who the fuck is on morpho?

idk if you’ve noticed, but there are $12 billion dollars just casually hanging out on morpho right now.

is $12 billion dollars enough to retire?

let me break down what’s happening here, because at first glance, this shit makes absolutely no sense. it’s overcollateralized lending - meaning for every dollar you put into this vending machine, it generously gives you back 75 cents. so… who the fuck is using this vending machine? why would anyone willingly lock up more capital than they can actually access? it seems completely backwards, right? like the worst trade deal in the history of trade deals. but stick with me, because when you actually look at who’s using it and what they’re doing with it, something legitimately fascinating starts to emerge.

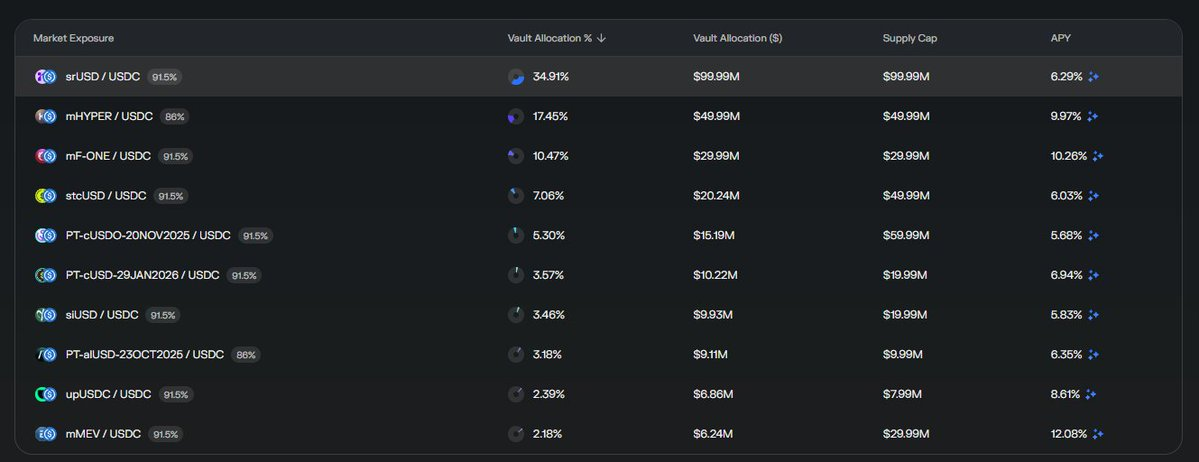

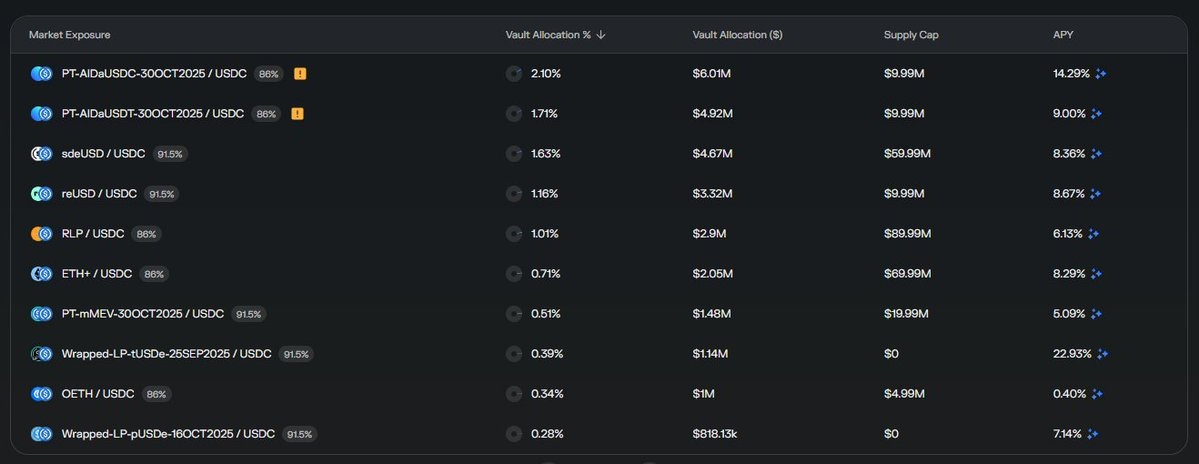

here are all the positions held by the 2nd largest vault on morpho.

funny looking logos.

what in the fuck.

seriously, look at this shit. it’s not just some retard gambling away his life savings on shitcoins. it’s not some whale arbitraging spreads between exchanges. it’s a carefully constructed portfolio of assets that, on the surface, looks almost… professional? strategic? like someone actually knows what they’re doing?

it turns out, something very cool is happening here…

defi has replicated traditional asset management.

here’s the thing: 8 out of the 10 largest hedge funds in the world - the real heavy hitters managing hundreds of billions of dollars - all fundamentally do the same thing. they construct diversified, near market neutral portfolios, where they systematically hedge out beta to isolate their alpha, and then they apply leverage to the entire portfolio to amplify returns. this is the playbook. this is how big money operates in traditional finance. it’s not rocket science; it’s just sophisticated risk management combined with leverage to juice returns on what would otherwise be modest gains.

but here’s where it gets weird: defi has no portfolio leverage. not a single dex in the whole damn industry offers the most widely used feature of nearly every major asset manager on god’s green earth. think about that for a second. we’ve built this entire parallel financial system with automated market makers, yield aggregators, perpetual futures, options protocols, lending markets - the whole nine yards - and somehow, we completely forgot to implement the one thing that makes institutional portfolio management actually work at scale.

so what does this have to do with morpho, which doesn’t even offer simple undercollateralized lending, much less the kind of sophisticated portfolio margin that would make an institutional trader feel at home?

this is some real gourmet shit

it turns out, most of those colorful logos you see in the screenshots above - the ones that look like they could be defi protocols but feel slightly off - are actually market neutral funds trading almost entirely offchain. these are real funds, managed by real people, running real strategies in traditional markets. but here’s the clever part: they throw a token onchain purely for distribution purposes. it’s basically a wrapper that lets defi users get exposure to offchain strategies without having to deal with the nightmare of traditional fund administration, compliance, kyc, accredited investor checks, or the lack of speed in getting things done

morpho vault curators then take these tokens and construct diversified portfolios of these market neutral, offchain funds. they’re essentially acting as fund-of-funds managers, picking and choosing which strategies to include, how to weight them, and how to balance risk across the portfolio. users and investors then use the vault to loop leverage the diversified, market neutral portfolio - depositing collateral, borrowing against it, redepositing that borrowed amount as new collateral, borrowing again, and repeating the process to stack leverage on what is, at its core, a market neutral basket of institutional grade strategies.

so that 75 cent vending machine suddenly makes perfect sense. if you’re running a market neutral strategy that generates consistent, low volatility returns, the ability to leverage that strategy 3 to 4x through loop leveraging turns a modest 8% annual return into a much more attractive 24 to 32% return. and because the underlying portfolio is market neutral and diversified across multiple uncorrelated strategies, the risk of liquidation remains relatively low even with significant leverage applied.

defi has found its way to perfectly replicate the core mechanics of traditional asset management - diversification, market neutrality, and portfolio leverage - through the least retarded vending machine available. it’s not elegant. it’s not what anyone designed the system to do. but it fucking works. and that $12 billion sitting on morpho is proof that when you give people the tools, they’ll find a way to rebuild the financial system they actually need, even if they have to do it with duct tape and overcollateralized lending protocols.

Disclaimer:

- This article is reprinted from [tittyrespecter]. All copyrights belong to the original author [tittyrespecter]. If there are objections to this reprint, please contact the Gate Learn team, and they will handle it promptly.

- Liability Disclaimer: The views and opinions expressed in this article are solely those of the author and do not constitute any investment advice.

- Translations of the article into other languages are done by the Gate Learn team. Unless mentioned, copying, distributing, or plagiarizing the translated articles is prohibited.

Related Articles

The Future of Cross-Chain Bridges: Full-Chain Interoperability Becomes Inevitable, Liquidity Bridges Will Decline

Solana Need L2s And Appchains?

Sui: How are users leveraging its speed, security, & scalability?

Navigating the Zero Knowledge Landscape

What is Tronscan and How Can You Use it in 2025?