Trade

Trading Type

Spot

Trade crypto freely

Alpha

Points

Get promising tokens in streamlined on-chain trading

Pre-Market

Trade new tokens before they are officially listed

Margin

Magnify your profit with leverage

Convert & Block Trading

0 Fees

Trade any size with no fees and no slippage

Leveraged Tokens

Get exposure to leveraged positions simply

Futures

Futures

Hundreds of contracts settled in USDT or BTC

Options

HOT

Trade European-style vanilla options

Unified Account

Maximize your capital efficiency

Demo Trading

Futures Kickoff

Get prepared for your futures trading

Futures Events

Participate in events to win generous rewards

Demo Trading

Use virtual funds to experience risk-free trading

Earn

Launch

CandyDrop

Collect candies to earn airdrops

Launchpool

Quick staking, earn potential new tokens

HODLer Airdrop

Hold GT and get massive airdrops for free

Launchpad

NEW

Be early to the next big token project

Alpha Points

NEW

Trade on-chain assets and enjoy airdrop rewards!

Futures Points

NEW

Earn futures points and claim airdrop rewards

Investment

Simple Earn

Earn interests with idle tokens

Auto-Invest

Auto-invest on a regular basis

Dual Investment

Buy low and sell high to take profits from price fluctuations

Soft Staking

Earn rewards with flexible staking

Crypto Loan

0 Fees

Pledge one crypto to borrow another

Lending Center

One-stop lending hub

VIP Wealth Hub

Customized wealth management empowers your assets growth

Private Wealth Management

Customized asset management to grow your digital assets

Quant Fund

Top asset management team helps you profit without hassle

Staking

Stake cryptos to earn in PoS products

BTC Staking

HOT

Stake BTC and earn 10% APR

GUSD Minting

Use USDT/USDC to mint GUSD for treasury-level yields

More

Promotions

Activity Center

Join activities and win big cash prizes and exclusive merch

Referral

20 USDT

Earn 40% commission or up to 500 USDT rewards

Announcements

Announcements of new listings, activities, upgrades, etc

Gate Blog

Crypto industry articles

VIP Services

Huge fee discounts

Proof of Reserves

Gate promises 100% proof of reserves

- Trending TopicsView More

5.82K Popularity

21.3K Popularity

21.81K Popularity

78.55K Popularity

189.53K Popularity

- Hot Gate FunView More

- MC:$3.45KHolders:10.00%

- MC:$3.45KHolders:10.02%

- MC:$3.46KHolders:10.00%

- MC:$3.46KHolders:10.00%

- MC:$3.51KHolders:10.48%

- Pin

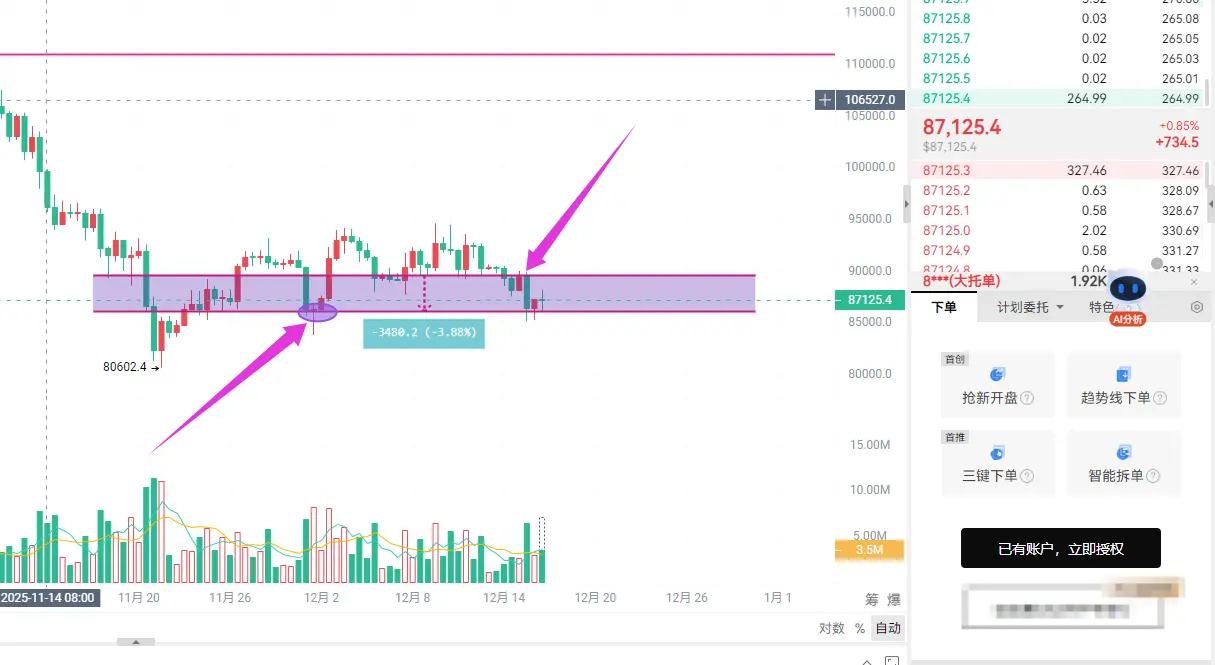

CPI countdown: Watch more, do less, wait for the bottom-fishing opportunity

Hot News |

December 18th at 21:30 US November Unadjusted CPI Year-over-Year Release

December 18th at 21:30 US Initial Jobless Claims for the week ending December 13( thousand)

Recap: On Tuesday (December 16th), local time, the US Bureau of Labor Statistics released a report stating that US non-farm employment in November was slightly above expectations. The Federal Reserve will hold its first policy meeting of 2026 in January next year. The market generally expects that the probability of the Fed continuing to cut interest rates is low. After the non-farm data was released, Bitcoin quickly fell, dropping to around 86,000, while Ethereum dipped to 2880.

The pattern of every Monday decline was once again confirmed. Yesterday, Bitcoin also rebounded from the support level I provided, but then quickly fell again at the higher resistance level, further indicating that overall market liquidity remains very weak. In the previous article, Tommy emphasized that before Thursday’s CPI and Friday’s Bank of Japan rate hike announcement, market funds tend to hedge risk in advance. The short-term speculative funds are also quick in and out, causing the market to jump up and down. Those who followed our trading rhythm this week have also enjoyed big gains. For those who missed out, don’t be regretful. Today, Tommy will once again clarify the watershed between Bitcoin and Ethereum.

BTC: Bitcoin is currently repeatedly testing the bottom near the 12H level of the box bottom, showing selling pressure and emotional sentiment. The 4H chart also shows a shrinking volume and a downward trend. The overall trend remains dominated by bears. Today’s intraday focus will be on two key zones: the upper zone around 88000-89000, which was yesterday’s resistance area after a rally, serving as the primary target for short-term shorts; and the lower zone around 85000-83500, which is the short-term box floor and an important mid-term defense zone. This is also a true emotional capitulation area. The strategy for Bitcoin is mainly to rebound on high-altitude corrections and to go long at low levels for short-term retracements. Remember, don’t expect to eat a big bullish candle in one go; quick in and out is the key to rhythm and discipline.

ETH: Ethereum is now smarter than Bitcoin, with weaker rebounds but faster declines. Focus on the short-term resistance zone around 3030. The support zone at 2850-2830 is for bulls. If the price approaches 3030 again and cannot break through with volume, that will be our primary target for short entries. You can refer to the same timing as Bitcoin for operations. Only after Ethereum repeatedly dips back to 2880-2850 for washout and accumulation, then rebounds, will the possibility of breaking above later increase. Pay attention to volume and price action; only when volume and price rise together can a sustained short- to medium-term rebound occur.

Intraday Trading Viewpoint (Mainly shorting, don’t try to bottom fish. Bottom fishing is just fueling the bears)

Note: When the take profit is reached without breaking the previous high, it’s a signal to reverse and go short again. Overall, recent operations follow the principle of high short and low long, riding the rhythm of the main force’s washouts.

Price levels are time-sensitive, and there may be delays in posting, so please refer to real-time market conditions. Lastly, remember the two key points from my previous article: in the short term, focus on testing positions; once outside our target zones, it’s the last chance to buy big before the end of the year. I am K-line Life Tommy, your real-time crypto butler.

Mainly for spot, futures, BTC/ETH/ETC

Expertise: K-line trading

Original volume-based trading strategy.

Short-term swing trading at high and low levels, medium- and long-term trend orders, daily extreme retracements, weekly top predictions, monthly top predictions.