2025 TAPrice Prediction: Analyzing Market Trends and Forecasting Future Values for Technical Assets

Introduction: TA's Market Position and Investment Value

Trusta.AI (TA), as a project aiming to create a trusted identity network for AI and crypto, has been making strides since its inception in 2025. As of 2025, Trusta.AI's market cap has reached $13,471,200, with a circulating supply of approximately 180,000,000 tokens, and a price hovering around $0.07484. This asset, dubbed the "AI-Crypto Bridge," is playing an increasingly crucial role in establishing a universal credit system for both human and artificial intelligence.

This article will comprehensively analyze Trusta.AI's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price predictions and practical investment strategies.

I. TA Price History Review and Current Market Status

TA Historical Price Evolution Trajectory

- 2025 (August): Initial launch, price started at $0.1

- 2025 (September 2): Reached all-time high of $0.3854

- 2025 (August 24): Touched all-time low of $0.046

TA Current Market Situation

TA is currently trading at $0.07484, showing a 6.79% increase in the last 24 hours. The token has a market cap of $13,471,200 with a circulating supply of 180,000,000 TA. The fully diluted valuation stands at $74,840,000.

Over the past week, TA has seen a 9.11% price increase, indicating short-term bullish momentum. However, the 30-day trend shows a significant decline of 25.91%, suggesting overall bearish pressure in the medium term.

The token's trading volume in the last 24 hours is $2,284,720.37, reflecting moderate market activity. TA's current price is significantly below its all-time high of $0.3854, but well above its all-time low of $0.046.

The market sentiment for TA appears mixed, with short-term gains contrasting against longer-term losses. Investors should note that the token is still in its early stages, having been launched just a few months ago in August 2025.

Click to view current TA market price

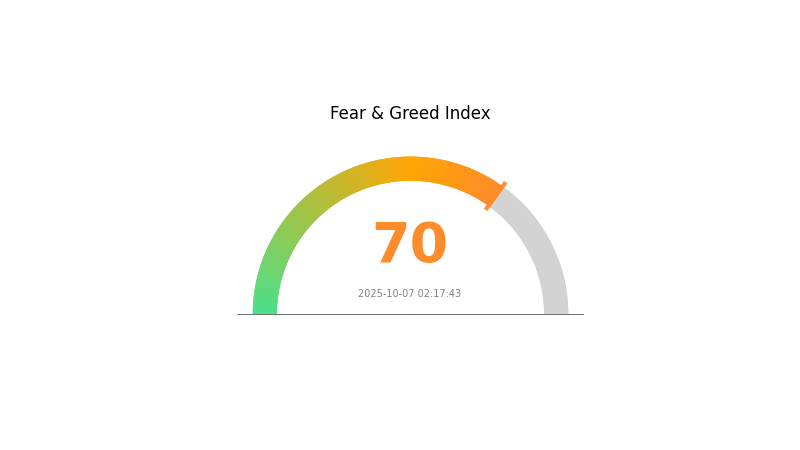

TA Market Sentiment Indicator

2025-10-07 Fear and Greed Index: 70 (Greed)

Click to view the current Fear & Greed Index

The crypto market is showing signs of exuberance, with the Fear and Greed Index reaching 70, indicating a state of greed. This suggests investors are becoming overly optimistic, potentially driving prices to unsustainable levels. While bullish sentiment can fuel further gains, it's crucial to remain cautious. Experienced traders often view extreme greed as a contrarian signal, considering it an opportune time to take profits or hedge positions. As always, diversification and risk management are key in navigating these volatile market conditions.

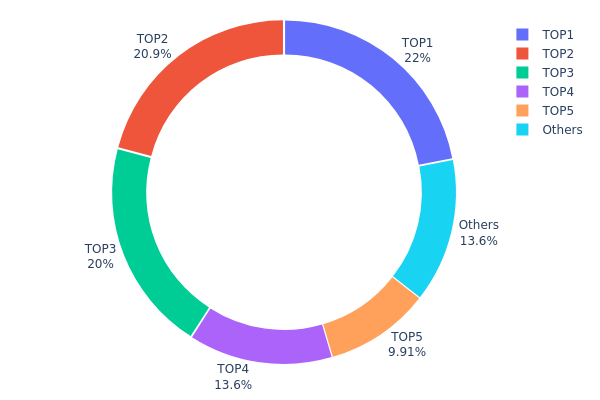

TA Holdings Distribution

The address holdings distribution data reveals a highly concentrated ownership structure for TA. The top five addresses collectively hold 86.38% of the total supply, with the remaining 13.62% distributed among other addresses. This concentration is particularly evident in the top three addresses, which control 62.88% of all tokens.

Such a high concentration of holdings raises concerns about market manipulation and price volatility. With a few large holders possessing significant influence over the token supply, there is an increased risk of sudden large-scale transactions that could dramatically impact market prices. This centralized distribution also contradicts the principles of decentralization often associated with blockchain projects.

From a market structure perspective, this concentration suggests a relatively immature and potentially unstable ecosystem for TA. It may deter smaller investors due to perceived risks of whale dominance and could limit organic price discovery mechanisms. Monitoring these top addresses for any significant changes in holdings will be crucial for assessing the token's future market dynamics and overall health.

Click to view the current TA Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x9581...88e952 | 210000.00K | 21.95% |

| 2 | 0xc413...740d97 | 200000.00K | 20.90% |

| 3 | 0x1b9d...261821 | 191666.67K | 20.03% |

| 4 | 0x6148...882ec0 | 130000.00K | 13.59% |

| 5 | 0xf89d...5eaa40 | 94815.71K | 9.91% |

| - | Others | 130079.86K | 13.62% |

II. Key Factors Influencing Future TA Prices

Supply Mechanism

- Historical patterns: Past supply changes have impacted prices, with increased supply often leading to price decreases.

- Current impact: Current supply changes are expected to influence future price movements.

Institutional and Whale Dynamics

- National policies: Government regulations and policies related to TA can significantly affect its market performance.

Macroeconomic Environment

- Inflation hedging properties: TA's performance in inflationary environments may influence its future price trends.

- Geopolitical factors: International trade tensions and tariff adjustments can alter the supply-demand balance of TA, potentially causing price fluctuations.

Technological Development and Ecosystem Building

- Technical analysis tools: Indicators such as RSI and MACD are used to predict TA price trends.

- Ecosystem applications: Development of decentralized applications (DApps) and ecosystem projects may impact TA's value proposition.

III. TA Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.05725 - $0.07533

- Neutral prediction: $0.07533 - $0.08512

- Optimistic prediction: $0.08512 - $0.09492 (requires positive market sentiment and increased adoption)

2027-2028 Outlook

- Market stage expectation: Potential growth phase with increasing adoption

- Price range forecast:

- 2027: $0.07685 - $0.15474

- 2028: $0.07758 - $0.18101

- Key catalysts: Technological advancements, wider market acceptance, and potential partnerships

2029-2030 Long-term Outlook

- Base scenario: $0.15515 - $0.16291 (assuming steady market growth and adoption)

- Optimistic scenario: $0.17067 - $0.22807 (with favorable market conditions and increased utility)

- Transformative scenario: Above $0.22807 (with groundbreaking developments and mass adoption)

- 2030-12-31: TA $0.22807 (potentially reaching new all-time highs)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.09492 | 0.07533 | 0.05725 | 0 |

| 2026 | 0.12258 | 0.08512 | 0.07916 | 13 |

| 2027 | 0.15474 | 0.10385 | 0.07685 | 38 |

| 2028 | 0.18101 | 0.12929 | 0.07758 | 72 |

| 2029 | 0.17067 | 0.15515 | 0.09464 | 107 |

| 2030 | 0.22807 | 0.16291 | 0.12055 | 117 |

IV. Professional Investment Strategies and Risk Management for TA

TA Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors with a high risk tolerance

- Operation suggestions:

- Accumulate TA tokens during market dips

- Hold for at least 1-2 years to ride out market volatility

- Store tokens in a secure hardware wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and support/resistance levels

- RSI (Relative Strength Index): Monitor overbought/oversold conditions

- Key points for swing trading:

- Set clear entry and exit points based on technical indicators

- Use stop-loss orders to limit potential losses

TA Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple crypto assets

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hardware wallet recommendation: Gate Web3 Wallet

- Software wallet option: Official Trusta.AI wallet (if available)

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for TA

TA Market Risks

- High volatility: Significant price fluctuations common in the crypto market

- Liquidity risk: Limited trading volume may affect ability to buy/sell quickly

- Competition: Other AI and identity-focused projects may impact TA's market share

TA Regulatory Risks

- Uncertain regulatory environment: Potential for new regulations affecting AI and crypto

- Cross-border compliance: Challenges in adhering to varying international regulations

- Data privacy concerns: Increased scrutiny on AI projects handling personal data

TA Technical Risks

- Smart contract vulnerabilities: Potential for exploits or bugs in the underlying code

- Scalability challenges: Possible limitations in handling increased network activity

- Integration issues: Difficulties in seamlessly connecting with various AI systems

VI. Conclusion and Action Recommendations

TA Investment Value Assessment

Trusta.AI presents an innovative approach to AI and crypto identity, offering long-term potential in a growing sector. However, short-term volatility and regulatory uncertainties pose significant risks.

TA Investment Recommendations

✅ Beginners: Start with small, regular investments to build a position over time

✅ Experienced investors: Consider a moderate allocation, balancing potential with risk

✅ Institutional investors: Conduct thorough due diligence and consider TA as part of a diversified crypto portfolio

TA Trading Participation Methods

- Spot trading: Buy and hold TA tokens on Gate.com

- DCA (Dollar-Cost Averaging): Set up regular, small purchases to average out price volatility

- Staking: Participate in staking programs if offered by Trusta.AI to earn additional rewards

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is the prediction for Aptos 2025?

The prediction for Aptos in 2025 ranges from $4.59 to $12.58, with potential growth up to 175%. Market trends suggest a possible significant increase in value.

What is the price target for T in 2026?

Based on Wall Street analysis, the price target for T in 2026 is $32.00, with a forecast range of $20.71 to $34.00.

What crypto has the highest price prediction?

Bitcoin has the highest price prediction, with forecasts suggesting it could reach $139,045 by 2025, up from its current price of around $124,798.

What is the total supply of TA tokens?

The total supply of TA tokens is 998.56 million, which matches the circulating supply as of October 7, 2025.

2025 BNKR Price Prediction: Analyzing Market Trends and Growth Potential in the Digital Asset Space

2025 ASPPrice Prediction: Market Trends and Strategic Forecast for Industry Leaders

2025 ORAI Price Prediction: Market Analysis and Future Growth Potential for Oraichain Token

2025 TAO Price Prediction: Analyzing Market Trends and Potential Growth Factors

2025 TAPrice Prediction: Analyzing Market Trends and Future Valuation of Token Assets

2025 DNX Price Prediction: Analyzing Market Trends and Potential Growth Factors

Understanding Zero-Knowledge Proofs: An In-Depth Guide for Web3 Innovators

Top Decentralized Exchange Platforms for Seamless Trading

Spot Trading Basics in Web3 and Decentralized Finance: A Beginner's Guide

Guide to Building Applications on the Polkadot Network

Comprehensive Guide to Liquidity Pools in Decentralized Exchanges