2025 TBCPrice Prediction: Analyzing Market Trends and Future Valuation of TBC in a Changing Crypto Landscape

Introduction: TBC's Market Position and Investment Value

TuringBitChain (TBC), as the pioneer of the Bitcoin Virtual Machine (BVM), has made significant strides since its inception. As of 2025, TBC's market capitalization has reached $468,569,000, with a circulating supply of approximately 27,800,000 coins, and a price hovering around $16.855. This asset, hailed as the "BTC smart contract layer solution," is playing an increasingly crucial role in unleashing Bitcoin's full potential and addressing its congestion issues.

This article will provide a comprehensive analysis of TBC's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. TBC Price History Review and Current Market Status

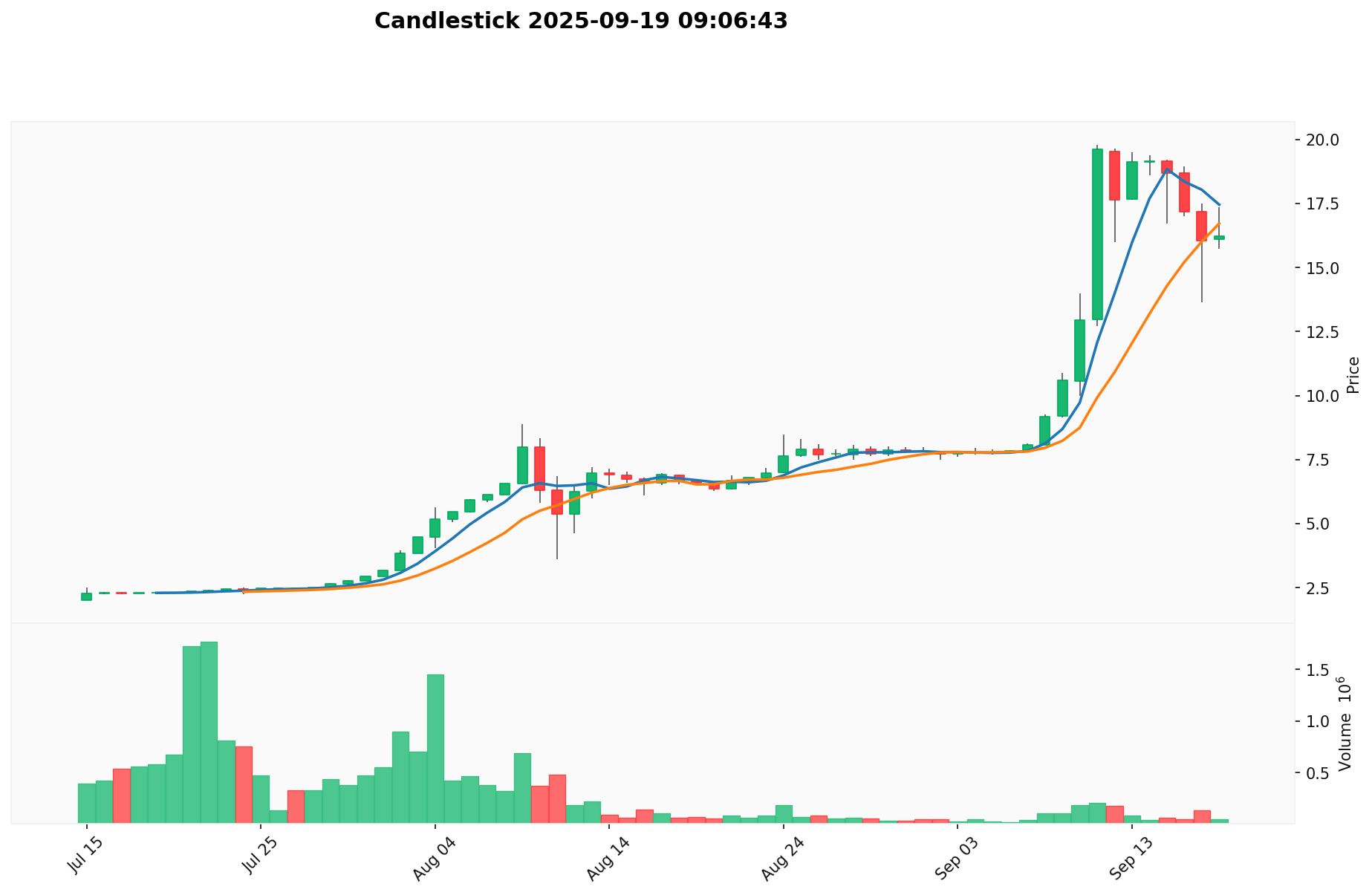

TBC Historical Price Evolution

- 2025: TBC launched, price started at $2

- July 2025: TBC reached its all-time low of $2

- September 2025: TBC hit its all-time high of $19.8, marking a significant price surge

TBC Current Market Situation

As of September 19, 2025, TBC is trading at $16.855, ranking 178th in the cryptocurrency market. The token has experienced a slight decrease of 1.06% in the last 24 hours, with a trading volume of $733,288.33549. TBC's market capitalization stands at $468,569,000.0, representing a 0.055% market share in the crypto ecosystem.

TBC has shown remarkable growth over the past month, with a 164.75% increase in price. However, it has faced a 7.48% decline in the last seven days, indicating some recent market volatility. The token is currently trading at 85% of its all-time high, suggesting potential room for growth if market conditions improve.

The circulating supply of TBC is 27,800,000 tokens, which is only 1.32% of its maximum supply of 2,100,000,000. This low circulating ratio could potentially impact the token's scarcity and future price movements.

Click to view the current TBC market price

TBC Market Sentiment Indicator

2025-09-19 Fear and Greed Index: 53 (Neutral)

Click to view the current Fear & Greed Index

The cryptocurrency market sentiment remains balanced today, with the Fear and Greed Index at 53, indicating a neutral stance. This suggests that investors are neither overly fearful nor excessively greedy. Such equilibrium often presents opportunities for thoughtful investment decisions. Traders might consider diversifying their portfolios or exploring new projects on Gate.com. Remember, while the sentiment is stable, it's crucial to conduct thorough research and manage risks wisely in the ever-evolving crypto landscape.

TBC Holdings Distribution

The address holdings distribution data for TBC reveals an interesting pattern in its current market structure. This metric provides insights into the concentration of token ownership across different addresses, offering a snapshot of the asset's decentralization and potential market dynamics.

Upon analysis, it appears that the TBC market exhibits a relatively balanced distribution of holdings. The absence of any single address holding a significant percentage suggests a decentralized ownership structure, which is generally considered positive for market stability. This distribution pattern indicates that the risk of market manipulation by large individual holders, often referred to as "whales," is relatively low for TBC.

However, it's important to note that this distribution snapshot represents a moment in time and can change. The current spread of holdings suggests a healthy ecosystem with diverse participation, potentially contributing to more organic price movements and reduced volatility. This distribution pattern may also reflect positively on the project's efforts to maintain a fair and widely accessible token economy.

Click to view the current TBC Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|

II. Key Factors Affecting TBC's Future Price

Supply Mechanism

- Total Supply: TBC has a maximum supply of 142,000,000 tokens.

- Current Impact: The limited supply may create scarcity as demand grows, potentially influencing price positively.

Institutional and Whale Dynamics

- Corporate Adoption: TuringBitChain has launched its own blockchain platform, which may attract corporate interest and adoption.

Macroeconomic Environment

- Geopolitical Factors: International situations and regulatory changes in different countries can impact TBC's global adoption and price.

Technical Development and Ecosystem Building

- Blockchain Platform: TuringBitChain has developed its own blockchain, which could enhance its technological capabilities and ecosystem growth.

- Ecosystem Applications: The project is focusing on building a robust ecosystem, which may include DApps and other blockchain-based solutions.

III. TBC Price Prediction for 2025-2030

2025 Outlook

- Conservative forecast: $13.39 - $16.94

- Neutral forecast: $16.94 - $21.01

- Optimistic forecast: $21.01 - $25.08 (requires favorable market conditions and increased adoption)

2026-2027 Outlook

- Market phase expectation: Potential growth phase with increased volatility

- Price range prediction:

- 2026: $11.56 - $26.05

- 2027: $12.71 - $24.24

- Key catalysts: Technological advancements, wider market acceptance, and potential regulatory clarity

2028-2030 Long-term Outlook

- Base scenario: $23.88 - $32.60 (assuming steady market growth and adoption)

- Optimistic scenario: $32.60 - $38.80 (with accelerated adoption and favorable market conditions)

- Transformative scenario: $38.80 - $45.31 (with breakthrough use cases and mainstream integration)

- 2030-12-31: TBC $32.60 (93% increase from 2025 average)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 25.07712 | 16.944 | 13.38576 | 0 |

| 2026 | 26.05309 | 21.01056 | 11.55581 | 24 |

| 2027 | 24.23778 | 23.53183 | 12.70719 | 39 |

| 2028 | 28.90061 | 23.8848 | 19.82439 | 41 |

| 2029 | 38.79728 | 26.39271 | 14.51599 | 56 |

| 2030 | 45.30704 | 32.595 | 31.61715 | 93 |

IV. TBC Professional Investment Strategy and Risk Management

TBC Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors with high risk tolerance

- Operational suggestions:

- Accumulate TBC during market dips

- Set a target exit price and stick to it

- Store TBC in a secure hardware wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential entry/exit points

- Relative Strength Index (RSI): Helps determine overbought/oversold conditions

- Key points for swing trading:

- Monitor BTC price movements as they may influence TBC

- Set stop-loss orders to limit potential losses

TBC Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of portfolio

- Aggressive investors: 5-10% of portfolio

- Professional investors: Up to 15% of portfolio

(2) Risk Hedging Strategies

- Diversification: Spread investments across multiple cryptocurrencies

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- hardware wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Paper wallet for long-term holding

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for TBC

TBC Market Risks

- High volatility: TBC price may experience significant fluctuations

- Liquidity risk: Limited trading volume may affect ability to buy/sell

- Correlation with Bitcoin: TBC performance may be heavily influenced by BTC price movements

TBC Regulatory Risks

- Uncertain regulatory environment: Potential for stricter regulations on cryptocurrencies

- Cross-border transactions: Varying legal status in different jurisdictions

- Tax implications: Evolving tax laws may impact TBC holdings and transactions

TBC Technical Risks

- Smart contract vulnerabilities: Potential for bugs or exploits in the TBC protocol

- Scalability challenges: Possible network congestion as adoption increases

- Compatibility issues: Potential difficulties integrating with existing Bitcoin infrastructure

VI. Conclusion and Action Recommendations

TBC Investment Value Assessment

TBC presents a unique value proposition as a pioneer in Bitcoin smart contract solutions. While it offers significant long-term potential, investors should be aware of short-term volatility and regulatory uncertainties.

TBC Investment Recommendations

✅ Beginners: Start with small investments and focus on education ✅ Experienced investors: Consider allocating a portion of portfolio based on risk tolerance ✅ Institutional investors: Conduct thorough due diligence and consider TBC as part of a diversified crypto strategy

TBC Participation Methods

- Spot trading: Purchase TBC on Gate.com

- Staking: Participate in staking programs if available

- DeFi: Explore decentralized finance opportunities within the TBC ecosystem

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is the price prediction for Tellor in 2025?

Based on market analysis, Tellor (TRB) is predicted to trade between $37.26 and $40.88 in 2025. This forecast reflects current trends and potential market developments.

What is the stock price forecast for TBC Bank?

Analysts project an average 12-month price target of 5861.99 for TBC Bank, with a high estimate of 6201.55, based on forecasts from 4 analysts.

What is the value of TBC coin?

The value of TBC coin is $0.5541, with a 24-hour trading volume of $47,876.88. The price has increased by 0.01% in the last 24 hours.

Which coin will be the next Bitcoin prediction in 2025?

Ethereum is predicted to be the next Bitcoin in 2025, with analysts forecasting substantial price growth due to its smart contract capabilities and widespread adoption.

ALPACA vs BCH: Comparing Two Innovative Approaches to Cryptocurrency

2025 SLAY Price Prediction: Analyzing Market Trends and Potential Growth Factors

2025 TAPPROTOCOL Price Prediction: Analyzing Market Trends and Potential Growth Factors

Bitminer Bot: Worth the Hype or a Crypto Trap?

Bitcoin Cash Price Analysis: BCH Market Trends and Trading Strategies for 2025

Bitget Token Price 2025: Investment Analysis and Market Performance

USD1 vs DOGE: Which Cryptocurrency Investment Strategy Will Dominate the Market in 2024?

XAUT vs CHZ: A Comprehensive Comparison of Gold-Backed and Gaming Tokens in the Crypto Market

What is NEAR: A Complete Guide to Understanding the NEAR Protocol and Its Ecosystem

What is OKB: A Comprehensive Guide to OKEx's Native Token and Its Use Cases

What is XAUT: Understanding the Gold-Backed Cryptocurrency Token on the Tezos Blockchain