Trade

Basic

Futures

Futures

Hundreds of contracts settled in USDT or BTC

Options

HOT

Trade European-style vanilla options

Unified Account

Maximize your capital efficiency

Demo Trading

Futures Kickoff

Get prepared for your futures trading

Futures Events

Participate in events to win generous rewards

Demo Trading

Use virtual funds to experience risk-free trading

Earn

Launch

CandyDrop

Collect candies to earn airdrops

Launchpool

Quick staking, earn potential new tokens

HODLer Airdrop

Hold GT and get massive airdrops for free

Launchpad

Be early to the next big token project

Alpha Points

NEW

Trade on-chain assets and enjoy airdrop rewards!

Futures Points

NEW

Earn futures points and claim airdrop rewards

Investment

Simple Earn

Earn interests with idle tokens

Auto-Invest

Auto-invest on a regular basis

Dual Investment

Buy low and sell high to take profits from price fluctuations

Soft Staking

Earn rewards with flexible staking

Crypto Loan

0 Fees

Pledge one crypto to borrow another

Lending Center

One-stop lending hub

VIP Wealth Hub

Customized wealth management empowers your assets growth

Private Wealth Management

Customized asset management to grow your digital assets

Quant Fund

Top asset management team helps you profit without hassle

Staking

Stake cryptos to earn in PoS products

Smart Leverage

NEW

No forced liquidation before maturity, worry-free leveraged gains

GUSD Minting

Use USDT/USDC to mint GUSD for treasury-level yields

More

Promotions

Activity Center

Join activities and win big cash prizes and exclusive merch

Referral

20 USDT

Earn 40% commission or up to 500 USDT rewards

Announcements

Announcements of new listings, activities, upgrades, etc

Gate Blog

Crypto industry articles

VIP Services

Huge fee discounts

Proof of Reserves

Gate promises 100% proof of reserves

The day of the news showdown—just do it.

Hot News |

December 18th at 21:30: Release of US November Unadjusted CPI Year-over-Year

December 18th at 21:30: Release of US Initial Jobless Claims for the week ending December 13th( thousand)

Recap: Last night, after the US stock market opened, the three major indices opened high, then quickly fell after Oracle’s market move. The three indices continued to decline, and Bitcoin and Ethereum also experienced short-term intense fluctuations. In the previous sharing, Tommy provided a precise target range of 2880-2830 for long positions, successfully hitting the target at 3030, gaining 150 points. During the daytime, Bitcoin and Ethereum also showed sideways consolidation at low levels. Based on current trading volume, major orders are continuously sweeping up around 2800. For evening operations, we only need to focus on the CPI release and wait for major funds to confirm the bottom and choose to quickly take action. To summarize in one sentence: today and tomorrow are the decisive days for news. Slightly wrong positioning will be swept away by major forces in one wave.

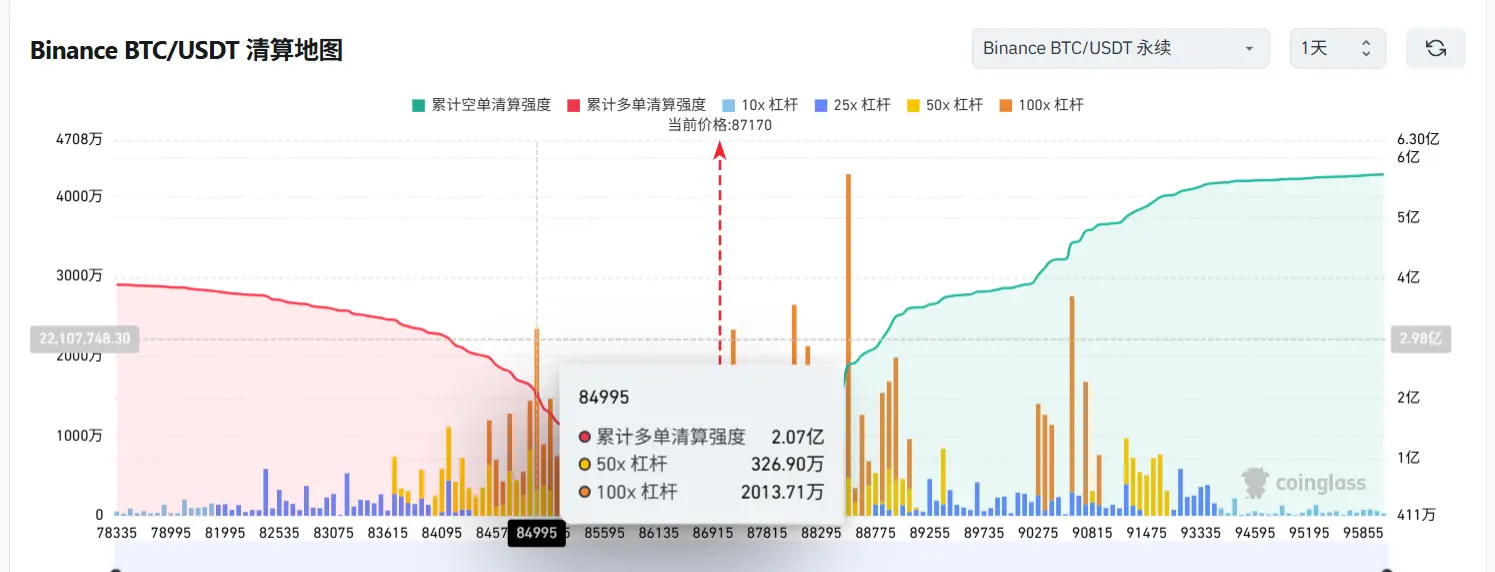

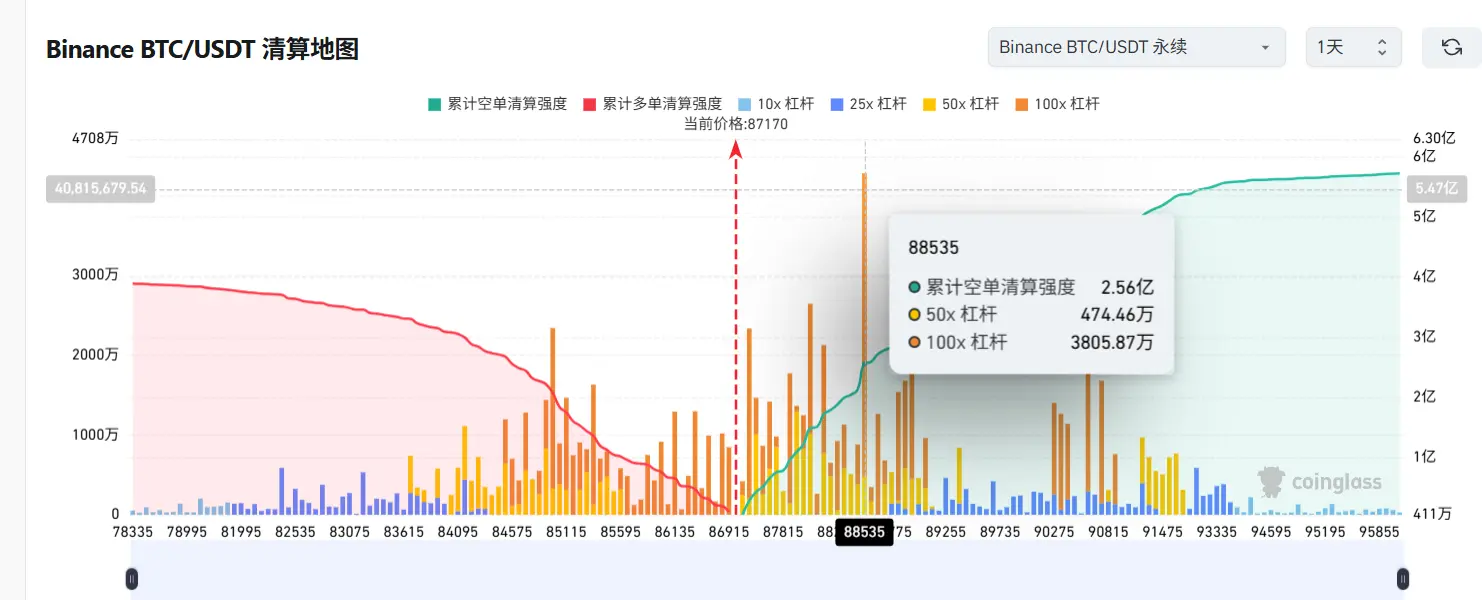

BTC: From the intraday trading volume, the fluctuation range is from the high of 90000 to the low of 85500, a 4600-point range. Many traders will suffer losses if they choose poor entry points. Based on the structure of the market and on-chain data, the major players have already exposed their intentions, with large liquidation zones lurking between 88500-85000. The market appears calm, but it is actually the calm before the storm, waiting for news to trigger a sharp sell-off first, then a buy-up. The 4-hour level has been oscillating narrowly between 87800-86000. The 90000 level is a strong resistance after the previous decline, and 85000-84000 is the last defense zone. Once broken, it is likely to test the 80000 level.

ETH: Compared to Bitcoin, Ethereum appears weaker. The 3000-3030 range has been a persistent barrier, and the rebound below 2780 has lacked volume. If Bitcoin weakens again, Ethereum will return to the 2780-2680 range.

Summary of today’s trading strategy: Don’t rush to sell the eagle without seeing the rabbit; patiently wait for the news to land and then look for rebound or shorting opportunities. Don’t get itchy to bet on the direction and give chips to the main players.

Follow the points mentioned in the previous article for your trading range. If you cannot break through the resistance level or the support level does not break down, quickly take profits and exit.

I am Tommy, bringing you the latest market analysis and trading ideas every day.

The points have time sensitivity, and there may be delays in posting, so please refer to real-time market data. Lastly, remember the two key points I mentioned in my previous article: in the short term, focus on testing positions; once outside our target range, it’s the last chance to buy big before the end of the year. I am K-line Life Tommy, your real-time crypto butler#BTC# ETH