What It Takes for Bitcoin to Hit $250K: The “Crazy” Conditions That Must Be Met

Bitcoin: Current Price vs. Target Gap

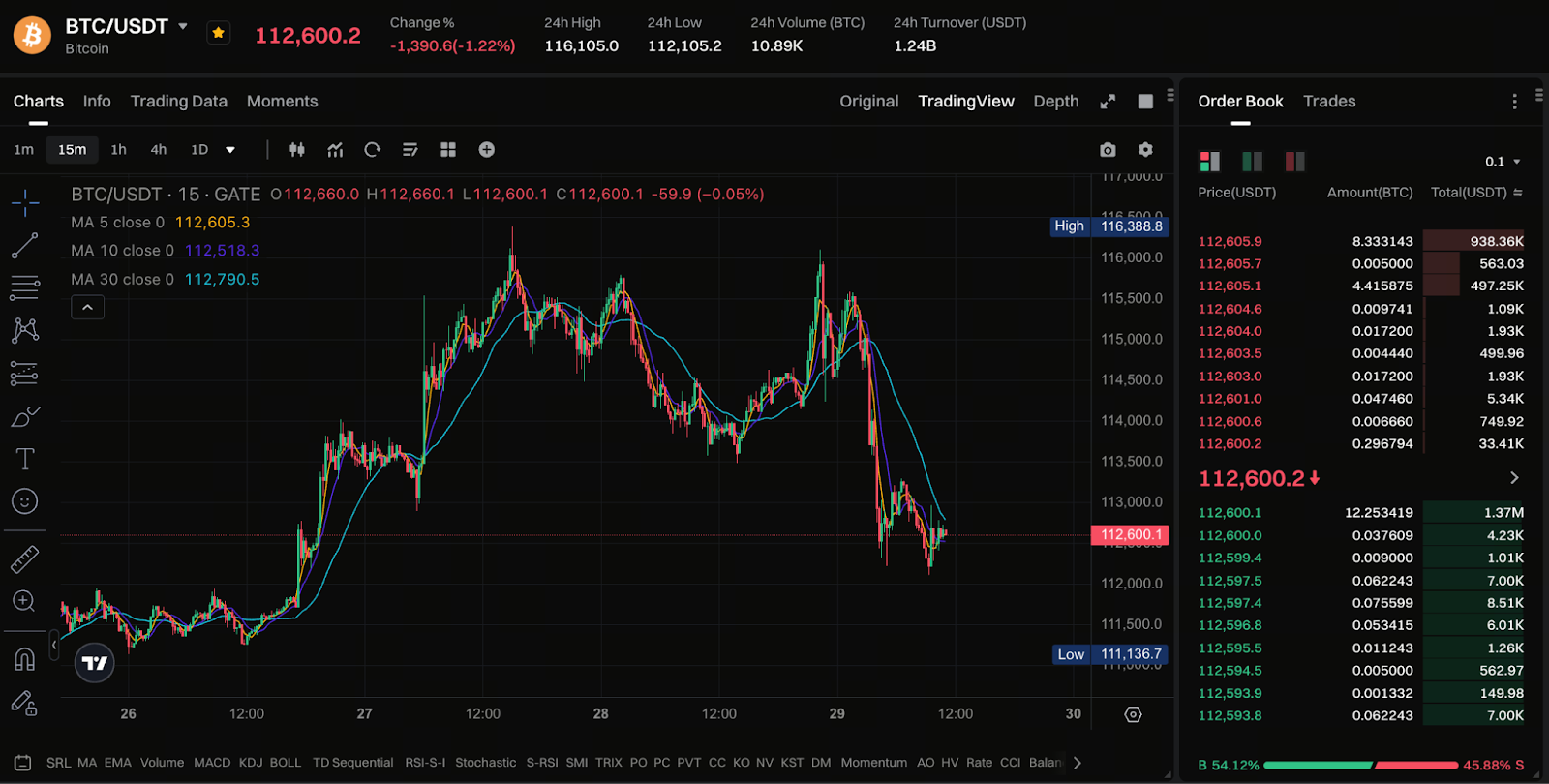

Chart: https://www.gate.com/trade/BTC_USDT

Recently, market discussions have intensified around whether Bitcoin can reach $250,000 in 2025. As of October 29, 2025, Bitcoin is trading at approximately $112,000. This means that to hit the $250,000 target within a year, the price would need to more than double.

Expert Insights Summary

Mike Novogratz, CEO of Galaxy Digital, was candid: for Bitcoin to reach $250,000, “there would have to be a heck of a lot of crazy stuff.” He believes that without a series of extreme catalysts, Bitcoin is more likely to trade between $100,000 and $125,000. Other analysts, including Tom Lee and Arthur Hayes, remain optimistic and contend that a run to $200,000–$250,000 is still possible.

Detailed Breakdown of Key “Crazy” Conditions

- Global Liquidity Surge & Central Bank Rate Cuts

Abundant liquidity is a critical driver of Bitcoin’s price appreciation. If major central banks, including the Federal Reserve, implement significant rate cuts or inject substantial liquidity, capital could flow into crypto assets. However, while rate cut expectations exist, they may not be sufficient to trigger a paradigm-shifting rally. - Regulatory Breakthroughs: Legal and Structural Reforms

Novogratz notes that a true breakout would require major regulatory milestones, such as the passage of the “CLARITY Act” (Crypto Market Structure Bill). Without regulatory advancement, institutional and large-fund participation barriers are likely to remain high. - Large-Scale Institutional Adoption & Corporate Treasury Allocation

If more traditional financial institutions and corporations add Bitcoin to their balance sheets or treat it as a reserve asset, the foundation for long-term price growth would be stronger. While there are emerging signs, scale and conversion rates have yet to reach a “currency-level” impact. - Unexpected Macro Events or Geopolitical Shocks

Historically, “black swan” events have triggered rapid price surges—examples include geopolitical conflicts, major policy reversals by key nations, or leading tech companies announcing Bitcoin strategies. These events are inherently unpredictable and cannot be relied upon as a strategy.

Risks and Realistic Possibilities Every Investor Should Consider

For newcomers, it is especially important to keep the following in mind:

- While the target may seem attractive, achieving it requires multiple conditions to align simultaneously.

- The market is highly susceptible to sentiment, leverage, and liquidity. Sharp rallies can be followed by equally swift corrections.

- Treating Bitcoin as a “get-rich-quick” vehicle carries very high risk—position sizing should be managed prudently.

- Focusing on medium- to long-term fundamentals is often more prudent than chasing short-term spikes. As Novogratz notes, absent major catalysts, prices may oscillate between $100K and $125K.

Conclusion: What Are the Odds of Hitting $250,000 This Year?

In summary, for Bitcoin to reach $250,000 this year would require an extraordinary combination of factors: ample liquidity, regulatory breakthroughs, large-scale institutional adoption, and simultaneous unexpected catalysts. While not entirely impossible, in the current environment, this scenario should not be the base case for most investors. The rational approach is to watch for potential catalysts, manage risk, and remain patient.

Related Articles

Pi Coin Transaction Guide: How to Transfer to Gate.io

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

What is N2: An AI-Driven Layer 2 Solution

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

Understand Baby doge coin in one article