# MacroOutlook

4.57K

MrThanks77

#USGovernmentShutdownRisk

As we move into the coming weeks, the growing risk of a U.S. government shutdown is becoming one of the most important macro factors markets cannot ignore. While headlines may change daily, the underlying issue remains the same: political gridlock continues to threaten economic stability, investor confidence, and global market sentiment.

A potential shutdown doesn’t just affect federal workers — it ripples through the entire financial system. Delayed economic data, paused government services, and uncertainty around fiscal policy can increase volatility across equitie

As we move into the coming weeks, the growing risk of a U.S. government shutdown is becoming one of the most important macro factors markets cannot ignore. While headlines may change daily, the underlying issue remains the same: political gridlock continues to threaten economic stability, investor confidence, and global market sentiment.

A potential shutdown doesn’t just affect federal workers — it ripples through the entire financial system. Delayed economic data, paused government services, and uncertainty around fiscal policy can increase volatility across equitie

BTC-3,91%

- Reward

- 9

- 5

- Repost

- Share

Discovery :

:

2026 GOGOGO 👊View More

#FedKeepsRatesUnchanged — 24H Macro Snapshot

The Federal Reserve has kept interest rates unchanged, reinforcing a clear message to global markets: patience, data-dependence, and no rush toward aggressive easing. This decision follows late-2025 rate cuts and marks a critical pause as policymakers assess inflation, labor strength, and financial stability.

🔍 Why the Fed Held Rates

Inflation continues to ease but remains above target

The labor market stays resilient, reducing urgency for stimulus

Policymakers aim to avoid premature moves that could re-ignite price pressure

Chair Powell emphasized

The Federal Reserve has kept interest rates unchanged, reinforcing a clear message to global markets: patience, data-dependence, and no rush toward aggressive easing. This decision follows late-2025 rate cuts and marks a critical pause as policymakers assess inflation, labor strength, and financial stability.

🔍 Why the Fed Held Rates

Inflation continues to ease but remains above target

The labor market stays resilient, reducing urgency for stimulus

Policymakers aim to avoid premature moves that could re-ignite price pressure

Chair Powell emphasized

- Reward

- 3

- 2

- Repost

- Share

BeautifulDay :

:

2026 GOGOGO 👊View More

#FedKeepsRatesUnchanged — 24H Macro Snapshot

The Federal Reserve has kept interest rates unchanged, reinforcing a clear message to global markets: patience, data-dependence, and no rush toward aggressive easing. This decision follows late-2025 rate cuts and marks a critical pause as policymakers assess inflation, labor strength, and financial stability.

🔍 Why the Fed Held Rates

Inflation continues to ease but remains above target

The labor market stays resilient, reducing urgency for stimulus

Policymakers aim to avoid premature moves that could re-ignite price pressure

Chair Powell emphasized

The Federal Reserve has kept interest rates unchanged, reinforcing a clear message to global markets: patience, data-dependence, and no rush toward aggressive easing. This decision follows late-2025 rate cuts and marks a critical pause as policymakers assess inflation, labor strength, and financial stability.

🔍 Why the Fed Held Rates

Inflation continues to ease but remains above target

The labor market stays resilient, reducing urgency for stimulus

Policymakers aim to avoid premature moves that could re-ignite price pressure

Chair Powell emphasized

- Reward

- 47

- 42

- Repost

- Share

TRK41 :

:

Happy New Year! 🤑View More

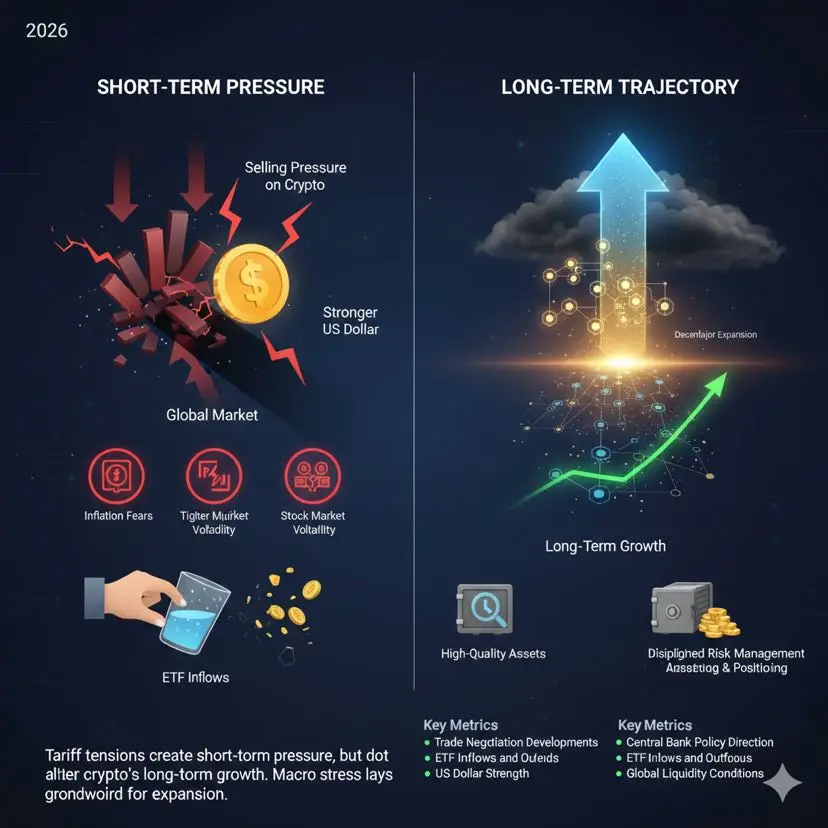

#FutureOutlook2026

Future Outlook & Market Impact (2026)

Rising global tariff tensions and renewed trade restrictions have become a powerful macro force shaping financial markets in 2026. As geopolitical pressure increases, cryptocurrencies—highly sensitive to liquidity conditions and investor psychology—are once again responding to uncertainty on a global scale.

When tariff conflicts escalate, markets typically shift into a risk-off environment. Investors reduce exposure to volatile assets and move capital toward perceived safety. This transition often creates immediate selling pressure acros

Future Outlook & Market Impact (2026)

Rising global tariff tensions and renewed trade restrictions have become a powerful macro force shaping financial markets in 2026. As geopolitical pressure increases, cryptocurrencies—highly sensitive to liquidity conditions and investor psychology—are once again responding to uncertainty on a global scale.

When tariff conflicts escalate, markets typically shift into a risk-off environment. Investors reduce exposure to volatile assets and move capital toward perceived safety. This transition often creates immediate selling pressure acros

BTC-3,91%

- Reward

- 4

- 3

- Repost

- Share

ybaser :

:

2026 GOGOGO 👊View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

19.59K Popularity

13.17K Popularity

8.9K Popularity

958 Popularity

5.36K Popularity

6.73K Popularity

18.97K Popularity

16.01K Popularity

13.51K Popularity

15.31K Popularity

12.09K Popularity

2.88K Popularity

1.24K Popularity

31.08K Popularity

225.28K Popularity

News

View MoreU.S. stocks closed with mixed gains and losses in the crypto-related stocks, with ALTS rising over 6.87%

4 m

DBS is transferring 3 million USDC to Galaxy Digital, which may be used to purchase ETH.

5 m

Two whales are respectively going long and short on BTC, with $3 million and $5.2 million.

8 m

USD/JPY breaks above 156, intraday gain of 0.17%

9 m

Spot gold reclaims the $5,000 level, with intraday gains expanding to 1.1%

13 m

Pin