# SEConTokenizedSecurities

2.76K

The SEC confirmed tokenization doesn’t change securities regulation. Does this signal a more institution-friendly phase for RWA, and which sectors stand to benefit first?

HighAmbition

#SEConTokenizedSecurities

📌 Tokenized Securities, SEC Oversight, and Market Dynamics

The landscape of tokenized securities is evolving rapidly, with the U.S. SEC playing a central role in shaping both regulation and market behavior. Tokenized securities—digital representations of traditional financial instruments like stocks, bonds, or funds—are treated under existing securities laws, regardless of whether they exist natively on-chain or as digital representations. The SEC has made it clear that all legal obligations, including registration, disclosures, investor protections, and anti-fraud

📌 Tokenized Securities, SEC Oversight, and Market Dynamics

The landscape of tokenized securities is evolving rapidly, with the U.S. SEC playing a central role in shaping both regulation and market behavior. Tokenized securities—digital representations of traditional financial instruments like stocks, bonds, or funds—are treated under existing securities laws, regardless of whether they exist natively on-chain or as digital representations. The SEC has made it clear that all legal obligations, including registration, disclosures, investor protections, and anti-fraud

- Reward

- 13

- 14

- Repost

- Share

BlackRiderCryptoLord :

:

2026 GOGOGO 👊View More

🏦 #SEConTokenizedSecurities: A New Era Begins! 🚨

The SEC has finally broken its silence on tokenized securities (RWA). The line between digital assets and traditional finance is now clearer than ever. Here’s the key takeaways from today’s update:

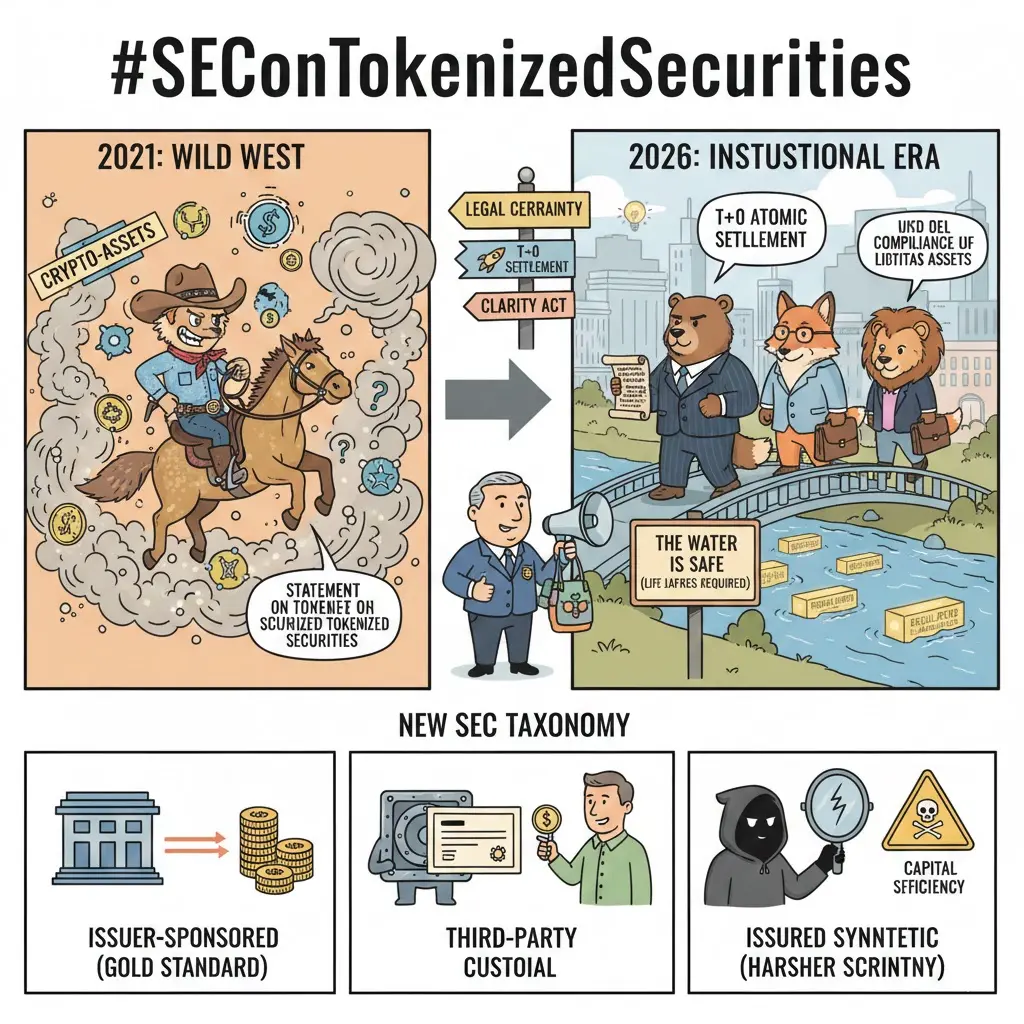

💎 1. “Format Changed, Law Didn’t”

The SEC made it clear: if a traditional security (stocks or bonds) is tokenized on a blockchain, it still remains a security. Changing the format does not remove regulatory obligations like registration or disclosure.

🏗️ 2. Project Crypto Rollout

Under the SEC’s new Project Crypto, starting Jan 2026, an “Innovatio

The SEC has finally broken its silence on tokenized securities (RWA). The line between digital assets and traditional finance is now clearer than ever. Here’s the key takeaways from today’s update:

💎 1. “Format Changed, Law Didn’t”

The SEC made it clear: if a traditional security (stocks or bonds) is tokenized on a blockchain, it still remains a security. Changing the format does not remove regulatory obligations like registration or disclosure.

🏗️ 2. Project Crypto Rollout

Under the SEC’s new Project Crypto, starting Jan 2026, an “Innovatio

RWA-4,36%

- Reward

- 4

- 3

- Repost

- Share

EagleEye :

:

Superb work! I love how clearly and creatively this is presented.View More

#SEConTokenizedSecurities

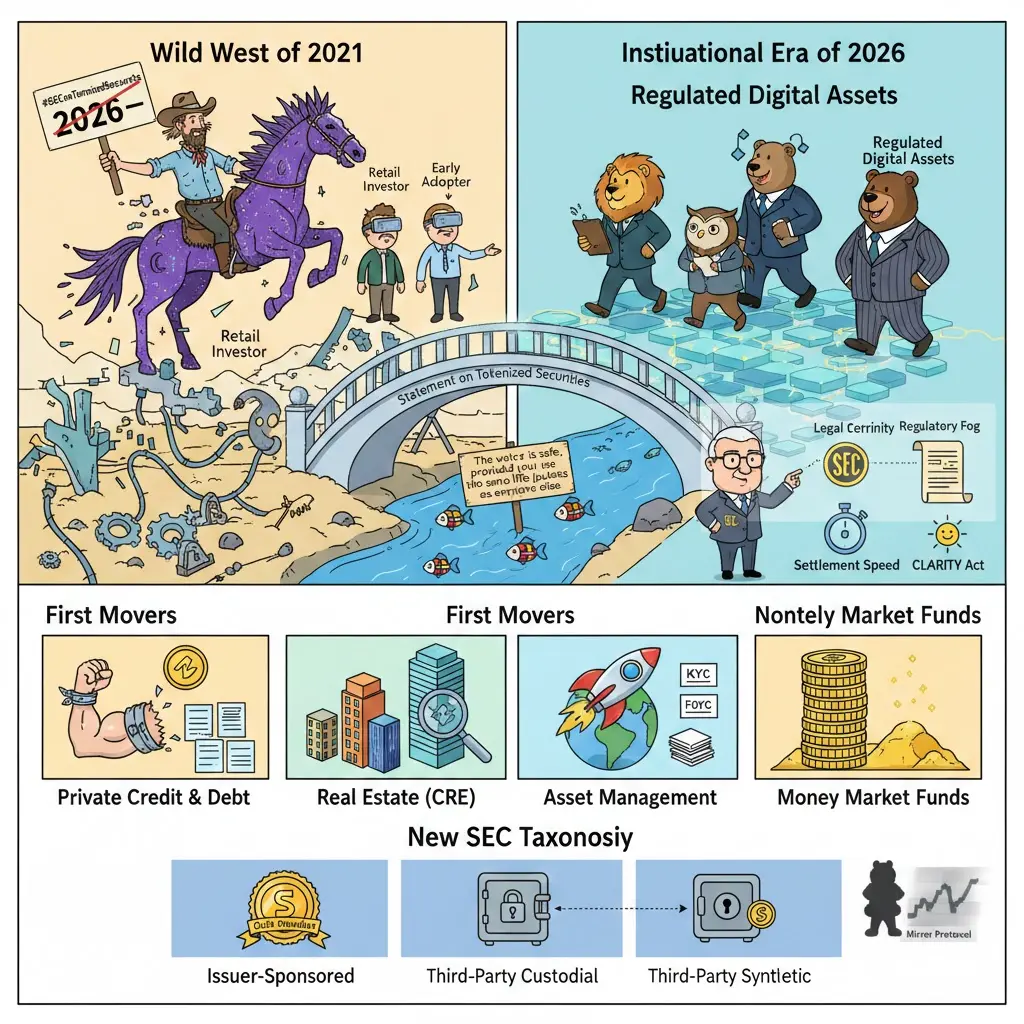

SEC Confirms Tokenized Securities Still Subject to Regulation: What It Means for RWAs and Institutional Adoption

The SEC has clarified that tokenization does not exempt securities from existing regulations. While this may initially appear restrictive, it could mark the beginning of a more institution-friendly phase for Real-World Assets (RWA) on blockchain.

Regulatory Clarity: A Double-Edged Sword

Tokenized assets remain under the same legal framework as traditional securities. This provides clear rules for issuers and investors, reducing legal uncertainty and givin

SEC Confirms Tokenized Securities Still Subject to Regulation: What It Means for RWAs and Institutional Adoption

The SEC has clarified that tokenization does not exempt securities from existing regulations. While this may initially appear restrictive, it could mark the beginning of a more institution-friendly phase for Real-World Assets (RWA) on blockchain.

Regulatory Clarity: A Double-Edged Sword

Tokenized assets remain under the same legal framework as traditional securities. This provides clear rules for issuers and investors, reducing legal uncertainty and givin

RWA-4,36%

- Reward

- 1

- 1

- Repost

- Share

Ryakpanda :

:

Just go for it💪#SEConTokenizedSecurities

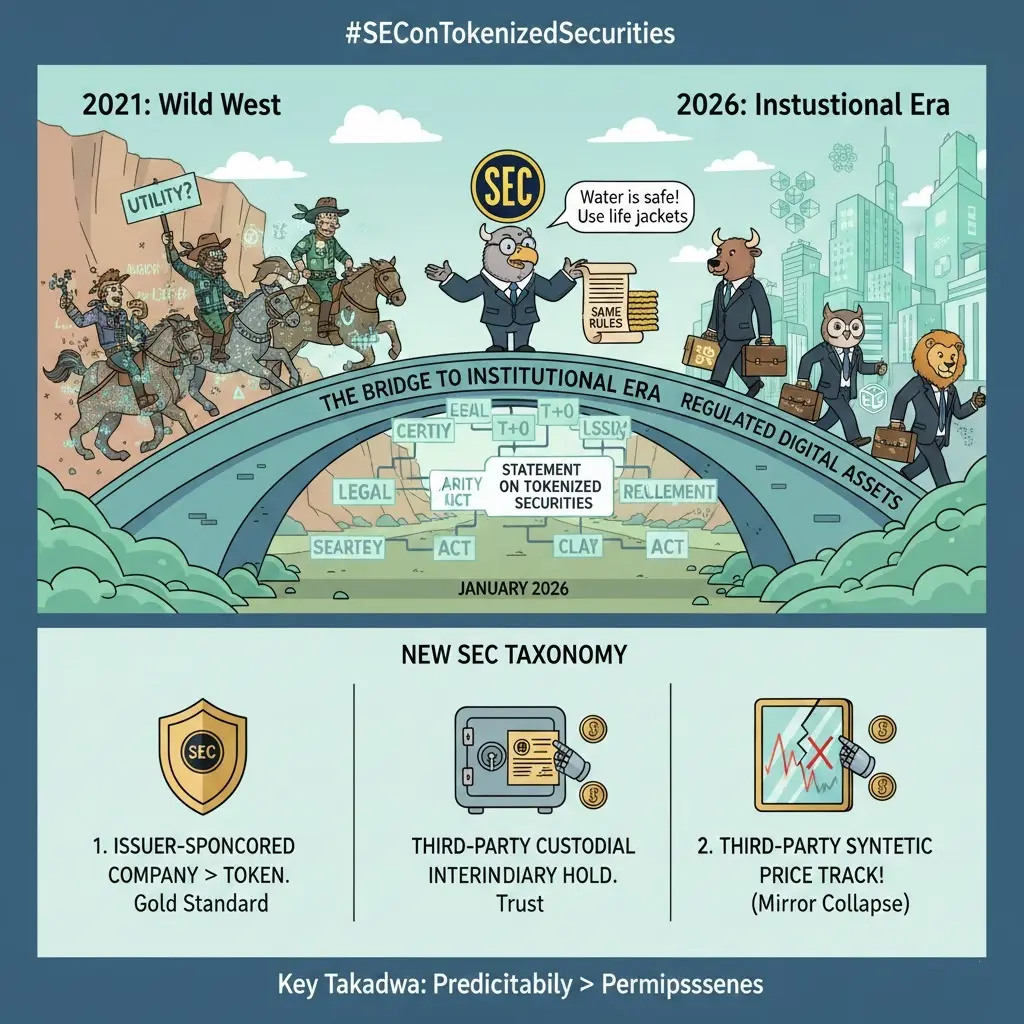

The SEC’s January 2026 guidance—summarized in its "Statement on Tokenized Securities"—is less of a "new rulebook" and more of a formal bridge between the Wild West of 2021 and the Institutional Era of 2026. By clarifying that tokenization is a technological wrapper rather than a legal transformer, the SEC has effectively told institutions: "The water is safe, provided you use the same life jackets as everyone else."

This shift signals a move from speculative "crypto-assets" to Regulated Digital Assets, where the focus is on capital efficiency rather than regulatory a

The SEC’s January 2026 guidance—summarized in its "Statement on Tokenized Securities"—is less of a "new rulebook" and more of a formal bridge between the Wild West of 2021 and the Institutional Era of 2026. By clarifying that tokenization is a technological wrapper rather than a legal transformer, the SEC has effectively told institutions: "The water is safe, provided you use the same life jackets as everyone else."

This shift signals a move from speculative "crypto-assets" to Regulated Digital Assets, where the focus is on capital efficiency rather than regulatory a

- Reward

- 6

- 6

- Repost

- Share

EagleEye :

:

Superb work! I love how clearly and creatively this is presented.View More

#SEConTokenizedSecurities 📌 Tokenized Securities, SEC Oversight, and Market Dynamics

The world of tokenized securities is evolving rapidly, with the U.S. Securities and Exchange Commission (SEC) playing a central role in shaping both regulation and market behavior. Tokenized securities are digital representations of traditional financial instruments such as stocks, bonds, or funds. Regardless of whether they exist natively on-chain or as digital representations, these assets are treated under existing securities laws. The SEC has made it clear that all legal obligations—including registration

The world of tokenized securities is evolving rapidly, with the U.S. Securities and Exchange Commission (SEC) playing a central role in shaping both regulation and market behavior. Tokenized securities are digital representations of traditional financial instruments such as stocks, bonds, or funds. Regardless of whether they exist natively on-chain or as digital representations, these assets are treated under existing securities laws. The SEC has made it clear that all legal obligations—including registration

- Reward

- 6

- 8

- Repost

- Share

MrThanks77 :

:

Happy New Year! 🤑View More

#SEConTokenizedSecurities Tokenized Securities, SEC Oversight, and Market Dynamics

The world of tokenized securities is evolving rapidly, with the U.S. Securities and Exchange Commission (SEC) playing a central role in shaping both regulation and market behavior. Tokenized securities are digital representations of traditional financial instruments such as stocks, bonds, or funds. Regardless of whether they exist natively on-chain or as digital representations, these assets are treated under existing securities laws. The SEC has made it clear that all legal obligations—including registration,

The world of tokenized securities is evolving rapidly, with the U.S. Securities and Exchange Commission (SEC) playing a central role in shaping both regulation and market behavior. Tokenized securities are digital representations of traditional financial instruments such as stocks, bonds, or funds. Regardless of whether they exist natively on-chain or as digital representations, these assets are treated under existing securities laws. The SEC has made it clear that all legal obligations—including registration,

- Reward

- 2

- 2

- Repost

- Share

HighAmbition :

:

Happy New Year! 🤑View More

#SEConTokenizedSecurities

📌 Tokenized Securities, SEC Oversight, and Market Dynamics

The landscape of tokenized securities is evolving rapidly, with the U.S. SEC playing a central role in shaping both regulation and market behavior. Tokenized securities—digital representations of traditional financial instruments like stocks, bonds, or funds—are treated under existing securities laws, regardless of whether they exist natively on-chain or as digital representations. The SEC has made it clear that all legal obligations, including registration, disclosures, investor protections, and anti-fraud

📌 Tokenized Securities, SEC Oversight, and Market Dynamics

The landscape of tokenized securities is evolving rapidly, with the U.S. SEC playing a central role in shaping both regulation and market behavior. Tokenized securities—digital representations of traditional financial instruments like stocks, bonds, or funds—are treated under existing securities laws, regardless of whether they exist natively on-chain or as digital representations. The SEC has made it clear that all legal obligations, including registration, disclosures, investor protections, and anti-fraud

- Reward

- 1

- Comment

- Repost

- Share

#SEConTokenizedSecurities

📌 Tokenized Securities, SEC Oversight, and Market Dynamics

The landscape of tokenized securities is evolving rapidly, with the U.S. SEC playing a central role in shaping both regulation and market behavior. Tokenized securities—digital representations of traditional financial instruments like stocks, bonds, or funds—are treated under existing securities laws, regardless of whether they exist natively on-chain or as digital representations. The SEC has made it clear that all legal obligations, including registration, disclosures, investor protections, and anti-fraud

📌 Tokenized Securities, SEC Oversight, and Market Dynamics

The landscape of tokenized securities is evolving rapidly, with the U.S. SEC playing a central role in shaping both regulation and market behavior. Tokenized securities—digital representations of traditional financial instruments like stocks, bonds, or funds—are treated under existing securities laws, regardless of whether they exist natively on-chain or as digital representations. The SEC has made it clear that all legal obligations, including registration, disclosures, investor protections, and anti-fraud

- Reward

- 3

- 2

- Repost

- Share

GateUser-8e61a01a :

:

😊🎉✌️View More

#SEConTokenizedSecurities

The growing interest of the US Securities and Exchange Commission in tokenized securities marks an important moment for the future of digital finance. The hashtag #SEConTokenizedSecurities reflects a regulatory shift toward understanding how traditional financial instruments, when issued or traded on blockchain networks, fit within existing legal frameworks. Tokenized securities blur the line between conventional assets and digital innovation, prompting regulators to reassess definitions, compliance requirements, and investor protections. This increased scrutiny sugg

The growing interest of the US Securities and Exchange Commission in tokenized securities marks an important moment for the future of digital finance. The hashtag #SEConTokenizedSecurities reflects a regulatory shift toward understanding how traditional financial instruments, when issued or traded on blockchain networks, fit within existing legal frameworks. Tokenized securities blur the line between conventional assets and digital innovation, prompting regulators to reassess definitions, compliance requirements, and investor protections. This increased scrutiny sugg

- Reward

- 5

- 3

- Repost

- Share

HighAmbition :

:

2026 GOGOGO 👊View More

#SEConTokenizedSecurities

The growing attention of the U.S. Securities and Exchange Commission (SEC) on tokenized securities marks a defining moment in the evolution of global financial markets. Tokenization the process of representing traditional financial assets such as equities, bonds, funds, and real-world assets on blockchain networks has moved beyond experimentation and is increasingly viewed as a transformative force. The SEC’s stance highlights both the opportunities and regulatory challenges that arise as traditional finance converges with decentralized technology.

At its core, token

The growing attention of the U.S. Securities and Exchange Commission (SEC) on tokenized securities marks a defining moment in the evolution of global financial markets. Tokenization the process of representing traditional financial assets such as equities, bonds, funds, and real-world assets on blockchain networks has moved beyond experimentation and is increasingly viewed as a transformative force. The SEC’s stance highlights both the opportunities and regulatory challenges that arise as traditional finance converges with decentralized technology.

At its core, token

- Reward

- 2

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

7.92K Popularity

6.89K Popularity

5.25K Popularity

2.76K Popularity

43.44K Popularity

1.39K Popularity

14.57K Popularity

1.35K Popularity

79.42K Popularity

26.45K Popularity

86.48K Popularity

23.07K Popularity

15.79K Popularity

13K Popularity

183.62K Popularity

News

View More"10·11 Flash Crash Insider Whale Opens Short" Lost $53 million in unrealized losses within 2 hours tonight

6 m

Machi Loses $2M in Single Day During Market Crash on HyperLiquid

18 m

Nasdaq 100 Index drops by 2%

18 m

Trader Reverses Position on U.S. Government Shutdown Bet

28 m

The Ethereum Foundation and Vitalik will create a $220 million security fund funded by "TheDAO"

30 m

Pin