no more “we’ll respond in 3–5 business days.”

For businesses needing to pay an Argentinian supplier at 11 p.m. on a Saturday, stablecoins are the ideal solution.

The Future Integrates Both

A company seeking favorable bank credit may also want to use stablecoins to reach long-tail markets.

Picture this:

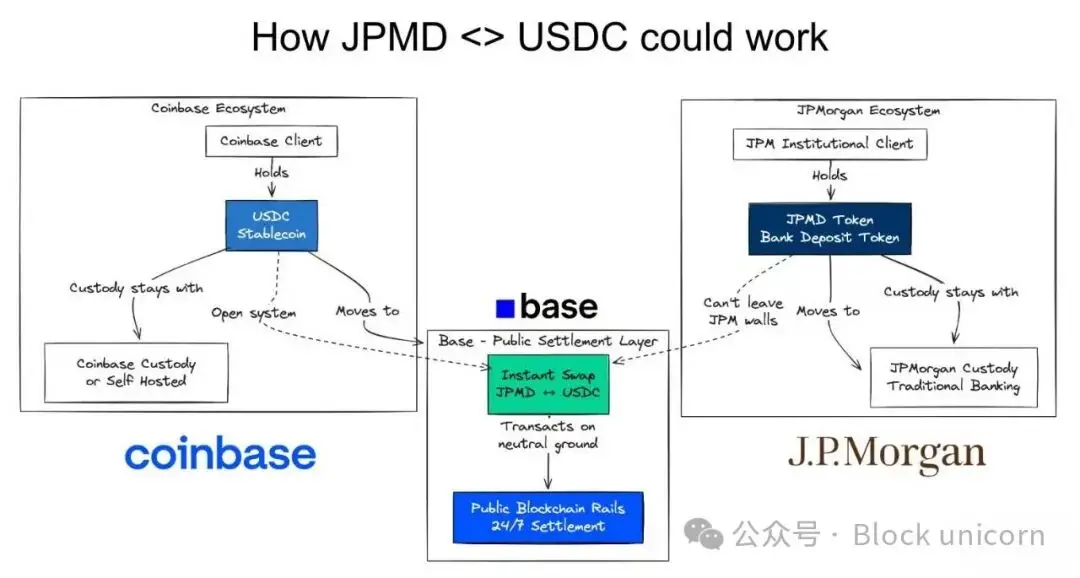

- A Fortune 500 company holds tokenized deposits at JPMorgan Chase

- In return, it secures attractive credit for its U.S. operations

- It needs to pay an Argentinian supplier who prefers stablecoins

- So, it converts JPMD to USDC

This scenario illustrates the direction we’re heading.

On-chain. Atomic-level.

Best of both worlds.

Use traditional rails when they fit.

Use stablecoins when they don’t.

This isn’t a binary choice—it’s about integration.

- Tokenized deposits → Low-cost credit within the banking system

- Stablecoins → Cash-like settlement outside the banking system

- On-chain exchange → Instant conversion, zero settlement risk

Each approach has its strengths and weaknesses.

They will coexist.

On-Chain Payments Surpass Payment Orchestration APIs

Some large banks argue, We don’t need tokenized deposits—we have APIs. In certain cases, they’re right.

That’s precisely where on-chain finance excels.

Smart contracts can automate logic across multiple organizations and individuals. When a supplier’s deposit lands, a smart contract can instantly trigger inventory financing, working capital loans, or FX hedging. Both banks and non-banks can execute these actions automatically and in real time.

Deposit → Stablecoin → Pay invoice → Complete downstream payment.

APIs connect point-to-point; smart contracts connect many-to-many. That’s why they’re perfect for workflows that cross organizational boundaries. This is the true strength of on-chain finance.

This is a fundamentally different financial architecture.

The Future Is On-Chain

Tokenized deposits address the need for low-cost credit. Deposits are locked, and banks lend against them. Their business model remains unchanged.

Stablecoins solve the portability challenge. Funds move freely and permissionlessly. The Global South gains dollar access. Businesses achieve rapid settlement.

Tokenized deposit advocates want regulated payment rails only.

Stablecoin advocates want to displace banks entirely.

The future requires both.

Fortune 500 companies want massive credit lines and instant global settlement. Emerging markets want local credit creation and dollar rails. DeFi wants composability and real-world asset backing.

Arguing over who wins misses the point. The future of finance is on-chain. Tokenized deposits and stablecoins are both foundational to this vision.

Stop debating winners. Start building interoperability.

Composable money.

Statement:

- This article is republished from [chaincatcher] and the copyright belongs to the original author [Simon Taylor]. If you have concerns about this republication, please contact the Gate Learn team, and we will address the issue promptly according to our procedures.

- Disclaimer: The views and opinions expressed in this article are solely those of the author and do not constitute investment advice.

- Other language versions of this article are translated by the Gate Learn team. Unless Gate is mentioned, do not copy, distribute, or plagiarize the translated article.

Related Articles

In-depth Explanation of Yala: Building a Modular DeFi Yield Aggregator with $YU Stablecoin as a Medium

What is Stablecoin?

Gate Research: 2024 Cryptocurrency Market Review and 2025 Trend Forecast

Altseason 2025: Narrative Rotation and Capital Restructuring in an Atypical Bull Market

Top 15 Stablecoins