Post content & earn content mining yield

placeholder

RedEnvelope

Institutional pressure: The massive outflow of funds from Bitcoin spot ETFs (more than 1 billion USD in 5 days) is intensifying short-term selling. Despite support from UBS banks and CZ's forecast of a "supercycle," the market shows weakness. Ethereum and Solana are currently holding up better — amid BTC stagnation, it is interesting to consider diversifying part of the portfolio into ETH and SOL, as well as partially into meme-token segment tokens (PEPE) and smart contracts (ADA).$BTC

BTC-0,07%

- Reward

- 3

- Comment

- Repost

- Share

汗血宝马

汗血宝马

Created By@gatefunuser_22b1

Listing Progress

100.00%

MC:

$56.67K

Create My Token

Analysis suggests that driven by rising safe haven demand and a weaker U.S. dollar, silver prices are approaching $100 per ounce

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

#IranTradeSanctions

#IranTradeSanctions introduces another layer of uncertainty into already sensitive global markets.

A proposed 25% tariff on countries trading with Iran could increase geopolitical tension and affect global trade flows.

Markets usually react quickly to sanction and tariff headlines, especially when they involve energy routes and international partners.

This can influence inflation expectations, risk sentiment, and indirectly pressure both financial and crypto markets.

The real question is whether this becomes strict policy enforcement or remains political pressure.

Either

#IranTradeSanctions introduces another layer of uncertainty into already sensitive global markets.

A proposed 25% tariff on countries trading with Iran could increase geopolitical tension and affect global trade flows.

Markets usually react quickly to sanction and tariff headlines, especially when they involve energy routes and international partners.

This can influence inflation expectations, risk sentiment, and indirectly pressure both financial and crypto markets.

The real question is whether this becomes strict policy enforcement or remains political pressure.

Either

- Reward

- 4

- 4

- Repost

- Share

Yusfirah :

:

2026 GOGOGO 👊View More

- Reward

- like

- 1

- Repost

- Share

rickyade :

:

and easy to fall 🫰Silver$XAG increased its market value over 3 weeks more than Bitcoin did in 15 years, so it's not that the market has no money, but that funds have all gone into precious metals. The bull market cycle for precious metals is particularly long, usually starting from two years. Until the precious metals bull market ends, funds are unlikely to flow out into the cryptocurrency market. Just wait patiently for the next bull run in the crypto space, by then the precious metals bull market will also be over, and the market conditions and liquidity for cryptocurrencies will be much better than now.#黄金白

View Original

- Reward

- 9

- 10

- Repost

- Share

SpeciallyTargetingChildren's :

:

Hold on tight, we're about to take off 🛫View More

PENGUIN has completely let loose, reaching a high of 68m today. Based on a 100,000 investment, the maximum increase is 680 times!

Only by distancing yourself from the herd consensus can you stand out.

What truly matters is your cognition; luck will run out, and the bull market will fade, but judgment and temperament will always stay with you.

A firm stance is the foundation of successful investing.

View OriginalOnly by distancing yourself from the herd consensus can you stand out.

What truly matters is your cognition; luck will run out, and the bull market will fade, but judgment and temperament will always stay with you.

A firm stance is the foundation of successful investing.

- Reward

- 1

- Comment

- Repost

- Share

EGY 🇪🇬🚀

Emerging digital currency with positive market momentum, supported by a noticeable increase in trading volume and relative stability in price movement. Shows gradual growth reflecting the interest of both investors and traders, with scalability and the potential to reach higher price levels within a risk-managed framework. It is a promising option within the digital asset market for those seeking well-studied growth opportunities and investments based on technical and market analysis. 📊🚀

💥 The rise is no coincidence

📊 The numbers speak

⏫ The trend continues… and what's coming is

Emerging digital currency with positive market momentum, supported by a noticeable increase in trading volume and relative stability in price movement. Shows gradual growth reflecting the interest of both investors and traders, with scalability and the potential to reach higher price levels within a risk-managed framework. It is a promising option within the digital asset market for those seeking well-studied growth opportunities and investments based on technical and market analysis. 📊🚀

💥 The rise is no coincidence

📊 The numbers speak

⏫ The trend continues… and what's coming is

DOGE-0,97%

- Reward

- like

- Comment

- Repost

- Share

🇺🇸 LUMMIS: "Every day without the CLARITY Act is a day we cede our competitive edge to other nations."#crypto

- Reward

- like

- Comment

- Repost

- Share

小臭猪

猪猪

Created By@han778

Listing Progress

0.00%

MC:

$3.42K

Create My Token

pajdnakshbszbjaj

#GoldAndSilverHitRecordHighs

#GoldAndSilverHitRecordHighs

- Reward

- like

- Comment

- Repost

- Share

Actually, I want to ask, isn't Greenland in the Arctic? Where do native penguins come from in the Arctic?

View Original

- Reward

- like

- Comment

- Repost

- Share

Gm if you Gm 🔆

- Reward

- like

- Comment

- Repost

- Share

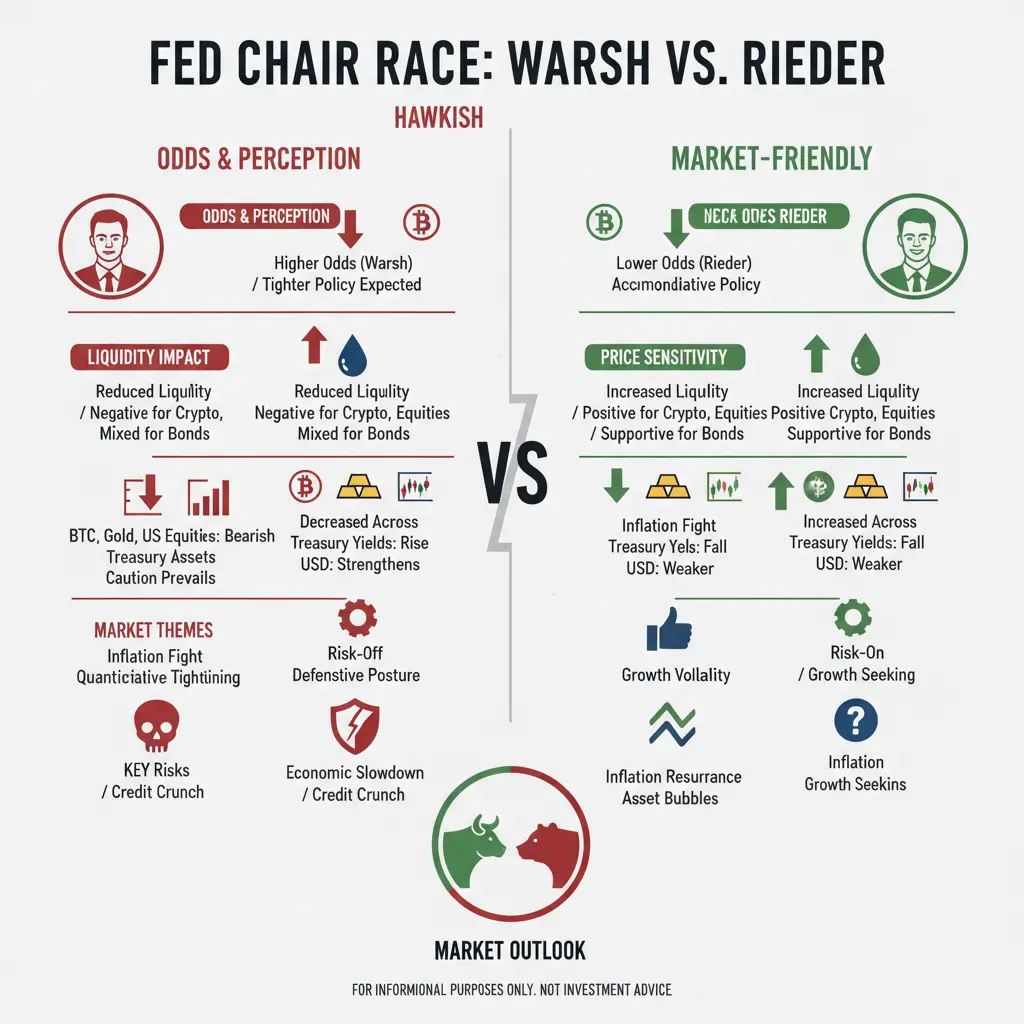

#NextFedChairPredictions

Who’s the Favorite for Fed Chair — And How Will It Impact Markets?

The race to replace Jerome Powell as Chair of the Federal Reserve has become one of the most influential macro events in global finance. President Trump has narrowed his shortlist, with Kevin Warsh and Rick Rieder emerging as clear frontrunners. Trump has hinted he could announce his decision as soon as next week, with Powell’s term ending in May.

This decision is not only political — it will directly impact liquidity, interest rates, market volatility, capital flow, and asset prices across crypto, equi

Who’s the Favorite for Fed Chair — And How Will It Impact Markets?

The race to replace Jerome Powell as Chair of the Federal Reserve has become one of the most influential macro events in global finance. President Trump has narrowed his shortlist, with Kevin Warsh and Rick Rieder emerging as clear frontrunners. Trump has hinted he could announce his decision as soon as next week, with Powell’s term ending in May.

This decision is not only political — it will directly impact liquidity, interest rates, market volatility, capital flow, and asset prices across crypto, equi

- Reward

- 4

- 7

- Repost

- Share

GateUser-7d358630 :

:

8847438937kxkkxfj xjkxxView More

gm my friendswhat’s keeping me away from ct lately isn’t boring ct or a bad marketit’s because of “teamfight tactics” and “where winds meet”i will be back after reaching master rank this season of tftnot a single web3 game can come closehave a great weekend!!!

- Reward

- like

- Comment

- Repost

- Share

#JapanBondMarketSell-Off

#JapanBondMarketSell-Off is a macro signal that many traders may be underestimating.

A jump of 25+ bps in 30Y and 40Y Japanese bond yields after plans to ease fiscal tightening is a notable shift.

Japan has long been associated with ultra-low yields, so movements like this can influence global rate expectations and capital flows.

If higher yields persist, risk assets around the world — including crypto — could start to feel indirect pressure.

Sometimes bond markets move first, and other markets react later.

This is why I’m watching this development closely rather tha

#JapanBondMarketSell-Off is a macro signal that many traders may be underestimating.

A jump of 25+ bps in 30Y and 40Y Japanese bond yields after plans to ease fiscal tightening is a notable shift.

Japan has long been associated with ultra-low yields, so movements like this can influence global rate expectations and capital flows.

If higher yields persist, risk assets around the world — including crypto — could start to feel indirect pressure.

Sometimes bond markets move first, and other markets react later.

This is why I’m watching this development closely rather tha

- Reward

- 5

- 6

- Repost

- Share

xxx40xxx :

:

2026 GOGOGO 👊View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

View More40.88K Popularity

23.98K Popularity

17.19K Popularity

5.32K Popularity

12.42K Popularity

Hot Gate Fun

View More- MC:$3.41KHolders:10.00%

- MC:$3.42KHolders:10.00%

- MC:$3.42KHolders:10.00%

- MC:$3.42KHolders:10.00%

- MC:$3.47KHolders:20.00%

News

View MoreA trader spent $54,000 to buy PENGUIN and made a profit of $739,000 within two days.

17 m

Data: USDC circulation decreased by approximately 1.4 billion tokens in the past 7 days

25 m

Rainbow will launch the CCA auction on Uniswap on February 2nd.

51 m

"Maqi" Ethereum long position currently has a floating profit of $60,000, with total holdings rising to 6,000 ETH.

1 h

The share of US dollar in global foreign exchange reserves drops below 60%

1 h

Pin