2025 HOPR Price Prediction: Expert Analysis and Market Forecast for Privacy-Focused Blockchain Token

Introduction: HOPR's Market Position and Investment Value

HOPR is a next-generation data privacy and protection platform that has developed cutting-edge technologies for digital privacy, zero-layer data transmission, and decentralized governance. Since its launch in December 2020, HOPR has established itself as a notable player in the privacy-focused blockchain ecosystem. As of December 21, 2025, HOPR's market capitalization stands at approximately $14.7 million, with a circulating supply of approximately 539.96 million tokens and a current price of $0.02723 per token. The HOPR token serves three critical functions within its ecosystem: payment, equity, and voting, positioning it as a multi-functional asset designed to support decentralized governance and privacy infrastructure.

This article provides a comprehensive analysis of HOPR's price trends and market dynamics, incorporating historical price patterns, market supply and demand factors, ecosystem developments, and macroeconomic conditions to deliver professional price forecasts and practical investment strategies for the period through 2030.

HOPR Price History Review and Market Status

I. HOPR Price History Trajectory and Current Market Situation

HOPR Historical Price Evolution

HOPR reached its all-time high (ATH) on March 30, 2021, trading at $0.951533. Since then, the token has experienced a significant downtrend. As of the latest data available, HOPR reached its all-time low (ATL) on December 19, 2025, at $0.02587327, representing a decline of approximately 97.28% from its peak.

The token was launched on December 21, 2020, at an initial price of $0.047729, and has since lost 42.91% from its launch price to the current level.

HOPR Current Market Performance

As of December 21, 2025, HOPR is trading at $0.02723, with a 24-hour trading volume of $23,305.28. The token demonstrates mixed short-term momentum, with a marginal 1-hour gain of 0.011% and a positive 24-hour change of 0.59%. However, longer-term performance shows significant weakness, with a 7-day decline of 7.13% and a 30-day loss of 14.26%. Over the past year, HOPR has declined by 71.12%.

The market capitalization stands at approximately $14.70 million, with a fully diluted valuation of $15.39 million. The circulating supply comprises 539,956,415.1542186 HOPR tokens, representing 53.99% of the total supply of 565,115,204.8942186 tokens. The maximum supply is capped at 1,000,000,000 tokens. With a current market dominance of 0.00047%, HOPR ranks #984 by market capitalization.

The token is currently held by 7,839 addresses. The 24-hour trading range shows a high of $0.03118 and a low of $0.02638.

Check current HOPR market price

HOPR Market Sentiment Indicator

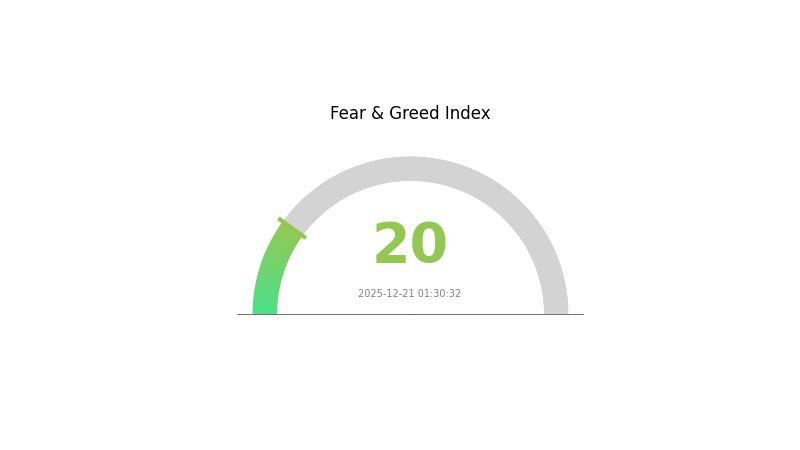

2025-12-21 Fear and Greed Index: 20 (Extreme Fear)

Click to view the current Fear & Greed Index

The cryptocurrency market is currently gripped by extreme fear, with HOPR facing significant downward pressure. An index of 20 signals heightened market pessimism and capitulation among investors. During such periods, risk-averse traders typically reduce positions, while contrarian investors may identify potential buying opportunities. This sentiment often precedes market rebounds as fear gets priced in. Monitor key support levels and market-moving catalysts closely to navigate this volatile environment on Gate.com.

HOPR Holdings Distribution

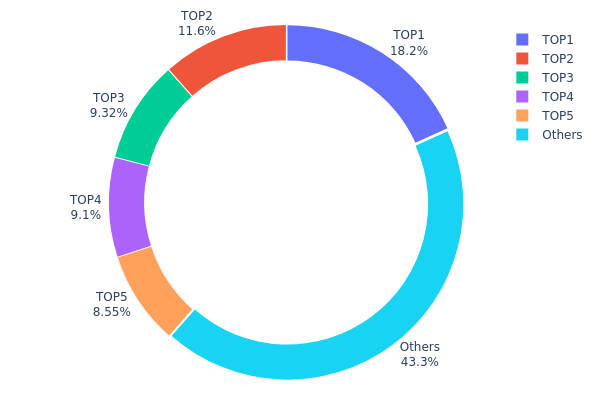

The address holdings distribution chart illustrates the concentration of HOPR tokens across blockchain addresses, providing critical insights into token ownership structure and potential market dynamics. This metric tracks the top token holders and the proportion of circulating supply each controls, serving as a key indicator of decentralization and market concentration risk.

Current analysis of HOPR's holdings distribution reveals a moderate concentration pattern among major stakeholders. The top five addresses collectively control approximately 56.71% of the token supply, with the leading address holding 18.20% and the second-largest holder maintaining 11.56%. While the remaining 43.29% of tokens are distributed among other addresses, the concentration in the top five positions suggests that key stakeholders retain substantial influence over token supply dynamics. This distribution pattern indicates that HOPR maintains a reasonably diversified holder base compared to projects with extreme concentration, though significant influence remains concentrated within a limited number of entities.

The current address distribution structure presents a balanced risk profile for market stability. With the top holder representing less than one-fifth of total supply and approximately 43% of tokens held across dispersed addresses, HOPR demonstrates reasonable decentralization characteristics. However, the combined influence of the top five addresses warrants monitoring, as coordinated actions by these major holders could potentially impact price volatility or market liquidity. This distribution pattern suggests the project has achieved moderate decentralization while maintaining sufficient concentration among core stakeholders, typical of established token projects with institutional and long-term community participation.

Visit HOPR Holdings Distribution on Gate.com for real-time updates.

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x88ad...655671 | 102890.95K | 18.20% |

| 2 | 0x2bcb...6b5b79 | 65370.15K | 11.56% |

| 3 | 0x2d8e...f65cf3 | 52662.46K | 9.31% |

| 4 | 0x849d...8d039d | 51406.29K | 9.09% |

| 5 | 0xe3df...cf2c9a | 48332.57K | 8.55% |

| - | Others | 244452.78K | 43.29% |

II. Core Factors Affecting HOPR's Future Price

Supply Mechanism

-

Block Reward Adjustments: HOPR's price trajectory is driven by supply and demand dynamics, with block reward halvings, hard forks, and protocol updates significantly influencing price movements. These structural changes to the token supply schedule directly impact the availability of new HOPR tokens entering the market.

-

Historical Patterns: Supply mechanism changes have historically demonstrated direct correlations with price volatility in similar blockchain projects, where scheduled supply reductions typically create upward price pressure when demand remains stable or increases.

-

Current Impact: Ongoing protocol updates and potential future supply adjustments are expected to continue shaping HOPR's market dynamics, with investors closely monitoring these changes for price signals.

Institutions and Major Holders

- Enterprise Adoption: Real-world adoption by enterprises and government entities represents a critical factor in HOPR's future price performance. The expansion of institutional use cases for privacy-focused solutions enhances the token's fundamental value proposition and market demand.

Macroeconomic Environment

-

Monetary Policy Impact: Global central bank policy expectations will significantly influence HOPR's price trajectory. Changes in interest rates, quantitative easing measures, and other monetary policy shifts directly affect overall cryptocurrency market sentiment and capital allocation decisions.

-

Inflation Hedging Properties: HOPR demonstrates characteristics relevant to macroeconomic environments marked by inflationary pressures, positioning it as a potential store of value amid currency devaluation concerns.

-

Geopolitical Factors: Regulatory developments, cryptocurrency exchange security incidents, and broader international policy shifts can materially impact HOPR's price, as real-world events often trigger significant market reactions in the digital asset space.

III. HOPR Price Forecast 2025-2030

2025 Outlook

- Conservative Forecast: $0.0226 - $0.02723

- Base Case Forecast: $0.02723

- Bullish Forecast: $0.03295 (requires sustained network adoption and institutional interest)

2026-2028 Mid-term Perspective

- Market Stage Expectation: Gradual accumulation phase with incremental utility expansion and ecosystem development

- Price Range Forecasts:

- 2026: $0.02648 - $0.04393

- 2027: $0.02258 - $0.04478

- 2028: $0.02372 - $0.04335

- Key Catalysts: Protocol upgrades, partnership announcements, expanded privacy infrastructure adoption, and increased validator participation

2029-2030 Long-term Outlook

- Base Case Scenario: $0.02485 - $0.05055 (assumes steady ecosystem growth and mainstream privacy awareness)

- Bullish Scenario: $0.03892 - $0.05143 (requires significant institutional adoption and Web3 infrastructure maturation)

- Transformational Scenario: $0.05143+ (driven by breakthrough privacy technology implementation, major exchange listings on platforms like Gate.com, and enterprise-level integration)

- 2030-12-31: HOPR projected at $0.05143 (70% cumulative appreciation from baseline, representing matured privacy infrastructure positioning)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.03295 | 0.02723 | 0.0226 | 0 |

| 2026 | 0.04393 | 0.03009 | 0.02648 | 10 |

| 2027 | 0.04478 | 0.03701 | 0.02258 | 35 |

| 2028 | 0.04335 | 0.0409 | 0.02372 | 50 |

| 2029 | 0.05055 | 0.04212 | 0.02485 | 54 |

| 2030 | 0.05143 | 0.04633 | 0.03892 | 70 |

HOPR Investment Strategy and Risk Management Report

IV. HOPR Professional Investment Strategy and Risk Management

HOPR Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Privacy-focused investors, decentralized governance advocates, and those seeking exposure to data privacy infrastructure

- Operational recommendations:

- Accumulate HOPR during market downturns, as the token offers exposure to an emerging privacy technology sector with long-term potential

- Hold positions for a minimum of 12-24 months to benefit from potential infrastructure adoption and ecosystem expansion

- Dollar-cost averaging: Invest fixed amounts monthly to reduce timing risk, given current market volatility

(2) Active Trading Strategy

- Technical analysis tools:

- Moving averages (MA 20/50/200): Identify price trends and support/resistance levels for entry and exit points

- Relative Strength Index (RSI): Monitor overbought/oversold conditions when RSI exceeds 70 or falls below 30

- Wave trading key points:

- Capitalize on the recent 24-hour upside movement of 0.59% as potential reversal opportunities

- Monitor weekly decline of -7.13% to identify potential support levels for tactical entries

- Set strict stop-losses at 5-8% below entry points to manage downside risk

HOPR Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-2% of portfolio

- Active investors: 3-5% of portfolio

- Professional investors: 5-10% of portfolio

(2) Risk Hedging Solutions

- Portfolio diversification: Balance HOPR holdings with established cryptocurrencies and traditional assets to reduce concentration risk

- Position sizing: Never allocate more than your risk tolerance allows; consider reducing positions during extended downtrends

(3) Secure Storage Solution

- Hardware wallet approach: Store majority holdings in secure cold storage solutions for long-term holdings

- Trading funds management: Keep active trading amounts on Gate.com for liquidity and efficient execution

- Security best practices: Enable two-factor authentication, use strong passwords, regularly audit wallet addresses, and never share private keys

V. HOPR Potential Risks and Challenges

HOPR Market Risks

- High price volatility: The token has declined 71.12% over the past year, indicating significant price instability and potential for further downside

- Liquidity constraints: With only 3 trading pairs on limited exchanges, HOPR faces reduced trading liquidity and wider bid-ask spreads, increasing execution costs

- Market sentiment exposure: Relatively low market dominance (0.00047%) means HOPR is heavily influenced by broader cryptocurrency market cycles and sentiment shifts

HOPR Regulatory Risks

- Privacy technology scrutiny: Privacy-focused projects face increasing regulatory scrutiny from global authorities, potentially impacting token utility and adoption

- Compliance uncertainty: Regulatory frameworks for privacy protocols remain unclear in many jurisdictions, creating potential legal challenges

- Decentralized governance complexity: Balancing decentralized decision-making with regulatory compliance creates operational and legal uncertainties

HOPR Technology Risks

- Network adoption challenges: Success depends on achieving critical mass of users and network participants for zero-layer data transmission viability

- Competition from established players: Other privacy solutions and data protection platforms pose competitive threats to HOPR's market positioning

- Technical execution risk: Developing and maintaining cutting-edge privacy technology requires significant ongoing R&D investment and technical expertise

VI. Conclusion and Action Recommendations

HOPR Investment Value Assessment

HOPR addresses a critical market need for decentralized data privacy and protection through innovative zero-layer data transmission technology. The project's three-token utility model (payment, equity, voting) demonstrates thoughtful tokenomics design. However, the token's 71.12% year-over-year decline and current market challenges reflect significant headwinds. Investors should approach HOPR as a high-risk, high-reward opportunity suited only to those with strong conviction in privacy infrastructure adoption and ability to withstand substantial drawdowns.

HOPR Investment Recommendations

✅ Beginners: Start with a small position (1-2% of crypto allocation) through dollar-cost averaging on Gate.com, focus on understanding the project fundamentals before increasing exposure, and prioritize security through proper wallet management

✅ Experienced Investors: Consider 3-5% allocations with active monitoring of technical indicators, implement hedging strategies through portfolio diversification, and exploit volatility for tactical entries during oversold conditions

✅ Institutional Investors: Conduct comprehensive due diligence on governance mechanisms and privacy technology roadmap, consider larger positions (5-10%) with proper risk management frameworks, and monitor regulatory developments across multiple jurisdictions

HOPR Trading Participation Methods

- Spot trading: Purchase HOPR directly on Gate.com using stablecoins or major cryptocurrencies for straightforward exposure

- Gradual accumulation: Implement monthly purchases via dollar-cost averaging to reduce timing risk and average entry costs

- Strategic rebalancing: Periodically review position sizes and adjust based on portfolio performance and changing risk factors

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors should make decisions based on their individual risk tolerance and financial circumstances. Always consult with a professional financial advisor before investing. Never invest more than you can afford to lose.

FAQ

Does Hopr have a future?

Yes, HOPR has a promising future. The project is finalizing its investment into HOPR Rise Holding AG and demonstrates strong commitment to infrastructure development. Continuous progress and strategic initiatives support HOPR's long-term viability and growth potential in the Web3 space.

What problem does Hopr Crypto solve?

Hopr solves data privacy and security issues by providing a blockchain-based protocol for secure, encrypted data transmission. It ensures data integrity and privacy protection across decentralized networks globally.

What is the hopr all time high?

HOPR's all-time high is $0.9515. This represents the highest price the token has ever reached in its trading history.

What is Hopr crypto used for?

Hopr is a decentralized privacy platform that protects user data and communications through an innovative network. It enables secure, private data transmission and enhances privacy in digital interactions across the blockchain ecosystem.

Hedera (HBAR) 2025 Price Analysis and Investment Prospects

Sui Price Market Analysis and Long-term Investment Potential in 2025

America Party: A Fundamental Analysis of Its White Paper Logic and Future Impact

Lark Davis Vs ZachXBT

2025 TIA Price Prediction: Analyzing Market Trends and Growth Potential for the Celestia Token

Elon Musk's Birthday And It's Astrology

Discovering DEGE: A Comprehensive Guide to Solana's Beloved Meme Coin

AI Copyright Guard and Digital Art on Blockchain: Secure Your Creations

Discover the Origins and Popularity of Cheems Meme Coin

Ultimate Guide to TOMA Token Launch: Price Insights and Predictions

PI Coin Listing Insights: Launch Timeline and Future Price Forecasts