2025 MSOL Price Prediction: Analyzing Potential Growth and Market Trends for Marinade Staked SOL

Introduction: MSOL's Market Position and Investment Value

Marinade Staked SOL (MSOL), as a liquid staking token on the Solana blockchain, has made significant strides since its inception. As of 2025, MSOL's market capitalization has reached $584,444,662, with a circulating supply of approximately 3,120,200 tokens, and a price hovering around $187.31. This asset, often referred to as "liquid staked SOL," is playing an increasingly crucial role in the Solana ecosystem and decentralized finance (DeFi) applications.

This article will comprehensively analyze MSOL's price trends from 2025 to 2030, taking into account historical patterns, market supply and demand, ecosystem development, and macroeconomic factors, to provide investors with professional price predictions and practical investment strategies.

I. MSOL Price History Review and Current Market Status

MSOL Historical Price Evolution

- 2022: Launch year, price reached an all-time low of $8.93 on December 30

- 2025: Market recovery, price hit an all-time high of $363.77 on January 19

- 2025: Current market cycle, price declined from the peak to $187.31

MSOL Current Market Situation

As of November 15, 2025, MSOL is trading at $187.31, experiencing a 1.96% decrease in the last 24 hours. The token's market capitalization stands at $584,444,662, ranking it 126th in the overall cryptocurrency market. MSOL has a circulating supply of 3,120,200 tokens, with a total supply of 3,120,200 and a maximum supply of 4,480,536.

The token has seen significant volatility in recent periods, with a 12.80% decrease over the past week and a substantial 27.45% drop in the last 30 days. Despite these short-term fluctuations, MSOL is still trading well above its all-time low, indicating overall growth since its inception.

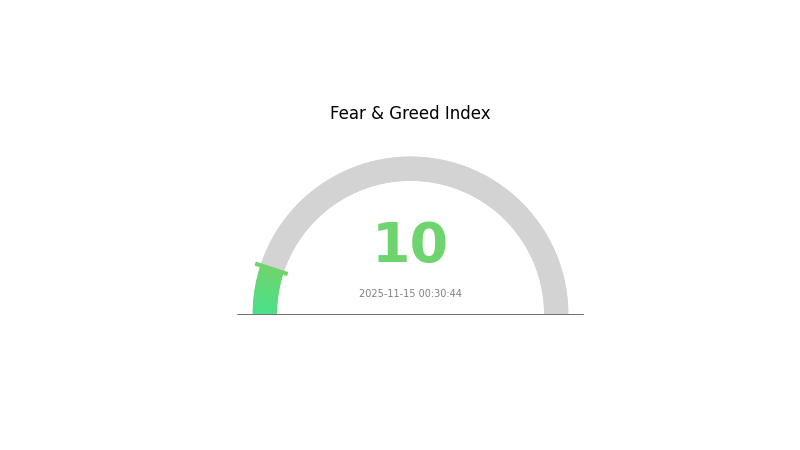

The current market sentiment for cryptocurrencies is characterized as "Extreme Fear" with a VIX index of 10, suggesting a highly cautious investor attitude in the broader crypto market.

Click to view the current MSOL market price

MSOL Market Sentiment Indicator

2025-11-15 Fear and Greed Index: 10 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is currently gripped by extreme fear, with the sentiment index plummeting to 10. This level of pessimism often signals a potential buying opportunity for contrarian investors. However, caution is advised as market volatility may persist. Traders on Gate.com should consider dollar-cost averaging strategies and thorough research before making investment decisions. Remember, market cycles are normal, and extreme fear doesn't last forever. Stay informed and manage your risk wisely in these challenging times.

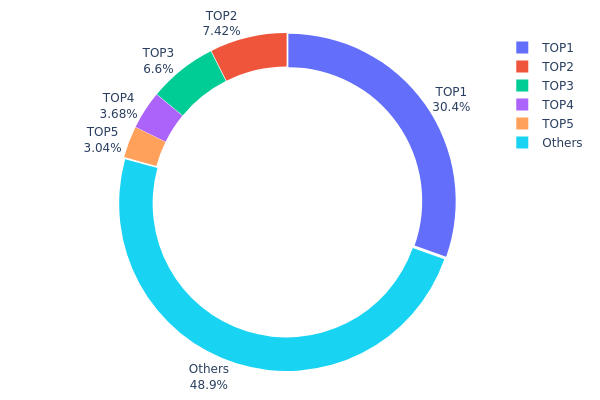

MSOL Holdings Distribution

The address holdings distribution data provides crucial insights into the concentration of MSOL tokens among various wallet addresses. Analysis of this data reveals a significant concentration in the top addresses, with the largest holder possessing 30.39% of the total supply. The top five addresses collectively control 51.1% of MSOL tokens, indicating a relatively high level of concentration.

This concentration pattern suggests potential risks to market stability and price volatility. The dominant position of the top address, holding nearly one-third of the supply, could exert substantial influence on market dynamics. However, the presence of a diverse group of smaller holders (48.9% held by "Others") indicates some level of distribution, which may help mitigate centralization concerns to an extent.

The current distribution reflects a moderate level of decentralization, though the significant holdings by top addresses warrant attention. This structure could impact liquidity and potentially lead to increased price fluctuations if large holders decide to make substantial moves. Market participants should be aware of this concentration when considering MSOL's on-chain stability and potential market reactions.

Click to view the current MSOL Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 9DrvZv...yDWpmo | 948.27K | 30.39% |

| 2 | DdZR6z...WPAuby | 231.36K | 7.41% |

| 3 | Gi2fcY...1eSQgt | 205.94K | 6.60% |

| 4 | 585B7B...cXQi9W | 114.73K | 3.67% |

| 5 | AkbDjk...yZgqxf | 94.82K | 3.03% |

| - | Others | 1525.08K | 48.9% |

II. Key Factors Influencing MSOL's Future Price

Supply Mechanism

- Staking Rewards: MSOL is issued as a liquid staking token representing staked SOL on the Marinade protocol. The supply of MSOL increases as more SOL is staked and accrues staking rewards.

- Current Impact: As Solana's ecosystem grows and more users stake their SOL through Marinade, the supply of MSOL is expected to increase, potentially impacting its price.

Institutional and Whale Dynamics

- Institutional Holdings: Some crypto-focused hedge funds and investment firms have shown interest in liquid staking derivatives like MSOL, though specific holdings are not publicly disclosed.

Macroeconomic Environment

- Inflation Hedging Properties: As a cryptocurrency-derived asset, MSOL may be viewed as a potential hedge against inflation, similar to other digital assets.

Technical Development and Ecosystem Building

- Solana Ecosystem Growth: The continued development and expansion of the Solana ecosystem directly impacts MSOL's utility and demand, as it represents staked SOL.

- Ecosystem Applications: Marinade Finance, the protocol behind MSOL, is actively working on integrations with various DeFi protocols on Solana to increase MSOL's utility and liquidity.

III. MSOL Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $123.97 - $170.00

- Neutral prediction: $170.00 - $200.00

- Optimistic prediction: $200.00 - $217.88 (requires strong market recovery and increased adoption of Solana)

2027-2028 Outlook

- Market stage expectation: Potential bull market phase

- Price range forecast:

- 2027: $121.04 - $280.20

- 2028: $146.26 - $317.74

- Key catalysts: Solana ecosystem growth, increased institutional adoption, and overall crypto market recovery

2029-2030 Long-term Outlook

- Base scenario: $284.96 - $310.61 (assuming steady growth in Solana ecosystem)

- Optimistic scenario: $336.25 - $397.57 (assuming widespread adoption and technological advancements)

- Transformative scenario: $400.00 - $500.00 (assuming Solana becomes a leading blockchain platform)

- 2030-12-31: MSOL $397.57 (potential peak price for the period)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 217.88 | 187.83 | 123.97 | 0 |

| 2026 | 245.46 | 202.86 | 170.4 | 8 |

| 2027 | 280.2 | 224.16 | 121.04 | 19 |

| 2028 | 317.74 | 252.18 | 146.26 | 34 |

| 2029 | 336.25 | 284.96 | 145.33 | 52 |

| 2030 | 397.57 | 310.61 | 211.21 | 65 |

IV. MSOL Professional Investment Strategies and Risk Management

MSOL Investment Methodology

(1) Long-term Holding Strategy

- Target investors: Conservative investors seeking stable returns

- Operational suggestions:

- Stake SOL tokens through Marinade.finance to receive MSOL

- Reinvest staking rewards to compound returns

- Store MSOL in a secure non-custodial wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving averages: Monitor short-term and long-term trends

- Relative Strength Index (RSI): Identify overbought and oversold conditions

- Key points for swing trading:

- Set stop-loss orders to limit potential losses

- Take profits at predetermined price targets

MSOL Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of portfolio

- Moderate investors: 3-7% of portfolio

- Aggressive investors: 7-15% of portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple cryptocurrencies and traditional assets

- Stop-loss orders: Implement automatic sell orders to limit potential losses

(3) Secure Storage Solutions

- Hardware wallet recommendation: Gate Web3 Wallet

- Software wallet option: Official Solana wallet

- Security precautions: Enable two-factor authentication, use strong passwords, and regularly update software

V. Potential Risks and Challenges for MSOL

MSOL Market Risks

- Volatility: Cryptocurrency markets are known for significant price fluctuations

- Liquidity risk: MSOL may experience periods of low trading volume

- Correlation risk: MSOL price is closely tied to SOL performance

MSOL Regulatory Risks

- Uncertain regulatory landscape: Evolving regulations may impact MSOL's legality or usage

- Compliance requirements: Potential for increased reporting or KYC obligations

- Tax implications: Changing tax laws may affect MSOL investments

MSOL Technical Risks

- Smart contract vulnerabilities: Potential for exploits in the Marinade.finance protocol

- Network congestion: Solana network issues could affect MSOL transactions

- Oracle failures: Inaccurate price feeds may disrupt the staking mechanism

VI. Conclusion and Action Recommendations

MSOL Investment Value Assessment

MSOL offers potential long-term value through staking rewards and Solana ecosystem growth, but faces short-term risks from market volatility and regulatory uncertainties.

MSOL Investment Recommendations

✅ Beginners: Start with a small allocation and focus on learning about staking mechanics ✅ Experienced investors: Consider MSOL as part of a diversified crypto portfolio ✅ Institutional investors: Evaluate MSOL for yield generation and Solana ecosystem exposure

MSOL Participation Methods

- Staking: Convert SOL to MSOL through Marinade.finance

- Trading: Buy MSOL on Gate.com or other supported exchanges

- DeFi: Utilize MSOL in Solana-based decentralized finance protocols

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is the price prediction for Msol coin?

Based on market trends and expert analysis, Msol coin is predicted to reach $50-$60 by the end of 2025, with potential for further growth in 2026.

Can Solana reach $500 in 2025?

Yes, Solana could potentially reach $500 in 2025. With its high-speed blockchain and growing ecosystem, Solana has the potential for significant price appreciation, especially if crypto market conditions remain favorable.

Does Marlin Pond have a future?

Yes, Marlin Pond has a promising future. As a key player in the Web3 ecosystem, it's likely to see continued growth and adoption in the coming years, driven by increasing demand for decentralized infrastructure solutions.

Would hamster kombat coin reach $1?

It's unlikely for Hamster Kombat Coin to reach $1 in the near future, given its current market cap and supply. However, with increased adoption and development, it could potentially reach higher price levels over time.

2025 MNDE Price Prediction: Will the Governance Token Surge to New Heights in the Evolving DeFi Landscape?

2025 CLOUDPrice Prediction: Emerging Market Trends and Investment Opportunities in the Global Cloud Computing Industry

Is Sanctum (CLOUD) a Good Investment?: Analyzing Potential Returns and Risks in the Cloud Security Token Market

2025 MNDE Price Prediction: Analyzing Market Trends and Potential Growth Factors for Marinade Finance

Is Sanctum (CLOUD) a good investment?: Analyzing the potential of this cloud-based security token

# How Much SOL Are Institutions Currently Holding: 2025 Holdings & Fund Flow Analysis

Hamster Kombat Daily Combo & Cipher Answer 4 january 2026

Dropee Daily Combo for 4 january 2026

# What Drives TTD Price Volatility? 52-Week Range Analysis and Trading Patterns

What are the compliance and regulatory risks in cryptocurrency markets in 2026?

What is BARD token and how does its Bitcoin DeFi infrastructure protocol work?