2025 HONEYPrice Prediction: Market Analysis and Future Outlook for the Sweet Commodity

Introduction: HONEY's Market Position and Investment Value

Hivemapper (HONEY), as a decentralized mapping network, has made significant strides since its inception. As of 2025, HONEY's market capitalization has reached $72,728,214, with a circulating supply of approximately 4,920,718,141 tokens, and a price hovering around $0.01478. This asset, often referred to as the "crowdsourced mapping solution," is playing an increasingly crucial role in industries requiring real-time geographical data.

This article will comprehensively analyze HONEY's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price predictions and practical investment strategies.

I. HONEY Price History Review and Current Market Status

HONEY Historical Price Evolution

- 2023: HONEY token launched, price fluctuated around $0.07

- 2024: Reached all-time high of $0.14222 on December 2nd, showing strong market interest

- 2025: Experienced significant decline, dropping to all-time low of $0.01309 on September 26th

HONEY Current Market Situation

As of September 28, 2025, HONEY is trading at $0.01478, with a 24-hour trading volume of $23,469.91. The token has shown a 4.45% increase in the last 24 hours, indicating a short-term positive momentum. However, looking at longer time frames, HONEY has experienced significant declines, with a 18.43% decrease over the past 30 days and a substantial 78.61% drop over the past year.

The current market capitalization of HONEY stands at $72,728,214, ranking it 544th among all cryptocurrencies. With a circulating supply of 4,920,718,141 HONEY tokens out of a total supply of 6,499,970,783, the token has a circulation ratio of 49.21%. The fully diluted market cap is $147,800,000, suggesting potential for future growth if market conditions improve.

Despite the recent price uptick, HONEY is still trading far below its all-time high, reflecting the overall bearish trend in the crypto market. The token's performance will likely depend on the progress of the Hivemapper project and broader market conditions in the coming months.

Click to view the current HONEY market price

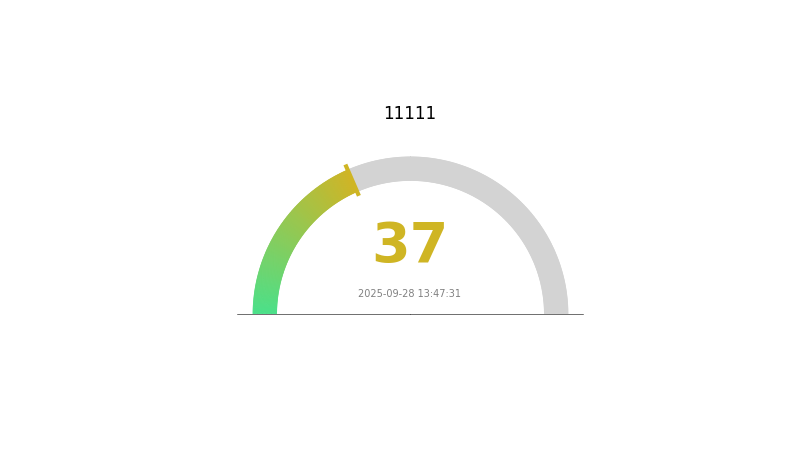

HONEY Market Sentiment Indicator

2025-09-28 Fear and Greed Index: 37 (Fear)

Click to view the current Fear & Greed Index

The crypto market is currently in a state of fear, with the Fear and Greed Index standing at 37. This suggests investors are becoming cautious and may be selling off assets. Such periods of fear can present potential buying opportunities for long-term investors, as prices may be undervalued. However, it's crucial to conduct thorough research and consider your risk tolerance before making any investment decisions. Remember, market sentiment can shift rapidly, and past performance doesn't guarantee future results.

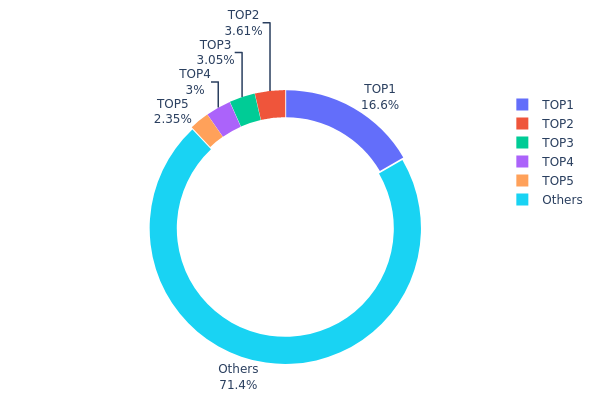

HONEY Holdings Distribution

The address holdings distribution data for HONEY reveals a moderately concentrated ownership structure. The top address holds a significant 16.58% of the total supply, indicating a dominant position in the market. The subsequent top 4 addresses collectively control an additional 12% of HONEY tokens. This concentration level suggests a potential for market influence by these major holders.

However, it's noteworthy that over 71% of HONEY tokens are distributed among numerous other addresses, indicating a degree of decentralization. This broader distribution could contribute to market stability and potentially mitigate the risk of price manipulation by any single entity. Nonetheless, the substantial holdings of the top addresses warrant attention, as their trading activities could potentially impact HONEY's price volatility and overall market dynamics.

Click to view the current HONEY holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | ERo2hR...RgKLvN | 1077988.06K | 16.58% |

| 2 | HyW7x3...bSsuvA | 234357.81K | 3.60% |

| 3 | 8MgKUj...bCiwfS | 198510.80K | 3.05% |

| 4 | 9QVqXW...CuRTMA | 195122.83K | 3.00% |

| 5 | EAmeyP...TjdT6i | 152680.46K | 2.34% |

| - | Others | 4641310.81K | 71.43% |

II. Key Factors Affecting HONEY's Future Price

Supply Mechanism

- Market Sentiment: Price action is largely driven by market sentiment, as reflected in candlestick charts, news announcements, and community sentiment.

- Historical Pattern: Long-term holders (HODLers) tend to focus on fundamental analysis for long-term trends.

- Current Impact: Short-term price movements are more influenced by immediate market reactions and news.

Institutional and Whale Dynamics

- Corporate Adoption: The adoption of HONEY by notable companies could potentially impact its price and perceived value.

Macroeconomic Environment

- Inflation Hedging Properties: As a digital asset, HONEY may be evaluated for its potential role in hedging against inflation.

Technical Development and Ecosystem Building

- Ecosystem Applications: The development of DApps and ecosystem projects within the HONEY network could drive adoption and value.

III. HONEY Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.01064 - $0.01478

- Neutral prediction: $0.01478 - $0.01729

- Optimistic prediction: $0.01729 - $0.01981 (requires favorable market conditions)

2026-2027 Outlook

- Market phase expectation: Potential growth phase

- Price range forecast:

- 2026: $0.01003 - $0.02196

- 2027: $0.01492 - $0.0208

- Key catalysts: Increased adoption and market expansion

2028-2030 Long-term Outlook

- Base scenario: $0.02022 - $0.02613 (assuming steady market growth)

- Optimistic scenario: $0.02613 - $0.0285 (assuming strong market performance)

- Transformative scenario: $0.0285 - $0.02850 (assuming exceptional market conditions and widespread adoption)

- 2030-12-31: HONEY $0.02744 (potential peak price)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.01981 | 0.01478 | 0.01064 | 0 |

| 2026 | 0.02196 | 0.01729 | 0.01003 | 17 |

| 2027 | 0.0208 | 0.01963 | 0.01492 | 33 |

| 2028 | 0.02729 | 0.02022 | 0.01476 | 37 |

| 2029 | 0.0285 | 0.02375 | 0.0152 | 61 |

| 2030 | 0.02744 | 0.02613 | 0.02482 | 77 |

IV. HONEY Professional Investment Strategies and Risk Management

HONEY Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Investors interested in decentralized mapping technology

- Operation suggestions:

- Accumulate HONEY tokens during market dips

- Stay informed about Hivemapper's project developments

- Store tokens in a secure wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Monitor short-term and long-term trends

- RSI (Relative Strength Index): Identify overbought and oversold conditions

- Key points for swing trading:

- Set clear entry and exit points

- Use stop-loss orders to limit potential losses

HONEY Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Balance HONEY with other crypto assets

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallet for long-term holdings

- Security precautions: Use two-factor authentication, avoid sharing private keys

V. Potential Risks and Challenges for HONEY

HONEY Market Risks

- Price volatility: Cryptocurrency market is highly volatile

- Competition: Other mapping projects may emerge

- Adoption risk: Slow user adoption could impact token value

HONEY Regulatory Risks

- Uncertain regulations: Cryptocurrency regulations may change

- Compliance issues: Potential challenges in meeting future regulatory requirements

- Geographic restrictions: Some countries may limit or ban cryptocurrency usage

HONEY Technical Risks

- Smart contract vulnerabilities: Potential for exploits or bugs

- Network congestion: Solana network issues could affect transactions

- Technological obsolescence: Mapping technology advancements may outpace Hivemapper

VI. Conclusion and Action Recommendations

HONEY Investment Value Assessment

HONEY presents a unique value proposition in the decentralized mapping space, with potential for long-term growth. However, short-term volatility and adoption challenges pose significant risks.

HONEY Investment Recommendations

✅ Beginners: Start with small positions, focus on learning about the project ✅ Experienced investors: Consider a balanced approach with careful risk management ✅ Institutional investors: Conduct thorough due diligence and consider as part of a diversified crypto portfolio

HONEY Trading Participation Methods

- Spot trading: Buy and sell HONEY on Gate.com

- Staking: Participate in staking programs if available

- Contribution: Earn HONEY by contributing to the Hivemapper network

Cryptocurrency investments carry extremely high risks. This article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

How much is the HONEY coin worth?

As of 2025-09-28, the HONEY coin is worth $1.77. To purchase 5 HNY, it would cost $8.84. Conversely, $1.00 can buy 0.57 HNY.

What is the price target for Hive in 2025?

The price target for Hive in 2025 is $9.3257, with a high estimate of $12.12 and a low estimate of $6.5347.

What crypto has the highest price prediction?

Bitcoin (BTC) has the highest price prediction for 2025, followed closely by Ethereum (ETH). These predictions are based on current market trends and expert analysis.

Is crypto going higher in 2025?

Yes, crypto is expected to go higher in 2025. Bitcoin could reach a maximum of $115,045 by September 2025, based on current trends and expert predictions.

2025 BLESS Price Prediction: Analyzing Market Trends and Future Potential for Investors

Is Roam (ROAM) a Good Investment?: Analyzing Market Potential and Long-Term Prospects for this Digital Nomad Token

2025 GRASS Price Prediction: Analyzing Market Trends and Potential Growth Factors

Is Fluence (FLT) a good investment?: Analyzing the potential and risks of this decentralized cloud computing platform

Is Dimitra (DMTR) a Good Investment?: Analyzing the Potential and Risks of Agricultural Blockchain Technology

2025 NODE Price Prediction: Comprehensive Analysis and Market Outlook for NODE Token in the Post-Halving Era

2025 RIF Price Prediction: Expert Analysis and Market Forecast for Rootstock's Native Token

2025 BTRST Price Prediction: Expert Analysis and Market Forecast for the Upcoming Year

2025 LUCIC Price Prediction: Expert Analysis and Market Forecast for the Upcoming Year

Is Cheelee (CHEEL) a good investment? An In-Depth Analysis of Tokenomics, Market Potential, and Risk Factors for 2024

Is Caldera (ERA) a good investment?: A Comprehensive Analysis of Risk, Potential Returns, and Market Positioning in 2024