2025 SUPERPrice Prediction: Analyzing Market Trends and Future Valuation of SUPER Token in the Evolving Blockchain Ecosystem

Introduction: SUPER's Market Position and Investment Value

SuperFarm (SUPER), as a cross-chain DeFi protocol designed to bring utility to any token through NFT farms, has made significant strides since its inception in 2021. As of 2025, SUPER's market capitalization has reached $373,214,256, with a circulating supply of approximately 628,412,622 tokens, and a price hovering around $0.5939. This asset, often hailed as the "NFT Utility Innovator," is playing an increasingly crucial role in the fields of DeFi and NFT infrastructure.

This article will comprehensively analyze SUPER's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price predictions and practical investment strategies.

I. SUPER Price History Review and Current Market Status

SUPER Historical Price Evolution Trajectory

- 2021: SUPER reached its all-time high of $4.72995838 on March 31, marking a significant milestone for the project.

- 2023: The token experienced a major downturn, hitting its all-time low of $0.07043172184672868 on October 19.

- 2025: SUPER has shown some recovery, with the current price at $0.5939, reflecting market cycles and project developments.

SUPER Current Market Situation

As of September 21, 2025, SUPER is trading at $0.5939, with a market cap of $373,214,256.45. The token has experienced a slight decline of 1.16% in the past 24 hours. SUPER's circulating supply stands at 628,412,622.4169173 tokens, which represents 62.84% of its total supply. The fully diluted valuation of the project is $593,898,858.18. Despite the recent dip, SUPER has shown resilience, maintaining a position within the top 215 cryptocurrencies by market capitalization. The token's trading volume in the last 24 hours is $45,993.382272, indicating moderate market activity.

Click to view the current SUPER market price

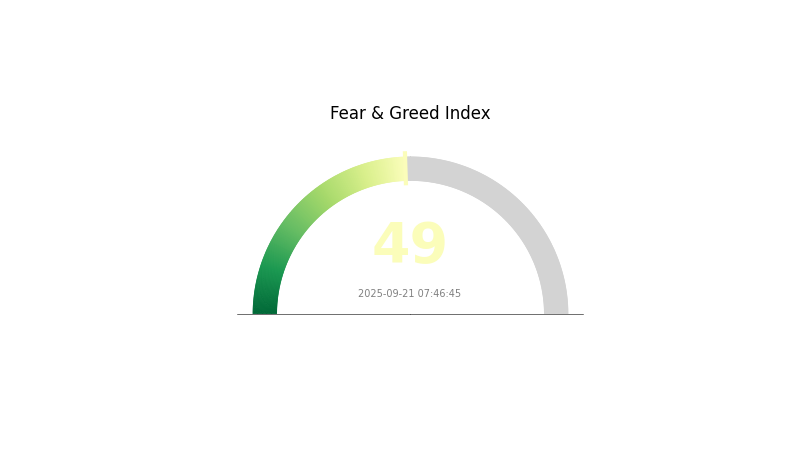

SUPER Market Sentiment Indicator

2025-09-21 Fear and Greed Index: 49 (Neutral)

Click to view the current Fear & Greed Index

The crypto market sentiment remains balanced today, with the Fear and Greed Index at 49, indicating a neutral stance. This suggests that investors are neither overly fearful nor excessively greedy. Such equilibrium often presents opportunities for traders to reassess their strategies and positions. While the market lacks extreme emotions, it's crucial to stay vigilant and monitor potential catalysts that could sway sentiment in either direction. As always, conducting thorough research and maintaining a diversified portfolio is advisable in this neutral climate.

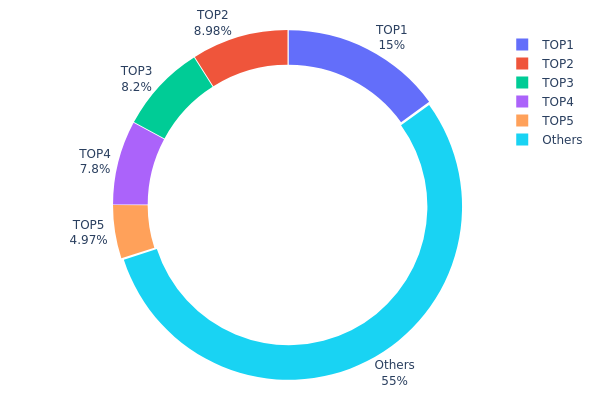

SUPER Holdings Distribution

The address holdings distribution data for SUPER reveals a significant concentration of tokens among a few top addresses. The largest holder possesses 15.02% of the total supply, while the top five addresses collectively control 44.97% of SUPER tokens. This level of concentration indicates a relatively centralized ownership structure, which could potentially impact market dynamics.

Such a concentrated distribution raises concerns about market manipulation and price volatility. With nearly half of the tokens held by just five addresses, there's an increased risk of large-scale sell-offs or coordinated actions that could significantly influence SUPER's price. Moreover, this concentration may undermine the project's decentralization efforts and could be perceived negatively by the broader crypto community.

However, it's worth noting that 55.03% of SUPER tokens are distributed among other addresses, suggesting some level of broader market participation. While this distribution is not ideal for a fully decentralized ecosystem, it does provide some balance against the top holders' influence. Ongoing monitoring of these holdings will be crucial for assessing SUPER's market structure and potential risks moving forward.

Click to view the current SUPER Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x7226...250cb1 | 150257.48K | 15.02% |

| 2 | 0x8c96...d0b887 | 89819.86K | 8.98% |

| 3 | 0xbda1...3a4700 | 82000.00K | 8.20% |

| 4 | 0xf6e4...2e14ca | 78020.00K | 7.80% |

| 5 | 0x7080...ac3f2c | 49720.80K | 4.97% |

| - | Others | 550179.93K | 55.03% |

II. Key Factors Affecting SUPER's Future Price

Supply Mechanism

- Token Release Schedule: SUPER has a total supply of 999,998,077 tokens, with 628,412,622 currently in circulation.

- Historical Patterns: Previous token releases have typically led to short-term price volatility.

- Current Impact: With about 37% of tokens still to be released, future distributions may create downward pressure on price.

Institutional and Whale Activity

- Institutional Holdings: Several major crypto investment firms have added SUPER to their portfolios.

- Enterprise Adoption: Gaming and NFT companies have begun integrating SUPER into their ecosystems.

- Government Policies: Regulatory clarity around NFTs and gaming tokens in major markets could impact adoption.

Macroeconomic Environment

- Monetary Policy Impact: Federal Reserve policies on interest rates will influence risk appetite for crypto assets like SUPER.

- Inflation Hedging Properties: SUPER's performance during inflationary periods has been mixed, showing some correlation with broader crypto markets.

- Geopolitical Factors: Global economic uncertainties and regulatory shifts in key markets may affect SUPER's valuation.

Technical Development and Ecosystem Growth

- Cross-Chain Expansion: SUPER has expanded to multiple chains including Ethereum, Polygon, Avalanche, and Base, increasing accessibility.

- NFT Functionality Upgrades: Planned improvements to NFT minting and trading features could drive increased utility.

- Ecosystem Applications: The growth of SuperVerse's gaming and NFT marketplace platforms will be crucial for SUPER's long-term value proposition.

III. SUPER Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.49 - $0.55

- Neutral prediction: $0.55 - $0.65

- Optimistic prediction: $0.65 - $0.73 (requires strong market recovery and increased adoption)

2027-2028 Outlook

- Market stage expectation: Potential growth phase with increasing adoption

- Price range forecast:

- 2027: $0.65 - $0.82

- 2028: $0.76 - $1.00

- Key catalysts: Technological advancements, expanding use cases, and overall crypto market growth

2029-2030 Long-term Outlook

- Base scenario: $0.89 - $0.95 (assuming steady market growth and adoption)

- Optimistic scenario: $0.95 - $1.00 (with accelerated adoption and favorable market conditions)

- Transformative scenario: $1.00 - $1.10 (with breakthrough applications and mainstream acceptance)

- 2030-12-31: SUPER $0.94 (potential for stable growth and increased utility)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.7305 | 0.5939 | 0.49294 | 0 |

| 2026 | 0.85424 | 0.6622 | 0.49665 | 11 |

| 2027 | 0.81887 | 0.75822 | 0.65207 | 27 |

| 2028 | 1.00145 | 0.78855 | 0.76489 | 32 |

| 2029 | 0.99345 | 0.895 | 0.537 | 50 |

| 2030 | 0.97255 | 0.94422 | 0.8498 | 58 |

IV. SUPER Professional Investment Strategies and Risk Management

SUPER Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term believers in NFT and DeFi integration

- Operation suggestions:

- Accumulate SUPER tokens during market dips

- Stake SUPER tokens to earn platform rewards

- Store in a secure non-custodial wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use for trend identification

- RSI: Identify overbought/oversold conditions

- Key points for swing trading:

- Monitor NFT market trends closely

- Set stop-loss orders to manage risk

SUPER Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3%

- Aggressive investors: 5-10%

- Professional investors: 10-15%

(2) Risk Hedging Solutions

- Diversification: Spread investments across different DeFi and NFT projects

- Stop-loss orders: Set automatic sell orders to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallet for large holdings

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for SUPER

SUPER Market Risks

- High volatility: NFT market sentiment can change rapidly

- Competition: Increasing number of NFT and DeFi platforms

- Liquidity risk: Potential difficulty in selling large amounts quickly

SUPER Regulatory Risks

- Uncertain regulations: Evolving global stance on NFTs and DeFi

- Tax implications: Unclear tax treatment for NFT transactions

- Cross-border restrictions: Potential limitations on international NFT trading

SUPER Technical Risks

- Smart contract vulnerabilities: Potential for exploits or bugs

- Scalability issues: Challenges in handling high transaction volumes

- Interoperability concerns: Difficulties in cross-chain NFT transfers

VI. Conclusion and Action Recommendations

SUPER Investment Value Assessment

SUPER presents a unique value proposition in the intersection of NFTs and DeFi, offering long-term potential for growth. However, it faces short-term risks due to market volatility and regulatory uncertainties.

SUPER Investment Recommendations

✅ Beginners: Start with small positions, focus on learning the SuperFarm ecosystem ✅ Experienced investors: Consider a balanced approach with staking and active trading ✅ Institutional investors: Explore strategic partnerships and large-scale NFT deployments

SUPER Trading Participation Methods

- Spot trading: Buy and sell SUPER tokens on Gate.com

- Staking: Participate in SuperFarm's staking programs for passive income

- NFT minting: Engage in SuperFarm's NFT creation and trading features

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Will SuperRare coins go up?

Yes, SuperRare coins are expected to rise. Predictions suggest RARE could reach $0.058011 by September, showing potential for growth in the near future.

What are the risks of SuperVerse?

SuperVerse carries risks of price volatility, potential market manipulation, and project-specific challenges. Investors may face significant losses due to these factors.

What is the future prediction for Siacoin?

Siacoin is predicted to reach $0.003288 by October 19, 2025, a 12.50% increase from current levels. This forecast is based on market trends.

What crypto has the highest price prediction?

Ethereum (ETH) has the highest price prediction, with forecasts suggesting it could reach up to $4,495 by 2025.

2025 BMT Price Prediction: Analyzing Future Market Trends and Investment Potential

What is K21: The Revolutionary AI System Transforming Healthcare Diagnostics

2025 K21 Price Prediction: Analyzing Market Trends and Potential Growth Factors

DON vs CHZ: A Battle of Blockchain Giants in the Sports and Entertainment Arena

2025 NFTFI Price Prediction: Navigating the Future of NFT-Backed Financial Instruments

BUSY vs THETA: The Battle of Productivity Apps in the Digital Age

Analysis of the Three Stages of Money Laundering and Challenges in the Era of Encryption

Marina Protocol Daily Quiz Answer December 12, 2025

Dropee Question of the Day December 12, 2025

Top Smartphones for Seamless Blockchain Experience

Spur Protocol Daily Quiz Answer Today December 12, 2025