2025 TMAI Price Prediction: Analyzing Market Trends and Potential Growth Factors for the Digital Asset

Introduction: TMAI's Market Position and Investment Value

Token Metrics AI (TMAI), as a groundbreaking token empowering the crypto community with AI tools and insights, has been making waves since its inception. As of 2025, TMAI's market capitalization stands at $3,200,666.88, with a circulating supply of approximately 7,989,682,672 tokens, and a price hovering around $0.0004006. This asset, hailed as a "AI-powered trading companion," is playing an increasingly crucial role in automated trading strategies and market analysis.

This article will comprehensively analyze TMAI's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price predictions and practical investment strategies.

I. TMAI Price History Review and Current Market Status

TMAI Historical Price Evolution

- 2024: Initial launch, price peaked at $0.017747 on December 17

- 2025: Market downturn, price dropped to an all-time low of $0.0003403 on October 11

TMAI Current Market Situation

As of October 13, 2025, TMAI is trading at $0.0004006, with a 24-hour trading volume of $15,050.04. The token has experienced a significant price increase of 8.74% in the past 24 hours, showing signs of short-term recovery. However, TMAI is still down 17.56% over the past week and 14.39% over the past month, indicating ongoing volatility and bearish pressure in the medium term.

The current price represents a 97.74% decrease from its all-time high, suggesting that TMAI is still in a prolonged bearish trend. The token's market capitalization stands at $3,200,666.88, ranking it at 2043rd position in the overall cryptocurrency market.

Despite the recent uptick, TMAI's price remains close to its all-time low, reflecting the challenging market conditions it faces. The token's performance over the past year shows a substantial decline of 91.041%, highlighting the significant downward pressure it has experienced in the long term.

Click to view the current TMAI market price

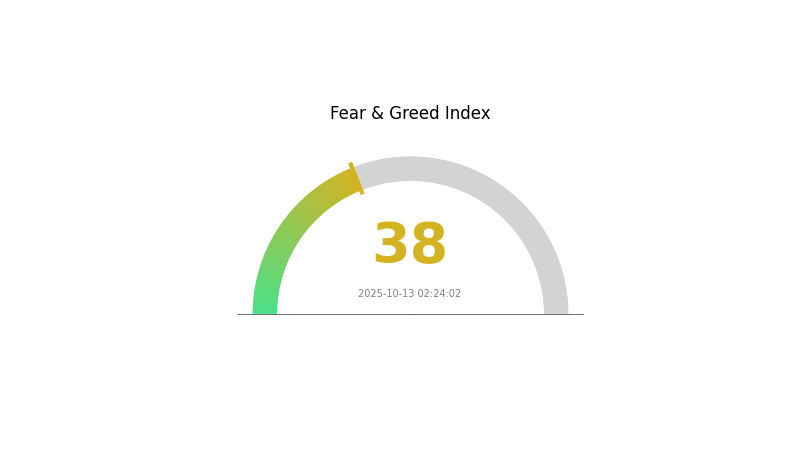

TMAI Market Sentiment Indicator

2025-10-13 Fear and Greed Index: 38 (Fear)

Click to view the current Fear & Greed Index

The cryptocurrency market is currently experiencing a period of fear, with the Fear and Greed Index at 38. This indicates a cautious sentiment among investors. During such times, it's crucial to remain vigilant and avoid making impulsive decisions. While fear may present buying opportunities for some, it's essential to conduct thorough research and consider your risk tolerance. Remember, market cycles are natural, and this sentiment could shift in the future. Stay informed and use platforms like Gate.com to monitor market trends and make informed decisions.

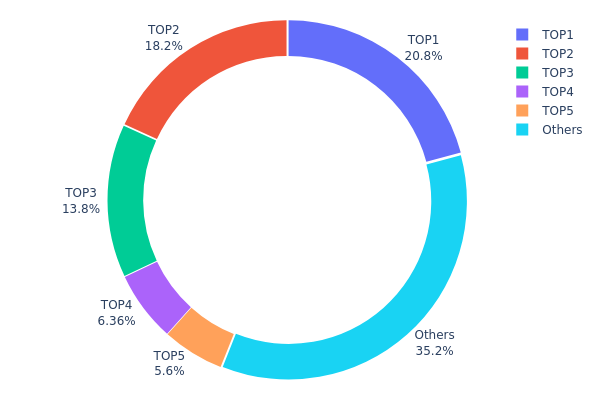

TMAI Holdings Distribution

The address holdings distribution data for TMAI reveals a relatively concentrated ownership structure. The top 5 addresses collectively hold 64.78% of the total supply, with the largest holder possessing 20.84%. This concentration level suggests a potential vulnerability to price manipulation and volatility.

The second and third largest holders control 18.15% and 13.84% respectively, further emphasizing the centralized nature of TMAI distribution. Such a top-heavy structure could impact market dynamics, as large holders have the potential to significantly influence price movements through their trading activities.

While 35.22% of TMAI is distributed among other addresses, the current distribution pattern indicates a lower degree of decentralization. This concentration may affect the token's on-chain stability and could be a point of concern for investors seeking more evenly distributed cryptocurrencies.

Click to view the current TMAI Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x1494...c4e5d7 | 2084367.07K | 20.84% |

| 2 | 0xbbee...300464 | 1815823.08K | 18.15% |

| 3 | 0x0529...c553b7 | 1384610.55K | 13.84% |

| 4 | 0xb859...53734e | 636400.47K | 6.36% |

| 5 | 0x5383...d012f8 | 559638.72K | 5.59% |

| - | Others | 3519160.12K | 35.22% |

II. Key Factors Affecting TMAI's Future Price

Supply Mechanism

- Circulating Supply: The current circulating supply of TMAI is 7,989,682,672 tokens.

- Current Impact: The total market value of TMAI is calculated based on this circulating supply, which directly affects its price.

Institutional and Whale Dynamics

- Institutional Holdings: Institutional interest in TMAI could significantly impact its price, though specific data is not provided.

- Corporate Adoption: Adoption of TMAI by known enterprises could boost its value and market recognition.

Macroeconomic Environment

- Monetary Policy Impact: Central bank policies and economic data releases can influence TMAI's price.

- Geopolitical Factors: International events and geopolitical tensions may affect the overall cryptocurrency market, including TMAI.

Technological Development and Ecosystem Building

- AI Advancements: As TMAI is focused on providing AI tools for the crypto community, technological improvements in AI could boost its value.

- Ecosystem Applications: TMAI offers AI-based trading bots to token holders, which could attract users and potentially increase demand.

III. TMAI Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.00036 - $0.00038

- Neutral prediction: $0.00039 - $0.00041

- Optimistic prediction: $0.00045 - $0.00047 (requires favorable market conditions)

2027-2028 Outlook

- Market phase expectation: Potential growth phase

- Price range forecast:

- 2027: $0.00032 - $0.00054

- 2028: $0.00043 - $0.00057

- Key catalysts: Increasing adoption and technological advancements

2029-2030 Long-term Outlook

- Base scenario: $0.00054 - $0.00056 (assuming steady market growth)

- Optimistic scenario: $0.00057 - $0.00060 (with strong market performance)

- Transformative scenario: $0.00060 - $0.00062 (with breakthrough developments)

- 2030-12-31: TMAI $0.00062 (potential peak for the period)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00047 | 0.0004 | 0.00036 | 0 |

| 2026 | 0.00055 | 0.00043 | 0.00023 | 8 |

| 2027 | 0.00054 | 0.00049 | 0.00032 | 23 |

| 2028 | 0.00057 | 0.00052 | 0.00043 | 29 |

| 2029 | 0.00057 | 0.00054 | 0.00044 | 35 |

| 2030 | 0.00062 | 0.00056 | 0.0005 | 39 |

IV. TMAI Professional Investment Strategies and Risk Management

TMAI Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors and AI technology enthusiasts

- Operational suggestions:

- Accumulate TMAI tokens during market dips

- Stay updated with Token Metrics AI project developments

- Store tokens in secure wallets with private key control

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Monitor short-term and long-term trends

- Relative Strength Index (RSI): Identify overbought and oversold conditions

- Key points for swing trading:

- Set clear entry and exit points based on technical indicators

- Monitor trading volume for confirmation of price movements

TMAI Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: 10-15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple AI-focused tokens

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallets for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for TMAI

TMAI Market Risks

- High volatility: TMAI price may experience significant fluctuations

- Competition: Emergence of other AI-focused tokens may impact TMAI's market share

- Market sentiment: General crypto market conditions can affect TMAI's performance

TMAI Regulatory Risks

- Regulatory uncertainty: Evolving regulations may impact AI-focused tokens

- Compliance requirements: Potential need for additional compliance measures

- Cross-border restrictions: Varying regulations across jurisdictions may limit adoption

TMAI Technical Risks

- Smart contract vulnerabilities: Potential for exploits or bugs in the token's code

- AI technology limitations: Possible underperformance of AI-powered trading tools

- Scalability issues: Challenges in handling increased user demand and transactions

VI. Conclusion and Action Recommendations

TMAI Investment Value Assessment

TMAI presents a unique value proposition in the AI-powered crypto trading space. Long-term potential lies in the growing demand for AI-driven tools, while short-term risks include market volatility and technological uncertainties.

TMAI Investment Recommendations

✅ Beginners: Start with small, regular investments to understand the token's behavior ✅ Experienced investors: Implement a balanced approach, combining long-term holding with active trading ✅ Institutional investors: Consider TMAI as part of a diversified AI and blockchain technology portfolio

TMAI Trading Participation Methods

- Spot trading: Purchase TMAI tokens on Gate.com

- DCA strategy: Set up recurring buys to average out price volatility

- Staking: Explore potential staking opportunities if offered by the project

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is the Tmai token?

TMAI is a cryptocurrency project using AI for trading insights. It aims to enhance trading strategies with AI-driven analytics, launched in 2025.

What meme coin will explode in 2025 price prediction?

Shiba Inu is predicted to explode in price in 2025, driven by strong community support and viral trends.

Where can I buy Tmai crypto?

You can buy Tmai on decentralized exchanges (DEXs) and cryptocurrency platforms. Check current listings and verify availability before trading.

What is the price prediction for XRP in 2030?

By 2030, XRP is predicted to reach $90 to $120. This forecast marks a significant growth milestone. Predictions are based on current market trends.

What is the ranking of 73.33 in the performance of Crypto Assets?

How Does Crypto Competitor Analysis Evolve in 2025?

2025 AIBOT Price Prediction: Navigating the Future of AI-Powered Trading Solutions

AI-Driven Crypto Trading Bot Solutions

2025 AIBOT Price Prediction: Analyzing Market Trends and Potential Growth Factors

Effortless Crypto Trading with Automated Bots

Understanding Decentralized Applications in the Crypto World

A Comprehensive Guide to Understanding Blockchain Network Nodes

Understanding Crypto Airdrops and Blockchain Forks

Custodial vs Non-Custodial Crypto Wallets: Key Differences Explained

Exploring Travel Insurance Options with Cryptocurrency Coverage